Accounts Payable Automation Market Size, Share & Trends Analysis Report By Component, By Deployment Mode, By Enterprise Size, By Industry Vertical, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-402-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Accounts Payable Automation Market Trends

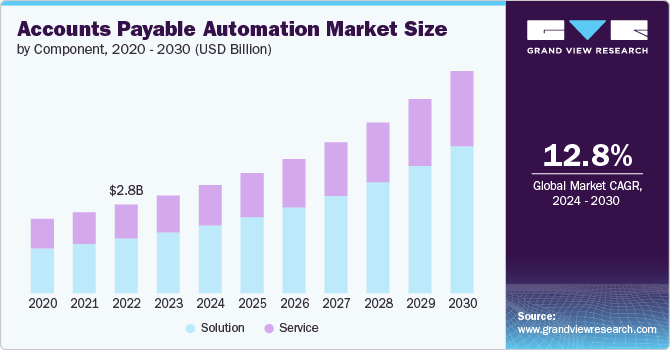

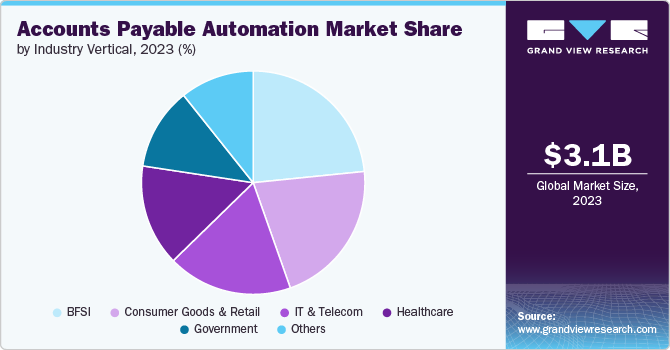

The global accounts payable automation market size was estimated at USD 3.08 billion in 2023 and is expected to grow at a CAGR of 12.8% from 2024 to 2030. Accounts payable automation involves streamlining invoice processing and financial operations using advanced technologies. The market’s growth can be attributed to the increased efficiency provided by the accounts payable automation solutions, and the continued technological advancements integrating Artificial Intelligence (AI) and Machine Learning (ML). In addition, the growing emphasis on regulatory compliance is pushing consumers to adopt accounts payable automation software, contributing to the market’s growth further.

The market is experiencing significant growth due to the increasing demand for efficient financial operations. Automation streamlines invoice processing, reduces errors, and enhances productivity. Businesses are adopting these solutions to save time and costs, leading to widespread market adoption. Furthermore, the reduction in manual intervention minimizes the likelihood of human error, further ensuring smooth financial operations and accurate record-keeping.

Another factor contributing to market growth is the integration of artificial intelligence (AI) and machine learning (ML) in accounts payable automation. AI and ML enhance data accuracy, automate repetitive tasks, and provide predictive analytics. These advanced technologies are driving the adoption of accounts payable automation across various industries. The ability of AI and ML to offer insights and forecast financial trends empowers businesses to make more informed decisions and optimize their financial strategies.

The growing emphasis on regulatory compliance is also boosting the market. Automated accounts payable systems ensure adherence to financial regulations and standards, reducing the risk of non-compliance penalties. This factor is particularly crucial for industries such as BFSI and healthcare, which are subject to stringent regulatory requirements. By automating compliance processes, organizations can avoid hefty fines and maintain their reputation in the market, thus fostering trust among stakeholders and customers.

However, high implementation costs and data security concerns are restraining market growth. Small and medium-sized enterprises (SMEs) often find the initial investment prohibitive, and fears of cyber threats deter some from adopting these solutions. Key players are addressing these challenges by offering scalable, cost-effective cloud-based solutions and enhancing cybersecurity measures. These initiatives aim to make accounts payable automation more accessible and secure for businesses of all sizes, thereby driving market growth despite these challenges.

Component Insights

Based on component, the solution segment led the market and accounted for 62.2% of the global revenue in 2023. The solution segment is driving market growth by offering comprehensive tools that enhance efficiency and reduce manual errors. These tools are in high demand due to their ability to automate complex financial processes, ensure accuracy, and provide real-time visibility into financial operations, capturing a significant revenue share.

The service segment is expected to register significant growth from 2024 to 2030. The services segment is expanding as businesses increasingly require consulting, implementation, and support services to effectively deploy and maintain automation solutions. These services ensure that companies can maximize the benefits of their automation investments, leading to a strong growth trajectory for this segment.

Deployment Mode Insights

Based on deployment mode, the cloud segment accounted for the largest market revenue share in 2023. The cloud segment is experiencing rapid growth, driven by its scalability, cost-effectiveness, and ease of access. Businesses favor cloud-based solutions for their flexibility and lower upfront costs, which enable easier updates and maintenance, leading to higher adoption rates compared to traditional on-premise solutions.

The on-premise segment is expected to register significant growth from 2024 to 2030. While the on-premise segment is witnessing slower growth, it remains relevant for businesses with strict data security and control requirements. However, cloud-based solutions are increasingly replacing on-premise systems due to their flexibility, lower costs, and simplified management, leading to a gradual decline in this segment's growth rate.

Enterprise Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises are driving significant growth in the market due to their need to handle high transaction volumes and complex workflows. These organizations invest in automation to improve operational efficiency, reduce processing times, and ensure compliance with regulatory standards, contributing to the segment's robust expansion.

The small & medium enterprises segment is expected to register significant growth from 2024 to 2030. SMEs are adopting automation solutions to streamline their operations, reduce costs, and enhance competitiveness. The ability to automate repetitive tasks and improve cash flow management is particularly appealing to SMEs, driving substantial growth in this segment.

Industry Vertical Insights

The BFSI segment accounted for a significant market revenue share in 2023. The BFSI sector is leading in the adoption of accounts payable automation due to the need for efficiency, accuracy, and compliance in financial transactions. Automation helps BFSI companies manage large volumes of invoices and payments, reduce processing times, and ensure adherence to regulatory standards, driving significant growth in this segment.

The consumer goods & retail segment is expected to register significant growth from 2024 to 2030. The consumer goods and retail segment is growing as companies seek to improve supply chain efficiency, reduce processing times, and enhance vendor relationships through automation. Automation solutions enable these companies to manage large volumes of transactions efficiently, reduce errors, and improve overall operational efficiency.

Regional Insights

North America accounts payable automation market dominated the global market and accounted for 33.2% of the global revenue share in 2023. North America dominates the market owing to the high adoption of advanced technologies and the presence of major players. The region's focus on enhancing business efficiency and compliance, along with substantial investments in automation technologies, drives continuous market growth.

U.S. Accounts Payable Automation Market Trends

The accounts payable automation market in the U.S. is anticipated to register significant growth from 2024 to 2030. The U.S. market is growing rapidly, driven by large enterprises' demand for efficient financial operations and technological advancements. The country's strong economic environment and early adoption of innovative solutions contribute to its leading position in the global market.

Europe Accounts Payable Automation Market Trends

Europe accounts payable automation market is poised for significant growth from 2024 to 2030. Europe is experiencing steady growth in the market, with businesses increasingly focusing on regulatory compliance and operational efficiency. The region's emphasis on adhering to strict financial regulations and improving business processes supports the adoption of automation technologies.

Asia Pacific Accounts Payable Automation Market Trends

The accounts payable automation market in the Asia Pacific is poised for significant growth from 2024 to 2030. The Asia Pacific market is expanding quickly due to rapid digitalization, economic growth, and increasing awareness of automation benefits. Countries in this region are investing heavily in technology to enhance business efficiency, which is driving significant growth in the market.

Key Accounts Payable Automation Company Insights

The market is highly competitive, with companies constantly seeking to gain an edge through advanced technological innovations and unique service offerings. Firms are prioritizing the development of sophisticated AI-driven systems that enhance efficiency and accuracy, addressing the specific needs of different industry verticals.

Key Accounts Payable Automation Companies:

The following are the leading companies in the accounts payable automation market. These companies collectively hold the largest market share and dictate industry trends.

- SAP

- Sage Group plc.

- Tipalti Inc.

- FreshBooks

- FIS

- Zycus

- Bottomline Technologies, Inc.

- Coupa Software Inc.

- Comarch SA.

- Financial Force

Recent Development

-

In April 2024, HighRadius announced the launch of a GenAI native accounts payable automation solution, to automate the complete payer-supplier payment process. The newly launched solution will help suppliers get immediate responses to their queries, including clear details on the status of their payments and guidelines for whichever actions are required. The product aims to improve supplier retention and lower costs by eliminating manual, repetitive tasks. Such initiatives are expected to harness the innovation and growth in the accounts payable automation market.

Accounts Payable Automation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.41 billion |

|

Revenue forecast in 2030 |

USD 7.01 billion |

|

Growth rate |

CAGR of 12.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment mode, enterprise size, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

SAP; Sage Group plc; Tipalti Inc.; FreshBooks; FIS; Zycus; Bottomline Technologies Inc.; Coupa Software Inc.; Comarch SA; Financial Force |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Accounts Payable Automation Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global accounts payable automation market report based on component, deployment mode, enterprise size, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Band Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises

-

Large Enterprises

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Consumer Goods & Retail

-

IT and Telecom

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global accounts payable automation market size was estimated at USD 3.08 billion in 2023 and is expected to reach USD 3.41 billion in 2024.

b. The global accounts payable automation market is expected to grow at a compound annual growth rate of 12.8% from 2024 to 2030 to reach USD 7.01 billion by 2030.

b. North America dominated the accounts payable automation market with a share of 33.2% in 2023. North America dominates the market owing to the high adoption of advanced technologies and the presence of major players.

b. Some key players operating in the accounts payable automation market include SAP, Sage Group plc, Tipalti Inc., FreshBooks, FIS, Zycus, Bottomline Technologies, Inc., Coupa Software Inc., Comarch SA., and Financial Force.

b. Key factors that are driving the market growth include an increase in the need to digitize the financial audit processes and growing demand for advanced technology to speed up the payment processes.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."