- Home

- »

- Organic Chemicals

- »

-

Acetylene Gas Market Size, Share & Growth Report, 2030GVR Report cover

![Acetylene Gas Market Size, Share & Trends Report]()

Acetylene Gas Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Transportation, Building & Construction, Electric & Electronics, Pharmaceutical), By Application (Metal Working, Chemicals, Lamps), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-118-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

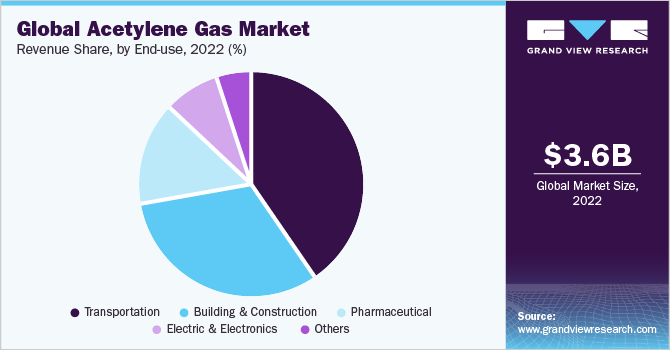

The global acetylene gas market size was valued at USD 3.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. The primary factors driving the market is the increasing demand for acetylene in various end-use industries, such as chemical manufacturing, metal fabrication, and automotive manufacturing. Acetylene gas is primarily used as a fuel gas for cutting, welding, and brazing applications due to its high flame temperature and quick ignition. The market demand for acetylene gas is expected to experience further growth due to the increasing demand for metal cutting and welding applications. Moreover, the healthcare sector is emerging as another key driver for the market, with rising demand for the market in the treatment of various medical conditions, including hypertension and angina.

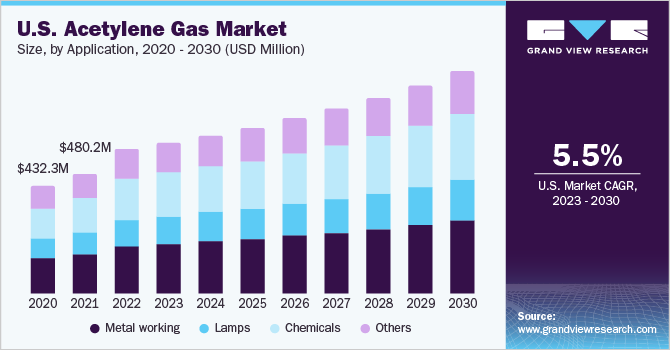

The U.S. is a significant market for the acetylene gas industry, with various driving factors contributing to its growth. One of the primary drivers of the product in the U.S. is the rising demand for acetylene in metalworking applications. It is commonly used in metal cutting, welding, and brazing applications due to its high flame temperature, quick ignition, and versatility. The growing number of metal fabrication and manufacturing industries in the U.S. is expected to further propel the market growth.

Moreover, the increasing demand for product in the chemicals industry is another driving factor for the U.S. market. The product is used as a building block to produce various chemicals, including vinyl chloride, acetic acid, and other specialty chemicals. The growth of the chemical manufacturing industry in the US is expected to boost the demand for the market.

Application Insights

The metal working application segment dominated the market with a revenue share of 33.4 % in 2022. This is attributed to metalworking industry, acetylene gas is commonly used for welding, cutting, and brazing applications due to its high flame temperature and quick ignition. The growing demand for metal fabrication and manufacturing is expected to boost the demand for market gas in the metalworking industry.

Acetylene gas is also widely used in the production of lamps, particularly in carbide lamps used in mining, caving, and other outdoor activities. These lamps are known for their reliable and robust performance in harsh environments, making them ideal for outdoor activities. The increasing adoption of sustainable lighting solutions is expected to drive the demand for products in the lamps industry.

Moreover, acetylene gas is widely used in the chemicals industry as a building block to produce various chemicals, including vinyl chloride, acetic acid, and other specialty chemicals. The growth of the chemical manufacturing industry is expected to boost the demand for the market.The demand for products in these applications is expected to drive the growth of the market. The increasing adoption of sustainable production methods and technological advancements in acetylene production is also expected to boost market growth.

End-use Insights

The transportation end-use segment dominated the market with more than revenue share of 41.5 % in 2022. This is attributable to the fact that acetylene gas is used in oxy-fuel welding and cutting processes, which use fuel gases and oxygen to weld or cut metals. The process involves the use of an oxy-fuel torch to heat the metal to its ignition temperature, followed by the use of a stream of oxygen to burn and cut through the metal. Acetylene gas is commonly used as a fuel gas in this process due to its high flame temperature and quick ignition. The growing demand for vehicles and the increasing use of lightweight materials in the automotive industry are expected to drive the demand for it in the transportation industry.

In the building and construction industry, the market is used for welding, cutting, and brazing applications, particularly in the construction of steel and metal structures. The growing demand for construction activities and the increasing adoption of sustainable construction methods are expected to drive the demand for acetylene gas in the building and construction industry.

Moreover, acetylene gas finds use in the pharmaceutical industry for the production of various pharmaceutical products, including antibiotics, antiseptics, and other specialty chemicals. The growing demand for pharmaceutical products and the increasing adoption of sustainable production methods are expected to drive the demand for acetylene gas in the pharmaceutical industry.

Acetylene gas is also widely used in the electric and electronics industry for the production of semiconductors, electronic chips, and other electronic components. The growing demand for electronic devices and the increasing adoption of energy-efficient technologies are expected to boost the demand for market in the electric and electronics industry.

Regional Insights

Asia Pacific region dominated market with a revenue share of 31.2% in 2022. This is attributable witness significant growth in the acetylene gas market due to the presence of rapidly developing economies such as China and India. The growing demand for electronic devices and the increasing adoption of sustainable production methods are expected to drive the demand for acetylene gas in the region. The construction industry in Asia Pacific is also a major consumer of market, particularly for welding and cutting applications.

North America is a significant market due to the presence of a well-established manufacturing sector, which uses products for various applications such as welding, cutting, and brazing. The growing demand for lightweight materials in the automotive and aerospace industries is expected to drive the demand for product in the region. Additionally, the increasing adoption of energy-efficient technologies and the growing focus on sustainable development are expected to boost the demand in North America.

Moreover, Europe is another significant market for acetylene gas, driven by the growing demand for construction activities and the increasing adoption of sustainable construction methods. The automotive industry in Europe is also a major consumer of the market, particularly for welding and cutting applications. The increasing focus on reducing carbon emissions and the growing demand for energy-efficient technologies are expected to drive the demand for acetylene gas in Europe.

Key Companies & Market Share Insights

The market for acetylene gas is characterized by intense competition. Major players expanding into different regions are engaged in diversifying their product portfolio and extending their global reach. These manufacturing companies have various strategic partnerships and distribution agreements to cater to the growing demand for their products in new geographical markets. For instance, in 2022, Orion Engineered Carbons S.A., a Luxembourg-based company, has proposed the construction of a singular manufacturing facility in the U.S. that will exclusively produce product -based conductive additives.These additives are an essential component in the value chain for lithium-ion batteries, high-voltage cables, and other products that are integral to the worldwide shift towards electrification and renewable energy. Some of the prominent players in the global acetylene gas market include:

-

BASF SE

-

Airgas

-

Gulf Cyro

-

China Petroleum and Chemical Corporation

-

Linde Group

-

SINOPEC

-

Praxair Technology Inc.

-

Dow Chemical Company

-

Toho Acetylene

-

Sichuan Vinylon

Acetylene Gas Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.7 billion

Revenue forecast in 2030

USD 5.4 billion

Growth rate

CAGR of 5.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Applications, end-use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Switzerland, Italy, Spain Netherland, Russia, China; India; Japan; Malaysia, Vietnam; Indonesia; Australia, New Zealand, Brazil; Argentina, Chile, Columbia, Saudi Arabia; South Africa; UAE; Iran, Oman, UAE, Qatar, Kuwait, Nigeria, Angola

Key companies profiled

BASF SE, Airgas, Gulf Cyro, China Petroleum and Chemical Corporation, Linde Group, SINOPEC, Praxair Technology Inc., Dow Chemical Company, Toho Acetylene, Sichuan Vinylon

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acetylene Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global acetylene gas market report on the basis of application, end-use and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Metal working

-

Lamps

-

Chemicals

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Transportation

-

Building & Construction

-

Electric & Electronics

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Switzerland

-

France

-

Italy

-

Spain

-

The Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Malaysia

-

Indonesia

-

Vietnam

-

Australia

-

New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

Iran

-

Oman

-

UAE

-

Qatar

-

Kuwait

-

Nigeria

-

Angola

-

-

Frequently Asked Questions About This Report

b. The global acetylene gas market size was estimated at USD 3.6 billion in 2022 and is expected to reach USD 3.7 billion in 2023.

b. The global acetylene gas market is expected to grow at a compound annual growth rate of 5.4 % from 2023 to 2030 to reach USD 5.4 billion by 2030.

b. Asia Pacific dominated the acetylene gas market with a share of 31.2% in 2022. This is attributable to the growing demand for electronic devices and the increasing adoption of sustainable production methods

b. Some key players operating in the acetylene gas market include BASF SE, Airgas, Gulf Cyro, China Petroleum and Chemical Corporation, Linde Group, SINOPEC, Praxair Technology Inc., Dow Chemical Company, Toho Acetylene, Sichuan Vinylon

b. Key factors that are driving the market growth include increasing demand for metal cutting and welding applications, the growing demand for vehicles, and the increasing use of lightweight materials in the automotive industry

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.