- Home

- »

- Next Generation Technologies

- »

-

Active Electronic Components Market Size Report, 2030GVR Report cover

![Active Electronic Components Market Size, Share & Trends Report]()

Active Electronic Components Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Semiconductor, Vacuum Tubes, Display Devices), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-083-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Active Electronic Components Market Summary

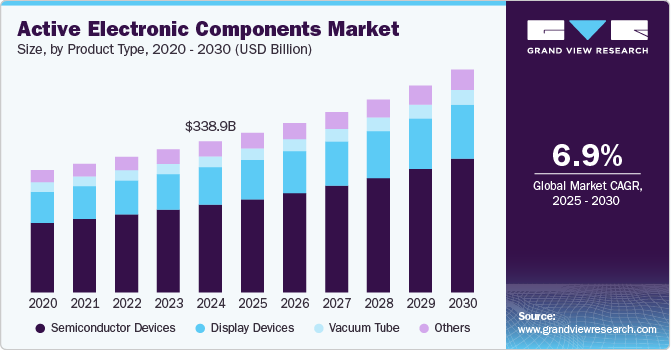

The global active electronic components market size was estimated at USD 338.87 billion in 2024 and is projected to reach USD 500.93 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. Active electronic components are incorporated into circuits to amplify electrical input signals and generate electricity.

Key Market Trends & Insights

- The Asia Pacific dominated the active electronic components market in 2024 with a market share of 55.5%.

- China, India, Vietnam, and Malaysia are among the leading Asia Pacific economies helping to drive the region's electronics sector growth.

- In terms of product, the semiconductor segment dominated the overall market, gaining a market share of 58.1% in 2024, and is also anticipated to witness the fastest growth, growing at a CAGR of 7.5% during the forecast period.

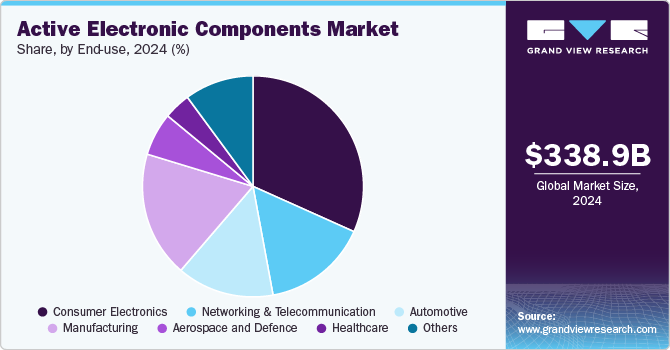

- Based on end use, the consumer electronics segment spearheaded the market in 2024, with a market share of 31.7%.

- On the basis of end use, the automotive segment is anticipated to grow at a considerable CAGR of 7.5% throughout the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 338.87 billion

- 2030 Projected Market Size: USD 500.93 billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

These components can act as AC circuits in electronic equipment, increasing power and voltage. All active components require an energy source, usually derived from a DC circuit. Increasing demand for active electronic components in numerous sectors and widespread usage of connected devices are some of the reasons driving this market growth.

The increasing popularity of smartphones, laptops, and other wearable devices, as well as increased industrial automation, has raised the demand for active electronic components. The worldwide active electronic components market benefits from increased demand for active electronic components in the healthcare and automotive industries owing to the fast use of MEMS technology. One of the most significant advantages of active electronic components is the ability to manage tiny inputs of electricity to match a greater power output. The most active components are semiconductors, such as diodes, transistors, and integrated circuits.

The automotive industry is undergoing a transformation, and there is a rising market for electric vehicles, thus increasing global adoption of different autonomous vehicle technologies. Numerous vehicle applications use the above-mentioned technologies, including parking assistance, safety airbags, telematics, and navigation. Additionally, a considerable rise in consumer smartphone use is anticipated to fuel the booming electronic components market's expansion throughout the projected years. The market expansion is predicted to be further driven by the probable introduction of active electronic components to produce network and communication equipment for 5G infrastructure. As a result, it is anticipated that high demand for these systems will fuel market expansion throughout the projection period.

To attract more customers, automotive manufacturers worldwide are concentrating on integrating numerous electronics and technologies into their products. The growing popularity of premium and ultra-luxury automobiles significantly impacts the automotive active electronic components industry. In July 2022, NXP Semiconductors announced a collaboration agreement with Hon Hai Technology Group to create platforms for a new generation of smart connected automobiles. Hon Hai, an electronics manufacturer and technology solution provider, aims to leverage NXP's automotive technology portfolio and long-standing experience in safety and security to offer architectural innovation and platforms for electrification, connectivity, and safe autonomous driving which in turn will drive the demand of active electronic components in automotive industry.

Product Type Insights

The semiconductor segment dominated the overall market, gaining a market share of 58.1% in 2024, and is also anticipated to witness the fastest growth, growing at a CAGR of 7.5% during the forecast period. Integrated circuits (ICs), the sub-segment of semiconductor devices, dominated the overall market, gaining a market share of 56.3% in 2024, and is also to witness the fastest growth, growing at a CAGR of 8.4%. A semiconductor substance exists between the insulator and the conductor, which controls and regulates the current flow in electrical devices and equipment. As a result, it has become an essential component of electronic chips used in computing components and various electronic devices, such as solid-state storage.

An SMD (Surface Mount Device) electronic component made of multiple transistors, diodes, resistors, and capacitors in a tiny semiconductor chip are an Integrated Circuit (IC). ICs, or Integrated Circuit Electronic Components, are small and light, providing more significant outcomes while using less power. An Integrated Circuit (IC) is the integration or assimilation of several electronic components (primarily transistors) on a chip (or single device) constructed of a semiconductor material. ICs are extensively utilized in various applications such as televisions, mobile phones, laptops, audio players, routers, etc.

End-use Insights

The consumer electronics segment is expected to dominate in 2024, with a market share of 31.7%. It is expected to grow at the fastest CAGR of 8.0% throughout the forecast period. The expansion is primarily due to rising demand for semiconductor devices for various consumer electronics such as digital cameras, mobile phones, gaming devices, wearable devices, Set-Top Boxes (STB), and others. Moreover, networking equipment such as modems, routers, repeaters, and gateways are in great demand, especially in the office automation and home application segments. Active electronics components are predicted to increase over the forecast period due to increased demand for network devices and other IT equipment. In June 2022, Nokia Corporation, a Finland-based telecommunication, IT, and consumer electronics company, has launched a new Fiber-ToThe-Home (FTTH) kit to help service providers deliver fiber networks to rural regions in the U.S. The package contains all the equipment and licenses for the operator to set up a standard 1,000-home community. The package includes active equipment for the central office (OLT or the optical line terminal), a fiber termination device for the home (ONT or the optical network terminal), and Wi-Fi modules inside the house. Over a single port, the kits support GPON and XGS-PON.

The automotive segment is anticipated to grow at a considerable CAGR of 7.5% throughout the forecast period. Automotive manufacturers worldwide focus on integrating various electronics and technology to attract customers. The increasing popularity of premium and ultra-luxury vehicles has considerably influenced the automotive active electronic components industry. Vehicles' reliance on electronic components and safety systems has grown significantly in recent years, resulting in increased use of electronic components in vehicles. Electronic components are frequently used to increase the functioning and efficiency of powertrain systems. These components let an automobile's powertrain systems exchange messages and sensor signals while also managing their operations. In powertrain systems, turbine speed, transmission fluid temperature, and throttle position sensors are all used.

Regional Insights

The North America active electronic components market is anticipated to grow at a considerable CAGR of 6.6% throughout the forecast period. In North America, the adoption of connected cars is gaining significant traction, particularly in the U.S. Leading telecom service providers, such as Verizon Inc. and AT&T Inc., are investing aggressively in deploying the next-generation 5G network infrastructure to provide unified connectivity between vehicles and the network infrastructure. The outbreak of the COVID-19 pandemic may have delayed the industrial deployment of 5G in the U.S. However, the U.S. government is trying to overcome this delay by investing aggressively in rolling out highly efficient network infrastructure and building smart cities. As such, the installation of telecom equipment and other networking devices is expected to gain traction in line with the unabated rollout of 5G network infrastructure across North America, thereby driving the growth of the North America active electronic components market over the forecast period.

U.S. Active Electronic Components Market Trends

The U.S. active electronic components market is projected to experience steady growth, driven by advancements in technology and increasing demand across various sectors, including consumer electronics, automotive, telecommunications, and industrial applications. Additionally, the growth of the Internet of Things (IoT) and increasing reliance on renewable energy sources are further driving demand for active electronic components.

Asia Pacific Active Electronic Components Market Trends

The Asia Pacific active electronic components market led the overall market in 2024, with a market share of 55.5%. The Asia Pacific dominates the global electronics sector and is mainly regarded as a manufacturing powerhouse for consumer electronics. Due to a variety of favorable factors, including relatively lower labor costs, the availability of a large pool of highly skilled workers, rising foreign direct investments, government initiatives supporting the production of electronic components, and preferential trading access to Europe and North America, Asia Pacific has emerged as the most prominent electronics manufacturing and exporting region. China, India, Vietnam, and Malaysia are among the leading Asia Pacific economies helping to drive the region's electronics sector growth. Over the projection period, these economies will likely strengthen their position in the semiconductor sector and grow their share of the worldwide market.

Key Active Electronic Components Company Insights

Some of the key players operating in the market include Intel Corporation and Qualcomm Inc., among others.

-

Intel Corporation is a prominent U.S. based multinational technology company headquartered in California. The company is one of the largest semiconductor chip manufacturers globally, specializing in designing, manufacturing, and selling a wide range of computer components and related products for both business and consumer markets. Intel Corporation offers a diverse range of active electronic components, including microprocessors such as the Core, Xeon, and Atom series, which are essential for personal computers, servers, and embedded systems. The company also produces chipsets that enhance processor functionality, along with memory products like its 3D NAND technology used in solid-state drives (SSDs).

Texas Instruments Incorporated and Renesas Electronics Corporation are some of the emerging market participants in the target market.

-

Microchip Technology, Inc., founded in 1989 and headquartered in Arizona, U.S. is a provider of microcontroller and analog semiconductor solutions. The company specializes in developing embedded control solutions for a variety of applications, including automotive, industrial, consumer electronics, and IoT devices. It offers an extensive portfolio of microcontrollers, which are designed for a range of functionalities, from simple applications to complex systems requiring high performance. Additionally, the company offers a comprehensive range of analog products, including operational amplifiers, voltage references, and power management solutions, which are essential for signal conditioning and power efficiency in electronic devices.

Key Active Electronic Components Companies:

The following are the leading companies in the active electronic components market. These companies collectively hold the largest market share and dictate industry trends.

- Infineon Technologies AG

- Advanced Micro Devices, Inc.

- STMicroelectronics N.V.

- Microchip Technology, Inc.

- Analog Devices, Inc.

- Broadcom Inc.

- NXP Semiconductors N.V.

- Intel Corporation

- Monolithic Power Systems, Inc.

- Texas Instruments Incorporated

- Qualcomm Inc.

- Renesas Electronics Corporation

- Semiconductor Components Industries, LLC

- Toshiba Corporation

Recent Developments

-

In September 2024, Intel Corporation launched its new Core Ultra 200V series mobile processors, offering significant advancements in AI, graphics, and energy efficiency for laptops. Featuring AI Acceleration and integrated GPU upgrades, the processors are designed to handle intensive computing tasks with reduced power consumption. These chips are targeted at a range of applications, from gaming to creative content production, enhancing both performance and battery life.

-

In September 2024, Qualcomm Inc. introduced new advancements for PC users with its Snapdragon X Plus, boosting performance in AI-powered features like Copilot. This processor enhances productivity, collaboration, and entertainment with AI acceleration and superior efficiency. Qualcomm is positioning itself as a leader in AI-driven computing solutions, aiming to optimize experiences in connected PCs while maintaining high energy efficiency and powerful processing capabilities.

Active Electronic Components Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 358.79 billion

Revenue forecast in 2030

USD 500.93 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Historical data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; South Korea; Brazil; Mexico

Key companies profiled

Infineon Technologies AG; Advanced Micro Devices, Inc.; STMicroelectronics N.V.; Microchip Technology, Inc.; Analog Devices, Inc.; Broadcom Inc.; NXP Semiconductors N.V.; Intel Corporation; Monolithic Power Systems, Inc.; Texas Instruments Incorporated; Qualcomm Inc.; Renesas Electronics Corporation; Semiconductor Components Industries, LLC; Toshiba Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Electronic Components Market Report Segmentation

This report forecasts market revenue growths at global, regional, as well as at country levels. It offers an analysis of the qualitative and quantitative market trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global active electronic components market report based on product type, end-use, and region.

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Semiconductor Devices

-

Diode

-

Transistors

-

Integrated Circuits (ICs)

-

Optoelectronics

-

-

Vacuum Tube

-

Display Devices

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer Electronics

-

Networking & Telecommunication

-

Automotive

-

Manufacturing

-

Aerospace & Defense

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia-Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global active electronic components market size was estimated at USD 338.87 billion in 2024 and is expected to reach USD 358.79 billion in 2025.

b. The global active electronic components market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 500.93 billion by 2030.

b. The semiconductor devices segment held the highest revenue share of over 58.1% in 2024 in the active electronic components market, and is estimated to expand further at the fastest CAGR from 2025 to 2030.

b. The consumer electronics segment led the global market for active electronic components in 2024, accounting for the highest revenue share of 31.7%. The segment is expected to expand further at the fastest CAGR of 8.0% over the forecast period.

b. Some of the key players operating in the active electronic components market include Infineon Technologies AG; NXP Semiconductors NV; Texas Instruments Incorporated; Toshiba Corporation; STMicroelectronics; Semiconductor Components Industries, LLC; Intel Corporation; Maxim Integrated; Renesas Electronics Corporation; Broadcom Inc.; Qualcomm Inc.; Analog Devices, Inc.; Advanced Micro Devices; and Microchip Technology Inc.

b. Asia Pacific held the highest revenue share of over 55.5% in 2024 in the active electronic components market and is estimated to exhibit the fastest CAGR from 2024 to 2030. The market growth in APAC is credited to the presence of a huge consumer electronics sector in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.