7T Magnetic Resonance Imaging Systems Market Size, Share & Trends Analysis Report By Application (Clinical, Research), By End-use (Hospitals & Clinics, Diagnostic Imaging Centers), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-480-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

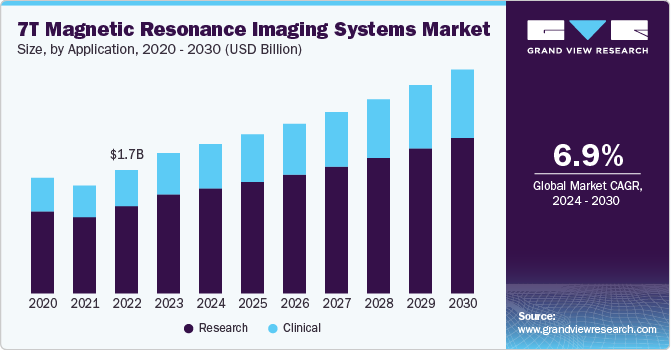

The global 7T magnetic resonance imaging systems market size was estimated at USD 2.11 billion in 2024 and is expected to grow at a CAGR of 7.1% from 2025 to 2030. Major factors contributing to the 7T magnetic resonance imaging (MRI) systems industry growth include advancements in imaging technology, increasing demand for high-resolution imaging, and expanding clinical applications.As 7T MRI offers superior image clarity and higher signal-to-noise ratios, it is increasingly favored in both research and clinical settings for detailed visualization of fine anatomical structures, especially in neurology, oncology, and musculoskeletal imaging. Growing research funding and investment in neuroscience and advanced diagnostic techniques further drive the market, as research institutes and academic centers continue to adopt 7T MRI for experimental and preclinical studies.

Technological advancements in 7T MRI have significantly enhanced its capabilities, leading to growing adoption among end users, particularly in research and clinical settings. The 7T MRI provides higher resolution and advanced imaging than conventional 1.5T or 3T MRI, providing detailed visualization of brain structures, small nerves, and other tissues. This has proven invaluable in studying neurological diseases like Alzheimer’s, epilepsy, and multiple sclerosis. Thus, as the technology continues to advance, increasing number of hospitals, research institutions, and clinical trial centers are adoption these devices. For instance, in March 2023, the most powerful 7-Tesla magnetic resonance imaging (MRI) machine in Europe was officially inaugurated at Otto von Guericke University Magdeburg.

The rising prevalence of chronic disorders is also driving the growth of 7T MRI technology, as these devices offer advanced capabilities that are increasingly beneficial for diagnosing various conditions. Chronic diseases such as Alzheimer’s, multiple sclerosis, epilepsy, and cardiovascular disorders require detailed and accurate imaging for effective diagnosis and treatment planning. The high-resolution imaging provided by 7T MRI allows clinicians to visualize structures, such as small blood vessels, tissues, and lesions, with high resolution than lower strength MRI machines. Thus, as the demand for precise diagnostic devices increases due to the growing prevalence of chronic diseases the 7T MRI market is expected to expand.

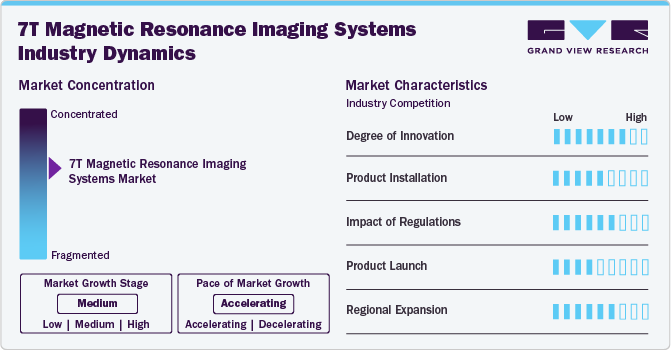

Market Concentration & Characteristics

The 7T magnetic resonance imaging (MRI) systems industry is accelerating at a high pace, driven by a combination of increasing research and development activities and growing range of applications. As more healthcare facilities and research institutions recognize the capabilities of 7T MRI, they are investing in this advanced technology to enhance diagnostic accuracy and patient care. The rise in R&D efforts is leading to innovative techniques and improved imaging protocols, further expanding the potential uses of 7T MRI in various fields, including neurology, oncology, and cardiovascular imaging. This combination of growing research initiatives and increasing clinical applications is contributing to industry growth.

Leading companies in the industry are consistently involved in enhancing their product portfolios to expand their customer base and capture a larger industry share. This effort includes upgrading their existing products, pursuing acquisitions, securing government approvals, and engaging in significant collaborative initiatives.

The level of innovation in 7T magnetic resonance imaging (MRI) systems industry is remarkable, fueled by a blend of technological advancements and growing clinical applications. These innovations are the result of significant progress in hardware, including enhanced magnet designs and more powerful gradients, which improve both image quality and resolution.

The increasing demand for 7-Tesla MRI systems from end users, such as hospitals, research institutions, and clinical trial centers, is playing a significant role in the growth of the 7-Tesla MRI industry. As healthcare providers and researchers seek more advanced imaging capabilities, particularly for complex conditions like neurological disorders and cardiovascular diseases, the high-resolution imaging offered by 7T MRI has become increasingly valuable. This growing interest is driving the expansion of the industry as more facilities adopt this advanced technology to enhance diagnostic accuracy and improve patient outcomes.

Regulations governing 7T magnetic resonance imaging (MRI) systems vary across different regulatory agencies and regions. Organizations like the FDA in the U.S., the EMA in Europe, and similar agencies globally are instrumental in ensuring the safety, effectiveness, and industry approval of these devices

Manufacturers are actively involved in launching new products to meet evolving industry demands and technological advancements.

The geographical reach of the 7T magnetic resonance imaging (MRI) systems industry has been expanding fueled by population growth, rising healthcare investments, and evolving regulatory landscapes. Manufacturers are actively expanding their product presence worldwide. For instance, in April 2024, Siemens Healthineers announced the launch of MAGNETOM Terra.X 7 Tesla (7T) MRI scanner in Canada.

Application Insights

The research segment dominated the market by capturing largest market share of 70.4% in 2024. This is primarily attributed to the increase in research activities. As academic institutions and medical research centers invest in advanced imaging technologies to explore complex neurological and physiological conditions, the demand for 7T MRI systems has increased. This high-resolution imaging capability is particularly valuable in research settings, enabling more detailed studies and innovative discoveries. For instance, the data published by NCBI states that the 7 Tesla MRI of the human spinal cord has been successfully demonstrated by several research centers worldwide. The spinal cord remains a key area where higher field strengths and enhanced resolution can offer advantages. As a result, the expanding applications in research are expected to further fuel market growth.

The clinical application segment is expected to grow at a fastest CAGR of over 7.6% the forecast period. The growing applications and increasing government approvals for clinical use are major factors contributing to the segment growth. For instance, according to an article published by Mayo Clinic in July 2023, there is growing interest in the clinical application of ultrahigh field 7T MRI, particularly for managing epilepsy and multiple sclerosis (MS). However, Mayo Clinic neuroradiologists have broadened the clinical use of 7T MRI beyond these conventional areas. They now regularly employ this advanced technology to guide treatment for patients with neurodegenerative disorders, cerebrovascular disease, amyotrophic lateral sclerosis (ALS), and other neurological conditions.

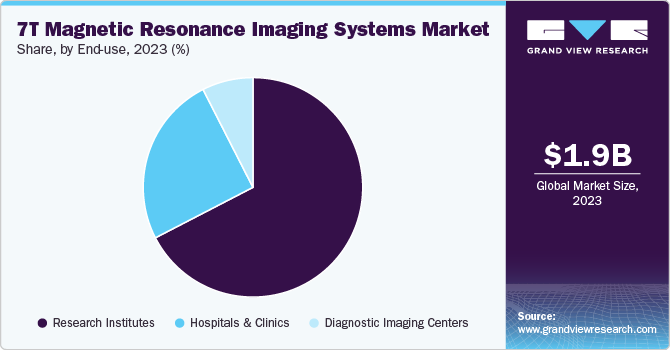

End Use Insights

The research institutes segment dominated the market with a share of over 67% in 2024. This dominance is attributed to the increasing focus on advanced imaging technologies in academic and medical research institutions, which are driving the adoption of 7T MRI systems for studying complex neurological and physiological conditions. Furthermore, research institutes also receive substantial funding and grants for advancing research, enabling them to invest in expensive technologies like 7T MRI. This funding also supports large scale studies and clinical trials that require the detailed imaging these systems provide.

The hospital segment of 7T MRI market is expected to grow at a fastest CAGR over the forecast period. This is owing to the increasing adoption of advanced imaging technologies in hospitals to enhance diagnostic accuracy and improve patient outcomes. These institutions are at the forefront of exploring complex neurological and physiological conditions, such as neurodegenerative diseases, multiple sclerosis (MS), and epilepsy. Furthermore, regulatory approvals for clinical use of 7T MRI systems are expanding globally, making it easier for hospitals to integrate these systems into routine medical care.

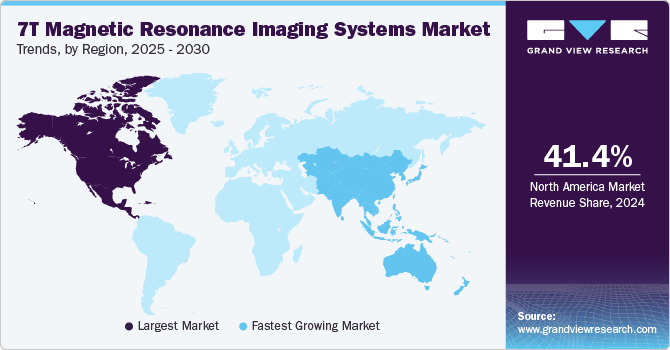

Regional Insights

North America 7T magnetic resonance imaging (MRI) systems market held the largest share of 41.4% in 2024. This can be attributed to the presence of a well-established healthcare infrastructure that enables the extensive adoption of advanced medical technologies, including 7T magnetic resonance imaging (MRI) systems. Moreover, favorable reimbursement policies and high healthcare spending in North America promote widespread access to 7T MRI technologies for both patients and healthcare providers.

U.S. 7T Magnetic Resonance Imaging (MRI) Systems Market Trends

The 7T magnetic resonance imaging (MRI) systems market in U.S. held the largest market share in 2024 in the North America region. This is owing to the presence of leading academic institutions, research centers, and hospitals that prioritize investment in high-end imaging systems for the diagnosis and treatment of complex neurological, musculoskeletal, and cardiovascular conditions.

Europe 7T Magnetic Resonance Imaging (MRI) Systems Market Trends

The 7T magnetic resonance imaging (MRI) systems market in Europe held a significant market share in 2024. Europe's aging population and the increasing prevalence of chronic diseases leads to the growing demand for accurate and early diagnostic devices. The emphasis on preventive healthcare and early detection strategies further drives the adoption of these technologies across the region.

The 7T magnetic resonance imaging (MRI) systems market in the UK is anticipated to expand due to the increasing demand for advanced imaging technologies in research and clinical diagnostics, particularly for neurological and musculoskeletal disorders. The 7T MRI systems provide higher resolution and more detailed images compared to standard 1.5T and 3T systems, making them beneficial in both research and clinical settings.

The 7T magnetic resonance imaging (MRI) systems market in France is expected to grow over the forecast period due to the rising prevalence of chronic diseases. As the incidence of these conditions increases with age, the demand for advanced diagnostic devices, such as 7T MRI increases as they can facilitate early detection and timely intervention.

The 7T magnetic resonance imaging (MRI) systems market in Germany is expected to grow over the forecast period this can be attributed to technological advancements. These innovations include improvements in imaging resolution and speed, enabling more detailed and accurate visualization of complex anatomical structures, particularly in the brain and nervous system.

Asia Pacific 7T Magnetic Resonance Imaging (MRI) Systems Market Trends

The 7T magnetic resonance imaging (MRI) systems market in Asia Pacific is estimated to witness the fastest CAGR of 8.30% during the forecast period, primarily due to rapid development of healthcare infrastructure in emerging economies such as China, India, and Japan. These countries show significant investments from both governments and private sectors aimed at expanding healthcare facilities, including hospitals and diagnostic centers, to improve the overall quality of medical care.

The7T magnetic resonance imaging (MRI) systems market in China is expected to grow at notable growth rate over the forecast period, driven by aging population and rising prevalence of chronic diseases, particularly neurological and cardiovascular disorders, that are fueling the demand for high-resolution imaging systems like 7T MRI, which provide superior diagnostic capabilities compared to lower-field MRI systems.

The 7T Magnetic Resonance Imaging (MRI) systems market in Japan is expected to grow, over the forecast period. This growth is mainly driven by increasing medical research and innovation, with strong collaborations between universities, research institutions, and the healthcare industry.

Latin America 7T Magnetic Resonance Imaging (MRI) Systems Market Trends

The 7T Magnetic Resonance Imaging (MRI) systems market in the Latin America market is anticipated to undergo moderate growth throughout the forecast period. This is due to improvement in healthcare infrastructure across the region, particularly in emerging economies such as Brazil, and Argentina. Governments and private healthcare providers are increasingly investing in modern medical facilities and advanced diagnostic tools to improve patient care and health outcomes

MEA 7T Magnetic Resonance Imaging (MRI) Systems Market Trends

The 7T Magnetic Resonance Imaging (MRI) Systems in MEA is anticipated to witness growth owing to the increasing focus of this region in R&D. Governments and private sectors in MEA countries, particularly in the Gulf states like the UAE and Saudi Arabia, are investing heavily in healthcare innovation and advanced medical technologies. These nations are working to position themselves as leaders in medical research, with initiatives aimed at improving diagnostic capabilities and enhancing patient care.

Key 7T Magnetic Resonance Imaging Systems Company Insights

The major players in the 7T magnetic resonance imaging (MRI) systems industry are actively enhancing their product portfolios through various strategies to remain competitive and expand their market share. These strategies include collaboration with research institutes, expanding applications and seeking government approvals for their products as it is crucial to ensure compliance with regulatory standards.

Key 7T Magnetic Resonance Imaging Systems Companies:

The following are the leading companies in the 7T magnetic resonance imaging systems market. These companies collectively hold the largest market. share and dictate industry trends.

- Bruker

- GE HealthCare

- Siemens Healthineers

- Koninklijke Philips N.V.

Recent Developments

-

In March 2024,Siemens Healthineers announced FDA clearance for the MAGNETOM Terra.X, a second-generation clinical 7-tesla magnetic resonance imaging scanner that significantly enhances 7T MR scanning capabilities with advanced hardware and XA60A software.

-

In May 2023, Researchers at the University of Florida campus have announced that they will soon have access to a new state-of-the-art 7 Tesla MRI/MRS Bruker preclinical scanner, made possible by a USD 2 million NIH High End Instrumentation Award.

7T Magnetic Resonance Imaging Systems Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.25 billion |

|

Revenue forecast in 2030 |

USD 3.16 billion |

|

Growth rate |

CAGR of 7.1% from 2025 to 2030 |

|

Actual period |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Bruker; GE HealthCare; Siemens Healthineers; Koninklijke Philips N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 7T Magnetic Resonance Imaging Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global 7T magnetic resonance imaging systems market report on the basis of application, end use and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical

-

Research

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Research Institutions

-

Diagnostic Imaging Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global 7T magnetic resonance imaging systems market size was estimated at USD 2.11 billion in 2024 and is expected to reach USD 2.25 billion in 2025.

b. The global 7T magnetic resonance imaging systems market is expected to grow at a compound annual growth rate of 7.1% from 2025 to 2030 to reach USD 3.16 billion by 2030.

b. The research segment dominated the 7T magnetic resonance imaging systems market with a share of 29.6% in 2024. This is due to the growing focus on research and development activities in many countries.

b. Some key players operating in the 7T magnetic resonance imaging systems market include Key companies profiled Bruker; GE HealthCare; Siemens Healthineers; Koninklijke Philips N.V.

b. Key factors that are driving the 7T magnetic resonance imaging systems market growth include advancements in imaging technology, increasing demand for high-resolution imaging, and expanding clinical applications

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."