Aberrometers Market Size, Share & Trends Analysis Report By Type (Harmann-Shack Wavefront, Ray Tracing Wavefront), By Indication (Myopia, Hyperopia), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-459-7

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Aberrometers Market Size & Trends

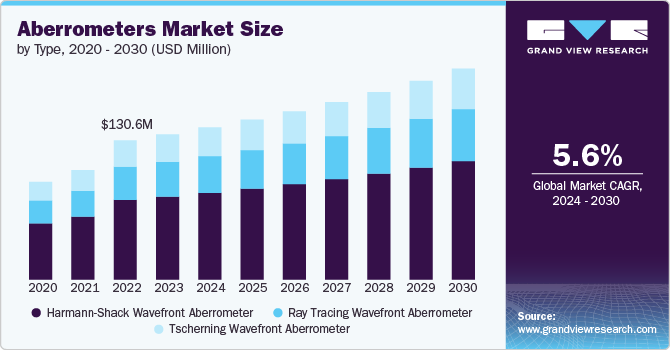

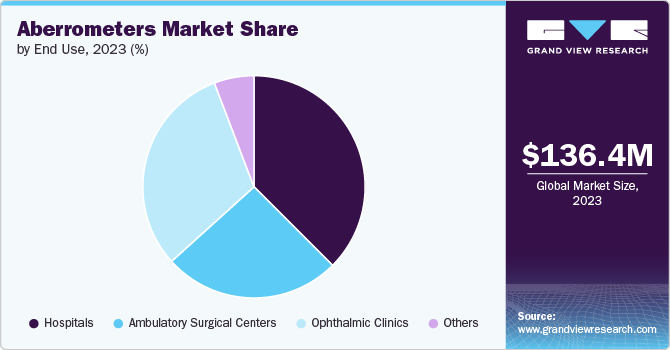

Theglobal aberrometers market size was estimated at USD 136.4 million in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. The market is expanding due to rising awareness of advanced diagnostic tools for precise vision correction. Aberrometers, which measure eye aberrations and imperfections, are increasingly utilized in customized refractive surgery and contact lens fitting. Technological advancements, such as the integration of wavefront technology and enhanced imaging capabilities, drive market growth by improving diagnostic accuracy and treatment outcomes.

The rising prevalence of vision disorders, including refractive errors and keratoconus, further fuels market demand. The aging population and increasing use of digital devices contribute to higher incidences of these conditions, driving the need for accurate diagnostic tools. In addition, growing awareness of the benefits of personalized eye care and adopting aberrometers in clinical and research settings support market expansion.

According to Healio, in April 2023, a high-resolution aberrometer prototype, the T-eyede, recently showcased its ability to detect micro alterations specific to keratoconus compared to healthy eyes. Presented at the European Society of Cataract and Refractive Surgeons winter meeting, this aberrometer uses advanced astrophysics technology to measure aberrations with 8.6 µm precision. It revealed significant differences in wavefront patterns between keratoconus and healthy eyes, with keratoconus showing a rough wavefront phase, especially in advanced stages. This innovation enhances diagnostic accuracy and could drive market growth by offering precise, stage-specific insights into keratoconus. The evidence backing our claims includes,

“As expected, a higher amount of aberrations was seen in the keratoconic eyes, not only coma but also astigmatism and [higher-order aberrations], and the difference was statistically significant; in addition, we noticed two different representation patterns in the wavefront phase, a smooth pattern that was present in 95% of the healthy eyes, and what we called a rough pattern, exhibited by 77% of the keratoconic eyes. We found it in 75% of stage I, 90% of stage II and 100% of stage III keratoconus,”

-Gonzalo Velarde-Rodriguez, MD Healio

Aberrometry during cataract surgery highlights the growing role of aberrometers in enhancing surgical outcomes. Intraoperative aberrometry, which involves measuring optical aberrations in real-time during cataract surgery, provides critical data for selecting the most suitable intraocular lens (IOL). This technology ensures that the IOL chosen will correct for the specific aberrations present in the patient's eye, leading to improved visual outcomes and reduced post-operative complications.

This news is significant for the market as it underscores the increasing integration of aberrometers into surgical procedures, expanding their application beyond preoperative diagnostics. Using aberrometers in intraoperative settings demonstrates their value in real-time, precise decision-making, thus driving demand for advanced aberrometers capable of delivering high-resolution, accurate measurements during surgery.

Moreover, this trend reflects the broader move towards personalized and precision medicine in ophthalmology, which is expected to boost market growth. The adoption of intraoperative aberrometry highlights the need for continuous innovation in aberrometer technology, presenting opportunities for manufacturers to develop products that cater to evolving surgical needs and enhance patient outcomes.

Market Concentration & Characteristics

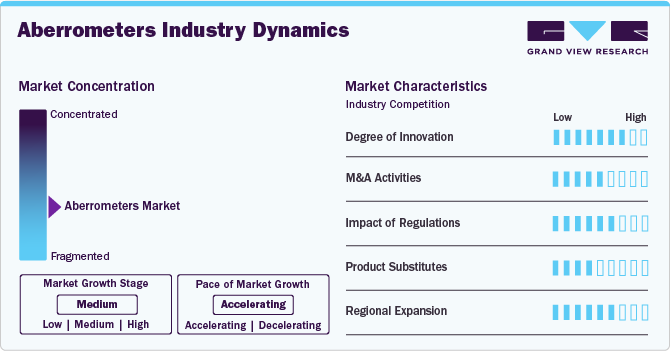

The aberrometers industry is characterized by high industry concentration, with leading players such as ZEISS, Nidek, and Topcon dominating the sector. These companies focus on continuous innovation and advanced technology integration to maintain competitive advantage. The industry features specialized products offering precise measurement and customization, driven by increasing demand for personalized vision care and advancements in diagnostic tools. This concentration fosters rapid technological development and high market competition.

The aberrometer industry is marked by a high degree of innovation, driven by technological advancements and the demand for precision in vision diagnostics. Key innovations include wavefront technology, which provides detailed measurements of optical aberrations, and enhanced imaging systems for improved accuracy. Recent developments involve integrating AI for real-time data analysis and miniaturizing devices for better portability. The introduction of intraoperative aberrometry tools also showcases the industry's commitment to enhancing surgical outcomes.

Regulations significantly impact the aberrometer industry by ensuring diagnostic device safety, efficacy, and quality. Regulatory standards, such as those from the FDA in the U.S. and CE marking in Europe, mandate rigorous testing and compliance before aberrometers can enter the market. These regulations help maintain high standards, protect patient safety, and introduce complexities and delays in product development and approval. Compliance with these regulations drives innovation and quality assurance, as manufacturers must adhere to strict guidelines. Consequently, while regulations can be challenging, they ultimately enhance the credibility and reliability of aberrometers in the market.

Mergers and acquisitions (M&A) in the aberrometer industry are shaping market dynamics by consolidating expertise and expanding product portfolios. Major companies are acquiring smaller firms to enhance their technological capabilities, diversify their offerings, and gain access to innovative technologies. For instance, acquisitions can enable companies to integrate advanced technologies like AI and wavefront analysis into their aberrometer solutions.

Key substitutes are corneal topographers, which measure the cornea's curvature and can provide valuable data for diagnosing refractive errors and keratoconus. Moreover, optical coherence tomography (OCT) is used for detailed imaging of the eye's internal structures, offering insights into various eye conditions. While these technologies serve different purposes, they can sometimes overlap with aberrometers in diagnosing visual impairments. The choice between these tools depends on specific diagnostic needs, with some clinics using a combination for comprehensive assessment.

Regional expansion in the aberrometer industry is driven by increasing global demand for advanced diagnostic tools. North America remains a leading market due to its advanced healthcare infrastructure and high adoption of new technologies. However, regions like Asia-Pacific are experiencing rapid growth due to rising healthcare investments, growing awareness of eye health, and expanding medical facilities. Companies are entering emerging markets to capitalize on the rising prevalence of vision disorders and improve access to precise diagnostic tools. Strategic partnerships and local collaborations further facilitate market entry and growth in these regions, enhancing global market reach.

Type Insights

The Harmann-Shack wavefront aberrometer segment accounted for the largest market share of 57.1% in 2023 due to its precise measurement of optical aberrations and widespread application in vision correction procedures. This technology offers highly detailed data, making it essential for diagnosing refractive errors and customizing treatments like LASIK. Its ability to assess lower and higher-order aberrations has made it the preferred choice for ophthalmologists and eye care professionals. As demand for personalized vision care and advanced diagnostics rises, the Hartmann-Shack segment continues to lead the market, driven by its accuracy and versatility in various clinical settings.

The ray tracing wavefront aberrometer segment is expected to witness significant growth in the coming years due to its advanced diagnostic capabilities. Unlike traditional methods, ray tracing technology provides highly accurate measurements of lower- and higher-order aberrations by tracing light rays through the eye's optical system. This precision is particularly valuable for personalized vision correction and complex refractive surgeries. Increasing demand for customized treatments and advancements in eye care technology is driving the adoption of ray tracing aberrometer-their ability to deliver detailed, patient-specific data positions this segment for strong market expansion.

Indication Insights

The hyperopia segment accounted for the largest market share of 43.9% in 2023. This prominence is due to the increasing incidence of hyperopia, or farsightedness, especially among older populations. Data from the National Eye Institute and the U.S. Department of Health and Human Services indicates that up to 10% of Americans experience some level of hyperopia. Furthermore, 1 in 7 children are affected, which can significantly hinder their learning, reading, and academic performance, as noted by Optometrists Network in November 2021. Aberrometers are essential in diagnosing and managing hyperopia by providing accurate measurements of refractive errors, enabling the development of personalized treatment plans.

The myopia segment is expected to see significant growth during the forecast period. According to the International Myopia Institute, evidence indicates that myopia is increasing globally. A recent study estimates that about 30% of the world's population is currently myopic, and this figure could reach nearly 50% by 2050, affecting around 5 billion people. Myopia prevalence is particularly high in East and Southeast Asia, with countries like South Korea, Taiwan, Singapore, China, and Japan reporting rates of 80% to 90%. In the U.S., myopia prevalence has also surged, reaching 42%, almost doubling over the past three decades.

End Use Insights

The hospitals segment accounted for the largest revenue share of 37.5% in 2023. Hospitals are primary hubs for complex vision assessments and surgeries, utilizing aberrometers for precise measurements of refractive errors and higher-order aberrations. These facilities offer comprehensive care, including personalized treatment plans and specialized equipment, making them the preferred choice for patients requiring vision correction procedures. In addition, hospitals' ability to adopt cutting-edge technologies further strengthens their position in the market, contributing to their dominant revenue share. This trend is expected to continue as demand for specialized eye care grows.

The ophthalmic clinics segment is projected to grow significantly over the forecast period due to the increasing demand for specialized eye care services and advanced diagnostic tools. Clinics offer a more personalized and accessible approach to eye care, often using advanced aberrometers for precise vision assessments and treatments. As awareness of vision health rises and technology becomes more accessible, patients are increasingly turning to ophthalmic clinics for routine eye exams and corrective procedures. This growth is further supported by the expanding prevalence of vision disorders, such as myopia and hyperopia, driving the need for specialized care in these settings.

Regional Insights

North America aberrometers market dominated the overall global market and accounted for 43.0% revenue share in 2023. The North American market is fueled by technological advancements in ophthalmology, increasing refractive errors, and rising demand for personalized vision correction procedures like LASIK. As of November 2023, the National Eye Institute reported over 150 million Americans have refractive errors. Aberrometers are essential for detecting optical imperfections and enhancing diagnostic accuracy and personalized care. The market also benefits from high healthcare spending, strong infrastructure, and growing eye health awareness. Key players are focusing on integrating aberrometry with tools like corneal topography to improve surgical outcomes, while the expanding use of aberrometers in clinical and research settings drives further market growth.

U.S. Aberrometers Market Trends

The aberrometers market in the U.S. held a significant share of North America's market in 2023. This can be attributed to the rising demand for advanced ophthalmic diagnostic tools, driven by increasing refractive errors such as myopia and astigmatism. Myopia, a global health concern, affects all age groups, with a prevalence of 33.1% in the U.S., according to NCBI data published in July 2021. Leading companies invest in research and development to create innovative aberrometry solutions for clinical and surgical applications.

Europe Aberrometers Market Trends

The aberrometer market in Europe is growing due to the rising prevalence of vision impairment, which affects around 90 million people, or 9% of the population, according to the WHO data published in June 2023. The demand for precise diagnostic tools is driven by the need to enhance surgical outcomes and provide personalized treatments. With well-established healthcare systems across European countries, there is a notable demand for advanced and high-quality medical equipment, which is expected to increase the demand for these devices in the European market.

The UK aberrometers market is experiencing substantial growth due to multiple factors, including an aging population and a rise in age-related eye conditions like cataracts and glaucoma. According to The Royal College of Ophthalmologists, over 700,000 people in the UK have glaucoma, with half being unaware of it. Glaucoma UK's advocacy for eye exams highlights the projected 30% increase in glaucoma cases from 2020 to 2035.

The aberrometers market in France is growing, fueled by increased healthcare investments and programs like L'OCCITANE France's support for Helen Keller Europe's "Plan Vue" initiative in 2023-2024. Inspired by the ChildSight initiative, this project focuses on raising awareness, screening, treating, and monitoring visual impairments in schoolchildren in priority areas like Nanterre and Aubervilliers. Such initiatives drive demand for advanced diagnostic tools, including aberrometers, by promoting early detection and treatment of eye conditions. Furthermore, France’s aging population and emphasis on preventive eye care further contribute to market growth.

Germany aberrometers market is experiencing substantial growth, driven by the country's aging population and a strong emphasis on preventive eye care. According to AARP, Germany's population aged 65 and older is projected to increase by 41%, reaching 24 million by 2050, representing nearly one-third of the total population. This demographic shift elevates the demand for advanced diagnostic tools, like aberrometers, as age-related eye conditions become more prevalent. Moreover, focusing on early detection and treatment of visual impairments further supports market growth, positioning Germany as a key player in the ophthalmic diagnostics sector.

Asia Pacific Aberrometers Market Trends

The aberrometers market in the Asia Pacific region is projected to experience the fastest growth during the forecast period. China and Japan are anticipated to lead the market in this region. In addition, the presence of skilled professionals and the development of healthcare infrastructure are key factors expected to fuel market expansion. The region's focus on improving diagnostic tools and healthcare services will likely support continued growth in the demand for aberrometers, positioning Asia Pacific as a major player in the global market over the coming years.

Japan aberrometers market is projected to grow rapidly. According to the Organization for Economic Cooperation & Development, Japan's healthcare spending, which accounted for 9.8% of its GDP in 2022, is expected to drive this market expansion during the forecast period. Increasing investments in healthcare infrastructure and advanced diagnostic tools further bolster this growth.

The aberrometers market in China is expected to grow significantly, driven by the country's increasing emphasis on advanced healthcare technologies and enhanced diagnostic capabilities. The rising incidence of vision-related disorders and an aging population fuel the demand for precise early detection tools like aberrometers. Market growth is further supported by expanding healthcare infrastructure, a growing healthcare workforce, and well-established medical facilities. For instance, CEIC data from 2022 shows that the number of hospitals in China rose to 36,976, up from 36,570 in 2021, highlighting the ongoing development in the sector.

India aberrometers market is growing quickly, fueled by the rising incidence of eye disorders, increased healthcare expenditures, and advancements in ophthalmic technology. An aging population and greater awareness of eye health drive the demand for advanced diagnostic tools like aberrometers. In addition, expanding private eye care centers are boosting diagnostic capabilities and positioning India as a significant market for aberrometers.

Latin America Aberrometers Trends

The aberrometers market in Latin America is driven by rising healthcare spending and infrastructural investments. Furthermore, expanding ophthalmic services and adopting advanced diagnostic tools drive regional demand.

Saudi Arabia Aberrometers market is poised for significant growth, driven by the country's extensive healthcare modernization efforts and increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions. As a part of its Vision 2030 initiative, the Saudi government is investing in advanced health technologies and digital health solutions, which support the adoption of aberrometers.

Key Aberrometers Company Insights

The highly competitive market features key players such as Topcon Healthcare, Carl Zeiss Meditec, and Essilor Instruments. These leading companies actively pursue organic and inorganic strategies, including product launches, partnerships, acquisitions, mergers, and regional expansion, to address their customers' unmet needs.

Key Aberrometers Companies:

The following are the leading companies in the aberrometers market. These companies collectively hold the largest market share and dictate industry trends.

- Topcon Healthcare

- Carl Zeiss Meditec

- Essilor instruments

- Luneau Technology USA, Inc.

- Luneau Technology USA, Inc.

- SCHWIND eye-tech-solutions

- Alcon Inc.

- HANSON INSTRUMENTS

Recent Developments

-

In March 2023, WaveFront Dynamics Inc. launched its WaveDyn Vision Analyzer, designed to enhance eye care diagnostics by precisely measuring optical distortions affecting vision. This innovative device provides comprehensive data on corneal health, aiming to improve outcomes for refractive surgery and contact lens fitting, ultimately optimizing patient vision correction solutions.

-

In February 2023, Tracey Technologies launched iTrace Prime, upgraded software for its iTrace Aberrometer. The new version enhances vision analysis with faster processing and improved reporting features. It integrates with advanced diagnostic tools, enabling surgeons to identify vision issues more effectively and optimize surgical planning for cataract and refractive procedures.

-

In July 2021, A study on LASIK outcomes using a new topography-integrated aberrometer showed improved visual results and patient satisfaction. This advanced technology combines corneal topography with wavefront aberrometry, offering more precise measurements for customized treatments. It enhances accuracy in correcting refractive errors, resulting in better vision quality and fewer post-surgery complications.

Aberrometers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 142.9 million |

|

Revenue forecast in 2030 |

USD 198.1 million |

|

Growth rate |

CAGR of 5.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Topcon Healthcare; Carl Zeiss Meditec; Essilor instruments; Luneau Technology USA, Inc.; NIDEK CO., LTD; OPTIKON; SCHWIND eye-tech-solutions; Alcon Inc.; HANSON INSTRUMENTS; Healio |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Aberrometers Market Report Segmentation

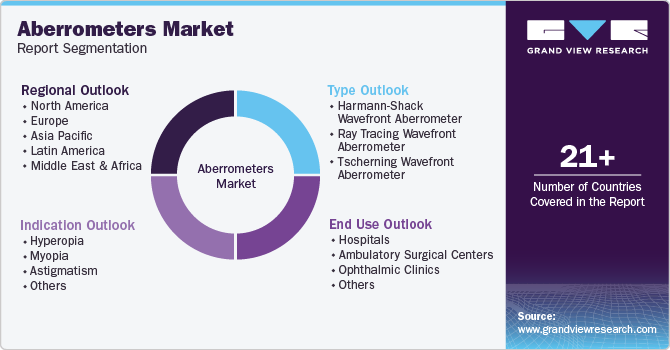

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aberrometers market report based on type, indication, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Harmann-Shack Wavefront Aberrometer

-

Ray Tracing Wavefront Aberrometer

-

Tscherning Wavefront Aberrometer

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Hyperopia

-

Myopia

-

Astigmatism

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Ophthalmic Clinics

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global aberrometers market size was estimated at USD 136.4 million in 2023 and is expected to reach USD 142.9 million in 2024.

b. The global aberrometers market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 198.1 million by 2030.

b. North America dominated the aberrometers market with a share of 43.0% in 2023. This is attributable to advancements in aberrometers, and rising aging population.

b. Some key players operating in the aberrometers market include Topcon Healthcare, Carl Zeiss Meditec, Essilor instruments, Luneau Technology USA, Inc., NIDEK CO., LTD, OPTIKON, SCHWIND eye-tech-solutions, Alcon Inc., HANSON INSTRUMENTS, Healio

b. Key factors that are driving the aberrometers market growth include the rising prevalence of eye diseases, technological advancements, and government initiatives for increasing awareness regarding visual impairment.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."