5G In Healthcare Market Size, Share & Trends Analysis Report By Component (Hardwar, Services), By Application (Remote Patient Monitoring, Connected Medical Devices), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-962-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

5G In Healthcare Market Size & Trends

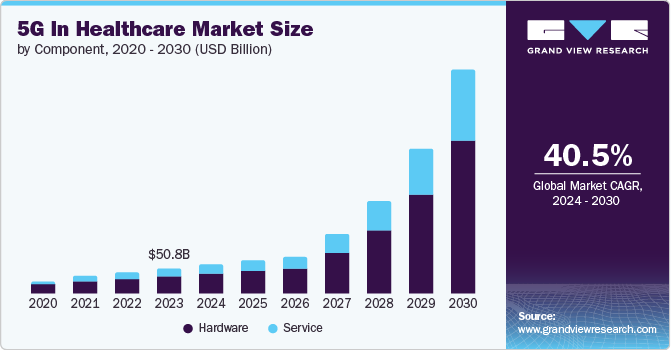

The global 5G in healthcare market size was estimated at USD 50.8 billion in 2023 and is expected to grow at a CAGR of 40.5% from 2024 to 2030. The global market is driven by the increasing adoption of robotic surgery and telehealth, alongside advancements in telecommunication and 5G technology. The deployment of 5G-based wearable medical devices, the ability of 5G to transfer massive patient data files quickly, and the availability of affordable sensors are fueling market growth. In addition, partnerships between governments and key market players to deploy 5G in healthcare are propelling this growth. For example, in March 2024, Thailand and Huawei partnered to establish ASEAN's first 5G-enabled "smart hospital," aiming to enhance healthcare delivery through the integration of 5G technology, artificial intelligence, multi-access edge computing, and a hybrid cloud system.

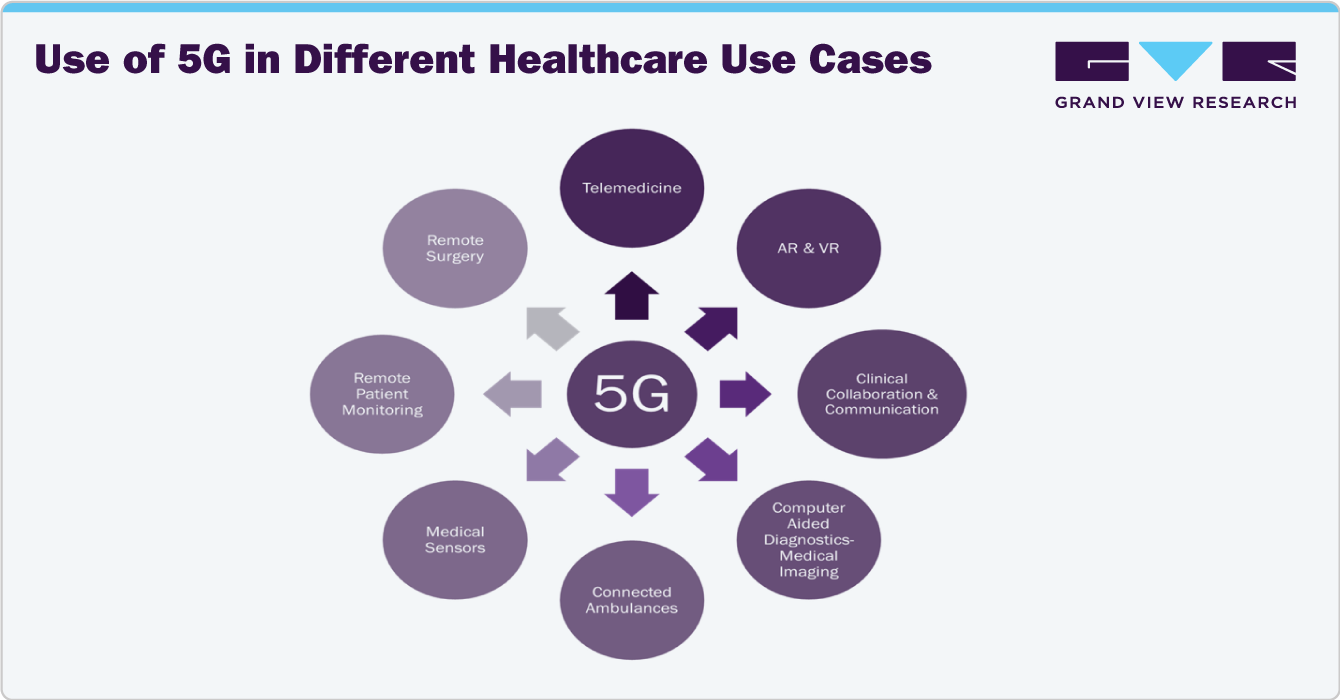

5G technology is revolutionizing the healthcare sector by enhancing various applications such as telemedicine, augmented reality (AR), and remote patient monitoring (RPM). It enables high-speed, low-latency data transfers, which are crucial for real-time consultations, high-resolution medical imaging, and seamless communication between medical staff and patients. In practice, 5G supports advanced use cases like connected ambulances for real-time patient data sharing, AR tools for improved surgical procedures, and high-capacity networks that handle large volumes of medical data efficiently. The technology's improved reliability, security, and performance are key factors driving its adoption and transforming healthcare delivery.

Moreover, the COVID-19 pandemic accelerated the shift towards the digital transformation of the healthcare system, with a focus on adopting telehealth and remote care services and thermal imaging solutions. The services require a significant amount of bandwidth, especially online medical consultations that include real-time video conferencing and image transmission. High bandwidth and dependable data connectivity services are possible with 5G networks. In March 2020, University Hospitals in Ohio announced the launch of a remote patient monitoring device, which is a wireless sensor device that monitors a patient’s oxygen levels, temperature, and reparation rate to detect possible chances of having COVID-19.

In the healthcare sector, cellular technology is poised to enhance the speed, coverage, and responsiveness of wireless networks. The increasing demand for faster and more reliable data transmission is expected to drive market growth. 5G technology will support a new healthcare ecosystem by providing the connectivity needed to efficiently and cost-effectively meet the needs of both patients and providers. It will serve as the backbone for IoT infrastructure, low-bitrate devices, supporting clinical wearables, remote sensors, and low-energy health monitoring systems.

Technological advancements are driving the market, with players establishing new 5G-powered healthcare facilities to revolutionize patient care. For instance, in July 2022, GE Healthcare opened its first 5G Innovation Lab in Bengaluru, India. This facility utilizes 5G’s high bandwidth, data speeds, low latency, and reliable connectivity to enhance the patient care continuum, including therapy, diagnosis, and prognosis. The lab positions GE Healthcare at the forefront of these advancements, extending advanced healthcare solutions to rural and suburban areas.

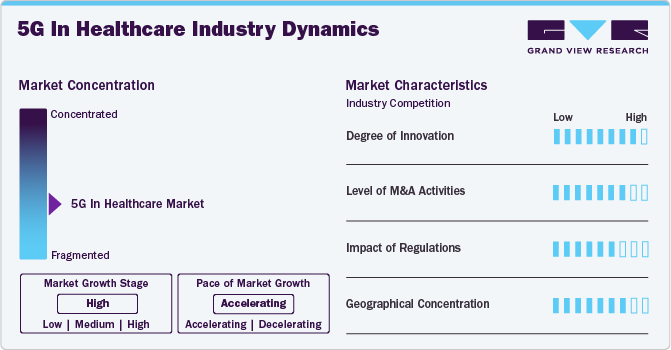

Market Characteristics & Concentration

The 5G healthcare industry exhibits a high degree of innovation. Advancements in real-time imaging, remote patient monitoring, and smart ambulances are enhancing patient care and emergency response. For instance, in May 2024, Apollo Hospitals introduced 5G-equipped ambulances in New Mumbai, India, featuring advanced patient monitoring and telemetry devices for real-time health data transfer to hospitals.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in July 2022, Qualcomm Technologies, Inc. announced the acquisition of Cellwize Wireless Technologies Pte. Ltd. This acquisition aims to enhance Qualcomm Technologies' position in 5G Radio Access Networks (RAN) adoption and innovation. Cellwize's software platform for 5G network automation, deployment, and management will strengthen the 5G infrastructure solutions of Qualcomm Technologies, supporting the digital changeover of industries, the connected, intelligent edge, and the expansion of the cloud economy.

The 5G in healthcare industry is regulated by various regulatory bodies, such as the FDA. The regulatory framework for 5G in healthcare involves multiple layers of oversight to ensure safety, security, and efficacy. Key components include:

-

Compliance with standards set by the International Telecommunication Union (ITU) for 5G deployment and spectrum allocation.

-

Adherence to healthcare-specific regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. for patient data privacy.

-

Guidelines from the Federal Communications Commission (FCC) regarding electromagnetic emissions.

In addition, healthcare providers must align with the Food and Drug Administration (FDA) requirements for medical device connectivity and cybersecurity to mitigate risks associated with 5G-enabled devices and applications.

Geographical expansion is propelling the 5G healthcare market by broadening access to advanced medical technologies and telehealth services. This expansion fosters global collaborations and integrates innovative healthcare solutions across regions, accelerating 5G adoption in the medical field. For example, in May 2024, China Unicom, Midea, AIS, and Huawei launched Southeast Asia's first 5G fully connected factory, transforming smart manufacturing. Key solutions include 5G data collection, 5G operating rooms, automated guided vehicles, AI inspection, and robotic arms, enhancing operational efficiency, safety, and product quality, and setting a new industry standard.

Product Insights

Hardware segment held the largest revenue share of 70.1% in 2023. The growth is driven by the frequent need for device replacements or upgrades to leverage the latest technologies. In addition, advancements in technology and the increasing demand for ultra-high bandwidth, massive connectivity, and ultra-low latency are boosting adoption in healthcare facilities.

For instance, in September 2022, the Ministry of Health Malaysia (MoH) and the Ministry of Science, Technology, and Innovation (Mosti) designated five hospitals as Health Technology Hubs under the National Technology and Innovation Sandbox (NTIS) initiative. Three urban hospitals-Putrajaya Hospital, the National Cancer Institute, and Tunku Azizah Hospital Kuala Lumpur-will focus on technological infrastructure, skilled workforce, and integrating current technologies like the internet and 5G hardware.

Services segment is anticipated to expand at the fastest CAGR during the forecast period. The growth is driven by the rising demand for enhanced connectivity for medical devices, faster and more reliable data transmission, and the improved mobile broadband and greater frequencies provided by 5G services. For example, in September 2022, MTN Nigeria and Ericsson launched 5G services after 21 years of collaboration. The initial phase covers parts of Lagos and Nigeria, utilizing Ericsson’s 5G Radio Access Network and NSA Packet Core.

This rollout aims to accelerate digitalization in sectors such as healthcare, education, and manufacturing, enhancing consumer and enterprise experiences. 5G technology will support innovative applications in IoT, AI, smart cities, and immersive communications with AR and VR, benefiting millions of consumers.

Application Insights

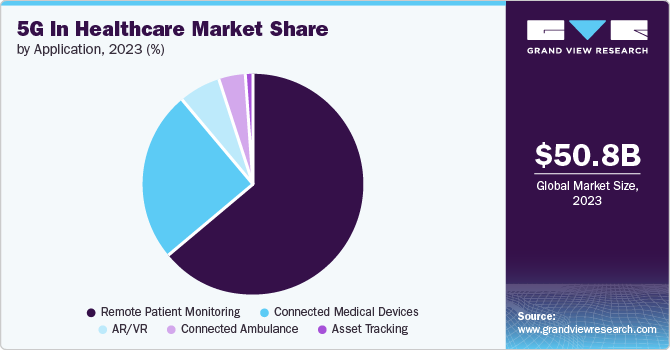

Remote patient monitoring segment accounted for the largest revenue share of over 64.0% in 2023. The growth is driven by the rising geriatric population and increasing demand for remote health checkups. Remote patient monitoring (RPM) is crucial for chronic care management (CCM) and proactive healthcare services. Rising healthcare costs and market players' initiatives to prioritize consumer health further propel the RPM market. For instance, in July 2024, Smart Meter launched a cellular-connected multi-cuff blood pressure monitor using a 4/5G private data network, specifically designed for RPM and CCM.

Connected medical devices segment is expected to register the fastest growth rate from 2024 to 2030. The growth is attributed to increased demand for medical devices by consumers for daily health tracking, a rise in demand for telehealth devices, and the increasing trend of home healthcare. To meet this demand, market players are advancing their products and services.

For instance, in December 2023, Virtual Internet announced enhancements to Virtual 5G aimed at improving performance and security for platforms incorporating wearable technologies. These enhancements are fully automated and require no special configuration changes from users. The improved Virtual 5G capabilities enable wearables to function more effectively and fulfill their intended purposes.

End-use Insights

Healthcare providers segment dominated the market with the largest revenue share in 2023. This growth is attributed to increasing demand for better technologies, the growing use of wearable medical devices with 5G technologies, growing patient volume, and increasing adoption of 5G-based solutions by hospitals and ambulatory care centers. In September 2023, Boston Children's Hospital introduced a hybrid 5G network as part of its integration with the Epic system. This technology aims to establish a foundation for future healthcare advancements, providing a that scalable network supports AI-driven specialist prioritization and RPM.

Healthcare payers segment is anticipated to expand at the fastest growth rate over the forecast period. Payers include both public and commercial insurance companies. The growth of the segment is fueled by an increase in the number of policyholders for health insurance due to the COVID-19 pandemic. Furthermore, payers also benefit from more efficient claims processing and fraud detection. These factors collectively drive the adoption of 5G technology among healthcare payers.

Regional Insights

North America 5G in healthcare market dominated globally and accounted for the largest revenue share of 34.5% in 2023. The growth is attributed to government initiatives for the deployment of 5G in healthcare and an increasing number of 5G-enabled medical devices. For instance, in August 2021, the Biden administration declared an investment of over USD 19 million to enhance telehealth services in rural areas and to improve telehealth quality and innovation nationwide.

U.S. 5G In Healthcare Market Trends

5G in healthcare market in the U.S. accounted for the largest share in 2023. One of the key factors driving the market growth is initiatives undertaken by market players. For instance, in January 2024, Pylo Health, in partnership with Prevounce, announced the launch of two devices: the Pylo 200-LTE weight scale and the Pylo 900-LTE blood pressure monitor. Both clinically validated devices connect to numerous cellular networks, ensuring reliable data transmission across the U.S. The 200-LTE and 900-LTE are compatible with the Prevounce distance care management platform and can be combined with independent health management systems and applications through the Pylo cloud API.

Europe 5G In Healthcare Market Trends

Europe 5G in healthcare market is expected to grow significantly during the forecast period. The growth is attributed to the increasing collaborations between market players and government to integrate hospital facilities with 5G services. For instance, in April 2024, Oulu University Hospital, in collaboration with WICOAR Technologies, the University of Oulu, and Boldyn Networks, established Europe's first operational private 5G network in a hospital setting. The 'Hola 5G Oulu' project, financed by the European Commission, is designed to enhance patient care through advanced wireless technologies.

5G in healthcare market in the UK had a substantial share in 2023. The growth is attributed to the increasing collaborations and mergers among market players to increase the adoption of 5G services in the healthcare sector. For instance, in July 2023, the proposed merger of Vodafone UK and Three UK is expected to result in an approximately USD 11 billion investment in 5G infrastructure in the UK. This investment aims to provide the NHS with one of Europe's most advanced connectivity networks, with a goal of connecting every hospital to standalone 5G by 2030.

Germany 5G in healthcare market is expected to grow significantly over the forecast period. The growth can be attributed to the rising adoption of 5G services by hospitals. For instance, in February 2024, Frankfurt University Hospital announced the implementation of a broad array of 5G-based services across its operations. This initiative aims to enhance public health service delivery, improve process efficiency, and optimize medical skill utilization and resources. The project will establish a public 5G mobile network on the hospital campus in Frankfurt, Germany, with the infrastructure designed to be converted into a private 5G mobile network (MPN) for future use cases if needed.

Asia Pacific 5G In Healthcare Market Trends

Asia Pacific 5G in healthcare market is expected to register the fastest growth rate over the forecast period. The growth is attributed to the significant adoption of advanced technologies, enhanced network connectivity, and increased government programs for raising awareness regarding telehealth and the penetration of 5G in the healthcare industry. Furthermore, in November 2023, Singapore's Infocomm Media Development Authority (IMDA) collaborated with Republic Power to deploy 5G-enabled unmanned medical booths for remote health screening and video consultations. This initiative introduces Asia's first 5G-supported pre-screening and teleconsultation medical booths, designed with advanced hygiene and safety features. Similarly, in November 2020, the health operator IHH Healthcare, along with the Chinese government, launched a WeChat program as an initiative to strengthen telehealth

5G in healthcare market in China held a significant market share in the region in 2023. The increasing efforts to adopt and advance 5G services are expected to drive the market. For instance, in July 2024, China announced plans to accelerate the commercial rollout of 5G-Advanced (5G-A) technologies, which are expected to enhance AI applications across various sectors and lay the groundwork for future 6G systems. This announcement, made during sessions at Mobile World Congress Shanghai, highlights 2024 as the year for the commercial introduction of 5G-A technology, representing a significant upgrade to the existing 5G network in terms of functionality and coverage.

India 5G in healthcare market is driven by the increasing adoption of 5G services for health purposes funded by the government. For instance, in September 2023, Shri G. Kishan Reddy, Minister for Development of North East Region, Tourism, and Culture, inaugurated India's first 5G training labs and 5G health applications across all eight North Eastern States. The project, centrally funded by the North East Council (NEC), is being implemented by Assam Electronic Development Corporation (AMTRON), a public sector undertaking of the Assam government.

Key 5G In Healthcare Company Insights

Key companies are more focused on strategic partnerships with technology providers and product innovation. Furthermore, they are adopting strategies such as mergers and acquisitions, product and service launches, agreements, joint ventures, collaborations, and expansion to strengthen their position in the market. For instance, in February 2021, AT&T announced a partnership with Rush University System for Health, a Chicago-based academic health system, for testing AT&T Multi-Access Edge Computing (MEC) and other advanced network-related technologies in Rush hospitals for improved operations and to improve staff and patient experience.

Similarly, in August 2020, Stasis Labs Inc., a patient monitoring platform, launched a mobile-connected remote patient monitoring platform for hospitals and outpatients in the U.S. The platform helps providers continuously monitor a patient without direct contact with the patient.

Key 5G In Healthcare Companies:

The following are the leading companies in the 5g in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T Inc.

- Verizon

- China Mobile International Limited

- Quectel

- Telit Cinterion

- TELUS International

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Orange

- NEC Corporation

Recent Developments

-

In February 2024, Telit Cinterion introduced the FE990B34/40 LGA module family, utilizing Qualcomm Technologies, Inc.'s Snapdragon X72 5G Modem-RF System. These new modules feature a quad-core high-power CPU for enhanced computing performance and various interfaces for integrating peripherals, representing a significant advancement in 5G connectivity.

-

In July 2023, Quectel Wireless Solutions launched a new range of antennas to meet diverse requirements. The YEMN926J1A is a 9-in-1 5G screw mount combo antenna, offering superior performance for 5G networks. The YECW000N1A is optimized for low power wide area (LPWA) networks, ensuring reliable connectivity. The YEGT000W8A is an advanced active GNSS L5 and L1 antenna, providing enhanced accuracy for precise timing and positioning. These antennas represent advanced technology designed to meet modern connectivity demands.

-

In July 2023, the Department of Veterans Affairs (VA) implemented Verizon's private 5G network at the VA Palo Alto Health Care System to enhance patient care delivery. This initiative is part of a broader collaboration between VA and Verizon Business, which started in 2020 when VA Palo Alto Health Care System was announced as VA's first 5G-enabled healthcare facility.

-

In April 2023, Verizon announced the construction of a private 5G network at Ohio's Cleveland Clinic facility. This project is among the first in the U.S. to integrate a 5G network into a hospital from its inception. The initiative aims to enhance connectivity and support advanced medical technologies. Verizon's involvement highlights the growing trend of embedding advanced networks in healthcare facilities.

5G In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 59.1 billion |

|

Revenue forecast in 2030 |

USD 454.7 billion |

|

Growth rate |

CAGR of 40.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

AT&T Inc.; Verizon; China Mobile International Limited; Quectel; Telit Cinterion; TELUS International; Huawei Technologies Co., Ltd.; Cisco Systems, Inc.; Orange; NEC Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 5G In Healthcare Market Report Segmentation

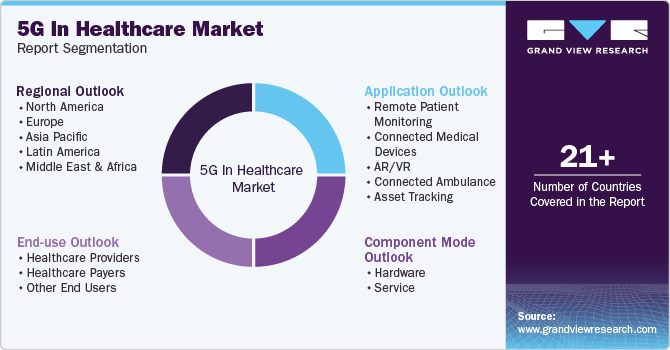

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global 5G in healthcare market report based on component, application, end-use, and region:

-

Component Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Service

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Remote Patient Monitoring

-

Connected Medical Devices

-

AR/VR

-

Connected Ambulance

-

Asset Tracking

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare Providers

-

Healthcare Payers

-

Other End Users

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global 5G in healthcare market size was estimated at USD 50.8 billion in 2023 and is expected to reach USD 59.1 billion in 2024.

b. The global 5G in healthcare market is expected to grow at a compound annual growth rate of 40.5% from 2024 to 2030 to reach USD 454.7 billion by 2030.

b. North America dominated the 5G in healthcare market with a share of 34.5% in 2023. This is attributed to the significant adoption of advanced technologies, enhanced network connectivity, government initiatives for the deployment of 5G in healthcare, and an increasing number of 5G-enabled medical devices. For instance, in August 2021, the Biden administration announced an investment totaling over USD 19 million to improve telehealth services in rural areas and to expand telehealth innovation and quality nationwide.

b. Some key players operating in the 5G in healthcare market are AT&T Inc.; Verizon; China Mobile International Limited; Quectel; Telit Cinterion; TELUS International; Huawei Technologies Co., Ltd.; Cisco Systems, Inc.; Orange; and NEC Corporation.

b. Key factors driving the market growth include rising adoption of robotic surgery and telehealth, an increase in demand for using fast and reliable data in the healthcare industry, adoption of advanced technologies, enhanced network connectivity, and government initiatives for the deployment of 5G in healthcare.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."