Account-based Marketing Market Size, Share & Trends Analysis Report By Account Type (Strategic Account-based Marketing, Account-based Marketing Lite), By Organization Size, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-545-3

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Account-based Marketing Market Trends

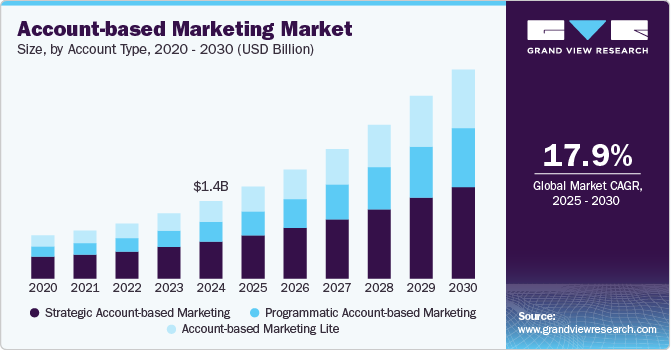

The global account-based marketing market size was estimated at USD 1,410.5 million in 2024 and is projected to grow at a CAGR of 17.9% from 2025 to 2030. The account-based marketing (ABM) market is growing rapidly, driven by the demand for personalized B2B marketing strategies. Companies are shifting from broad lead generation to high-value accounts for better ROI and long-term relationships. AI and machine learning enhance customer insights, predictive analytics, and automation, improving campaign effectiveness. Seamless CRM integration and real-time data synchronization strengthen sales and marketing alignment. As data privacy regulations tighten, ABM’s precise targeting minimizes large-scale data collection, ensuring compliance. Digital transformation and remote work further fuel the need for scalable, digital-first ABM platforms, making ABM a key driver of efficiency, personalization, and revenue growth.

Behavioral signals to identify high-value accounts actively exploring relevant solutions, enabling timely and precise engagement. By integrating first-party and third-party intent data, ABM strategies become more data-driven and conversion-focused, minimizing resource waste while improving lead qualification and overall effectiveness.

Additionally, the shift toward multichannel strategies is expanding ABM’s reach. Practitioners now use a mix of email, social platforms, targeted ads, personalized websites, live events, and direct mail to ensure cohesive messaging across every buyer touchpoint. This diversified approach enhances visibility and engagement, making multichannel execution essential for scalable and impactful ABM. Consequently, the ABM market is experiencing robust growth, driven by data-driven targeting and integrated engagement frameworks.

The integration of predictive analytics is emerging as a core enabler of growth in the account-based marketing industry. ABM platforms increasingly rely on machine learning models to forecast which accounts are most likely to convert, enabling smarter prioritization and decision-making. This analytical capability helps marketers allocate resources efficiently and focus on high-yield opportunities. By driving data-backed targeting and reducing campaign inefficiencies, predictive analytics enhances overall program effectiveness. This evolution is propelling the ABM market forward through intelligent, outcome-driven execution.

Artificial intelligence is reshaping the account-based marketing industry by enabling hyper-personalized outreach on a scale. AI tools interpret real-time intent signals, firmographics, and behavioral data to craft highly customized content and messaging for each account. This capability allows marketers to automate and scale personalization without compromising relevance. As a result, AI-driven campaigns are generating higher engagement, deeper account relationships, and stronger pipeline performance. The growing reliance on AI innovation is a key factor fueling the rapid expansion of the ABM market.

The rising demand for agility in B2B marketing is driving the account-based marketing industry to adopt real-time account intelligence solutions. These tools deliver dynamic insights into accountancy, intent signals, and behavioral shifts as they occur. This empowers ABM teams to respond instantly with timely messaging, tailored offers, or sales engagement. Faster response times improve account experiences and increase the likelihood of conversion. Consequently, the ABM market is growing through enhanced responsiveness and data-driven agility.

Account Type Insights

The strategic account-based marketing segment captured the largest market share of over 47% in 2024. Strategic ABM is increasingly leveraging co-created content to build trust and deepen relationships with key accounts. This includes joint webinars, tailored white papers, custom workshops, and solution roadmaps developed in collaboration with the client. These assets demonstrate a deep understanding of the account’s business and position the vendor as a long-term partner. The bespoke nature of content helps differentiates offerings in competitive enterprise sales cycles. This trend is driving the Strategic Account-Based Marketing segment toward higher engagement and stronger account loyalty.

The programmatic account-based marketing segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2030. ABM strategies are becoming increasingly powered by intent data, allowing companies to identify and engage prospects at the right moment in the buyer journey. Programmatic tools can now sync with third-party intent platforms to detect when key accounts show signals of interest online. This insight enables marketers to tailor content and campaigns in real-time, significantly improving conversion rates. Intent-based targeting minimizes wasted impressions and improves alignment between sales and marketing teams. As competition intensifies in the ABM space, leveraging intent data is becoming a critical differentiator.

Organization Size Insights

The large enterprises segment captured the largest market share in 2024. In large organizations, intent data is now being used not just by marketing, but also across sales, product, and customer success teams. By aggregating behavioral signals from across the web, enterprises can pinpoint when and where decision-makers are on their buying journey. This insight allows for coordinated, data-informed outreach across departments-turning ABM into a company-wide growth engine. Enterprise teams can tailor their campaigns with remarkable precision, reducing sales cycles and increasing close rates. With data silos breaking down, intent data has become a strategic asset across the entire enterprise ABM ecosystem.

The small and medium enterprises (SMEs) segment is expected to witness the fastest CAGR from 2025 to 2030. The rising demand for ABM among SMEs is driven by the growing need to compete with larger players using smarter, more targeted marketing strategies. Affordable programmatic ABM platforms are now offering SMEs access to capabilities once reserved for large enterprises-such as real-time targeting, automation, and personalization. These tools allow small teams to manage high-impact campaigns without the need for large marketing departments or custom-built systems. As competition intensifies in the B2B space, SMEs are increasingly investing in tech stacks that provide measurable ROI with minimal overhead. This democratization of ABM tools is fueling rapid adoption among resource-conscious small businesses.

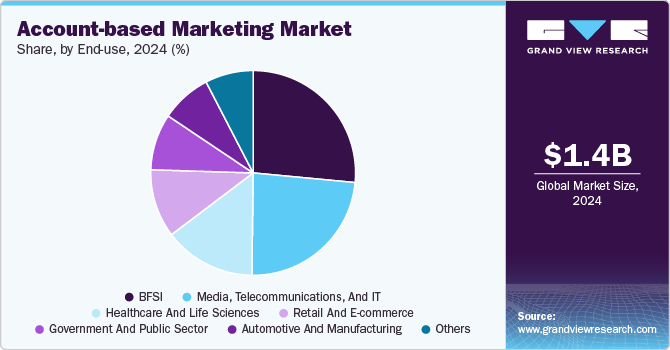

End-use Insights

The BFSI segment captured the largest market share in 2024. The rising demand for ABM in the BFSI sector is largely driven by the need to deliver hyper-personalized experiences to high-net-worth individuals and corporate clients. Programmatic ABM allows financial institutions to tailor content and messaging across digital channels based on real-time behavioral data and firmographics. This precision helps banks and insurers engage specific accounts with relevant offerings, such as wealth management, loan products, or commercial insurance. The automation of programmatic platforms enables institutions to deliver these personalized experiences at scale, improving both conversion rates and client satisfaction. As financial services become more customer-centric, programmatic ABM is becoming essential for targeted growth.

The media, telecommunications, and IT segment is expected to witness the fastest CAGR from 2025 to 2030. As media and tech companies expand globally, there’s a rising need for brand consistency across regions and digital touchpoints. Programmatic ABM helps these companies coordinate account-based messaging across platforms-whether it’s through connected TV ads, mobile, programmatic audio, or social media. This ensures that every decision-maker, regardless of geography or channel, sees a coherent message tailored to their role and stage in the buying cycle. With multiple teams often running campaigns simultaneously, centralized programmatic tools help maintain a unified brand voice. In industries where perception and innovation drive value, consistent omnichannel presence is a strategic must.

Regional Insights

The account-based marketing market in North America generated the largest revenue share, accounting for over 32% in 2024. The rising demand for programmatic ABM in North America is driven by the region's mature digital infrastructure and advanced Martech adoption. Enterprises across sectors are prioritizing ABM to personalize outreach and maximize ROI in highly competitive B2B markets. The focus is shifting toward AI-powered targeting and automation to enhance account-level engagement.

U.S. Account-based Marketing Market Trends

The U.S. Account-based marketing market held a dominant position in 2024. In the U.S., there is increasing investment in programmatic ABM, particularly among tech, finance, and healthcare firms aiming to shorten sales cycles. Companies are leveraging deep data integrations and omnichannel delivery to reach decision-makers with pinpoint accuracy. The U.S. market is also leading in integrating ABM with predictive analytics and CRM systems.

Europe Account-based Marketing Market Trends

The Europe Account-based marketing market was identified as a lucrative region in 2024. Europe is seeing rising demand for programmatic ABM due to the push for GDPR-compliant, personalized marketing. Businesses are adopting platforms that offer real-time insights and multi-language localization for cross-border campaigns. The trend also reflects the region’s growing preference for intent-based marketing to improve efficiency.

The U.K. account-based marketing market is increasing as companies seek post-Brexit growth opportunities through more strategic account targeting. Mid-sized and large enterprises are adopting programmatic platforms to streamline B2B acquisition and retention. There's a strong focus on aligning marketing and sales functions through ABM automation.

Account-based marketing in Germany is rising interest in programmatic ABM is fueled by its robust manufacturing and industrial tech sectors. German enterprises are prioritizing targeted outreach for high-value accounts using compliant, data-driven ABM tools. Integration with ERP and CRM systems is a key differentiator in the German market.

Asia-Pacific Account-based Marketing Market Trends

The Account-based marketing market in the Asia Pacific region is expected to grow at the highest CAGR of 20.4% from 2025 to 2030. Asia Pacific is witnessing rapid growth in programmatic ABM adoption as digital transformation accelerates across emerging and mature economies. Enterprises are using ABM to penetrate complex markets with localized, account-based strategies. The rise of mobile-first platforms and multilingual personalization is a driving force in the region.

China account-based marketing (ABM) is in high demand, supported by the booming B2B e-commerce and tech ecosystem. Companies are turning to programmatic tools to break through high competition and build stronger relationships with key accounts. Local platforms and integration with Chinese digital ecosystems like WeChat are crucial for success.

Account-based marketing in India is experiencing increasing adoption of ABM among IT, SaaS, and consulting firms aiming to target international clients. Programmatic ABM offers Indian businesses a cost-effective way to scale outreach and personalize communication at the account level. Demand is also rising for platforms that support multilingual targeting and real-time analytics.

Key Account-based Marketing Company Insights

Some of the key players operating in the market include Oracle and Salesforce

-

Oracle integrates its Account-Based Marketing (ABM) capabilities within its Marketing Cloud and Eloqua platforms, delivering advanced, data-driven personalization. The platform supports comprehensive audience targeting, campaign orchestration, and performance analytics at scale. Oracle is particularly effective in managing large enterprise accounts, with its key strength being the seamless integration of ABM strategies into broader customer experience (CX) initiatives. Its value lies in combining robust marketing automation with deep enterprise-level data insights.

-

Salesforce enables ABM through its Marketing Cloud Account Engagement (formerly Pardot), offering seamless integration with its CRM and AI-powered insights. It supports precise account segmentation, personalized engagement, and deep-funnel analytics. Salesforce excels at aligning sales and marketing around shared account goals, promoting real-time collaboration. The platform is highly scalable and well-suited for organizations with complex B2B sales structures.

RollWorks, and Influ2 are some of the emerging participants in the Account-based marketing market.

-

RollWorks offers full-funnel ABM solutions tailored to mid-sized businesses aiming to scale their marketing efforts. Its platform features account targeting, retargeting, campaign measurement, and sales enablement tools. RollWorks differentiates itself through an intuitive user interface and seamless integration with popular CRMs such as HubSpot and Salesforce, making it a preferred choice for growing B2B companies transitioning from traditional lead generation to ABM.

-

Influ2 brings a unique proposition to the ABM market by enabling person-based targeting, allowing marketers to identify and engage specific decision-makers within target accounts. The platform provides detailed visibility into individual ad engagement and supports highly personalized B2B advertising. Influ2 is increasingly popular among fast-growing companies seeking precise, measurable, and impactful ABM campaigns.

Key Account-based Marketing Companies:

The following are the leading companies in the account-based marketing market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Demandbase

- Engagio

- HubSpot

- Influ2

- Madison Logic

- Oracle

- RollWorks

- SAP

- Salesforce

- Terminus

- 6sense

Recent Developments

-

In March 2025, Adobe introduced two AI-powered solutions, Agent Orchestrator and Brand Concierge, at its Adobe Summit conference. Agent Orchestrator enables businesses to create, manage, and integrate AI agents from Adobe and third-party ecosystems to enhance customer engagement and automate marketing workflows. Brand Concierge offers immersive and conversational brand experiences across text, voice, and images while guiding consumers through personalized product exploration and purchase decisions. These innovations are supported by strategic partnerships with major companies like Amazon Web Services, IBM, and Microsoft to ensure seamless execution across industries.

-

In November 2024, HubSpot introduced "Breeze," an AI-powered engine unveiled at its Inbound conference. Breeze integrates features like task automation, customer engagement scoring, and enriched data profiles to streamline marketing processes for small to mid-sized businesses. It includes Breeze Copilot for personalized recommendations, Breeze Agents for workflow automation, and Breeze Intelligence for combining customer data with third-party sources

-

In September 2024, RollWorks, a division of NextRoll, Inc., was honored as the "Best Account-Based Marketing Solution" at the 2024 MarTech Breakthrough Awards. This recognition underscores RollWorks' ability to assist B2B companies in generating pipelines, accelerating sales cycles, and driving revenue growth through account-based insights and multi-touch advertising. The platform empowers marketers to identify high-value accounts, launch multi-channel campaigns, and align sales and marketing efforts effectively.

Account-based Marketing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1,675.0 million |

|

Revenue forecast in 2030 |

USD 3,811.4 million |

|

Growth rate |

CAGR of 17.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Account type, organization size, end-use, regional |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; Australia; Japan; India; South Korea; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

Adobe; Demandbase; Engagio; HubSpot; Influ2; Madison Logic; Oracle; RollWorks; SAP; Salesforce; Terminus; 6sense. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Account-based Marketing Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global account-based marketing market report based on account type, organization size, end-use, and region:

-

Account Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Strategic account-based Marketing

-

Account-based Marketing Lite

-

Programmatic Account-based Marketing

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Media, Telecommunications, and IT

-

BFSI

-

Healthcare and Life Sciences

-

Retail & E-commerce

-

Automotive and Manufacturing

-

Government and Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global account-based marketing market size was estimated at USD 1,410.5 million in 2024 and is expected to reach USD 1,675.0 million in 2025.

b. The global account-based marketing market is expected to grow at a compound annual growth rate of 17.9% from 2025 to 2030 to reach USD 3,811.4 million by 2030.

b. North America dominated the account-based marketing market with a share of 32.0% in 2024. The rising demand for programmatic ABM in North America is driven by the region's mature digital infrastructure and advanced Martech adoption. Enterprises across sectors are prioritizing ABM to personalize outreach and maximize ROI in highly competitive B2B markets.

b. Some key players operating in the account-based marketing market include Adobe, Demandbase, Engagio, HubSpot, Influ2, Madison Logic, Oracle, RollWorks, SAP, Salesforce, Terminus, and 6sense.

b. Key factors that are driving the market growth include personalization and targeted marketing, growing adoption of AI and automation, and increased demand for B2B sales alignment.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."