- Home

- »

- Consumer F&B

- »

-

Acai Berry Market Size, Share, Growth, Industry Report 2030GVR Report cover

![Acai Berry Market Size, Share & Trends Report]()

Acai Berry Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Acai Berry Pulp, Dried Acai Berry), By Application (Cosmetics, Pharmaceuticals), By Distribution, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-491-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Acai Berry Market Size & Trends

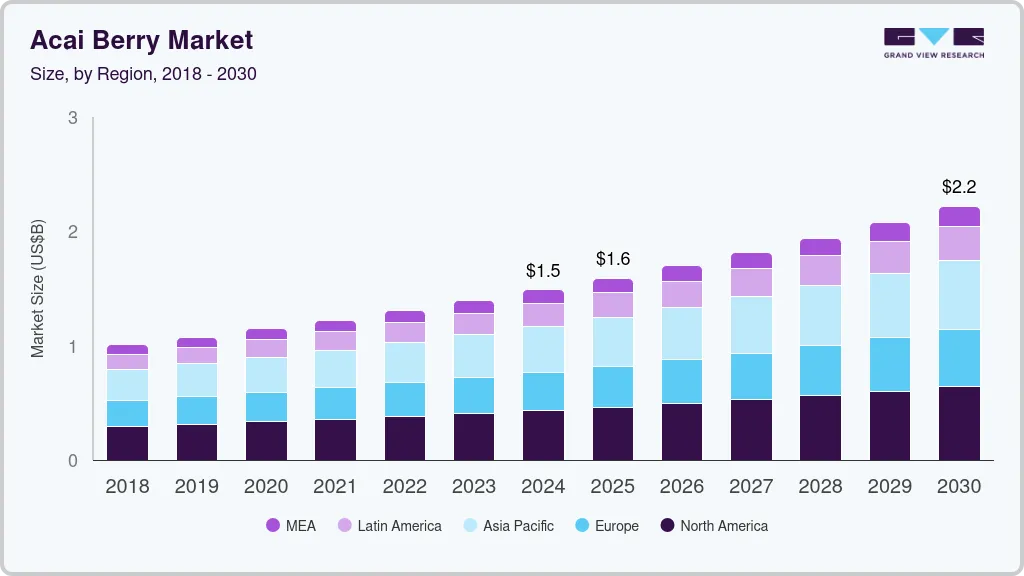

The global acai berry market size was estimated at USD 1,489.9 million in 2024 and is projected to grow at a CAGR of 6.9% from 2025 to 2030. One of the primary drivers of the acai berry market is the increasing global emphasis on health and wellness. Consumers are becoming more aware of the health benefits of acai berries, which are rich in antioxidants, fiber, and healthy fats. These nutrients are linked to various health advantages, including improved immune function, heart health, and weight management. As a result, there is a growing demand for superfoods like acai berries in dietary products across the food and beverage industry. The rising interest in natural and organic products further propels this trend as health-conscious consumers seek nutritious options that align with their lifestyle choices.

The surge in e-commerce has also significantly impacted the acai berry industry. Online retail platforms provide consumers with convenient access to various acai berry products, including powders, supplements, and ready-to-drink beverages. This shift towards digital shopping has made it easier for consumers to purchase acai products from the comfort of their homes, driving sales growth. For instance, major online retailers have reported substantial increases in acai product sales due to heightened consumer awareness and the convenience of online shopping. This trend allows companies to expand their reach and cater to a broader audience.

Innovation within the product offerings is another critical factor contributing to market growth. Companies are increasingly developing new formulations incorporating acai berries into various products, from dietary supplements to functional foods and beverages. Introducing unique blends that combine acai with other superfoods or vitamins caters to evolving consumer preferences for holistic well-being. This focus on innovation allows businesses to diversify their product lines and capture a larger market share.

Sustainability has become a focal point for consumers and producers in the acai berry industry. As awareness of environmental issues grows, consumers seek responsibly sourced and sustainably harvested products. Companies that adopt ethical sourcing practices can enhance their brand reputation while ensuring a reliable supply chain of high-quality acai berries. This trend aligns with consumer values and supports small-scale farmers who cultivate these berries in their native Amazon rainforest habitat.

The acai berry industry is characterized by its unorganized nature, with a significant portion dominated by small-scale farmers and informal operations. This fragmentation presents challenges such as inconsistent quality standards and supply chain inefficiencies. However, larger companies are working towards standardization by investing in better supply chain management and quality control measures. By establishing themselves as reliable suppliers of premium acai products, these players can increase their market share while addressing consumer concerns regarding quality.

The acai berry industry faces stiff competition from other superfoods that are gaining popularity among health-conscious consumers. Products like blueberries, goji berries, and spirulina offer similar health benefits and may be more readily available in various regions. This competition can dilute consumer interest in acai berries, particularly if alternative superfoods are perceived as more affordable or accessible. As consumers explore diverse health options, maintaining a unique value proposition becomes crucial for acai products to stand out in a crowded marketplace.

Cost is another significant barrier impacting the acai berry industry. The high import costs of transporting acai berries from Brazil to other regions can lead to elevated consumer retail prices. This situation may limit affordability for some consumers, particularly in developing markets where disposable income is lower. In addition, the costs associated with sustainable farming practices and compliance with regulatory standards can further increase production expenses, impacting profit margins for producers.

Product Insights

Acai berry pulp was the largest consumed product form and had a market size of USD 826 million in 2023. Acai pulp is often considered nutritionally superior to dried acai due to its higher antioxidant content and better retention of essential nutrients. Research indicates that acai pulp contains significant levels of anthocyanins, which are powerful antioxidants that combat oxidative stress and inflammation in the body. In contrast, the drying process can diminish some of these beneficial compounds. For instance, 100 grams of frozen acai pulp boasts an Oxygen Radical Absorbance Capacity (ORAC) score of 15,405, significantly higher than that of dried forms. This makes the pulp a preferred choice for consumers looking to maximize their intake of antioxidants. Consumer preferences are shifting towards fresh or minimally processed foods, which enhances the appeal of acai pulp over dried forms. Many consumers are now more discerning about food processing methods and are inclined to choose products that retain their natural state as much as possible. This trend aligns with the growing demand for organic and natural foods, making frozen or fresh acai pulp a more attractive option than dried alternatives.

Distribution Insights

Supermarkets and hypermarkets were the most preferred distribution channels and are expected to be valued at USD 683 million in 2023. Supermarkets and hypermarkets offer a broad selection of acai berry products, including frozen pulp, dried berries, powders, and ready-to-eat items like acai bowls. This extensive range allows consumers to find various options in one location, catering to diverse preferences and dietary needs. The convenience of having multiple product choices under one roof enhances the shopping experience and encourages consumers to purchase acai products more frequently.

Supermarkets and hypermarkets are accessible, which plays a crucial role in their dominance as distribution channels. These retail outlets are typically located in urban areas with high foot traffic, making them convenient for consumers who prefer to shop physically rather than online. The ability to purchase acai products during regular grocery shopping trips aligns with consumer habits, encouraging more frequent purchases.

The online retail segment of the market is expected to grow at a CAGR of 7.3% from 2024 to 2030. The growth of online distribution for acai berry products is driven by several key factors that align with changing consumer behaviors and market dynamics. E-commerce platforms typically offer more acai berry products than traditional retail outlets. This variety enables consumers to choose options that best meet their needs, whether looking for organic certifications, specific formulations, or unique blends. The ability to compare different brands and products further enriches the shopping experience. Online shopping provides unparalleled convenience, allowing consumers to order acai berry products from the comfort of their homes or offices. This particularly appeals to busy individuals needing more time to visit physical stores. The ease of accessing a wide range of acai products-such as powders, frozen pulp, supplements, and ready-to-drink beverages-enhances the purchasing experience and encourages more frequent buying.

Application Insights

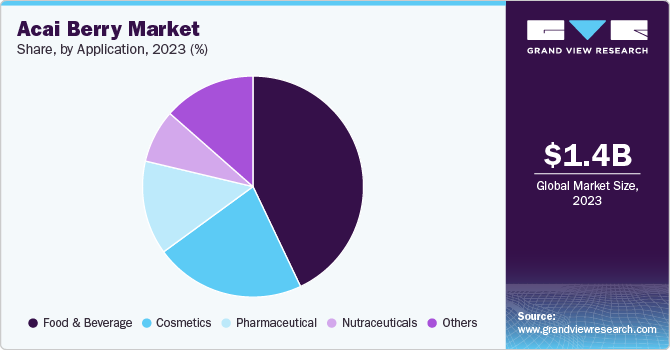

Food & beverage was the largest application and accounted for a market revenue of USD 600 million in 2023. The rising trend of superfoods has further propelled the popularity of acai berries. As consumers look for nutrient-dense foods that provide added health benefits, acai berries have emerged as a favored choice due to their unique nutritional profile and perceived health-boosting properties. This trend is reflected in the growing incorporation of acai into smoothies, juices, energy bars, and other health-focused products within the food and beverage industry. Acai berries are versatile ingredients that can be easily incorporated into a wide range of food and beverage products. Their unique flavor and vibrant color make them appealing for use in smoothie bowls, desserts, beverages, and snacks. This adaptability allows manufacturers to innovate and create new products that cater to evolving consumer tastes, further driving demand within the industry.

Cosmetics are expected to be the fastest-growing application and are expected to grow at a CAGR of 7.2% from 2024 to 2030. Acai berries are rich in antioxidants, vitamins, and essential fatty acids, which are highly valued in cosmetic formulations for their skin-nourishing properties. The high content of polyphenols and anthocyanins in acai berries contributes to their anti-aging effects, making them attractive ingredients for products aimed at improving skin elasticity, hydration, and overall appearance. As consumers seek products that promote youthful skin and combat signs of aging, the demand for acai-infused cosmetics continues to rise.

There is a growing trend among consumers towards natural and organic cosmetics, driven by increased awareness of the potential harmful effects of synthetic ingredients. Acai berries, often marketed as a superfood, fit well within this trend due to their natural origin and health benefits. Cosmetic brands are responding to this shift by formulating products that leverage the nourishing qualities of acai berries, appealing to environmentally conscious consumers who prefer sustainable and ethically sourced ingredients.

Regional Insights

The North America acai berry market dominated and accounted for 29.15% in 2023. One of the primary drivers for the acai berry's popularity in North America is the increasing consumer awareness of its health benefits. Acai berries are rich in antioxidants, fiber, and healthy fats, which contribute to various health advantages such as improved heart health, enhanced immune function, and weight management. As consumers become more health-conscious, they actively seek out superfoods like acai that offer substantial nutritional value, leading to a surge in demand for acai-based products across food, beverage, and supplement categories.

U.S. Acai Berry Market Trends

The U.S. acai berry market is expected to exceed USD 500 million by 2030. The growing preference for natural and organic products significantly influences the acai berry industry. Many consumers are shifting towards clean eating and are increasingly wary of artificial additives and processed foods. Acai berries, being a natural fruit with minimal processing, align well with this trend. This shift is evident in the rising demand for organic acai products as consumers prioritize sustainability and health benefits in purchasing.

Asia Pacific Acai Berry Market Trends

Asia Pacific acai berry market is expected to grow at a CAGR of 7.1% from 2024 to 2030. As disposable incomes rise across many Asian countries, consumers are more willing to spend on premium health products such as acai berries. This economic growth allows for greater investment in health-focused foods and supplements, contributing to the overall market expansion. Countries like India and China are experiencing rapid growth in the acai berry industry due to their burgeoning middle class seeking healthier lifestyle options.

The introduction of innovative acai-based products is another key driver in the Asian market. Companies are launching new formulations that combine acai with other superfoods or functional ingredients to enhance health benefits. This trend not only diversifies product offerings but also attracts a broader consumer base interested in holistic wellness solutions.

Key Acai Berry Company Insights

The competitive landscape of the acai berry industry is shaped by a variety of factors, including key players, market dynamics, and emerging trends. As the demand for acai berries continues to grow, driven by health consciousness and the popularity of superfoods, companies are adapting their strategies to maintain a competitive edge. These companies increasingly invest in product innovation, marketing strategies, and sustainable practices to differentiate themselves in a competitive market.

Key Acai Berry Companies:

The following are the leading companies in the acai berry market. These companies collectively hold the largest market share and dictate industry trends.

- Sambazon, Inc.

- Acai Roots, Inc.

- The Berry Company Limited

- Nativo Acai

- Nossa! Fruits SAS

- Amazon Power Pty Ltd.

- Amazon Forest Trading

- Açaí Berry Foods

- AcaiExotic

- Energy Foods International LLC

- Sunfood

- Tropical Acai LLC

- Amafruits

- Terrasoul Superfoods

- Frooty Comercio e Industria de Alimentos SA

Acai Berry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,591.5 million

Revenue forecast in 2030

USD 2,217.3 million

Growth rate (Revenue)

CAGR of 6.9% from 2025 to 2030

Actuals

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, UAE

Key companies profiled

Sambazon, Inc.; Acai Roots, Inc.; The Berry Company Limited; Nativo Acai; Nossa! Fruits SAS; Amazon Power Pty Ltd.; Amazon Forest Trading; Açaí Berry Foods; AcaiExotic; Energy Foods International LLC; Sunfood; Tropical Acai LLC; Amafruits; Terrasoul Superfoods; Frooty Comercio e Industria de Alimentos SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Acai Berry Market Report Segmentation

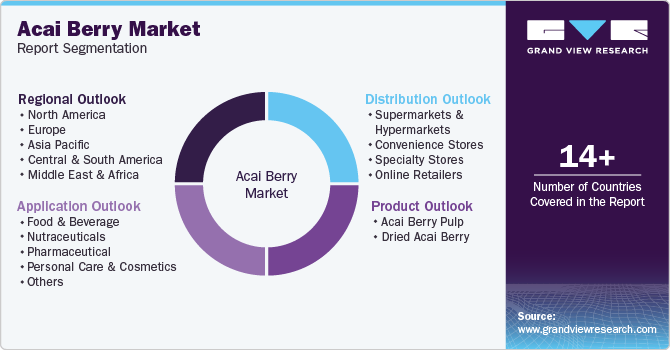

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global acai berry market report based on product, application, distribution, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Acai Berry Pulp

-

Dried Acai Berry

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Nutraceuticals

-

Pharmaceutical

-

Personal Care & Cosmetics

-

Others

-

-

Distribution Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global acai berry market was valued at USD 1,395 million in 2023 and is expected to reach USD 1,489.9 million in 2024.

b. The global acai berry market is expected to grow at a CAGR of 6.9% from 2024 to 2030 to reach USD 2,217.3 million by 2030.

b. Acai berry pulp was the largest consumed product form and had a market size of USD 826 million in 2023. Acai pulp is often considered nutritionally superior to dried acai due to its higher antioxidant content and better retention of essential nutrients. Research indicates that acai pulp contains significant levels of anthocyanins, which are powerful antioxidants that combat oxidative stress and inflammation in the body. In contrast, the drying process can diminish some of these beneficial compounds.

b. Some key players operating in the acai berry market include Sambazon, Inc.; Acai Roots, Inc.; The Berry Company Limited; Nativo Acai; Nossa! Fruits SAS; Amazon Power Pty Ltd.; Amazon Forest Trading; Açaí Berry Foods; AcaiExotic; Energy Foods International LLC; Sunfood; Tropical Acai LLC; Amafruits; Terrasoul Superfoods; Frooty Comercio e Industria de Alimentos SA

b. One of the primary drivers of the acai berry market is the increasing global emphasis on health and wellness. Consumers are becoming more aware of the health benefits of acai berries, which are rich in antioxidants, fiber, and healthy fats. These nutrients are linked to various health advantages, including improved immune function, heart health, and weight management. As a result, there is a growing demand for superfoods like acai berries in dietary products across the food and beverage industry. The rising interest in natural and organic products further propels this trend as health-conscious consumers seek nutritious options that align with their lifestyle choices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.