5G NTN Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Platform (UAS Platform, LEO Satellite, MEO Satellite, GEO Satellite), By Location (Urban, Rural), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-441-2

- Number of Report Pages: 129

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

5G NTN Market Size & Trends

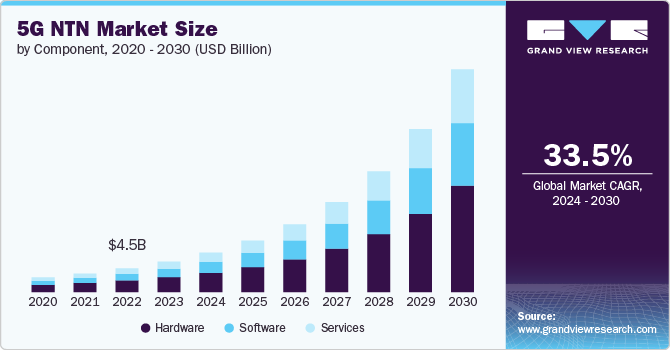

The global 5G NTN market size was valued at USD 5.76 billion in 2023 and is expected to grow at a CAGR of 33.5% from 2024 to 2030. The rising adoption of a software-centric approach is a significant factor contributing to the growth of the market. This strategy allows for greater flexibility and scalability in network management, enabling operators to rapidly deploy new services and adapt to changing market demands. By leveraging software-defined networking (SDN) and network functions virtualization (NFV), providers can enhance network performance and reduce operational costs, making 5G NTN solutions more attractive to various sectors, including enterprise and government.

Another critical trend contributing to the growth of the 5G NTN market is the need to address extreme coverage extension. Traditional terrestrial networks often struggle to provide consistent and reliable connectivity in remote or underserved areas. The deployment of NTNs via satellites or high-altitude platforms allows for broader and more reliable coverage, overcoming the limitations of terrestrial infrastructure. This expansion is particularly important for delivering 5G services to rural communities, maritime regions, and other challenging environments, thereby enhancing global connectivity.

The 3GPP evolution towards NTN interworking and integration is also a significant driver of market growth. The 3rd Generation Partnership Project (3GPP) has been advancing standards that facilitate the seamless integration of terrestrial and non-terrestrial networks. This interoperability ensures that users experience consistent, high-quality service across different network types, enhancing the user experience and broadening the appeal of 5G NTN solutions. This evolution not only simplifies network management but also promotes a unified ecosystem that supports diverse applications, from consumer connectivity to mission-critical communications.

Furthermore, the growing demand for the Internet of Things (IoT) is accelerating the adoption of 5G NTN technologies. IoT applications require ubiquitous, reliable, and high-capacity connectivity to function effectively, and NTNs are well-positioned to meet these requirements. With the proliferation of IoT devices in sectors such as agriculture, logistics, and smart cities, the demand for networks that can provide seamless and widespread coverage is rising. This trend is pushing operators to explore NTNs as a viable solution for extending 5G coverage to areas where traditional networks fall short.

NTNs, which include satellites, high-altitude Platforms, and other non-ground-based systems, are poised to play a crucial role in delivering high-speed, low-latency communication to remote and underserved regions. As 5G technology evolves, the integration of NTNs can enhance network coverage, support IoT deployments, and bridge connectivity gaps in rural and isolated areas. This expansion is anticipated to unlock new revenue streams for service providers, stimulate innovation in satellite and aerospace technologies, and drive growth in applications ranging from smart agriculture and disaster response to global enterprise connectivity. With investments in satellite constellations and advanced Non-terrestrial network (NTN) solutions, the market is set for robust growth, offering substantial opportunities for industry players to capitalize on the evolving landscape of global communications.

Component Insights

Based on component, the hardware segment led the market and accounted for 48.9% of the global revenue in 2023. This segment encompasses essential components such as satellites, antennas, and ground-based equipment that are critical for establishing and maintaining 5G NTN infrastructure. The hardware's role is pivotal in ensuring reliable connectivity and high performance across diverse environments, driving its significant market share. Technological advancements and the growing demand for robust network solutions continue to fuel the hardware segment's prominence. As investments in satellite constellations and high-altitude Platforms increase, hardware is expected to maintain its la better position in the market.

The services segment is expected to register significant growth over the forecast period. This segment includes offerings such as network management, maintenance, and data analytics, which are becoming increasingly crucial as 5G non-terrestrial network (NTN) deployments expand. Service providers are developing sophisticated solutions to optimize network performance and support diverse applications, enhancing their market appeal. The rise of new service models and the integration of advanced analytics are driving innovation and attracting investment. As the 5G NTN ecosystem matures, the services segment is set to play a pivotal role in shaping the future of global connectivity.

Platform Insights

The UAS platform segment accounted for the largest market revenue share in 2023. The UAS platforms, including drones and other aerial vehicles, are pivotal in providing flexible, high-altitude connectivity solutions, making them essential for expanding 5G network coverage. Their ability to deploy rapidly in various environments and offer real-time data collection contributes to their dominance. Technological advancements in UAS design and operational capabilities are enhancing their efficiency and performance. As demand for versatile and scalable network solutions grows, UAS platforms are poised to continue leading the market.

The LEO satellite segment is expected to grow significantly from 2024 to 2030. LEO satellites offer promising advantages such as reduced latency and improved global coverage, which are critical for enhancing 5G connectivity. Recent advancements in satellite technology and the launch of new constellations are expanding their capabilities and market potential. As investment in satellite infrastructure increases, LEO satellites are becoming a focal point for global connectivity solutions. This emerging segment is set to play a crucial role in bridging connectivity gaps and supporting the next generation of network services.

Location Insights

The urban segment accounted for the largest market revenue share in 2023. In urban environments, the need for high-speed, reliable internet is critical for supporting a range of applications, from smart city initiatives to extensive IoT networks. The dense infrastructure and large number of users make urban areas a prime focus for NTN deployments, leading to significant investment in technologies that enhance network capacity and performance. Urban areas benefit from the advanced capabilities of 5G NTN systems, which are essential for maintaining connectivity and addressing the complexities of high-density environments. Since urban areas continue to grow, their dominance in the NTN market is expected to persist

The rural segment is expected to grow significantly during the forecast period. In rural areas, 5G NTN solutions are increasingly recognized for their potential to bridge the digital divide and provide essential services where traditional infrastructure is limited. Advances in satellite technology and the development of cost-effective solutions are making it feasible to deploy NTN systems in these remote locations. Efforts to improve connectivity in rural areas are gaining momentum, with a focus on enhancing accessibility and supporting agricultural, educational, and healthcare applications.

Application Insights

The Enhanced Mobile Broadband (EMBB) segment accounted for the largest market revenue share in 2023. The Enhanced Mobile Broadband (EMBB) segment is a leading force in the 5G Non-Terrestrial Network (NTN) market, driven by the increasing demand for high-speed, high-capacity connectivity. EMBB applications are crucial for delivering superior data rates and improved user experiences in both urban and remote areas. This segment supports a wide range of applications, from streaming high-definition content to enabling advanced augmented and virtual reality experiences. Technological advancements in NTN infrastructure are continually enhancing EMBB capabilities, making it a dominant area of investment and development.

The Massive Machine-Type Communications (MMTC) segment is expected to grow significantly from over the forecast period. MMTC focuses on enabling the communication of a large number of devices simultaneously, which is crucial for applications such as smart agriculture, industrial automation, and smart cities. Recent developments in 5G NTN technology are making it increasingly feasible to support the extensive connectivity requirements of MMTC. The increasing deployment of sensors and machine-to-machine communication systems is fueling this segment's growth. As the demand for connected devices and smart solutions rises, the MMTC segment is expected to gain prominence in the 5G NTN market.

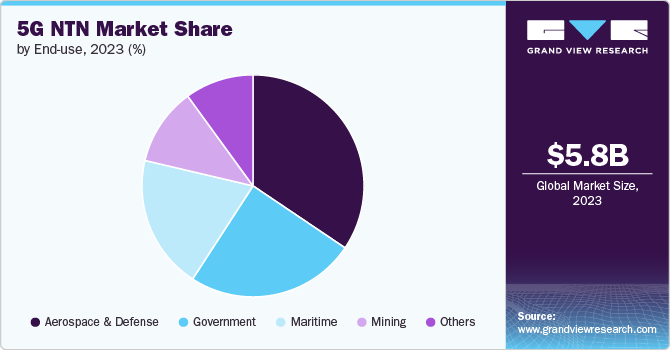

End-use Insights

The aerospace & defense segment accounted for the largest market revenue share in 2023. The growth of the segment can be attributed to sector's demand for high-reliability, secure, and high-speed communications. This segment benefits from NTN’s ability to provide extensive coverage and connectivity in remote and challenging environments, crucial for military operations and aerospace applications. The integration of NTN technology supports critical functions such as surveillance, navigation, and tactical communications, enhancing operational effectiveness. Continued advancements in NTN infrastructure are addressing the unique requirements of aerospace and defense, further solidifying its dominance in the market. Since defense and aerospace technologies evolve, the reliance on robust NTN solutions is expected to grow, maintaining this segment's prominent position.

The maritime segment is expected to register significant growth from 2024 to 2030.The growth of the segment is driven by the increasing need for reliable and continuous connectivity at sea. As global shipping and maritime operations expand, there is a growing demand for NTN solutions that can offer high-speed communication and data transfer capabilities in remote oceanic regions. Advances in satellite technology are making it increasingly feasible to provide consistent connectivity for maritime applications, including navigation, weather monitoring, and real-time data exchange. The maritime industry’s shift towards digitalization and the integration of IoT technologies are fueling growth in this segment.

Regional Insights

North America 5G NTN market dominated the global market in 2023 and accounted for a 33.17% revenue share. The U.S. and Canada are spearheading advancements in NTN technology to enhance connectivity, particularly in remote and underserved areas. The growing demand for high-speed internet and the proliferation of IoT devices are fueling investments in NTN solutions. Additionally, North America's focus on integrating 5G with satellite and high-altitude platforms is addressing the need for comprehensive and reliable coverage. The strategic importance of NTN in supporting smart city initiatives and enhancing communication capabilities is expected to drive significant market growth in the region.

U.S. 5G NTN Market Trends

The U.S. 5G NTN market is anticipated to register a significant growth from 2024 to 2030. The U.S. is at the forefront of deploying NTN solutions to bolster connectivity across diverse landscapes, including urban, rural, and remote areas. The expansion of 5G infrastructure and the increasing adoption of advanced technologies such as autonomous systems and smart devices are driving the demand for NTN.

Europe 5G NTN Market Trends

The Europe 5G NTN market is poised for significant growth from 2024 to 2030. Europe’s focus on enhancing connectivity and supporting green technology is leading to increased adoption of NTN solutions. The region's emphasis on sustainability and the integration of NTN with smart infrastructure are key factors driving market expansion. European countries are leveraging NTN to improve coverage in rural and remote areas while advancing smart city projects. The alignment of NTN with Europe’s digital strategy and regulatory frameworks is expected to foster significant growth and innovation in the market.

Asia Pacific 5G NTN Market Trends

The Asia Pacific 5G NTN market is poised for significant growth from 2024 to 2030. In the Major economies such as China, Japan, and South Korea are leading the adoption of NTN technologies to enhance connectivity across diverse environments. The region’s focus on developing smart cities, expanding IoT applications, and supporting advanced technologies such as autonomous vehicles is propelling the demand for NTN solutions. Investments in satellite networks and high-altitude Platforms are addressing connectivity challenges in both urban and remote areas. The Asia Pacific market's dynamic growth is fueled by a combination of technological innovation and strategic infrastructure development.

Key 5G NTN Company Insights

The market is highly competitive, featuring a blend of established technology leaders and emerging innovators striving for market leadership. Major players, including major satellite operators and aerospace companies, are actively advancing their NTN solutions to cater to the growing demand for global high-speed connectivity. This competitive landscape fosters rapid technological advancements and service improvements, benefiting network operators and end-users by enhancing connectivity across various environments.

Several players in the market are actively pursuing strategic initiatives to broaden their geographic footprint. For instance, in August 2023, Auden Techno Group, a prominent player in antenna and connectivity solutions, is unveiling its latest technology at the ComNext 2024 expo in Tokyo. Their new offering aims to enhance private 5G networks through advanced non-terrestrial infrastructure. This solution integrates a state-of-the-art LEO satellite user terminal with a new 5G NR Open RAN radio unit (O-RU). Auden’s innovation is designed to support private 5G networks of various sizes, including those for mission-critical applications.

Key 5G NTN Companies:

The following are the leading companies in the 5G NTN market. These companies collectively hold the largest market share and dictate industry trends.

- Thales

- Echostar Corporation

- Qualcomm Technologies, Inc.

- MediaTek Inc.

- Keysight Technologies

- Anritsu Corporation

- Intelsat

- Telefonaktiebolaget LM Ericsson

- Softbank Group

- ZTE Corporation

5G NTN Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.46 billion |

|

Revenue forecast in 2030 |

USD 42.20 billion |

|

Growth rate |

CAGR of 33.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, platform, location, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Thales; Echostar Corporation; Qualcomm Technologies, Inc.; MediaTek Inc.; Keysight Technologies; Anritsu Corporation; Intelsat; Telefonaktiebolaget LM Ericsson; Softbank Group; ZTE Corporation |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 5G NTN Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the home 5G NTN market based on component, platform, location, application, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Platform Outlook (Revenue, USD Million, 2018 - 2030)

-

UAS Platform

-

LEO Satellite

-

MEO Satellite

-

GEO Satellite

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Urban

-

Rural

-

Remote

-

Isolated

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Enhanced Mobile Broadband (EMBB)

-

Ultra Reliable and Low Latency Communications (URLCC)

-

Massive Machine-Type Communications (MMTC)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Maritime

-

Aerospace & Defense

-

Government

-

Mining

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 5G NTN market size was estimated at USD 5.76 billion in 2023 and is expected to reach USD 7.46 billion in 2024.

b. The global 5G NTN market is expected to grow at a compound annual growth rate of 33.5% from 2024 to 2030 to reach USD 42.20 billion by 2030.

b. North America dominated the 5G NTN market with a share of 33.17% in 2023. The U.S. and Canada are spearheading advancements in NTN technology to enhance connectivity, particularly in remote and underserved areas.

b. Some key players operating in the 5G NTN market include Thales, Echostar Corporation, Qualcomm Technologies, Inc., MediaTek Inc., Keysight Technologies, Anritsu Corporation, Intelsat, Telefonaktiebolaget LM Ericsson, Softbank Group, and ZTE Corporation.

b. Key factors that are driving the market growth include the rising need to address extreme coverage extension and the growing demand for the Internet of Things (IoT).

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."