Action Camera Market Size, Share & Trends Analysis Report By Product (Box Style Camera, 360-degree Camera), By Resolution, By Distribution Channel, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-067-5

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Action Camera Market Size & Trends

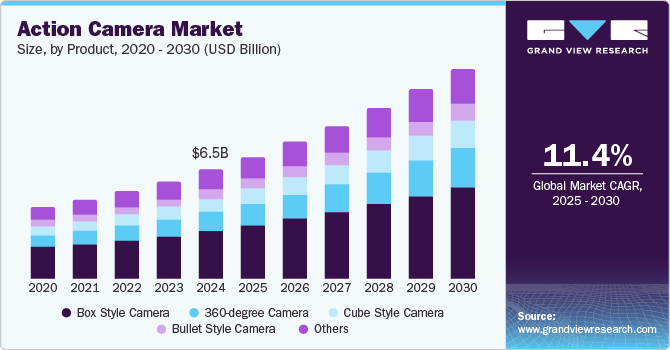

The global action camera market size was valued at USD 6.50 billion in 2024 and is projected to grow at a CAGR of 11.4% from 2025 to 2030. The growing popularity of outdoor activities and adventure sports globally, coupled with the content creation trend on social media platforms, has led casual consumers and enthusiasts to utilize action cameras that can record their experiences in high-quality photo and video formats. Moreover, recent innovations in camera technology, including 4K/8K video capability, image stabilization, and compact design, have attracted consumers looking for high-performance and portable cameras. For instance, in November 2023, SJCAM announced the imminent launch of the SJ20 dual-lens action camera, the first such in the world. The device leverages an advanced nigh-specific lens that allows light intake of more than two times that available in other cameras. There has been substantial growth in the number of companies launching these products on both regional and global levels, enabling competitive pricing strategies that have helped in steadily expanding the user base.

Growing concerns regarding fitness and health have led to the widespread adoption of workouts and outdoor activities among consumers, driving the demand for action cameras from this segment that can capture these activities in high quality. Additionally, rapidly rising popularity of extreme sports events such as bungee jumping, rock climbing, and mountain biking and their growing viewership has encouraged participants and athletes to leverage advanced action cameras. These cameras can be strapped on the chest or helmet to provide a first-person view to audiences throughout the complete journey, which helps in improving viewership and popularity. The proliferation of influencer culture and marketing is another factor boosting sales of these devices. Influencers use action cameras to capture high-quality and dynamic content during outdoor adventures, travel, and lifestyle activities. Their ability to showcase the camera's capabilities encourages followers to seek similar products. Additionally, many influencers create tutorials, unboxing videos, and reviews of action cameras that highlight their features and benefits. This helps potential buyers understand the product better and influences their purchasing decisions.

Increasing competition in the market has compelled manufacturers to undertake partnerships with leading optics and imaging companies and invest in innovations to establish and highlight their unique selling points. These features are aimed at improving user experience and convenience while capturing different activities. The use of advanced stabilization technologies such as HyperSmooth (GoPro) and FlowState (Insta360) ensures the recording of smooth footage even during intense motion. New sensor technologies have helped enhance low-light capabilities of these cameras, enabling users to capture better quality images and videos in challenging lighting conditions. The popularity of social media platforms has driven brands to focus on integrating live streaming features that allow users to broadcast their adventures in real time on platforms such as Instagram, Facebook, and YouTube. The constantly improving recording quality has also increased the size of individual files, leading to brands offering cloud services for automatic video backups that make it easy for users to save and access their footage without requiring physical storage.

Product Insights

The box style camera segment accounted for the largest revenue share of 44.2% in 2024 in the global market. These cameras feature a specific design that is typically rectangular and compact, resembling a small box. This style has gained popularity due to its functionality and versatility among a majority of users. They are often built to withstand tough conditions, with several models being rugged, waterproof, and shockproof, which makes them ideal for outdoor and adventure activities. The box shape of these devices allows for various mounting solutions, such as tripods, helmets, and handlebars, making them adaptable for different use cases. Additionally, box-style cameras often have longer battery life when compared to smaller models, enabling extended shooting times. Popular models in this segment include the GoPro HERO Series, the DJI Osmo Action, and the Garmin VIRB Series.

Meanwhile, the 360-degree camera segment is anticipated to witness the fastest growth in this market during the forecast period. Increasing use of innovative technologies that can substantially improve user experience and convenience has led to increased sales of such action cameras. These devices allow users to create immersive videos and photos that provide a unique perspective, attracting content creators and filmmakers. The rapid growth in popularity of virtual reality (VR) has further established promising opportunities for segment expansion, as 360-degree cameras are increasingly used to produce content for VR experiences, driving demand among content creators. Innovations in sensor technology, stabilization, and editing software have enhanced the quality and ease of use of 360-degree cameras, making them more appealing to consumers. The emergence of other application areas, such as real estate marketing, education, and training, is expected to enable significant segment expansion.

Resolution Insights

In terms of resolution, the SD and full HD segment accounted for a leading revenue share in the global market in 2024. First-time users prefer action cameras with these resolutions, as they are economical and convenient while offering different useful functions. They can be used for basic recording when video quality is not the primary concern. Full HD action cameras offer a wider scope for market growth when compared to SD cameras, as they can record activities at different frame rates, such as 30fps, and 60 fps, and generally have better sensors and optics, resulting in superior image quality, especially in outdoor and brightly lit environments. Many leading manufacturers, including GoPro, Garmin, and Sony, offer full HD action cameras that are customized for a range of users.

Action cameras offering 4K and higher resolutions are expected to witness the fastest growth in demand during the forecast period. These products leverage the most recent innovations in video technology, providing exceptional resolution and detail for capturing high-quality footage. Brands such as GoPro (HERO10, HERO11), DJI (Osmo Action 3), and Insta360 (ONE R) offer high-quality 4K options, while the 8K segment is still developing, with Insta360 being one of the few notable brands offering 8K recording capabilities. Rapid technological advancements and increasing competition between companies are expected to accelerate the launch of more products with these resolutions. Athletes in extreme sports and enthusiasts of outdoor adventure activities are major customers of such action cameras, as they can record their experiences to keep track of their performance and share with their audience. Integrating functionalities such as voice control to improve user experience is another substantial driver of segment expansion.

Distribution Channel Insights

The e-commerce segment accounted for a larger revenue share in the global market in 2024 and is further expected to advance at a faster CAGR from 2025 to 2030. The high rate of Internet proliferation globally, the increasing use of smartphones, and the presence of manufacturer websites that sell action cameras are major factors aiding segment expansion. Brands are making use of social media platforms to announce new products and features, while also partnering with celebrities and sportspersons to drive product awareness. Platforms such as Amazon, Walmart, and Shopify have a range of action cameras available from different manufacturers at competitive prices, driving customer preference to shop for these products online. Moreover, brands also take advantage of festivals and events such as Christmas, Thanksgiving, Halloween, and the Lunar New Year to sell products at further discounts, driving higher traffic during these periods.

Brick-and-mortar stores are expected to witness moderate growth in the coming years. Physical outlets such as retail stores and specialty camera shops maintain a significant stock of action cameras and accessories while also deploying knowledgeable staff that can help understand customer requirements and guide them in their purchasing decisions. Moreover, the offline mode of purchase is preferred by customers who want to inspect and test the quality of the camera and its features, while also being able to compare with other brands in terms of functionality and pricing. Consumers are increasingly looking for hands-on experiences with products, making in-store demonstrations an important aspect of this segment. Additionally, retailers often create bundles that include cameras, mounts, and accessories, providing convenience and added value to consumers. However, the ease of online shopping and availability of extensive product information through various websites and social media channels are expected to restrict growth of the offline segment.

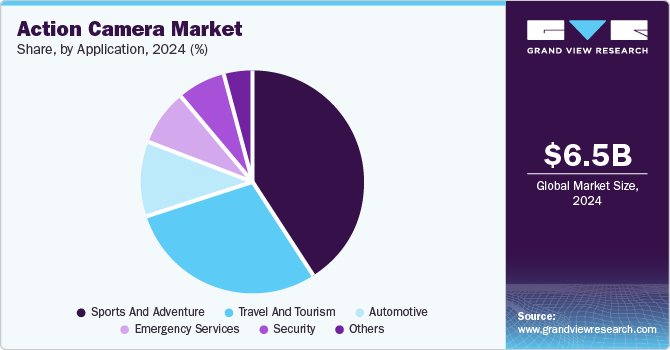

Application Insights

The sports and adventure segment accounted for a leading revenue share in the action camera market in 2024. A significant increase in the popularity of extreme sports events and growing preference for adventure activities among consumers has helped maintain a consistently strong demand for action cameras from this application area. For instance, action cameras are mounted on helmets or gear by snowboarders and skiers to capture thrilling runs and jumps, showcasing the experience from the rider's perspective. Water-based activities such as snorkeling and diving make use of underwater action cameras, often with specialized housing for depth protection, which can capture marine life and underwater landscapes in high quality. These devices are generally shockproof and waterproof, making them reliable in harsh conditions, while their compact size and lack of heavy accessories make them comfortable to be carried around in different locations.

The automotive segment is expected to grow fastest from 2025 to 2030. The increasing integration of dashcams in vehicles is expected to present a major growth avenue for market players in the coming years. Action cameras can be used as dash cams to record road conditions and incidents, providing crucial evidence in case of accidents. Moreover, footage from dashcams can simplify the claims process by offering clear visual evidence of events leading up to an incident. Modernization in driving schools and training programs is another factor aiding market expansion, as these devices are used to record sessions, allowing instructors and students to review their techniques and improve their skills. The trend of DIY projects on cars by enthusiasts is another emerging use case of action cameras, as they help in documenting the process of modifications, restorations, or custom builds, creating engaging content for sharing with audiences on social media channels.

Regional Insights

North America action camera market led the global market with 34.4% of the revenue share in 2024. The demand for action cameras is driven by various notable factors, such as the growing popularity of outdoor activities and adventure sports among regional consumers, the influence of social media that encourages younger demographics to post their adventures, and technological advancements by major market players. The U.S. and Canada have several locations ideal for adventure sports, such as beaches, mountains, and hilly areas, driving the demand for action cameras that can capture images and videos in high quality. Additionally, growing use of these devices in other markets, such as surveillance and filmmaking, is expected to encourage manufacturers to launch tailored offerings in the coming years.

U.S. Action Camera Market Trends

The U.S. action camera market accounted for a dominant revenue share of the regional market in 2024, on account of the growing demographic of adventure sports enthusiasts and increasing awareness regarding the features and benefits of action cameras. Mountain biking has become a preferred activity for many people in the country looking to improve their health and fitness. Rock climbing, paragliding, and surfing have also seen a significant increase in participation in recent years, leading to a higher demand for accessories such as action cameras that can capture every moment during these activities. The presence of established brands such as GoPro and the emergence of several new entrants has led to competitive pricing and an increased range of options to choose from, driving market appeal.

Europe Action Camera Market Trends

Europe action camera market accounted for a notable revenue share of the global market in 2024. Growing consumer interest in adventure sports and the increasing presence of notable brands such as GoPro, Sony, and DJI have led to substantial market expansion in this region in recent years. Europe boasts diverse landscapes for outdoor activities such as skiing, mountain biking, hiking, and water sports, driving the need for durable action cameras. For instance, Spain and Portugal are well-known for offering quality surfing experiences in locations such as Galicia, Peniche, and Nazaré, attracting a significant number of tourists and surfing enthusiasts from around the world. Meanwhile, economies such as Norway, Iceland, and Sweden are considered ideal destinations for hikers and trekkers due to their scenic beauty and varied terrain. Integration of features such as 4K and ultra HD recording in action cameras have resulted in consumers being able to capture high-quality photos and videos that they can directly post on social media channels, boosting product demand.

Asia Pacific Action Camera Market Trends

Asia Pacific is anticipated to emerge as the fastest-growing market during the forecast period. Continued improvements in standard of living in regional economies and rising disposable income levels have led to a sharp increase in travel and tourism activities among consumers, resulting in a strong demand for specialized devices such as action cameras. Asian countries such as Thailand, Indonesia, and Japan are popular for activities including diving, trekking, and skiing, encouraging people to record their adventures. On the other hand, the presence of several renowned mountain peaks and ranges such as Mount Everest have led to a consistently strong footfall of mountaineers, who extensively leverage gadgets such as action cameras to record their journeys. The presence of several major brands such as Sony, Panasonic, and YI Technology, coupled with rising interest in these gadgets among the younger demographics, has maintained a significant momentum in this market.

China is anticipated to become a major market for action cameras in the coming years, aided by a noticeable increase in domestic tourism that has led to more people engaging in outdoor activities such as hiking, skiing, and water sports. Moreover, increasing popularity of social media platforms such as Douyin and Xiaohongshu and the presence of a large youth population that is eager to document their lifestyles and adventures has boosted the market for durable and portable cameras. The rapid emergence of the economy as a technological hub has further encouraged the entry of several new market participants, enabling market expansion. For instance, in October 2024, Insta360, a camera company based in Shenzhen, China, announced the launch of the Insta360 Ace Pro 2, the newest addition to its Ace series of action cameras. The product has been co-developed with Leica and allows recording of higher frame rate videos at 4K60fps and 8K30fps Active HDR, through a 1/1.3-inch 8K sensor, as well as Leica SUMMARIT lens with a 157-degree FOV.

Key Action Camera Company Insights

Some key companies involved in the action camera market include GoPro, Garmin, and DJI, among others.

-

GoPro is a leading global name in the action camera industry, offering a range of action cameras, mounts, and accessories. The company manufactures and sells products under the GoPro and HERO brand names, with the latter including products such as HERO10 and HERO11 that are well-regarded for their compactness and durability.

Key Action Camera Companies:

The following are the leading companies in the action camera market. These companies collectively hold the largest market share and dictate industry trends.

- DRIFT

- Garmin Ltd.

- GoPro Inc.

- Nikon Inc.

- Olympus Corporation

- Panasonic Holdings Corporation

- SJCAM

- Sony Group Corporation

- DJI

- YI Technology

- ARASHI VISION INC. (Insta360)

- AKASO Tech LLC

Recent Developments

-

In September 2024, DJI announced the launch of the Osmo Action 5 Pro camera, which features a cutting-edge 1/1.3-inch sensor with a pixel size of 2.4 μm and a dynamic range of up to 13.5 stops. The device can shoot low-light and high-dynamic videos at 4K and 60fps, while the use of the SuperNight mode with AI-enabled noise reduction algorithms can yield clear footage in low-light environments.

-

In September 2024, GoPro announced the launch of two cameras: the advanced HERO13 Black with HB-Series Lenses, and a basic 4K camera, the HERO. The former offers capabilities such as GPS, magnetic latch mounting, four swappable HB-Series lens choices with auto detection to ensure ideal capture settings, an ultra-wide POV, and macro with variable focus, among other features. On the other hand, the HERO is an extremely compact camera that weighs under 100 grams and offers 4K resolution with a simple user interface.

Action Camera Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.27 billion |

|

Revenue Forecast in 2030 |

USD 12.49 billion |

|

Growth rate |

CAGR of 11.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million, volume in thousand units, and CAGR from 2025 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Product, resolution, distribution channel, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Austria, Belgium, Czech Republic, Denmark, Finland, France, Germany, Iceland, Ireland, Italy, Netherlands, Norway, Poland, Spain, Sweden, Switzerland, UK, Australia, China, Hong Kong, India, Indonesia, Japan, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand, Vietnam, Brazil, Argentina, Chile, Israel, Nigeria, Saudi Arabia, South Africa, Turkey, UAE |

|

Key companies profiled |

DRIFT; Garmin Ltd.; GoPro Inc.; Nikon Inc.; Olympus Corporation; Panasonic Holdings Corporation; SJCAM; Sony Group Corporation; DJI; YI Technology |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Action Camera Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global action camera market report based on product, resolution, distribution channel, application, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Box Style Camera

-

Cube Style Camera

-

Bullet Style Camera

-

360-degree Camera

-

Others

-

-

Resolution Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

SD & Full HD

-

Ultra HD

-

4K and Above

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

E-commerce

-

Brick and Mortar

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Sports and Adventure

-

Travel and Tourism

-

Automotive

-

Emergency Services

-

Security

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Austria

-

Belgium

-

Czech Republic

-

Denmark

-

Finland

-

France

-

Germany

-

Iceland

-

Ireland

-

Italy

-

Netherlands

-

Norway

-

Poland

-

Spain

-

Sweden

-

Switzerland

-

UK

-

-

Asia Pacific

-

Australia

-

China

-

Hong Kong

-

India

-

Indonesia

-

Japan

-

Malaysia

-

New Zealand

-

Philippines

-

Singapore

-

South Korea

-

Taiwan

-

Thailand

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Chile

-

-

Middle East & Africa

-

Israel

-

Nigeria

-

Saudi Arabia

-

South Africa

-

Turkey

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."