- Home

- »

- Next Generation Technologies

- »

-

Cognitive Computing Market Size And Share Report, 2030GVR Report cover

![Cognitive Computing Market Size, Share & Trends Report]()

Cognitive Computing Market Size, Share & Trends Analysis Report By Technology, By Deployment (On-premises, Cloud), By Application (Healthcare, Retail), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-243-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Cognitive Computing Market Size & Trends

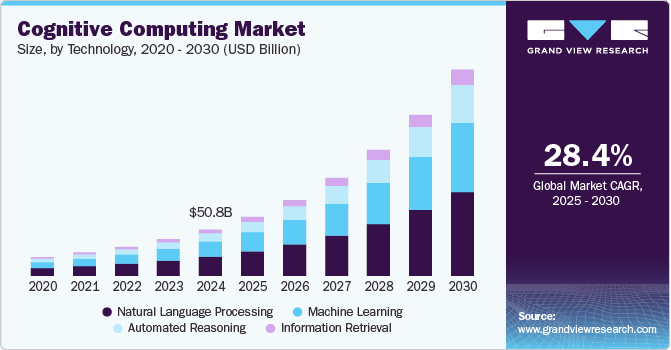

The global cognitive computing market size was estimated at USD 50.76 billion in 2024 and is projected to grow at a CAGR of 28.4% from 2025 to 2030. The market has been expanding rapidly, driven by the increasing need for intelligent systems capable of processing vast amounts of data. Companies across industries are recognizing the potential of cognitive technologies, such as natural language processing and machine learning, to enhance decision-making and improve efficiency. The rise in demand for personalized experiences has also fueled the growth of these systems, particularly in sectors such as healthcare, finance, and retail. Cognitive computing solutions are being integrated into various business processes, from customer service to supply chain management.

The increasing volume of unstructured data propels the market forward as traditional systems struggle to process it efficiently. Cognitive computing, with its ability to understand and derive insights from such data, offers a valuable solution. Moreover, organizations are focusing on automating repetitive tasks and enhancing productivity, further boosting the demand for cognitive solutions. Governments and public sector organizations are also investing in cognitive technologies to improve services and decision-making. These systems can analyze large datasets, predict trends, and offer actionable insights, helping organizations make informed decisions. Moreover, the integration of cognitive computing with cloud platforms has made these technologies more accessible to businesses of all sizes. As a result, the market has witnessed significant investments from both private and public sectors.

The growing demand for automation is a significant trend driving the market growth. Businesses are increasingly looking for ways to streamline operations and enhance efficiency. Automation allows organizations to reduce human error and improve the accuracy of routine tasks. Cognitive computing technologies, with their advanced data processing capabilities, enable more intelligent automation solutions. This improves productivity and also helps in making faster, data-driven decisions. As automation continues to evolve, more industries are expected to adopt cognitive systems to stay competitive. Furthermore, automation powered by cognitive computing enables businesses to optimize resource allocation and reduce operational costs. As cognitive technologies advance, they are expected to drive even greater innovation across various sectors, transforming the way companies operate and compete in the marketplace.

Technology Insights

Based on technology, the natural language processing segment led the market with the largest revenue share of 41.83% in 2024, due to its ability to understand and interpret human language. This technology facilitates improved communication between machines and users, enhancing user experiences across various applications. Businesses increasingly rely on NLP for tasks such as sentiment analysis, chatbots, and voice recognition systems. The growing need for efficient customer service solutions further contributes to NLP's prominence in the market. As organizations strive for better engagement and personalized interactions, NLP continues to play a critical role in cognitive computing advancements.

The machine learning (ML) segment is anticipated to grow at a significant CAGR during the forecast period, as organizations seek to leverage data for better insights. This technology enables systems to learn from data patterns, improving their performance over time without human intervention. Businesses are increasingly adopting ML to automate decision-making processes and enhance predictive analytics capabilities. The rise of big data analytics has further fueled the demand for machine learning solutions, allowing organizations to process and analyze vast datasets effectively. As ML algorithms become more sophisticated, their applications across various industries are expanding, driving continued market growth.

Deployment Insights

Based on deployment, the cloud segment led the market with the largest revenue share of 71.49% in 2024, due to its scalability and cost-effectiveness. Organizations benefit from the flexibility of accessing advanced cognitive technologies without significant upfront capital expenditures. This model allows businesses to quickly adapt to changing demands and scale their resources as needed. The cloud environment also promotes collaboration by enabling teams to share insights and data seamlessly. As the demand for agile and innovative solutions rises, the cloud segment continues to lead in the cognitive computing landscape.

The on-premises segment is benefiting within the market as businesses seek enhanced data control and security. Many organizations are adopting on-premises solutions to comply with stringent data privacy regulations and ensure that sensitive information remains protected. This approach allows companies to customize their cognitive systems according to specific operational requirements. On-premises deployments often provide faster data processing capabilities, reducing latency for critical applications. As the importance of data governance increases, more organizations are investing in on-premises cognitive computing solutions.

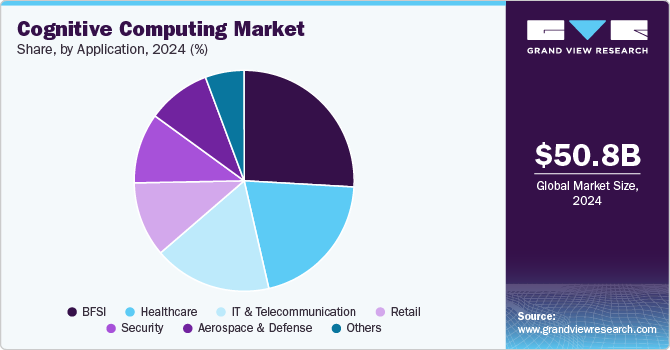

Application Insights

Based on application, the BFSI segment led the market with the largest revenue share of 25.86% in 2024, due to its significant reliance on data analysis and risk management. Organizations within this sector utilize cognitive technologies to enhance fraud detection and streamline compliance processes. The ability to process large volumes of unstructured data allows BFSI companies to gain valuable insights into customer behavior and preferences. Moreover, cognitive computing supports personalized financial services, improving customer satisfaction and loyalty. As financial institutions increasingly adopt innovative technologies, the BFSI segment remains at the forefront of cognitive computing advancements.

The IT and telecommunications segment is anticipated to experience at the fastest CAGR during the forecast period, as organizations seek to improve operational efficiency and customer engagement. Companies in this sector are implementing cognitive solutions to analyze vast amounts of data generated by network traffic and user interactions. This enables them to optimize service delivery and enhance predictive maintenance strategies. The demand for smarter customer support solutions is driving the adoption of chatbots and virtual assistants in the telecommunications industry. As technology continues to evolve, the IT and telecommunications sector is expected to increasingly leverage cognitive computing to remain competitive and innovative.

Regional Insights

North America dominated the cognitive computing market with the largest revenue share of 38.5% in 2024. The market is growing rapidly in North America, driven by the region's advanced technological infrastructure. Organizations are increasingly adopting artificial intelligence and machine learning to enhance operations, particularly in sectors such as finance and healthcare. The presence of major tech firms and a dynamic startup ecosystem fosters innovation and competition, leading to continuous advancements in cognitive technologies. Moreover, the emphasis on data analytics and personalized customer experiences is further propelling the demand for cognitive computing solutions across various industries.

U.S. Cognitive Computing Market Trends

The cognitive computing market in the U.S. is experiencing significant growth due to the presence of leading technology companies that are pioneering advancements in artificial intelligence. The increasing focus on automation and data analytics drives organizations to adopt cognitive technologies for improved efficiency and decision-making. A highly skilled workforce in tech and engineering fields further supports the growth of cognitive computing by enabling organizations to utilize these advanced technologies effectively.

Europe Cognitive Computing Market Trends

The cognitive computing market in Europe is expanding as businesses increasingly recognize the importance of these technologies for improving productivity and compliance. Strict data protection regulations prompt organizations to adopt cognitive solutions that ensure security while driving innovation. European companies are utilizing cognitive computing for applications such as smart manufacturing and enhanced customer service.

Asia Pacific Cognitive Computing Market Trends

The cognitive computing market in Asia Pacific is witnessing rapid growth, driven by the region's increasing digitalization and substantial government initiatives to advance AI technologies. Countries such as China and India are leading this growth, investing heavily in cognitive solutions to enhance various industries, including finance, healthcare, and logistics. The rising adoption of mobile technologies and e-commerce is fueling demand for cognitive applications, enabling businesses to optimize operations and improve customer experience.

Key Cognitive Computing Company Insights

Some of the key companies in the global market include Google LLC, IBM Corporation, Oracle Corporation, Microsoft, Nuance Communications Inc., and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Microsoft has made significant progress in cognitive computing with its Azure cloud platform, which provides a range of AI and machine learning services. The company has developed tools such as Azure Cognitive Services, enabling developers to integrate capabilities such as natural language processing, computer vision, and speech recognition into their applications. Moreover, Microsoft’s investments in research and partnerships with academic institutions accelerate advancements in AI technologies

-

Nuance Communications Inc. has made significant advancements in cognitive computing, particularly in conversational AI and natural language processing. The company's Dragon software suite utilizes advanced speech recognition technology to provide accurate transcription and voice commands, greatly enhancing productivity, especially in healthcare. Moreover, Nuance's AI-driven solutions improve customer engagement by automating interactions and gathering insights from conversations. Their developments in voice biometrics further enhance security and simplify authentication processes

Key Cognitive Computing Companies:

The following are the leading companies in the cognitive computing market. These companies collectively hold the largest market share and dictate industry trends.

- CognitiveScale

- Enterra Solutions

- HP Development Company, L.P.

- IBM Corporation

- Microsoft

- Muance Communications Inc.

- Numenta

- Oracle Corporation

- Palantir

- PTC

- Saffron Technology

- SAP

- Statistical Analysis System (SAS)

- Tibco Software

- Vicarious

Recent Developments

-

In May 2024, Wipro, an IT company in India, partnered with Microsoft to launch a suite of generative AI-powered cognitive assistants for financial services to enhance market intelligence, accelerate onboarding, and streamline loan origination. These solutions will utilize Microsoft Azure OpenAI and Document Intelligence to provide timely information, reduce paperwork, and improve the overall user experience for financial professionals and their clients

-

In May 2024, IBM Corporation and SAP announced an expanded collaboration focused on generative AI capabilities and industry-specific cloud solutions to help clients enhance business value and accelerate digital transformation. The collaboration aims to integrate AI into various SAP business processes, enabling innovation across sectors while utilizing IBM's expertise in hybrid cloud and AI technologies

-

In February 2024, Microsoft collaborated with Mistral AI, a French artificial intelligence company, to boost AI innovation over several years. This collaboration will use Azure's advanced infrastructure to develop and deploy Mistral's large language models, including the new Mistral Large. This collaboration aims to provide commercial opportunities, enhance AI research and development, and make Mistral AI's models accessible to customers through Azure's Models as a Service (MaaS)

-

In March 2023, Nuance Communications launched Dragon Ambient eXperience (DAX) Express. This innovative voice-enabled medical scribe application integrates OpenAI's GPT-4 to automate clinical documentation by capturing physician-patient interactions and generating draft notes in seconds. This advancement aims to reduce administrative burdens for healthcare providers, enhance documentation accuracy, and ultimately alleviate physician burnout

Cognitive Computing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 64.52 billion

Revenue forecast in 2030

USD 225.33 billion

Growth rate

CAGR of 28.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Technology, deployment, application, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

CognitiveScale; Enterra Solutions; Google; HP Development Company; L.P.; IBM Corporation; Microsoft; Nuance Communications, Inc.; Numenta; Oracle Corporation; Palantir; PTC; Saffron Technology; SAP; Statistical Analysis System (SAS); Tibco Software; Vicarious

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cognitive Computing Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cognitive computing market report based on technology, deployment, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Natural Language Processing

-

Machine Learning

-

Automated Reasoning

-

Information Retrieval

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Application (Revenue, USD Billion, 2018 - 2030)

-

Healthcare

-

Retail

-

BFSI

-

Security

-

IT & Telecom

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cognitive computing market size was estimated at USD 50.76 billion in 2024 and is expected to reach USD 64.52 billion in 2025.

b. The global cognitive computing market is expected to grow at a compound annual growth rate of 28.4% from 2025 to 2030 to reach USD 225.33 billion by 2030.

b. North America dominated the cognitive computing market with a share of 38.5% in 2024. This is attributable to its early adoption of advanced technologies, a robust innovation ecosystem, and significant government and private sector support.

b. Some key players operating in the cognitive computing market include CognitiveScale, Enterra Solutions, Google, HP Development Company, L.P., IBM Corporation, Microsoft, Nuance Communications Inc., Numenta, Oracle Corporation, Palantir, PTC, Saffron Technology, SAP, Statistical Analysis System (SAS), Tibco Software, and Vicarious

b. Key factors that are driving the cognitive computing market growth include increasing demand for intelligent business solutions, advancements in machine learning and AI technologies, rising adoption of cloud-based services, and expanding applications across various industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."