- Home

- »

- Agrochemicals & Fertilizers

- »

-

Acaricides Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Acaricides Market Size, Share & Trends Report]()

Acaricides Market (2024 - 2030) Size, Share & Trends Analysis Report, By Product (Organophosphorus Compounds), By Application (Agriculture, Animal Husbandry), By Mode Of Action, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-338-5

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Acaricides Market Size & Trends

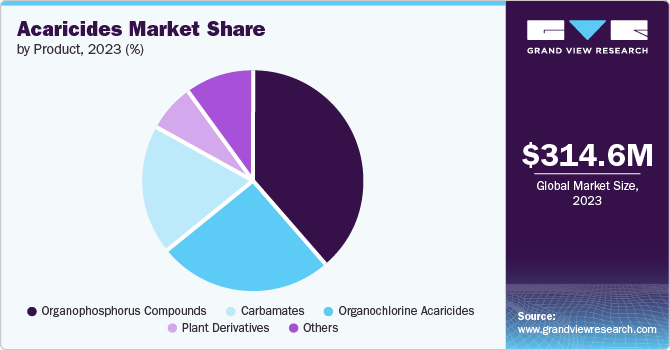

The global acaricides market size was estimated at USD 314.62 million in 2023 and growing at a CAGR of 5.0% from 2024 to 2030. Owing to the increasing product demand in agricultural and horticultural practices globally. The continuous increase in the global population is another major driver of rising food consumption worldwide. According to the United Nations, the global population is expected to be 7.6 billion in 2023 and is anticipated to reach 8.6 billion and over 9.8 billion, respectively, by 2030 and 2050. The continuously increasing global population is anticipated to surge the demand for food, fueling product consumption to increase agricultural yields.

The Pest Management Regulatory Agency (PMRA), a Canadian organization, has been spreading awareness and is planning to take initiatives to introduce sustainable pest management products to reduce the risk caused by insecticide products to humans and the environment. This is further expected to increase the consumption of natural forms of the product in the country.

In 2022, the European Commission adopted a proposal for fresh regulation on the sustainable approach to the consumption of plant protection products. The regulation encourages the sustainable use of pesticides through integrated pest management or by introducing alternatives to insecticide products.

Application Insights

Agriculture applications dominated the market with a revenue share of 63.4% in 2023, owing to its increasing demand for cereals and grains, oilseed and pulses, and fruits and vegetables in various regions. According to the U.S. Department of Agriculture, in 2022, the production of grains in North America witnessed an upward trend from 437,578 thousand metric tons in 2018/2019 to 454,922 thousand metric tons in 2021/2022. Thus, the increasing production of cereals and grains due to the increasing demand and reducing arable land is anticipated to drive the demand for insecticides.

Asia will continue to play the most significant role in shaping global demand for food over the outlook period. India's population increase and significant growth in per capita incomes in both India and China are expected to contribute significantly to the consumption of all food commodities. Moreover, the demand for organic products in major agricultural markets like India is growing. According to the India Brand Equity Foundation, it is anticipated to rise with a CAGR of 25.25% between 2022 and 27. Rising demand for organic products is further expected to increase the demand for natural products in the country.

Mode Of Action Insights

The spray segment dominated the market, with a revenue share of 45.3% in 2023. Spraying is the most common mode of application for insecticides. This method is considered effective as the insecticide applied by spraying reaches all areas, including the undersides of leaves and dense foliage.

Dipping vats are used primarily in livestock management to control ectoparasites such as ticks, mites, and lice. The process involves immersing animals in a vat filled with diluted pesticide solution, typically cattle, sheep, or goats. The pesticide solution coats the animal’s skin and fur, directly contacting the parasite.

Product Insights

Organophosphorus compounds dominated the market with a revenue share of 38.5% in 2023 owing to their application in controlling pests on a variety of crops, including cereals, fruits, vegetables, and cotton. They are also applied in vector control programs to manage the mosquito population and reduce the spread of vector-borne diseases like malaria and dengue fever. Organophosphorus pesticides are a class of insecticides containing phosphorus in their chemical structure. They are widely used in agriculture and horticulture.

The natural form of the product is gaining traction owing to its lower environmental impact and reduced toxicity compared to synthetic chemicals. These are extracted from various plants and essential oils containing acaricidal properties, such as neem, eucalyptus, tea tree, clove, peppermint, and rosemary. Moreover, different compounds isolated from the plants are known to have acaricidal properties, including alkaloids, flavonoids, terpenoids, and saponins.

Regional Insights

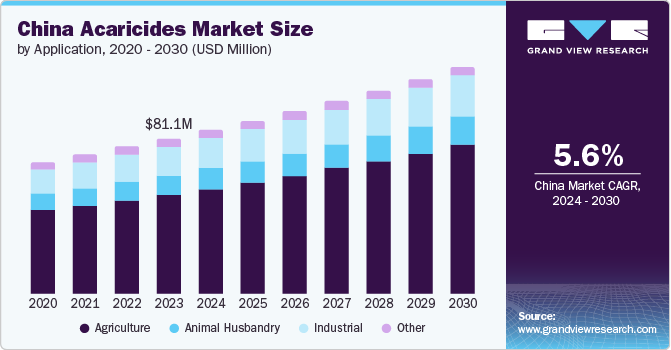

Asia Pacific dominated the acaricides market segment with a revenue share of 45.30% in 2023. In terms of product consumption, Asia Pacific is the dominating region owing to the growing food demand from the rapidly increasing population of the region. Agriculture is the primary sector in many Asian countries, including India and Vietnam. China and India are the major producers of crops such as wheat, rice, and cotton and have established themselves as the major global exporters. The consumption of insecticides is expected to grow in the coming years due to the increasing population and decreasing arable land, which has created pressure to increase the overall crop yield. In terms of insecticide consumption, China, India, Japan, South Korea, and Vietnam were the prominent contributors to the regional market growth in 2023, owing to increasing demand for grains, pulses, cereals, fruits, and vegetables.

North America Acaricides Market Trends

The acaricides market in North America is expected to grow lucratively during the forecast period owing to increased agricultural activities in the region. This is because North America is witnessing a surging demand for food. Growing agrarian activities to enhance crop productivity also lead to a rise in demand for insecticides in North America.

Europe Acaricides Market Trends

The acaricides market in Europe is expected to have significant growth over the forecast period. The insecticides market is primarily driven by the growing need to improve crop yield and production efficiency due to the rising population and shrinking farmlands. The major challenges the agricultural industry faces include decreasing arable land and changing climatic conditions. According to the World Economic Forum, Europe was the largest agrifood exporter in 2022, accounting for around 40% of the region’s landmass and providing 44 million jobs. Thus, increasing agricultural produce in Europe is expected to drive the demand for the product over the forecast period.

Key Acaricides Company Insights

Some of the key players operating in the market include Corteva Agriscience, Bayer AG, BASF SE, FMC Corporation, Corteva Agrisciences, DuPont, Nissan Chemical Industries, Ltd., STAR BIO SCIENCE, PI Industries, NIPPON SODA CO., LTD., Nufarm, Sumitomo Chemical Ltd.,

-

Bayer AG develops genetically modified crops, insecticides, herbicides, pesticides, and digital farming practices under its Agri Care business, and most of its products are manufactured at BAYER AG’s manufacturing site. It supplies its products to more than 30 countries globally.

-

BASF SE is a Germany-based multinational chemical company with more than 100 research and production sites across North America. On a global scale, it is one of the dominant chemical producers of crop protection chemicals such as pesticides, insecticides, specialties, and fungicides. The company operates through six business segments: industrial solutions, chemicals, agricultural solutions, materials, surface technologies, and nutrition & care.

-

FMC Corporation is an agricultural science company that started as an insecticide producer and diversified into other industries. The company discovers new active ingredients and develops innovative biologicals and formulations to support sustainable agriculture worldwide, with 7% of its revenue committed to research and development activities.

Key Acaricides Companies:

The following are the leading companies in the acaricides market. These companies collectively hold the largest market share and dictate industry trends.

- Corteva Agriscience

- Bayer AG

- BASF SE

- FMC Corporation

- Corteva Agrisciences

- DuPont

- Nissan Chemical Industries, Ltd.

- STAR BIO SCIENCE

- PI Industries

- NIPPON SODA CO., LTD.

- Nufarm

- Sumitomo Chemical Ltd.

Recent Developments

-

In September 2023, ICAR- Central Island Agricultural Research Institute, Port Blair, received a patent for an invention entitled “Novel acaricide compositions for veterinary topical applications and the method of preparation thereof’’ under the Patents Act, 1970 (Patent No: 455756) today. The invention is a process for developing an oil-based herbal topical formulation as an acaricide to treat tick infestation in livestock.

-

In November 2023, the Chinese National Pesticide Technical Standardization Committee gave Kangqiao's second new acaricide a common name.

-

In March 2023, Syngenta launched two insecticides in Brazil: VERDAVIS SC (Isocycloseram + lambda-cyhalothrin) and SPONTA (Isocycloseram), as well as the insecticide/acaricide Joiner (Isocycloseram).

Acaricides Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 330.98 million

Revenue forecast in 2030

USD 443.55 million

Growth rate

CAGR of 5.0% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, mode of action, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Corteva Agriscience; Bayer AG; BASF SE; FMC Corporation; Corteva Agrisciences; DuPont; Nissan Chemical Industries, Ltd.; STAR BIO SCIENCE; PI Industries; NIPPON SODA CO., LTD.; Nufarm; Sumitomo Chemical Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acaricides Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acaricides market report based on product, application, mode of action, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Organophosphorus Compounds

-

Organochlorine Acaricides

-

Carbamates

-

Plant Derivatives

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Animal Husbandry

-

Industrial

-

Other

-

-

Mode Of Action Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Dipping Vat

-

Spray

-

Hand Dressing

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global acaricides market was valued at USD 314.62 million in 2023 and is projected to reach USD 330.98 million by 2024

b. The global acaricides market is growing at a CAGR of 5.0% from 2024 to 2030 to reach USD 443.55 million by 2030.

b. Organophosphorus pesticide dominated the market with a revenue share of 38.5% in 2023 owing to their application in controlling pests on a variety of crops including cereals, fruits, vegetables and cotton.

b. Some prominent players in the global acaricides market include: ● Corteva Agriscience ● Bayer AG ● BASF SE ● FMC Corporation, ● Corteva Agrisciences ● DuPont ● Nissan Chemical Industries, Ltd. ● STAR BIO SCIENCE, PI Industries

b. The continuous increase in the global population is major driver for rising food consumption across the world. According to the United Nations, the global population is expected to be 7.6 billion in 2023 and is anticipated to reach 8.6 billion and over 9.8 billion, respectively by 2030 and 2050. The continuously increasing global population is anticipated to surge the demand for food, thereby fueling the consumption of product to increase agricultural yields.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.