- Home

- »

- Pharmaceuticals

- »

-

Acne Drugs Market Size, Share And Trends Report, 2030GVR Report cover

![Acne Drugs Market Size, Share & Trends Report]()

Acne Drugs Market Size, Share & Trends Analysis Report By Type (Inflammatory, Non-inflammatory), By Therapeutic Class, By Mode Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-440-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Acne Drugs Market Size & Trends

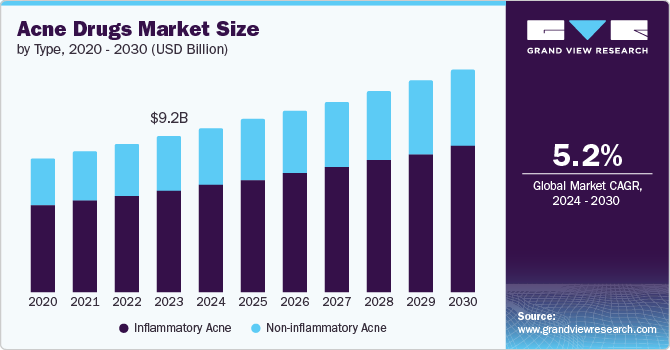

The global acne drugs market size was valued at USD 9.22 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The driving factors of the growth include the increasing prevalence of acne, lifestyle changes, rising skin awareness, and growing cosmetic concerns. Acne is a chronic skin condition caused by hormonal fluctuations, unhealthy lifestyle changes, and dietary changes. According to the National Library of Medicine report published in June 2021, acne is the most common skin condition affecting 9.4% of the global population, making it the eighth most prevalent disease worldwide. This high prevalence of acne cases is driving the growth of the acne drug market.

Lifestyle changes such as indulgence in smoking, rising stress levels, hormonal imbalances, and excessive pollution contribute to acne. According to the World Health Organization (WHO) report published in December 2022, 99% of the world's population lives where air quality does not meet World Health Organization guidelines. The rising air pollution can harm the skin, leading to dehydration, damaging the skin barrier, and causing severe skin issues such as acne. Such rising incidences are creating high demand for acne treatment and driving market growth.

Type Insights

Inflammatory acne dominated the market and accounted for a share of 65.4% in 2023. The factors attributing to the growth of the segment are bacterial skin infections that can cause inflammatory acne. According to the ReAct global network organization’s report published in December 2022, bacterial infections claimed the lives of 7.7 million people in 2019. In addition, the inflammatory acne caused by bacterial infections may further lead to cysts requiring medical attention. The increasing treatment options for inflammatory acne, such as topical creams, oral drugs, and extraction procedures, are also adding to the segment growth.

The non-inflammatory acne segment is expected to grow significantly over the forecast period. The comedonal acne, also known as non-inflammatory acne, are formed due to excess oil secretions in the skin. The increasing awareness and availability of various treatment options for non-inflammatory acne such as such as salicylic acid, tea tree oil, benzoyl peroxide, glycolic acid, retinoids such as tretinoin, and isotretinoin is expected to boost segment growth.

Therapeutic Class Insights

Over the counter (OTC) drugs dominated the market and accounted for a share of 35.9% in 2023. The expensive alternatives and growing consumer awareness are attributed to the segment growth. Nonprescription drugs for treating acne are on the rise because of self-awareness, accurate dosage provided, ease of administration, and user-friendliness for end consumers. Various companies are offering over-the-counter drugs to treat acne, such as Johnson & Johnson Services, Inc., Pfizer Inc., and GALDERMA.

The topical retinoids segment is expected to register the fastest CAGR over the forecast period. The rising prevalence of acne is primarily driving the segment market. Topical retinoids are used to treat many skin conditions, including acne, and are available in the form of creams, serums, gels in various concentrations, and user-friendly packaging. Companies are involved in discovering innovative solutions to treat skin conditions. For instance, Bausch Health Companies Inc. received FDA approval in October 2023 for Cabtreo, a triple combination topical treatment powered with a retinoid for acne. Such innovations are expected to drive the segment growth.

Mode Of Administration Insights

Topical segment dominated the market and accounted for a share of 47.5% in 2023. The segment growth can be attributed to rising demand for topical products due to their ease of use, accurate dosage, and high availability as an over-the-counter drug. According to the research report published by the National Library of Medicine in June 2023, the most used topical drug to treat acne is adapalene, a retinoid approved by the U.S. Food and Drug Administration (FDA). The topical medications are used to treat mild to moderate acne, and various companies offer these as nonprescription drugs. For instance, GALDERMA’s Differin is a topical retinoid solution containing adapalene 0.1% or 0.3% to treat acne. Such players in the market are driving the segment growth.

The injectable segment is expected to register the fastest CAGR over the forecast period. Mild acne can be treated with topical drugs, but severe acne, nodular, and cystic acne can be treated by injecting a steroid drug, enabling faster recovery and reduction in pain. In addition, cortisone is injected as it can penetrate deeply into the skin, making it an effective alternative over topical for treating cystic acne, and preventing scars. Such advanced alternatives and their increased demand drive the segment growth.

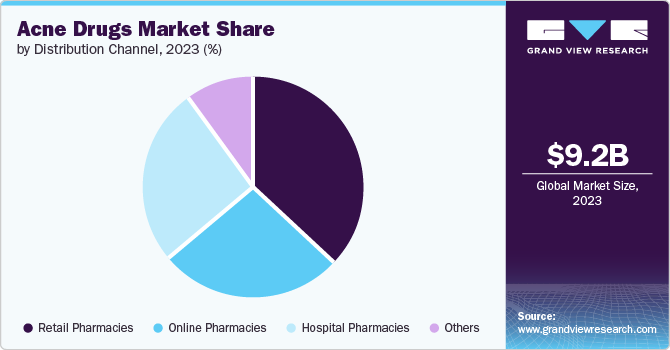

Distribution Channel Insights

Retail pharmacies dominated the market and accounted for a share of 37.5% in 2023. The increased skin awareness, ready-to-use drugs available in customized concentrations for various affected people, and their availability for nonprescription are attributed to the growth of the segment. Over-the-counter medicines available at the retail pharmacies and increased consumer awareness regarding the acne drugs drive the segment growth. The retail pharmacies offering acne drugs are CVS Pharmacy, Walmart, Walgreens, The Kroger Co., to name a few. Such key players are expected to drive the segment growth.

Online pharmacies are expected to register the fastest CAGR of 6.6% during the forecast period. The emergence of the COVID-19 pandemic, increased internet connectivity, and a rise in consumer awareness of skin issues are attributed to the segment growth. The increased telemedicine sector has paved the way for online pharmacies, enabling them to offer a wide range of medications and drugs for treating various health issues, such as acne. Some key players expected to drive the segment growth are Patel's Chemist Limited's Click2Pharmacy, PharmEasy, Tata 1mg, and Expert Health Limited's LloydsPharmacy.

Regional Insights

North America acne drugs market dominated the market in 2023. The acne drugs market growth is attributed to the rising prevalence of acne, developed healthcare infrastructure, and the strong presence of companies involved in the acne drugs market. According to the Canadian Dermatology Association, 5.6 million citizens are affected by acne, accounting for around 20% of the population. Various companies are involved in the acne drug market to offer innovative solutions. For instance, Sun Pharmaceutical Industries Ltd. received approval from Health Canada for WINLEVI, a topical drug for acne, in June 2023. Such innovations are expected to drive market growth.

U.S Acne Drugs Market Trends

The U.S. acne drugs market accounted for a 35.9% share of the global market in 2023. The increasing incidences of acne and the presence of established pharmaceutical firms are primarily driving market growth. According to Pfizer Inc. data, acne is a common skin condition in the U.S. and affects 50 million citizens in the country annually. Various companies are involved in R&D to provide advanced alternatives to treat chronic conditions. For instance, Sun Pharmaceutical Industries Ltd. launched WINLEVI, a topical medication for treating acne, in the U.S. in November 2021. Such advanced solutions are expected to drive market growth in the region.

Europe Acne Drugs Market Trends

Europe accounted for a significant market share in 2023 in the acne drugs market. The altered lifestyle, rise in stress levels, and hormonal imbalances are the main factors causing acne and driving high demand for its treatment. The data published in Nature in February 2024 reported an acne prevalence of 57.8% in European countries. Companies are involved in partnerships to offer acne solutions to the affected citizens. For instance, Cosmo Pharmaceuticals signed a distribution and license agreement in September 2023 with GLENMARK PHARMACEUTICALS LTD. to commercialize Winlevi in 15 European countries and in South Africa. Such collaborations are expected to drive the regional growth.

Acne skin condition is very common in the UK. According to local online pharmacy data published in May 2022, one in every four young people suffers from acne, accounting for 24% of the UK population. According to the article published by the University of York in September 2023, NHS spent approximately USD 786 million on skin conditions. Several companies are involved in providing new drugs for the treatment of the condition. For instance, Cutera launched AviClear, an energy-based device applicable for long-term acne treatment, in February 2024, available in the UK, Europe, and Australia. Such innovations are expected to drive market growth.

Asia Pacific Acne Drugs Market Trends

Asia Pacific acne drugs market is estimated to register the fastest CAGR over the forecast period. According to the SingHealth Group, about 88% of adolescents are affected with mild to moderate acne. Various companies are involved in R&D activities and collaborations and are launching new skin treatment drugs. For instance, Hyphens Pharma International Limited entered into a license and supply agreement with Cassiopea S.p.A., a Cosmo Pharmaceutical subsidiary, to commercialize Winlevi, an acne drug, in December 2022 across 10 ASEAN countries. Such collaborations and agreements are expected to drive market growth.

According to the International Journal of Applied Pharmaceutics report published in September 2022, acne prevalence is rising in India, accounting for 72.3% of adolescents and 27% of adults with skin conditions. Various companies seek advanced solutions to treat skin conditions and discover new drugs. For instance, GLENMARK PHARMACEUTICALS LTD. launched a topical gel, Minocycline 4%, in India in July 2022. Such progress in acne drug treatment is driving market growth.

Key Acne Drugs Company Insights

Some key companies in the acne drugs market include GALDERMA, Johnson & Johnson Services, Inc., GSK plc., Sun Pharmaceutical Industries Ltd., and Bayer AG. Key companies are involved in strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

GALDERMA is a dermatology company dedicated to providing a wide range of flagship brands and services in the field of dermatology. The company develops dermatological products and manufactures medical solutions, drugs, and therapeutic skin products for treating various skin issues, such as acne, psoriasis, and skin cancer.

-

Bausch Health Companies Inc. is a pharmaceutical company that develops, manufactures, and markets a range of products in dermatology and neurology. The company develops a range of dermatology products to treat acne, actinic keratosis, atopic dermatitis, psoriasis, and other skin issues.

Key Acne Drugs Companies:

The following are the leading companies in the acne drugs market. These companies collectively hold the largest market share and dictate industry trends.

- GALDERMA

- Johnson & Johnson Services, Inc.

- GSK plc.

- Pfizer Inc.

- AbbVie Inc.

- Sun Pharmaceutical Industries Ltd.

- Bausch Health Companies Inc.

- Nestlé Skin Health S.A.

- Bayer AG

- Viatris Inc.

- Teva Pharmaceutical Industries Ltd.

- F. Hoffmann-La Roche Ltd

- LEO Pharma A/S

- Perrigo Company plc

Recent Developments

-

In April 2024, Allergan Aesthetics launched two new SkinMedica acne products, namely an acne clarifying treatment and a purifying gel cleanser.

-

In June 2023, Cutera received U.S. Food and Drug Administration (FDA) clearance for AviClear, an acne treatment.

-

In March 2022, GALDERMA launched TWYNEO cream with a combination of 0.1% tretinoin and 3% benzoyl peroxide to treat moderate to severe acne.

Acne Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.69 billion

Revenue forecast in 2030

USD 13.13 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, therapeutic class, mode of administration, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, Brazil, KSA, UAE, South Africa

Key companies profiled

GALDERMA, Johnson & Johnson Services, Inc., GSK plc., Pfizer Inc., AbbVie Inc., Sun Pharmaceutical Industries Ltd., Bausch Health Companies Inc., Nestlé Skin Health S.A., Bayer AG, Viatris Inc., Teva Pharmaceutical Industries Ltd., F. Hoffmann-La Roche Ltd, LEO Pharma A/S, Perrigo Company plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acne Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acne drugs market report based on product, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inflammatory Acne

-

Non-inflammatory Acne

-

-

Therapeutic Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical Retinoids

-

Oral Antibiotics

-

Oral Retinoids

-

Over-the-Counter (OTC) Drugs

-

-

Mode of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Oral

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."