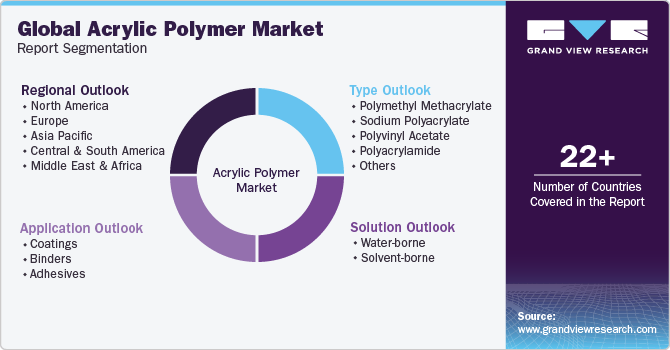

Acrylic Polymer Market Size, Share & Trends Analysis Report By Type (PMMA, PAAS, PAA), By Solution (Water-borne, Solvent-borne), By Application (Coatings Binders, Adhesives), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-268-1

- Number of Report Pages: 168

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Acrylic Polymer Market Size & Trends

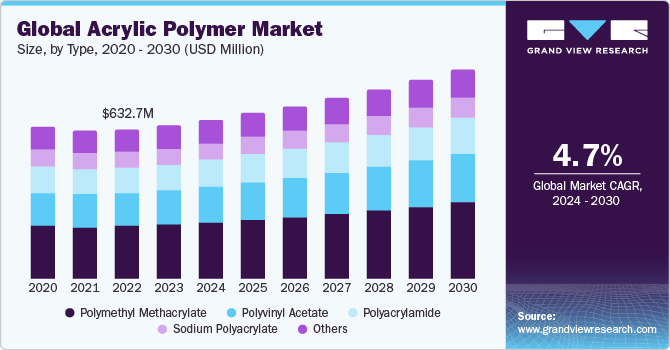

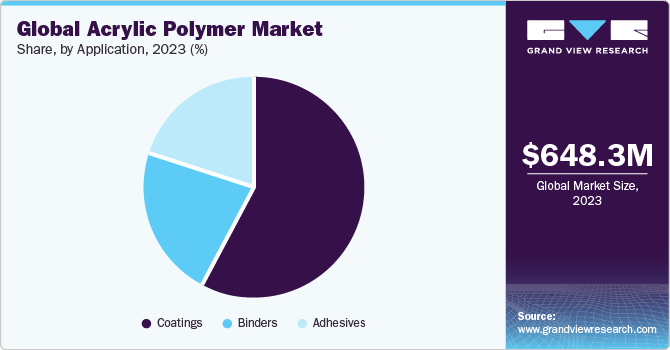

The global acrylic polymer market size was estimated at USD 648.3 million in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030. Increasing demand for environmentally friendly and sustainable materials as acrylic polymers can be produced with low volatile organic compounds (VOC) emissions and are recyclable. In addition, growth in construction, automobile production, and consumer goods manufacturing is increasing the demand for acrylic polymers in various end-use sectors.

Acrylic polymers have remarkable versatility, making them indispensable in a wide range of industries and applications. From paints and coatings to adhesives, textiles, building materials, automotive components, medical devices, and consumer products, acrylic polymers find extensive applications due to their desirable properties. These polymers offer properties such as durability, weather resistance, impact resistance, chemical resistance, UV stability, clarity, and color stability, making them the preferred choice for various end applications.

Despite its robust growth, the acrylic polymer market faces certain challenges. Fluctuations in raw material prices, particularly petrochemicals, can impact manufacturers' production costs and profit margins. In addition, regulatory measures to reduce VOC emissions and promote sustainability may require investments in research and development to develop compliant products. Competition from alternative materials and substitutes poses a challenge to the market growth.

Market Concentration & Characteristics

The acrylic polymer market has a fragmented structure characterized by numerous global and regional manufacturers, suppliers, and traders. While several large multinational companies dominate the market, there are several small-scale players and niche manufacturers that target specific applications or regional markets. This fragmentation promotes competition, innovation, and diversity in the product range.

Technological innovation plays a critical role in driving growth and competitiveness in the acrylic polymer industry. Manufacturers continually invest in research and development to develop new formulations, additives, and processing techniques that improve the performance, functionality, and sustainability of acrylic polymers. Advanced polymerization methods, improved crosslinking technologies, and novel additives contribute to product differentiation and market differentiation.

Type Insights

The Polymethyl Methacrylate (PMMA) type segment held the largest market share of 36% in 2023. PMMA is a transparent thermoplastic polymer widely used in applications, such as automotive parts, signage, lighting fixtures, and optical lenses, due to its excellent optical clarity, weather resistance, and impact resistance. This is anticipated to bode well for the segment’s growth over the forecast period.

Sodium polyacrylate, a superabsorbent polymer, finds extensive use in hygiene products, agriculture, and water treatment due to its exceptional water absorption capacity and moisture retention properties. Polyvinyl acetate (PVAc) is widely used in adhesives, paints, coatings, and emulsions and offers advantages such as good adhesion, flexibility, and ease of application.

Polyacrylamide is used in various industries such as wastewater treatment, mining, and oil extraction due to its flocculation, thickening, and rheological properties. Other types of acrylic polymers include a diverse range of materials with specific functionalities and applications. These include acrylic copolymers, acrylic emulsions, acrylic latex, and acrylic resins, which are used in industries such as construction, textiles, packaging, and medical technology due to their versatility, durability, and performance characteristics.

Solution Insights

Water-based acrylic polymers are characterized by their dispersion in water, making them environmentally friendly and having low VOC emissions. These solutions are widely used in industries such as coatings, adhesives, textiles, and building materials due to their ease of application, fast drying time, and excellent adhesion to various substrates. Water-based acrylic polymers offer benefits such as improved processability, reduced odor, and increased safety for both workers and end-users and are consistent with regulatory requirements and environmental sustainability initiatives.

In contrast, solvent-based acrylic polymers are dispersed in organic solvents such as toluene, xylene, or ethyl acetate. While solvent-based solutions offer benefits such as high gloss, excellent adhesion, and quick drying, they have higher VOC emissions and pose environmental and health risks. Solvent-based acrylic polymers are often used in applications where performance properties such as chemical resistance, durability, and weatherability are critical, for example, car paints, industrial paints, and special adhesives.

Application Insights

Acrylic polymers are widely used as binders in coating formulations due to their excellent adhesion, weather resistance, chemical resistance, and durability. Architectural coatings, including interior and exterior paints, benefit from the versatility and aesthetic properties of acrylic polymers, offering options for color retention, UV protection, and ease of application.

Acrylic polymers serve as binders in various industries including textiles, paper, nonwovens, and building materials. Acrylic binders provide adhesion, cohesion, and strength to substrates, enabling the formulation of long-lasting and high-performance products. In textiles, acrylic binders are used for textile finishing, carpet backing, and nonwoven production, offering properties such as stiffness, water repellency, and dimensional stability.

Regional Insights

North America dominated the global market and held a revenue share of over 36% in 2023. The acrylic polymer market in North America is driven by robust demand in industries such as coatings, construction, and automotive, with a focus on sustainable solutions and technological innovation.

U.S. Acrylic Polymer Market Trends

The U.S. acrylic polymer market is expected to grow at a CAGR of 5.3% from 2024 to 2030. The U.S. market benefits from a strong manufacturing base, high demand for eco-friendly coatings and adhesives, and investments in infrastructure development and renewable energy projects.

Europe Acrylic Polymer Market Trends

The Europe market captured 23% of the global market share, in terms of revenue, in 2023. In Europe, the acrylic polymer industry is characterized by stringent environmental regulations, growing adoption of water-borne formulations, and emphasis on sustainability across industries such as construction, packaging, and healthcare.

The acrylic polymer market in the UK is influenced by trends in architectural coatings, consumer goods manufacturing, and electronics, with increasing emphasis on recyclability and circular economy principles.

The Germany acrylic polymer market dominated Europe with a revenue share of around 26% in 2023. Germany is a key player in Europe, with a focus on advanced manufacturing technologies, automotive coatings, and green building initiatives, thus driving the demand for high-performance and eco-friendly solutions.

The Italy acrylic polymer market is anticipated to witness growth from 2024 to 2030. This growth is driven by innovation in textiles, fashion, and automotive sectors, with a growing demand for specialty coatings, adhesives, and polymer composites.

Asia Pacific Acrylic Polymer Market Trends

The acrylic polymer market in Asia Pacific is experiencing robust growth driven by rapid industrialization, urbanization, and infrastructure development, particularly in China, India, and Southeast Asian countries.

The China acrylic polymer market accounted for over 24% share of Asia Pacific in 2023, with its expanding manufacturing base, booming construction sector, and rising demand for automotive coatings, adhesives, and consumer goods.

The acrylic polymer market in India benefits from strong growth in construction, automotive, and packaging industries, supported by government initiatives to promote sustainable development and investments in infrastructure projects.

Central & South America Acrylic Polymer Market Trends

The acrylic polymer market in Central & South America is anticipated to grow at a CAGR of 3.9% from 2024 to 2030. The market is influenced by trends in automotive manufacturing, construction, and packaging sectors, with an increasing focus on sustainability and regulatory compliance.

Middle East & Africa Acrylic Polymer Market Trends

Growth of the acrylic polymer market in the Middle East & Africa is driven by infrastructure development projects, construction activities, and investments in oil & gas industry, with a growing demand for specialty coatings, adhesives, and sealants.

Key Acrylic Polymer Company Insights

Key companies are adopting several organic and inorganic expansion strategies, such as mergers & acquisitions, new product launches, capacity expansions, and joint ventures, to maintain and expand their market share.

-

In February 2024, Mallard Creek Polymers introduced a new acrylic water-based emulsion designed for functional barrier coatings. Tailored to offer robust resistance against oil and grease (even under varying temperatures), this product targets food packaging applications.

-

In September 2023, BASF unveiled an exclusive method for efficiently manufacturing 2-Octyl Acrylate (2-OA) on a large scale. This fresh acrylic monomer boasts a remarkable 73% bio-based content, validated through carbon-14 (C-14) analysis.

Key Acrylic Polymer Companies:

The following are the leading companies in the acrylic polymer market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Dow Chemical Company

- Arkema

- Celanese Corporation

- Mitsubishi Chemical Corporation

- DuPont

- LG Chem

- Sumitomo Chemical

- SABIC

- Solvay

Acrylic Polymer Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 673.0 million |

|

Revenue forecast in 2030 |

USD 884.7 million |

|

Growth rate |

CAGR of 4.7% from 2024 to 2030 |

|

Base year |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, trends |

|

Segments covered |

Type, solution, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; China; India; Japan; Australia; Brazil; Saudi Arabia |

|

Key companies profiled |

BASF; Dow Chemical Company; Arkema; Celanese Corporation; Mitsubishi Chemical Corporation; DuPont; LG Chem; Sumitomo Chemical; SABIC; Solvay |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Acrylic Polymer Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acrylic polymer market report based on type, solution, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polymethyl Methacrylate

-

Sodium Polyacrylate

-

Polyvinyl Acetate

-

Polyacrylamide

-

Others

-

-

Solution Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-borne

-

Solvent-borne

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Coatings

-

Binders

-

Adhesives

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global acrylic polymer market size was estimated at USD 648.3 million in 2023 and is expected to reach USD 673.0 million in 2024.

b. The global acrylic polymer market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 884.7 million by 2030.

b. Polymethyl methacrylate (PMMA) type segment held the largest share of 36% in 2023. It is a transparent thermoplastic polymer widely used in applications such as automotive parts, signage, lighting fixtures, and optical lenses due to its excellent optical clarity, weather resistance, and impact resistance.

b. Key players in acrylic polymer market are BASF, Dow Chemical Company, Arkema, Celanese Corporation, Mitsubishi Chemical Corporation, DuPont, LG Chem, Sumitomo Chemical, SABIC, and Solvay.

b. Increasing demand for environmentally friendly and sustainable materials as acrylic polymers can be produced with low VOC (volatile organic compounds) emissions and are recyclable.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."