- Home

- »

- Next Generation Technologies

- »

-

5G Security Market Size, Share And Growth Report, 2030GVR Report cover

![5G Security Market Size, Share & Trends Report]()

5G Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Architecture, By Network Security, By End-use, By Industries, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-025-9

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2020 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

5G Security Market Summary

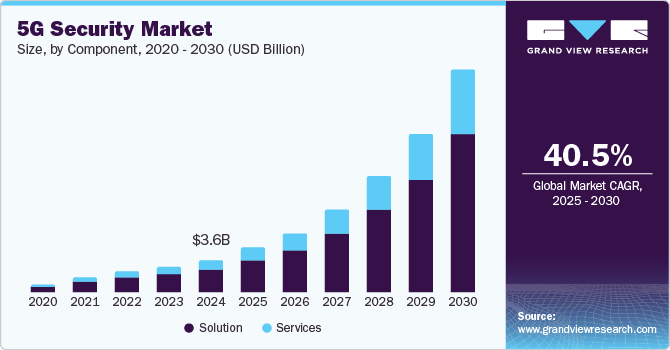

The global 5G security market size was estimated at USD 3.63 billion in 2024 and is projected to reach USD 27.59 billion by 2030, growing at a 40.5% from 2025 to 2030. The growth of the 5G security market can be attributed to the growing attacks on critical infrastructure, rising ransomware attacks on IoT devices, and growing security concerns in the 5G network.

Key Market Trends & Insights

- The North America 5G security market dominated the industry and accounted for 30.11% share of the global revenue in 2024.

- The U.S. 5G security market is anticipated to register a significant growth from 2025 to 2030.

- By component, the solution segment led the market and accounted for 71.11% of the global revenue in 2024.

- By deployment, the cloud segment dominated the market in 2024. Cloud-based deployments have become more popular in recent years to offer security services remotely.

- By architecture, the 5G NR non-standalone segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.63 Billion

- 2030 Projected Market Size: USD 27.59 Billion

- CAGR (2025-2030): 40.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market in 2024

The fifth generation (5G) network is a wireless technology that includes a whole ecosystem of radio frequencies, data transfers, and technical communications, which needs better security. Network slicing and significant security expansion over 4G and LTE are also expected to create more demand for 5G security solutions. Moreover, stringent government regulations to prevent data thefts by using 5G applications are also expected to create lucrative growth opportunities for the market over the forecast period.

The integration of artificial intelligence (AI) and machine learning (ML) is revolutionizing the 5G security landscape. These technologies allow for the automation of threat detection and response, enabling organizations to identify and neutralize threats in real time. AI-driven analytics can sift through vast amounts of data transmitted via 5G networks, detecting anomalies and potential security breaches before they escalate. As cyber threats become more sophisticated, leveraging AI and ML in 5G security systems has become essential to staying ahead of attackers.

Technological advancements and the expansion of networks beyond 5G Radio Access Networks (RAN) are anticipated to have a substantial impact on security, such as edge computing, Network Function Virtualization (NFV), and Software-defined Networking (SDN). Security solutions must evolve to protect vital infrastructure from the rising hazards posed by the nation-states and other sophisticated players, as well as the real dangers they bring to mobile network operators (MNOs) and their suppliers. The 5G 3GPP standard is adaptable enough to support many forms of physical and virtual overlap between the radio access network (RAN) and core network, such as from a remote device to the core network. Rapid technological change, including virtualization, disaggregation, cloud computing, Artificial Intelligence (AI), the Internet of Things (IoT), and Industry 4.0, is affecting telecom networks which are met by a broad and challenging cyber security environment.

Cyber security has evolved with the introduction of 5G. International Mobile Subscriber Identity (IMSI) encryption is a feature of a 5G cyber security toolbox or solution that enhances network security. To further ensure optimum data security, all traffic data sent over the 5G network is integrated, secured, encrypted, and adheres to a mutual authentication standard. In addition, the deployment of artificial intelligence (AI), the internet of things (IoT), cloud computing, etc., benefits from 5G security's stronger foundation. It makes use of deep packet inspection (DPI), which includes hardware and software resources into a single entity, and meticulously examines data being delivered over a computer network, as well as network virtualization.

For businesses, technology offers enormous opportunities by enabling novel use cases. The development of smart infrastructures, the rising demand to revolutionize the mobile broadband experience, and the rise of the worldwide 5G services industry are the key drivers for expanding the market. On the other side, there are sizable growth prospects for 5G security solutions providers. The future of the 5G security market is expected to be shaped by the increasing demand for the high reliability and low latency networks, releasing a massive IoT ecosystem, critical communications services, and growing demand for private 5G networks across governments, industries, and industrial sectors. However, high costs associated with deploying 5G services and a lack of awareness in developing economies are expected to hinder the growth of the market during the coming years.

Component Insights

The solution segment led the market and accounted for 71.11% of the global revenue in 2024. One of the main factors fueling the segment's growth is the quick adoption of 5G security solutions by end-user companies to protect their own personal networks. To secure the networks, major market competitors are concentrating on developing 5G security solutions to further protect the enterprise network architecture. In addition, the rise in edge computing and virtualized network functions has further pushed organizations to adopt comprehensive, integrated security solutions to ensure network integrity and resilience across multiple points of connectivity.

The services segment is anticipated to register the highest CAGR over the forecast period. The widespread use of 5G services is responsible for the expansion of the services market. Applications that support the Internet of Things (IoT), real-time communications (RTC), ultra-reliable communications, and broadcast-like services are accessible to businesses using 5G services. Fifth-generation services also satisfy rising consumer demand for in-vehicle services and help during vehicle diagnostics and autonomous driving applications that are integrated into mobile on-the-go vehicles.

Deployment Insights

The cloud segment dominated the market in 2024. Cloud-based deployments have become more popular in recent years to offer security services remotely. Significant performance improvements across applications such as cloud-based resources, network slicing, virtualization, and other emerging technologies are just a few advantages that 5G security offers. The cloud deployment model also provides advantages for managing DNS, rerouting traffic, and protecting website traffic. In addition, the cloud services are implemented in accordance with the needs of the client, depending on the usage volume of cloud-based 5G security services. Such factors bode well for the growth of the segment during the forecast period.

The on-premise segment is anticipated to register the significant CAGR over the forecast period.The ability of the on-premise 5G security solutions to verify and protect the 5G network connections in organization's premises is a significant factor driving the growth of the segment. On-premise solutions make it easier for the businesses to check any possible dangers on their site. Along with offering fast speed for 5G networks, 5G security solutions also helps to ensure better privacy of the client data. Due to these reasons, businesses are adopting on-premises 5G security solutions to stop fraud on 5G networks.

Architecture Insights

The 5G NR non-standalone segment dominated the market in 2024. Growing demand for 5G mobile phone usage, increase in demand for fast and dependable networks, and rising investments in 5G services are the major factors driving the growth of the segment. Market players across the globe are implementing 5G NR non-standalone technology on existing LTE infrastructures in order to meet an increase in customer demand for better and reliable network connectivity. Manufacturers of mobile phones are now concentrating more on creating smartphones that are 5G enabled. Hence, 5G NR non-standalone architecture has expanded because of the rising adoption of the smartphones with 5G capabilities.

The 5G NR standalone segment is anticipated to register the significant CAGR over the forecast period. The benefits offered by the 5G NR standalone architecture to offer higher speeds, wider coverage, ultra-low latency, higher stability, and better services compared to 5G NR non-standalone is a major factor driving the segment growth. Standalone 5G uses a 5G New Radio access network, which incorporates standards that replace the LTE network 4G wireless communications standard. The end-to-end core 5G network serves as the foundation of the independent 5G architecture. Equipment of 5G architecture hardware and network features were created, keeping 5G requirements in mind.

Network Security Insights

The RAN security segment dominated the market in 2024. The ability of the RAN (Radio Access Network) component to connect devices to auxiliary network components via radio connection is a major factor driving the segment growth. Mobile network operators (MNOs) and network service providers are increasingly implementing centralized RAN and virtual RAN (VRAN) to minimize overall infrastructure costs and network complexity. Furthermore, the RAN enables corporations and mobile network operators employing private 5G to offer network slicing solutions allocating capabilities to particular firms to separate network utilization inside a public mobile network. As RAN offers the capability of network slicing, providing security is also of utmost importance, which in turn creates lucrative growth opportunities for the 5G security solution providers during the coming years.

The core security segment is anticipated to register the significant CAGR over the forecast period.The broad use of modern technologies such as machine learning and artificial intelligence along with the quick advancement of the networks for machine-to-machine communication is a significant factor driving the growth of the segment.5G core has the capability to perform a variety of tasks, including subscriber data management, authentication & authorization, connection & mobility management, and policy management. As 5G core is responsible for various functions, 5G security solutions for the core would help prevent potential security threats to the end-users.

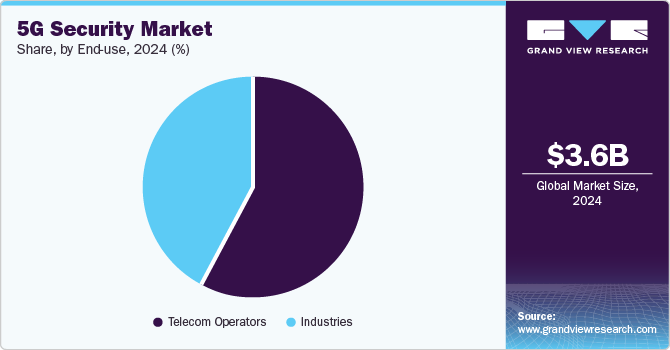

End-use Insights

The telecom operators segment dominated the market in 2024. The segment growth can be attributed to the expanding number of mobile users, skyrocketing need for high-speed data connectivity, and the rising demand for value-added managed services. Over the past few decades, the global communication network has clearly been one of the most significant areas for continuing technical breakthroughs. Telecom operators are using multi-vendor networks based on cloud-native technology to accelerate and cost-effectively roll out 5G services and improve user experience. Moreover, to ensure better security for 5G, telecom operators are leveraging network slicing, dividing a single network design into numerous independent logical networks with distinct features.

The industries segment is anticipated to register the significant CAGR over the forecast period. The growing demand among Industries for better network connectivity between machine-to-machines is a major factor driving the segment growth. As the deployment of IoT-based devices is increasing day by day in Industries, the demand to keep the data secure over the 5G networks is also growing, thereby creating an opportunity for the 5G security solution providers. At the same time, as Industries focus more on identifying possible attacks on 5G networks, they are increasingly searching for 5G security solutions.

Industries Insights

The manufacturing segment dominated the market in 2024. The increasing implementation and use of Industry 4.0 are driving the need for 5G services to operate the machines remotely, thereby contributing to more demand for security solutions. Development in automation and software-based procedures has increased the use of better connectivity solutions in the manufacturing sector. Moreover, to tackle current difficulties and needs, manufacturing companies are employing augmented reality, virtual reality, machine learning, artificial intelligence, and a variety of other modern technologies to meet more customer demands.Moreover, the push towards Industry 4.0 and the need for enhanced tracking, positioning, and quality control in complex manufacturing environments are key factors driving the adoption of 5G SONAR solutions.

The healthcare segment is anticipated to register the fastest CAGR over the forecast period.The Internet of Medical Things (IoMT), a network of connected medical equipment, software programs, health systems, and services, is quickly transforming the role of medical technology in healthcare. Healthcare businesses are leveraging the internet of medical things to improve remote patient care and automate clinical workflow management through 5G connectivity.5G technology is expected to enable telemedicine due to the low latency it provides. Furthermore, because of the reduced latency it provides, as well as advancements in robotics and data analysis of the patients, 5G is projected to enable tele-surgery. Such aspects bode positively for the segment expansion.

Regional Insights

North America 5G security market dominated the industry and accounted for 30.11% share of the global revenue in 2024. Palo Alto Networks., A10 Networks, Inc., and AT&T are among the leading industry participants driving the regional growth. The increasing use of 5G security solutions by the manufacturing companies, in order to prevent potential threats on 5G networks, offers growth prospects for 5G solutions providers in the area, supporting the market growth of North America. Furthermore, the increasing inclination for the digitalization is expected to fuel demand for the novel solutions from retail, healthcare, and other financial organizations. During the foreseeable term, such variables are expected to increase regional growth.

U.S. 5G Security Market Trends

The U.S. 5G security market is anticipated to register a significant growth from 2025 to 2030. As 5G technology becomes the backbone of critical infrastructure spanning industries such as healthcare, finance, manufacturing, and transportation, there is an increasing emphasis on securing these networks from evolving cyber threats. U.S. enterprises and government agencies are investing heavily in advanced security solutions such as encryption, threat intelligence, and network monitoring tools to protect against sophisticated attacks.

Asia Pacific 5G Security Market Trends

Asia Pacific is expected to emerge as the fastest-growing regional market over the forecast period. The geographic expansion might be ascribed to the growing awareness of 5G security solutions in emerging economies such as India and Japan. Simultaneously, growing 5G connections and strict government rules requiring 5G security processes are projected to boost regional growth. For instance, according to the GSM Association's Mobile Economy Asia-Pacific 2022 study, 5G adoption is expected to increase across Asia-Pacific, with more than 400 million 5G connections, or slightly more than 14% of total mobile connections, by 2025. (GSMA).

The China 5G security market is anticipated to register a significant growth from 2025 to 2030. As China accelerates its 5G expansion across industries such as manufacturing, transportation, and smart cities, the need for advanced security solutions has intensified. With the surge in connected devices and critical systems relying on 5G, concerns around data privacy, cyber threats, and network integrity are at the forefront.

Europe 5G Security Market Trends

The Europe 5G security market is poised for significant growth from 2025 to 2030. European countries are prioritizing the security of their 5G networks due to rising concerns over cyberattacks and data breaches, especially as 5G enables more complex digital ecosystems with a vast number of connected devices. Regulatory bodies, such as the European Union Agency for Cybersecurity (ENISA), are enforcing stringent guidelines to ensure robust 5G security frameworks across member states. European telecom operators are increasingly adopting advanced security solutions, such as network segmentation, encryption, and AI-driven threat detection, to protect their networks.

The UK 5G security market is anticipated to register a significant growth from 2025 to 2030 With the UK’s emphasis on digital transformation across industries such as healthcare, finance, and transportation, securing the 5G ecosystem has become a national priority. Government initiatives, such as the National Cyber Security Centre’s (NCSC) guidelines, play a pivotal role in shaping the country’s approach to 5G security, focusing on threat mitigation, data protection, and safeguarding network integrity.

The Germany 5G security market is anticipated to register a significant growth from 2025 to 2030. As Germany aims to lead in Industry 4.0 and connected technologies, the need for secure, high-performance 5G networks has become critical. The increasing deployment of IoT devices and real-time communication systems in factories and urban environments requires advanced security solutions to prevent cyber threats and ensure data integrity.

Key 5G Security Company Insights

Leading market competitors are concentrating on providing 5G security solutions that may assist Industries in increasing operational efficiency and work conditions. Market players are focusing on methods such as collaboration and product launch to expand their product offerings. The product launch aims to validate security in the 5G networks. The firms operating in the 5G security industry are seeking to combine advanced technologies such as AI low latency, and others in their 5G security solutions. This integration of advanced technology allows businesses to strengthen their competitive advantage and customer experience. The use of network slicing in 5G solution provides a more trustworthy, dependable, and highly dynamic network speed and connectivity.

-

Ericsson is a prominent player in the 5G security market, focusing on integrating security features into its telecommunications infrastructure. The company offers advanced solutions such as secure network slicing, encrypted communications, and robust cybersecurity controls tailored for 5G environments. Ericsson's commitment to end-to-end security ensures comprehensive protection for data across networks, devices, and cloud systems, making it essential for operators seeking to deploy secure and resilient 5G networks.

-

Palo Alto Networks offers specialized cybersecurity solutions designed to address the unique challenges posed by 5G networks. The company leverages its expertise in advanced threat detection, AI-driven analytics, and comprehensive security frameworks to protect against a wide array of cyber threats.

Key 5G Security Companies:

The following are the leading companies in the 5G security market. These companies collectively hold the largest market share and dictate industry trends.

- ERICSSON

- Palo Alto Networks

- Thales

- A10 Networks, Inc.

- Allot

- AT&T

- F5, Inc.

- Check Point Software Technologies Ltd.

- Fortinet, Inc.

- Spirent Communications.

Recent Developments

-

In February 2024, Palo Alto Networks launched comprehensive end-to-end private 5G security solutions in collaboration with key Private 5G partners, such as Druid, Celona, Ataya, NVIDIA, NETSCOUT, and NTT DATA, to help organizations secure their 5G networks from deployment to operation. These solutions address growing security risks in complex 5G environments, driven by the increasing use of 5G-connected devices, which 70% of executives identify as a rising threat. The ecosystem approach integrates Palo Alto Networks' enterprise-grade 5G security with partner technologies, offering enhanced visibility, secure access, AI-powered applications, and threat detection for private 5G networks. This collaboration ensures robust protection of mission-critical 5G infrastructures, supporting industries' digital transformation.

-

In February 2023, Atos launched its new "5Guard" security offering to provide end-to-end protection for private 5G networks and telecom operators. The 5Guard portfolio helps organizations develop a comprehensive security strategy, addressing risks across the 5G ecosystem, including RAN, MEC, and multi-cloud platforms. It includes Atos' encryption, identity management, and managed detection and response (MDR) solutions, along with partner technologies from companies such as Fortinet. The solution is designed to ensure compliance with international standards like 3GPP while enabling secure 5G network deployments.

5G Security Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.04 billion

Revenue forecast in 2030

USD 27.59 billion

Growth rate

CAGR of 40.5% from 2025 to 2030

Base year of estimation

2024

Historical data

2020 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, architecture, network security, end-use, industries, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ERICSSON; Palo Alto Networks; Thales; A10 Networks, Inc.; Allot; AT&T; F5, Inc.; Check Point Software Technologies Ltd.; Fortinet, Inc.; Spirent Communications

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 5G Security Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For the purpose of this study, Grand View Research has segmented the global 5G security market report based on component, deployment, architecture, network security, end-use, industries, and region:

-

Component Outlook (Revenue, USD Million, 2020 - 2030)

-

Solution

-

Next Gen Firewall

-

Antivirus/Antimalware

-

Security Gateway

-

Distributed Denial of Service Protection (DDoS)

-

Sandboxing

-

Others

-

-

Services

-

Consulting

-

Implementation

-

Support & Maintenance

-

-

-

Deployment Outlook (Revenue, USD Million, 2020 - 2030)

-

Cloud

-

On-premise

-

-

Architecture Outlook (Revenue, USD Million, 2020 - 2030)

-

5G NR Standalone

-

5G NR Non-Standalone

-

-

Network Security Outlook (Revenue, USD Million, 2020 - 2030)

-

RAN Security

-

Core Security

-

-

End-use Outlook (Revenue, USD Million, 2020 - 2030)

-

Industries

-

Telecom Operators

-

-

Industries Outlook (Revenue, USD Million, 2020 - 2030)

-

Manufacturing

-

Healthcare

-

Retail

-

Automotive And Transportation

-

Public Safety

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G security market size was estimated at USD 3.63 billion in 2024 and is expected to reach USD 5.04 billion in 2025.

b. The global 5G security market is expected to grow at a compound annual growth rate of 40.5% from 2025 to 2030 to reach USD 27.59 billion by 2030.

b. The 5G NR non-standalone segment led the market and accounted for 63.30% of the global revenue in 2024. Growing demand for 5G mobile phone usage, increase in demand for fast and dependable networks, and rising investments in 5G services are the major factors driving the growth of the segment.

b. Some key players operating in the 5G security market include ERICSSON, Palo Alto Networks, Thales, A10 Networks, Inc., Allot, AT&T, F5, Inc., Check Point Software Technologies Ltd., Fortinet, Inc., and Spirent Communications.

b. Key factors that are driving the 5G security market growth include the growing attacks on critical infrastructure, rising ransomware attacks on IoT devices, and growing security concerns in the 5G network.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.