- Home

- »

- Automotive & Transportation

- »

-

Acoustic Vehicle Alerting System Market Size Report, 2030GVR Report cover

![Acoustic Vehicle Alerting System Market Size, Share & Trends Report]()

Acoustic Vehicle Alerting System Market Size, Share & Trends Analysis Report By Vehicle Type (Two-Wheelers, Passenger, Commercial), By Propulsion, By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-175-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

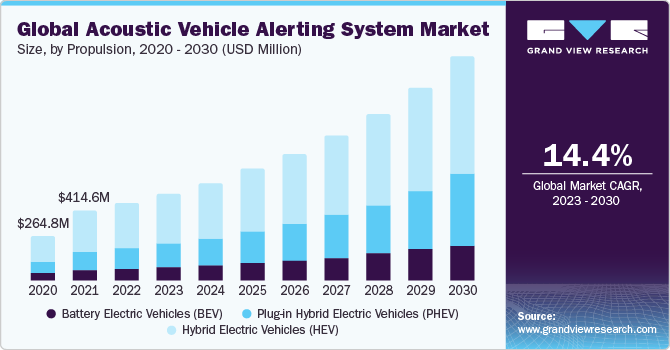

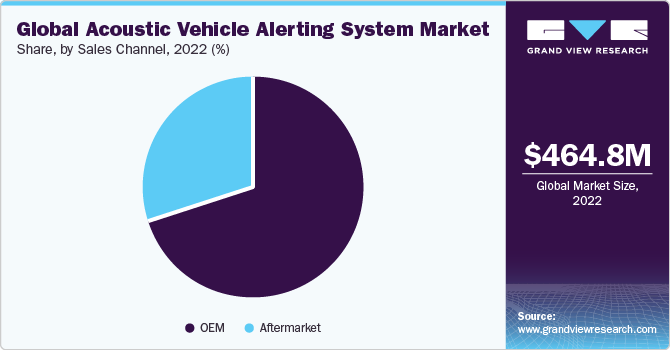

The global acoustic vehicle alerting system market size was valued at USD 464.8 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 14.4% from 2023 to 2030. The deployment of acoustic vehicle alerting system (AVAS) is accelerating due to the growth of Electric Vehicles (EVs) and the development of autonomous vehicles. Consumers increasingly adopt collision avoidance systems in their vehicles as they become more accustomed to advanced safety features. Due to consumer demand, manufacturers include these technologies as standard or optional features in their lineup of products.

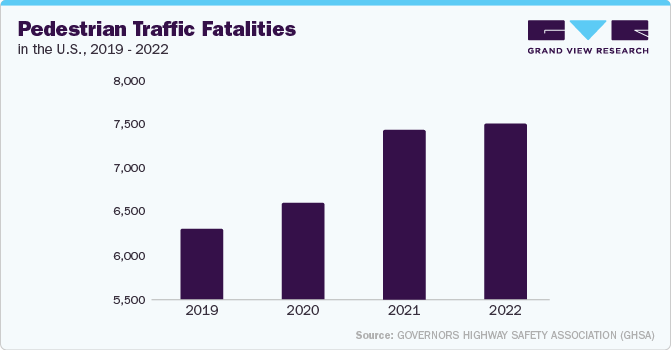

Furthermore, the surge in road accidents has led to a growing need for safety technologies such as collision avoidance systems, parking assistance, traction control, lane departure warnings, electronic stability control, airbags, tire pressure monitors, and telematics across the globe. Automotive semiconductors play a critical role in many ADAS technologies, enabling these systems to seamlessly detect and classify objects in the vehicle’s path. Moreover, these technologies can alert drivers to their surroundings and road conditions and automatically slow down or stop the vehicle based on calculations made by the semiconductors and related components.

According to the World Health Organization, around 1.24 million individuals die as a result of road traffic crashes each year. If this situation persists, road traffic crashes would become the seventh leading cause of death by 2030. This has triggered an increased focus on the prevention of accidents through the implementation of active safety measures. As a result, active safety features are increasingly being integrated into vehicles to help avoid collisions and accidents. Amongst the vehicle safety provisions, crash avoidance technology, including AVAS for electric vehicles, is set to remain a standard feature. Thus, with the rise in the adoption of vehicle safety systems, the market for AVAS is expected to grow significantly over the forecast period.

Vehicle Type Insights

Based on the vehicle type, the acoustic vehicle alerting system market is segmented into two-wheelers, passenger, and commercial. The passenger vehicles segment dominated the market in 2022. The market is driven by initiatives taken by governments of various countries to promote the manufacturing and adoption of electric passenger vehicles. Additionally, increasing awareness of the environmental hazards of combustion engine vehicle emissions is promoting customers to adopt electric passenger vehicles.

Propulsion Insights

On the basis of propulsion, the market is segmented into Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Hybrid Electric Vehicle (HEV). The HEV segment dominated the market in 2022. The continued urbanization and growing infrastructure spending in developing economies, such as China, India, and Turkey, are expected to drive the growth of the electric commercial vehicle market. Furthermore, the growth of the e-commerce sector, which has completely transformed logistics, is contributing to the high demand for electric commercial vehicles.

Sales Channel Insights

On the basis of a sales channel, the market is segmented into OEM and aftermarket. An OEM segment held the largest market share in 2022. The government mandates for the implementation of AVAS for safety concerns are propelling demand in the market. For instance, as per the EU regulation 540/2014, all new vehicles sold or imported from July 2021 in Europe must be equipped with an Acoustic Vehicle Alerting System.

Regional Insights

Asia Pacific dominated the market in 2022. The automotive sector, which includes the manufacture of motor vehicles and aftermarket parts, has a high production level and contributes significantly to the region's sales of two-wheelers, passenger cars, and commercial vehicles. The sector has a promising future since original equipment manufacturers are becoming more involved in aftermarket activities, and component wholesalers are merging.

Key Companies & Market Share Insights

Key players operating in the market include Hella Gmbh & Co. KGaA; Brigade Electronics; Mercedes-Benz AG; Continental Engineering Services GmbH; Harman International; Soundracer AB; Kendrion NV; Kufatec GmbH & Co. Kg; Texas Instruments; and Honda Motor Company; among others. The market players are adopting strategic initiatives such as mergers & acquisitions, collaborations, and new product developments to gain a competitive edge.

-

In July 2023, Maruti Suzuki India Limited, a subsidiary of Suzuki Motor Corporation, launched the Maruti Grand Vitara hybrid variant with AVAS to enhance pedestrian safety.

-

In April 2022, Honda Cars India Limited, a subsidiary of Honda Motor Co. Ltd., launched an electric hybrid vehicle named City e:HEV in India. The vehicle is equipped with safety features, including an Acoustic Vehicle Alerting System (AVAS), ACE body structure, Multi-angle Rearview Camera, six airbags, a Tyre Pressure Monitoring System, Vehicle Stability Assist, Hill Start Assist, and Deflation Warning.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."