- Home

- »

- Clothing, Footwear & Accessories

- »

-

Active Backpack Market Size, Share & Trends Report, 2030GVR Report cover

![Active Backpack Market Size, Share & Trends Report]()

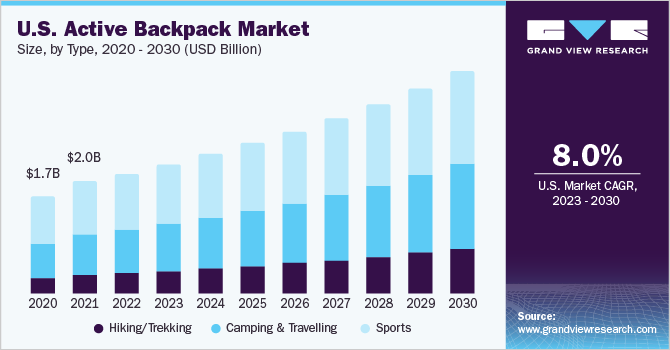

Active Backpack Market Size, Share & Trends Analysis Report By Type (Hiking/Trekking, Camping And Travelling, Sports), By Size (Less Than 10L, 10L-20L, 20L-40L), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-074-2

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Active Backpack Market Size & Trends

The global active backpack market size was valued at USD 5.41 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2023 to 2030. An increasing number of people participating in recreational activities such as hiking, camping, fishing, biking, running, and other sports activities has significantly boosted the sales of sporting products, including active backpacks. According to a report by the Outdoor Industry Association, the outdoor recreation participant base grew 2.2% in 2021 to 164.2 million participants, outpacing the overall U.S. economy. Moreover, according to a 2021 ISPO study, the majority of Europeans-or 81% participated in outdoor activities the year before.

The most popular activity was found to be hiking, which was followed by jogging, cycling, trekking, and mountaineering. The research additionally found that, among 39% and 33% of all respondents, respectively, hiking and jogging were the two most popular outdoor activities. Cycling tours also registered a considerable increase in popularity in 2020 in Europe.

In addition, active backpacks have become a popular fashion statement in recent years due to their versatility and functionality. Many backpacks now come in stylish designs, colors, and patterns, making them fashionable accessories that complement a person's style and personality. For instance, Nike’s fashionable backpacks included utility-based features via brands such as Brasilia. These training backpacks are designed for athletes and feature a durable, water-resistant exterior, a large main compartment for gear, and a separate ventilated shoe compartment. In addition to their appearance, the features of an active backpack can also contribute to their fashion status. For example, backpacks with smart technology such as wireless chargers, built-in speakers, or LED lights are not only practical but also innovative and eye-catching.

Furthermore, active backpacks have become popular for various occasions, from outdoor adventures to daily commutes, and even as a substitute for traditional handbags. This versatility allows people to express their sense of style and individuality while meeting their practical needs. For instance, Under Armour offers Hustle 4.0 Backpack designed for sports and gym goers and features a water-repellent finish, a padded laptop compartment, a front pocket for organization, and two side water bottle pockets. Overall, active backpacks have become a fashion statement due to their combination of style, functionality, and versatility. As a result, they are increasingly seen as essential accessories that reflect a person's fashion sense and lifestyle. The multi-functionality of backpacks serves as a key driver for the market, as consumers seek versatile and adaptable products to meet their various needs and preferences.

However, the rise of counterfeit goods is impeding market expansion. Over the anticipated timeframe, the ease with which counterfeit goods are available is projected to provide challenges to market expansion. The price difference between counterfeit and branded products is a significant barrier to the market. Competition from other bags and baggage kinds, such as messenger bags, duffel bags, and rolling suitcases, is one of the main obstacles. Depending on their unique requirements, preferences, or travel plans, consumers may choose various substitutes, which could impact the market for active backpacks.

Changing consumer preferences can pose a challenge to the active backpack market in several ways. As consumer preferences shift towards more sustainable and eco-friendly products, active backpack manufacturers must adapt to meet these changing demands. This may involve investing in new materials or manufacturing processes, which can be costly and time-consuming. In addition, changing consumer preferences can also lead to a shift in the types of features and functions consumers seek in active backpacks. For instance, as more consumers prioritize sustainability, they may also look for backpacks incorporating eco-friendly features, such as recycled materials or renewable energy sources. If manufacturers are slow to adapt to these changing demands, they may find themselves losing market share to competitors who are quick to respond.

Furthermore, the online portal, both e-commerce and company websites, offers various growth opportunities for the market. Consumers prefer e-commerce websites on account of increasing access to the internet, convenience, greater variety, and cost benefits. Consumers can compare a wide range of products on websites and make an informed decision. In addition, products purchased through e-commerce websites are delivered to the doorstep, thus offering convenience to customers. Additionally, many websites offer huge discounts throughout the year, making expensive products such as active backpacks affordable to an extent. Such offers attract a large consumer base and provide opportunities for increased sales of active backpacks.

Type Insights

The sports segment accounted for a share of over 45% in 2022. The participation rate of people in sports has been increasing steadily over the past few years, with more individuals adopting an active lifestyle. Several factors, including increasing awareness of the health benefits of regular exercise, rising disposable incomes, and the availability of more diverse and accessible sports and fitness options, have driven this trend. The growing participation rate in sports has created a strong demand for sports accessories like sports backpacks, as athletes/people need these items to support their active lifestyle. Additionally, the increasing popularity of sports among youth and the rising trend of athleisure trends have also contributed to the growth of the stylish sports backpack industry.

The hiking/trekking segment is anticipated to grow at a CAGR of 10.1% over the forecast period from 2023 to 2030. Sales of backpacks for hiking are anticipated to be driven by comfort-based backpacks, ongoing product launches targeting hikers, and increased participation in outdoor activities, particularly among young people. Manufacturers focus on lightweight materials and designs to introduce new hiking backpacks. Consumers seek lightweight backpacks that are simple to carry on lengthy hikes. Due to this, active backpack manufacturers use novel materials like carbon fiber, Dyneema fiber, and lightweight nylon, and streamlined designs with reduced bulk.

Size Insights

The 20L-40L active backpack size accounted for a share of over 50% in 2022. Hikers mostly use active backpacks with a 20 to 40-liter capacity, as they are required to carry a large number of supplies and hiking gear. These backpacks are highly durable and adjustable to withstand rigorous hiking or sporting activity. They come with numerous features and compartments that allow for customization and organization of gear, making it easier for users to find and access the items quickly. Many players offer active backpacks in this size. For instance, Black Diamond’s backpacks in the 20 to 40-liter range come with customizable options like adjustable harnesses and hip belts, multiple compartments for organization, and trekking pole and ice axe attachments. Similarly, Gregory Packs offers backpacks with adjustable harnesses, interchangeable hip belts, and numerous pockets and compartments for organization.

The backpack segment with a size less than 10L is expected to grow at a CAGR of 10.5% over the forecast period. Active backpacks with a volume capacity of less than 10 liters are typically used for activities that require minimal equipment and gear, such as running, cycling, or small hiking trails. For example, runners may use a small backpack to carry essentials such as water, energy gels, and a phone, while cyclists might use it to hold a repair kit, snacks, and a water bottle. These backpacks are often designed to be lightweight and compact, allowing the wearer to move freely and quickly.

Price Point Insights

Backpacks ranging from $51 - $100 accounted for a share of over 25% in 2022. Backpacks in this price segment appeal to consumers willing to spend a little more on additional features and higher quality. Customers who may not be willing to spend more than USD 100 on a backpack can still find a high-quality and functional option within this price range. The North Face is a well-known brand offering active backpacks priced at USD 51 to USD 100, including the Borealis and Recon series. These backpacks come with features such as padded straps, multiple pockets and compartments, and a comfortable and breathable back panel. More individuals are taking up outdoor hobbies like hiking, camping, and cycling. These consumers are looking for backpacks that offer improved functionality and durability within a specific price range.

The backpack segment ranging under $50 is anticipated to grow at a CAGR of 10.9% over the forecast period. As more people engage in outdoor activities like exercising and traveling, there is a growing demand for affordable backpacks that can withstand the rigors of outdoor use. Active backpacks under USD 50 are well-positioned to meet this demand by providing a cost-effective option for consumers who are just starting to explore outdoor activities or may not have a lot of disposable income to spend on the necessary gear. Moreover, advances in material science and manufacturing processes have made it possible to manufacture comparatively durable active backpacks at a lower cost. Players that offer active backpacks in this price range include AmazonBasics; High Sierra; TETON Sports; and Outlander.

Distribution Channel Insights

The specialty stores segment accounted for a share of over 45% of the global revenue in 2022. Specialty stores often carry a wide selection of active backpacks from different brands and in various price ranges. This allows customers to compare and choose from a variety of options, ensuring that they find a backpack that meets their needs and preferences. As sports enthusiasts or hikers need a backpack that fits well and is comfortable to wear during their activities, specialty stores often allow customers to try on backpacks to ensure a good fit and comfortable wear. Specialty stores continue to remain popular, as many customers prefer in-store shopping. Retailers can offer advice and recommendations on individualized items that further can be customized to meet the demands of the customer.

The sales through the online channel are projected to grow at a CAGR of 10.2% over the forecast period. E-commerce has grown in popularity over the past few years as a result of the convenience of online shopping. Online shopping is becoming increasingly popular as it allows consumers to compare several options on a single platform.

Several niche players offer high-quality active backpacks for various sports activities and travelers online. These players pose new challenges to other renowned market players, such as Osprey Packs and CamelBak. E-commerce has significantly changed consumers’ shopping choices and trends as it offers benefits such as doorstep delivery, heavy discounts, and the availability of a wide range of products on a single platform. Key players in the market are increasingly launching e-commerce websites to capitalize on the rising popularity of online shopping among millennials and Gen Z.

Regional Insights

North America held a share of over 40% of the global market in 2022. The primary driver propelling the market is the availability of several adventure sports destinations in the U.S. and Canada. According to Outdoor Industry Association, behind biking, jogging, and fishing, hiking is the fourth most popular sport in the U.S. According to the same source, in 2021, 54% of Americans aged six and older engaged in outdoor recreation at least once. The number of outdoor participants increased by 6.9% since March 2020. Moreover, according to the Sports & Fitness Industry Association (SFIA), a total of 236.9 million Americans, or 77.6% of the population, engaged in at least one activity in 2022.

The market in Asia Pacific is anticipated to grow with a CAGR of 9.8% over the forecast period. The growing popularity of active backpacks among those who enjoy sports and treks and the well-established sports industry in the region drive the sales of active backpacks across Asia Pacific. The rising popularity of outdoor recreational activities is an important factor driving the growth of the Asia Pacific market.

Consumers are increasingly participating in outdoor activities owing to changing lifestyles and attitudes, rising leisure spending, and the mental and physical health advantages of outdoor activities. Due to rising urbanization and hectic work schedules, people are finding it more challenging to spend time outdoors with their family and friends. Therefore, an increasing number of people have started camping with their friends and families over the weekend. These factors are expected to drive the growth of the active backpack industry in Asia Pacific.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others. Some of the initiatives include:

-

In April 2023, Arc'teryx collaborated with BEAMS, a Japanese brand, to launch the Boro collection. The line features a jacket, hoodie, waist pack, and backpack. The Mantis 26L backpack collection is simple, with a blend of black and bright blue colors. The collection was made available via an online lottery on the BEAMS webstore.

-

In April 2023, Kelty introduced its Spring 2023 line, which includes backpacking, hiking, lifestyle, and vehicle-based products, featuring refreshed prints and colors inspired by the brand's top-selling items. The collection includes the Glendale 85 and 105 backpacks, equipped with features such as the FIT-Plus suspension system, dual stretch pockets on the shoulder harness, and dual-access water bottle pockets.

-

In March 2023, Arc'teryx collaborated with Songtsam, the luxury boutique hotel group, to release its latest collection Kawagarbo. The products in the line include Beta AR Jacket, Gamma Hoody, and Aerios 15L Backpack. The line shares a common alpine heritage between ARC’TERYX and Songtsam, as both brands aim to promote boundless exploration while advocating for environmental sustainability.

Some prominent players in the global active backpack market include:

-

Arc'teryx

-

CamelBak

-

Deuter Sport GmbH

-

Samsonite IP Holdings S.AR.L

-

JanSport, a VF Company

-

Kelty

-

Osprey Packs

-

The North Face

-

Patagonia, Inc.

-

Columbia Sportswear

Active Backpack Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 5.85 billion

Revenue forecast in 2030

USD 10.45 billion

Growth rate

CAGR of 8.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, size, price point, distribution channel, region

Regional scope

North America; Europe; Asia Pacific;Central & South America; Middle East & Africa

Country scope

U.S.; UK; Germany; France; China; Japan; India; Australia; Brazil; South Africa

Key companies profiled

Arc'teryx; CamelBak; Deuter Sport GmbH; Samsonite IP Holdings S.AR.L; JanSport, a VF Company; Kelty; Osprey Packs; The North Face; Patagonia, Inc.; Columbia Sportswear

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Active Backpack Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global active backpack market report based on type, size, price point, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Hiking/Trekking

-

Camping and Travelling

-

Sports

-

-

Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 10L

-

10L-20L

-

20L-40L

-

-

Price Point Outlook (Revenue, USD Million, 2017 - 2030)

-

Under $50

-

$51 - $100

-

$101 - $150

-

$151 - $200

-

$201 - $250

-

Above $250

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Specialty Stores

-

Retail Stores

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global active backpack market size was estimated at USD 5.41 billion in 2022 and is expected to reach USD 10.45 billion in 2030.

b. The global active backpack market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 10.45 billion by 2030.

b. North America dominated the active backpack market with a share of 40.08% in 2022. The availability of various adventure sports venues in the United States and Canada is the main factor driving the market.

b. Major players in the active backpack market include Arc'teryx; CamelBak; Deuter Sport GmbH; Samsonite IP Holdings S.AR.L; JanSport, and VF Company

b. An increasing number of people participating in recreational activities such as hiking, camping, fishing, biking, running, and other sports activities has significantly boosted the sales of sporting products, including active backpacks.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."