Accounts Receivable Automation Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Cloud, On-premise), By Enterprise Size, By Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-417-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

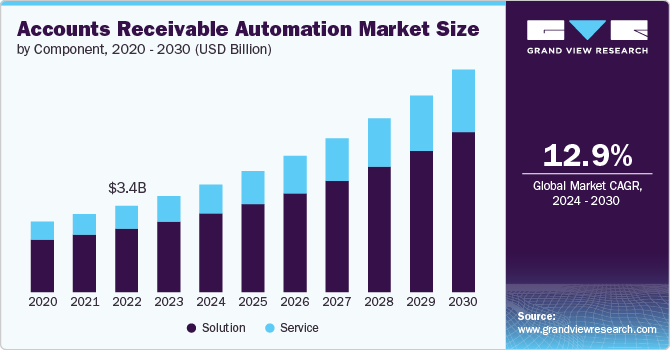

The global accounts receivable automation market size was estimated at USD 3.81 billion in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030. The ever-increasing complexity of financial transactions in today's global business landscape is pushing organizations to seek efficient solutions to manage their accounts receivable processes. As a result, businesses are turning to automation to streamline these operations, reduce errors, and enhance overall efficiency. Moreover, the mounting pressure to improve cash flow management is a significant market driver in the global market’s growth.

In an environment where liquidity is paramount, organizations are recognizing the importance of accelerating the collection of outstanding payments. Accounts receivable automation solutions offer features such as automated invoicing, payment reminders, and online payment portals, empowering businesses to expedite their cash conversion cycles. Furthermore, the growing adoption of cloud-based technologies is fueling market expansion. Cloud-based accounts receivable automation platforms offer scalability, flexibility, and cost-effectiveness, making them an attractive choice for businesses of all sizes.

The rise of Artificial Intelligence (AI) and Machine Learning (ML) technologies represents a revolution in accounts receivable automation. These advanced technologies empower businesses to leverage predictive analytics for forecasting customer payment behaviors. Consequently, organizations can take proactive measures to prevent late payments, improving cash flow management. Businesses can liberate their finance teams by automating routine tasks and applying AI-driven algorithms, enabling them to concentrate on strategic decision-making.

Regulatory compliance and data security concerns are pushing organizations to invest in automation. With the implementation of stringent data protection regulations such as GDPR, companies must ensure that their accounts receivable processes adhere to these standards. Automation solutions offer robust security features and audit trials, reducing the risk of data breaches and non-compliance. Moreover, the market's growth is also attributed to the increasing recognition of the strategic value of accounts receivable. Rather than viewing it solely as an operational task, organizations are now leveraging automation to gain deeper insights into customer behavior, optimize credit management, and strengthen customer relationships.

One significant restraint in the accounts receivable automation industry is the initial cost associated with implementing automation systems. Many businesses, particularly smaller ones, may hesitate to invest in these solutions due to concerns about upfront expenses. To overcome this obstacle, companies can explore flexible pricing models offered by automation providers, such as subscription-based or pay-as-you-go options. In addition, educating businesses about the long-term benefits, including cost savings and improved efficiency, can help them recognize the value of these investments and make informed decisions. Demonstrating a clear return on investment and showcasing success stories from similar businesses can further encourage adoption and mitigate this restraint.

Component Insights

Based on component, the solution segment dominated the market and accounted for 73.2% of the global revenue in 2023. The solution segment is further bifurcated into credit evaluation & management, invoice presentment & payment, customer relationship & dispute management, transaction reconciliation, cash application automation, collections management, and others. Businesses are adopting solutions such as credit evaluation & management as they are becoming more risk-conscious, especially in uncertain economic environments, and are placing a high premium on understanding the creditworthiness of their customers. The adoption of such solutions is expected to drive the market’s growth.

The service segment is anticipated to register a significant CAGR from 2024 to 2030. The services segment is further bifurcated into integration & deployment, support & maintenance, training & consulting, and managed services. Many businesses, regardless of their size or industry, are recognizing the transformative potential of accounts receivable automation but often lack the in-house expertise to implement these complex systems effectively. At this juncture, services such as integration & deployment, training & consulting, among others, are gaining traction, thus contributing to the services segment’s growth in the market.

Deployment Insights

Based on deployment, the on-premise segment held the largest market revenue share in 2023. Many businesses, particularly in highly regulated industries such as finance and healthcare, have stringent data security and compliance requirements. On-premise deployments allow these organizations to maintain direct control over their data and infrastructure, ensuring compliance with industry regulations and safeguarding sensitive financial information. Moreover, some enterprises have legacy systems or unique integration needs better addressed through on-premise solutions, which offer greater customization and compatibility with existing infrastructure.

The cloud segment is expected to register significant growth from 2024 to 2030. Cloud-based solutions offer scalability and flexibility, allowing businesses to adapt easily to changing needs and market dynamics. This agility is particularly valuable in today's fast-paced business environment. Moreover, cloud deployments reduce the burden of maintaining on-premise infrastructure, resulting in cost savings and operational efficiency.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Larger enterprises often have more extensive and complex financial operations, making the need for efficient automation solutions more critical. Moreover, larger enterprises typically have the resources to invest in advanced automation technologies, including AI and machine learning, which can deliver substantial benefits in terms of accuracy and efficiency. In addition, their higher transaction volumes and diverse customer bases make automation a strategic imperative to handle the sheer scale of accounts receivable processes.

The small & medium enterprises segment is anticipated to register a significant CAGR from 2024 to 2030. SMEs are increasingly recognizing the need for streamlined financial processes to compete effectively in a dynamic business landscape. They face similar challenges as larger enterprises face, such as late payments, but often lack the resources to address them manually. Accounts receivable automation offers an accessible and cost-effective solution, enabling SMEs to enhance efficiency and cash flow.

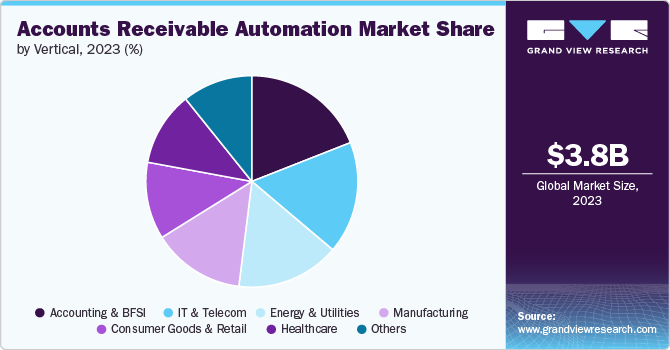

Vertical Insights

The accounting & BFSI segment held a significant market revenue share in 2023. The accounting and BFSI sectors handle vast volumes of financial transactions and customer data, making efficient accounts receivable management critical for their operations. Automation streamlines processes reduces errors, and enhances compliance, aligning perfectly with the stringent regulatory requirements of the BFSI industry. Moreover, the adoption of technology-driven solutions in accounting and finance has been a longstanding practice, making these verticals early adopters of accounts receivable automation.

The energy & utilities segment is anticipated to register significant growth from 2024 to 2030. The energy & utilities sector is undergoing a substantial digital transformation driven by the need for operational efficiency, cost reduction, and enhanced customer service. In this context, automating accounts receivable processes is seen as a vital step towards achieving these objectives. Moreover, this industry handles a large customer base with recurring billing cycles, making it particularly well-suited for automation solutions that can handle high transaction volumes reliably.

Regional Insights

North America accounts receivable automation market dominated globally with the largest revenue share of 31.0% in 2023. North America is home to many established businesses across various industries, making it a fertile ground for automation adoption. In addition, North American organizations often strongly emphasize innovation and technological advancement, making them early adopters of automation solutions.

U.S. Accounts Receivable Automation Market Trends

The U.S. accounts receivable automation market is anticipated to register significant growth from 2024 to 2030. Stringent regulatory requirements and the need for compliance have driven companies in the U.S. to seek efficient and accurate automation tools. In addition, the country’s well-developed IT infrastructure and access to advanced technologies have facilitated the seamless integration of automation systems into existing operations, driving the growth of the U.S. market.

Europe Accounts Receivable Automation Market Trends

The Europe accounts receivable automation market is poised for significant growth from 2024 to 2030. Rising awareness of the benefits of automation, including cost savings, improved accuracy, and enhanced operational efficiency, is driving businesses in Europe to adopt these technologies at an accelerating pace. Furthermore, the ongoing digital transformation initiatives across industries in the region are driving the adoption of advanced automation tools to streamline financial processes, contributing to the overall market’s growth.

Asia Pacific Accounts Receivable Automation Market Trends

The accounts receivable automation market in Asia Pacific is poised for significant growth from 2024 to 2030. The region's dynamic and rapidly expanding business landscape, driven by emerging economies such as China and India, has led to an increased volume of financial transactions, creating a greater demand for efficient accounts receivable solutions, thus driving the regional market’s growth.

Key Accounts Receivable Automation Company Insights

Key players operating in the market include Oracle Corporation, Sage Group plc, INTUIT INC., Wave Financial Inc., Quadient, Zoho Corporation Pvt. Ltd., BlackLine, Inc., Corcentric, Inc., HighRadius, and Tesorio. The competitive landscape of the accounts receivable automation industry is characterized by a dynamic interplay of emerging innovators and established players. The market is witnessing a surge in partnerships and collaborations as incumbents seek to enhance their offerings through strategic alliances with fintech startups specializing in AI and machine learning.

In March 2023, Growfin, a fintech startup headquartered in Singapore and San Francisco, specializes in providing Software as a Service (SaaS) solutions. Its offerings aim to assist finance departments in tracking and collecting payments, as well as streamlining the accounts receivable process. The company has recently raised USD 7.5 million in its Series A funding round. Growfin plans to utilize this funding to support its ongoing expansion efforts in the U.S. and Asian markets, alongside a stronger emphasis on the development of advanced AI-driven technologies to expand its platform.

Key Accounts Receivable Automation Companies:

The following are the leading companies in the accounts receivable automation market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle Corporation

- Sage Group plc

- INTUIT INC.

- Wave Financial Inc.

- Quadient

- Zoho Corporation Pvt. Ltd.

- BlackLine, Inc.

- Corcentric, Inc.,

- HighRadius

- Tesorio

Accounts Receivable Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.27 billion |

|

Revenue forecast in 2030 |

USD 8.83 billion |

|

Growth rate |

CAGR of 12.9% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, vertical, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa |

|

Key companies profiled |

Oracle Corporation, Sage Group plc, INTUIT INC., Wave Financial Inc., Quadient, Zoho Corporation Pvt. Ltd., BlackLine, Inc., Corcentric, Inc., HighRadius, and Tesorio |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Accounts Receivable Automation Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each subsegment from 2018 to 2030. For this study, Grand View Research has segmented the global accounts receivable automation market based on component, deployment, enterprise size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Credit Evaluation & Management

-

Invoice Presentment & Payment

-

Customer Relationship & Dispute Management

-

Transaction Reconciliation

-

Cash Application Automation

-

Collections Management

-

Others

-

-

Services

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Accounting & BFSI

-

IT & Telecom

-

Manufacturing

-

Consumer Goods & Retail

-

Healthcare

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global accounts receivable automation market size was estimated at USD 3.81 billion in 2023 and is expected to reach USD 4.27 billion in 2024.

b. The global accounts receivable automation market is expected to grow at a compound annual growth rate of 12.9% from 2024 to 2030 to reach USD 8.83 billion by 2030.

b. North America dominated the accounts receivable automation market with a share of 31.0% in 2023. North America is home to many established businesses across various industries, making it a fertile ground for automation adoption.

b. Some key players operating in the accounts receivable automation market include Oracle Corporation, Sage Group plc, INTUIT INC., Wave Financial Inc., Quadient, Zoho Corporation Pvt. Ltd., BlackLine, Inc., Corcentric, Inc., HighRadius, and Tesorio.

b. Key factors that are driving the market growth include increasing adoption of technologies such as cloud computing and AI and growing need for business efficiency.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."