- Home

- »

- Organic Chemicals

- »

-

Acetonitrile Market Size, Share And Growth Report, 2030GVR Report cover

![Acetonitrile Market Size, Share & Trends Report]()

Acetonitrile Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Derivatives, Solvents), By End Use (Pharmaceutical, Agrochemicals, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-349-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Acetonitrile Market Summary

The global acetonitrile market size was estimated at USD 395.4 million in 2023 and is projected to reach USD 591.4 million by 2030, growing at a CAGR of 6.1% from 2024 to 2030. The market driven by the rising demand for high-purity solvents in pharmaceutical manufacturing processes is a crucial driver influencing the market growth.

Key Market Trends & Insights

- The Asia Pacific dominated the market and accounted for a 53.6% share in 2023.

- Based on product, solvent dominated the market and accounted for a revenue share of approximately 61.3% in 2023.

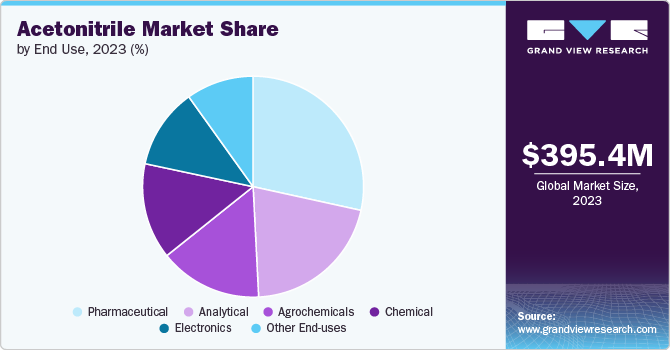

- Based on end Use, Pharmaceutical dominated the market and accounted for a revenue share of 28.5% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 395.4 Million

- 2030 Projected Market Size: USD 591.4 Million

- CAGR (2024 to 2030): 6.1%

- Asia Pacific: Largest market in 2023

- Europe: Fastest growing market

Additionally, the increasing production of liquid crystal displays (LCDs) and semiconductors in the electronics industry is a major factor boosting the industry.Acetonitrile, also known as methyl cyanide, is a colorless liquid organic compound with the chemical formula CH3CN. It belongs to the nitrile group of organic compounds and is commonly used as a polar aprotic solvent in various chemical reactions and processes. It is highly miscible with water, making it a versatile solvent for chromatography, spectroscopy, and electrochemistry. Its low viscosity and high dielectric constant make it an ideal solvent for a wide range of applications in the pharmaceutical, agricultural, and industrial sectors.

Drivers for the global acetonitrile market include its versatile properties, making it suitable for a wide range of applications across various end use industries. For instance, the increasing production of liquid crystal displays (LCDs) and semiconductors in the electronics industry has been a major driver boosting the industry growth. Acetonitrile's use in the photolithography process for the production of semiconductors, where it is used to clean and prepare silicon wafers, has stimulated market growth significantly. Additionally, the pharmaceutical industry represents a significant segment of the market, with consumption expected to continue growing over the forecast period.

Restraints in the acetonitrile market include factors such as its potential hazards to human health during prolonged exposure, volatility in supply, and its relatively poor environmental profile. These factors have asserted a negative influence on its use across laboratories and manufacturing facilities, posing challenges to the industry’s growth. However, despite these restraints, the market presents several opportunities. For instance, the rising downstream demand from the pharmaceutical industry has led to increasing acetonitrile prices internationally, despite low petrochemical demand. This surge in demand has opened up opportunities for growth in the industry, especially with the resurgence of COVID-19 instances leading to increased activity in the pharmaceutical and solvent industries.

Product Insights & Trends

“Derivative emerged as the fastest growing product with a CAGR of 6.4%”

Solvent dominated the market and accounted for a revenue share of approximately 61.3% in 2023. This segment is driven by its widespread use in various applications such as high-performance liquid chromatography (HPLC) and as a medium-polarity non-protic solvent in laboratory settings. Acetonitrile's properties, including low viscosity, high dielectric constant, and compatibility with a wide range of analytes, make it an ideal solvent for chromatographic techniques such as HPLC and liquid chromatography-mass spectrometry (LCMS).

Moreover, the demand for acetonitrile as a solvent is attributed to its application in the manufacturing of antibiotics, owing to its physical and chemical properties such as low freezing and boiling points, low viscosity, and low toxicity, making it a safe and effective solvent for pharmaceutical applications.

Derivatives of acetonitrile are projected to witness significant market share during the forecast period. Acetonitrile is commonly used as an important intermediate in organic synthesis, leading to the development of new methods for the synthesis of a variety of important compounds. For instance, acetonitrile serves as a solvent in the extraction of fatty acids, animal and vegetable oils, and unsaturated petroleum hydrocarbons, with the extraction segment expected to witness the highest compound annual growth rate (CAGR) during the forecasted years.

End Use Insights & Trends

“Analytical emerged as the fastest growing end use with a CAGR of 6.8%”

Pharmaceutical dominated the market and accounted for a revenue share of 28.5% in 2023. Acetonitrile is widely used as a solvent in the manufacturing of antibiotics and in drug recrystallization due to its exceptional physical and chemical properties, including low viscosity and low freezing/boiling points. The increasing usage of these products as a derivative in the pharmaceutical industry is a major factor driving the growth of the derivative segment. The pharmaceutical industry's reliance on acetonitrile for drug synthesis, purification, and formulation underscores its critical role in pharmaceutical manufacturing processes.

In the analytical industry, acetonitrile serves as a high-performance liquid chromatography (HPLC) solvent due to its ability to dissolve a wide range of ionic compounds. The analytical applications of acetonitrile are projected to lead the market, reflecting its significance in analytical chemistry as a solvent or mobile phase. The compound's low viscosity, high elution strength, and compatibility with a wide range of analytes make it an ideal solvent for chromatographic techniques such as HPLC and liquid chromatography-mass spectrometry (LCMS).

Acetonitrile is used in pesticides, along with other compounds, for the extraction of fatty acids, vegetable oils, or pesticide residue. The segmental growth of the market is attributed to the sharp uptake of agrochemicals in the agricultural sector and the healthy export activities. The seamless availability of fertilizers and pesticides in developing economies, coupled with the increasing sowing activities, is expected to drive the demand for acetonitrile in the agrochemicals industry.

Regional Insights & Trends

The North America acetonitrile market has witnessed improvements in production, particularly in the third quarter, owing to the high availability of upstream propylene. However, logistical issues have continued to affect the regional petrochemical market, with record high container freight rates escalating the import prices of several petrochemicals. Despite these challenges, the demand in the region has been seen improving significantly. The region is also a major producer of acetonitrile, holding more than 50% of the total market share in terms of production and leading in terms of consumption.

Asia Pacific Acetonitrile Market Trends

Asia Pacific dominated the market and accounted for a 53.6% share in 2023. The end use sector in Asia Pacific is dominated significantly by the pharmaceuticals sector, accounting for 70% of the acetonitrile market share. The rapidly rising production of generic pharmaceuticals, engineered drugs, and pesticides in the region is expected to continue driving the growth of the industry. Additionally, continuous research and development activities being carried out in the region for the development of new medicines and pesticides are also fueling the growth of the Asia Pacific acetonitrile market

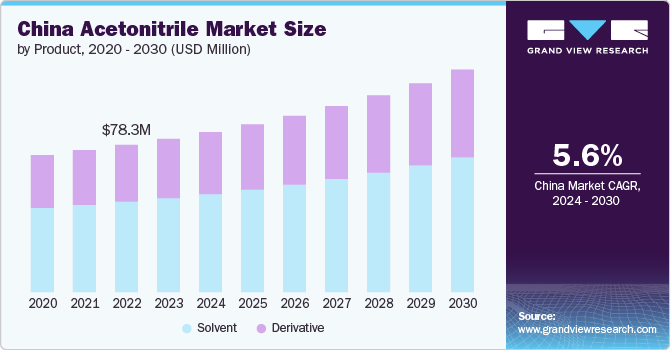

China Acetonitrile Market Trends

In China, the largest consumer nation and one of the major producers of acetonitrile, the market is expected to witness significant growth. The region's rapid industrialization and the expansion of the pharmaceutical and biotechnology industries have contributed to its major market share. The country's manufacturing hub status further solidifies its position in the global industry, making it a key player in the industry's growth.

Europe Acetonitrile Market Trends

“Europe emerged as the fastest growing market with a CAGR of 6.9% from 2024-2030”

Europe also plays a significant role in the global acetonitrile market, contributing to consumption growth. The increasing demand for acetonitrile due to the growing petrochemical industry and the rising interest in natural and sustainable products is fostering industry growth in Europe. The pharmaceutical industry, among others, continues to drive the demand for acetonitrile in the region.

Key Acetonitrile Company Insights

The competitive landscape of the global acetonitrile market is characterized by key players and their strategic initiatives, market trends, consolidation, and other major effects. Ineos AG stands out as the world's biggest producer of acetonitrile, accounting for around a third of the total global production. The company's dominance in worldwide industry reflects its strong position and influence on market dynamics. Furthermore, major players in the market are working closely with end-users to meet consumer requirements, indicating a customer-centric approach to business operations. This customer focus is likely to drive innovation and product development to cater to evolving market needs and preferences.

Some of the key players operating in the global acetonitrile market include

-

INEOS AG is a major player in the global acetonitrile market, with a significant share in both production and consumption. It has a strong focus on regulatory compliance and quality control in pharmaceuticals and food safety testing, driving the demand for acetonitrile in analytical applications.

-

Honeywell International plc’s initiatives include a customer-centric approach to business operations, driving innovation and product development to cater to evolving market needs and preferences. Honeywell International PLC is actively involved in the rapid expansion of the pharmaceutical and petrochemical industries, which are strengthening the overall industry.

Alkyl Amines Chemicals Limited: and Jindal Speciality Chemicals are some of the emerging market participants in the global acetonitrile market.

-

Alkyl Amines Chemicals Limited is a global supplier of aliphatic amines, specialty amines, and amine derivatives to various industries, including pharmaceuticals and agrochemicals. Alkyl Amines Chemicals Limited's product portfolio includes acetonitrile, DEHA, DMA-HCLA, and Triethylamine, reflecting its diverse offerings in the chemical industry.

-

Jindal Specialty Chemicals Private Limited, a member of the Jindal Group, has made significant investments in the construction of an acetonitrile plant in Kheda, Gujarat, reflecting its commitment to expanding its production capacity. The company's focus on technology-oriented product manufacturing and differentiation positions it as a key player in the global market.

Key Acetonitrile Companies:

The following are the leading companies in the acetonitrile market. These companies collectively hold the largest market share and dictate industry trends.

- INEOS

- Honeywell International Inc

- Cepsa

- Alkyl Amines Chemicals Limited

- Henan GP Chemicals Co.,Ltd

- Shandong Xinhua Pharma

- Zhengzhou Meiya Chemical Products Co.,Ltd

- Jindal Speciality Chemical

Recent Developments

-

In April 2024, INEOS announced the launch of the world’s first bio-based acetonitrile product meant for pharmaceutical industry. The new product named INVIREO would enable a 90% reduction in the carbon footprint for INEOS Nitriles.

-

In April 2022, INEOS Nitriles announced the plan to invest and raise a world scale acetonitrile manufacturing facility at its operational location in Kln, Germany. The move is expected to cater to the increasing demand from the region’s pharma and petrochemical industry.

Acetonitrile Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 414.7 million

Revenue forecast in 2030

USD 591.4 million

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume and Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Thailand; Indonesia; Vietnam; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

INEOS; Honeywell International Inc; Cepsa; Alkyl Amines Chemicals Limited; Henan GP Chemicals Co. Ltd; Shandong Xinhua Pharma; Zhengzhou Meiya Chemical Products Co. Ltd; Jindal Speciality Chemical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acetonitrile Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acetonitrile market report based on product, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Derivative

-

Solvent

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Analytical

-

Agrochemicals

-

Electronics

-

Chemical

-

Other End-Uses

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Indonesia

-

Vietnam

-

Malaysia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global acetonitrile market was valued at USD 395.43 million in 2023 and is expected to reach USD 414.69 million in 2024

b. The global acetonitrile market is anticipated to grow at a high CAGR of 6.1% from 2024 to reach USD 591.36 million by 2030.

b. Asia Pacific dominated the market and accounted for a 53.6% share in 2023. The end-use sector in Asia Pacific is dominated significantly by the pharmaceuticals sector, accounting for 70% of the acetonitrile market share. The rapidly rising production of generic pharmaceuticals, engineered drugs, and pesticides in the region is expected to continue driving the growth of the industry.

b. The competitive landscape of the global acetonitrile market is characterized by key players and their strategic initiatives, market trends, consolidation, and other major effects. Some of the key players operating in the market are INEOS AG, Honeywell International plc, Alkyl Amines Chemicals Limited, and Jindal Specialty Chemicals Private Limited.

b. The market driven by the rising demand for high-purity solvents in pharmaceutical manufacturing processes is a crucial driver influencing the market growth. Additionally, the increasing production of liquid crystal displays (LCDs) and semiconductors in the electronics industry is a major factor boosting the industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.