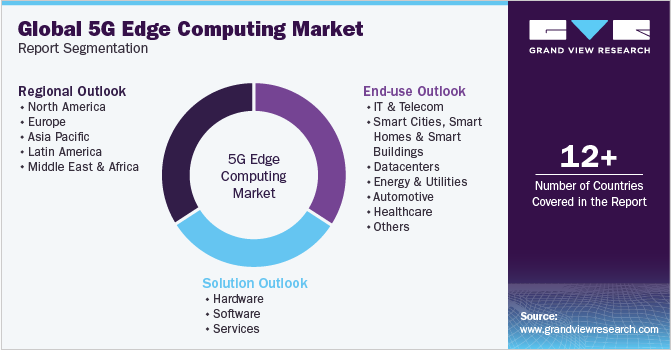

5G Edge Computing Market Size, Share & Trends Analysis Report By Solution (Hardware, Software, Services), By End-use (IT & Telecom, Datacenters, Energy & Utilities), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-110-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

5G Edge Computing Market Size & Trends

The global 5G edge computing market size was estimated at USD 4.74 billion in 2024 and is expected to grow at a CAGR of 47.8% from 2025 to 2030. This high growth is driven by the accelerating take-up of advanced technologies such as Internet of Things (IoT), big data, and cloud computing across industries such as healthcare, education, manufacturing, and government. With industries producing large volumes of data, they are confronted with mounting complexities in computing processes, which are further compounded by demands for real-time data processing. This has fueled the need for such solutions as 5G edge computing, which allows data to be processed nearer to end users, lowering latency and enhancing efficiency.

5G edge computing is a distributed computing model that localizes computation and storage capacity near end users and devices, e.g., smartphones, IoT devices, and self-driving cars, through the convergence of 5G connectivity. This architecture is specifically intended to meet the increasing demand for applications of low-latency, high-bandwidth, and high reliability, including augmented reality (AR), virtual reality (VR), games, and industrial automation. These applications will importantly fuel the market's growth, as 5G allows real-time interaction and ultra-high-speed processing required by these data-driven applications.

The demand for real-time processing of data is increasingly demanded as companies endeavor to store and process significant amounts of data created by networked devices. Sectors such as the healthcare industry utilize 5G edge computing to offer quicker and more consistent healthcare services via real-time patient and medical device monitoring. Similarly, the manufacturing industry is increasingly incorporating edge computing to support smart factory applications, improving productivity and minimizing downtime. The pervasiveness of cloud computing offerings and ongoing IoT device penetration is likely to spur growth of the industry in the forecast period. Additionally, 5G networks, as they can deliver fast speeds, stand to support well the rollout of edge computing solutions in different sectors.

The flexibility and scalability of 5G edge computing make it a promising solution for businesses in different sectors. Utilizing local devices such as routers, smartphones, and PCs to perform computing tasks, edge computing solutions enable data processing at greater speeds and far less latency, which ultimately translates into cost optimization and enhances operational efficiency. These benefits are compelling businesses to increasingly embrace edge computing solutions, making the way they process and handle data better. With such benefits in consideration, the market demand for edge computing hardware and software solutions is likely to rise exponentially in the next few years.

Furthermore, prominent industry players are forming partnerships and collaborations with other leading players to advance product development and raise awareness. For instance, in February 2023, Fujitsu exhibited its innovations in 5G network technology at the Mobile World Congress (MWC) Barcelona. The organization partnered with Microsoft to execute connectivity trials for verifying seamless interoperability between Fujitsu's 5G infrastructure and Microsoft Azure's private Multi-Access Edge Computing (MEC) platform. Such partnerships are likely to drive the 5G edge computing industry through enhanced technological capacity and increased offerings of services. With the growing demand for data-hungry applications and the increased adoption of 5G networks, 5G edge computing will play a key role in allowing industries to fulfill the demand for real-time data processing and low-latency communication.

Solution Insights

The software segment dominated the market in 2024 with a revenue share of around 47.7% and is expected to grow at a CAGR of around 48.9% during the forecast period. Software solutions like edge computing platforms, network orchestration software, and security software are crucial for managing and optimizing edge infrastructure. With more industries embracing 5G technology, the need for software capable of addressing the dynamic and complex nature of edge computing systems becomes greater. The software solutions are meant to handle large amounts of data locally, minimizing latency and enhancing application performance, especially for real-time analytics and IoT-driven services. Secondly, software is also instrumental in making edge networks secure and private, given that edge networks are distributed and prone to external attacks. With 5G uptake continuing to increase across industries, the Software segment is poised to retain its dominance and propel substantial growth in the market.

The services segment holds a significant share in the 5G edge computing industry, fueled by the growing demand for specialized services to deploy, manage, and optimize edge computing infrastructure. Such services comprise consulting, integration, deployment, and managed services that assist organizations in efficiently implementing 5G edge computing solutions. Since companies are struggling to make the shift to 5G-enabled edge environments, it is essential that service providers offer end-to-end support to enable smooth integration and maximum performance. Given the complexity of edge computing system deployment and maintenance, companies depend on services to ensure setup, ongoing monitoring, and timely upgrades of their infrastructure. The need for cloud-based edge offerings and tailor-made deployment solutions is also driving the services segment growth even more. With the expansion of the market, this segment is expected to exhibit robust growth, as increasingly more companies are turning to professional help to optimize the potential of 5G edge computing.

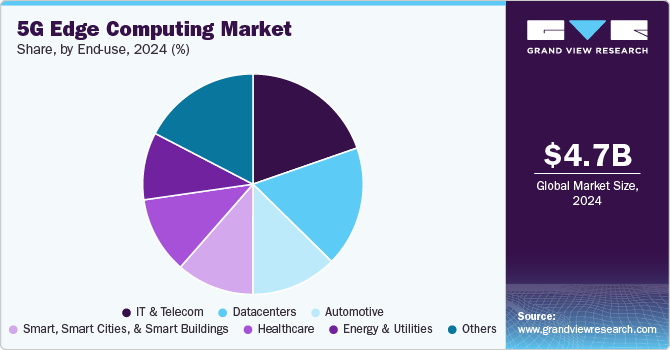

End Use Insights

The IT & telecom segment dominated the market in 2024 with a revenue share of 19.7% and is expected to grow at a significant CAGR over the forecast period. The increased need for 5G connectivity and low-latency, high-bandwidth applications drive the adoption of edge computing solutions by the sector. Edge computing helps telecom companies by locating computation and storage closer to end users, enhancing service delivery speeds, and also making the network more efficient. This is particularly important for uses such as augmented reality (AR), virtual reality (VR), and autonomous systems, which need data to be processed quickly with minimal lag. The IT industry also increasingly employs edge computing to implement IoT-based applications, allowing quicker analysis of data and real-time decision-making. As the need for data-driven services increases, telecom operators are utilizing 5G edge computing to improve their infrastructure, delivering improved customer experience and facilitating the deployment of future-proofed services. The trend is set to persist, with the IT & Telecom sector contributing notable growth to the market.

The energy & utilities business has registered strong growth in its contribution to the 5G edge computing industry, based on the sector's increasing requirement for real-time data processing and operational efficiency. Edge computing is highly beneficial in energy management systems, where equipment and data need to be monitored and analyzed in real time in order to maximize energy production and distribution. With the emergence of smart grids, IoT-based devices, and predictive maintenance, the energy industry is embracing edge computing to eliminate latency and enhance decision-making processes. Furthermore, 5G connectivity offers the bandwidth required for data transmission from massive amounts of data created by remote and distributed energy assets. This allows for faster and more reliable communication, which results in better asset management, demand response, and system optimization. As the need for clean, efficient energy solutions grows, the Energy & Utilities segment will become a more critical contributor to the 5G edge computing industry, enabling the industry's digitalization.

Regional Insights

North America 5G edge computing market accounted for the largest market share of more than 39.8% in 2024. North America was the first to adopt 5G technology and saw the fastest growth in the number of IoT devices. The U.S. is the biggest market here, led by the presence of key players from different industries like telecommunications, healthcare, and IT services. Telecom is still the most important sector, as 5G will be crucial for satisfying the increased demand for high-speed, low-latency applications. The medical sector is also highly impacted by 5G edge computing, as the technology enables quicker and more precise medical data analysis, enhancing patient treatment and the overall quality of medical services. As companies of all types look for more dependable and effective data processing power, demand for 5G edge computing products in North America is likely to remain robust.

U.S. 5G Edge Computing Market Trends

The U.S. 5G edge computing industry is experiencing rapid growth, driven by the widespread adoption of 5G networks and the increasing need for low-latency, high-bandwidth applications across industries. As one of the world’s early adopters of 5G technology, the U.S. is witnessing increased deployment of edge computing solutions, particularly in sectors like telecommunications, healthcare, and manufacturing. The rise in IoT devices and real-time data processing demands in industries such as automotive, smart cities, and energy further fuels the market. The U.S. government’s focus on infrastructure development, along with public-private collaborations, is accelerating innovation and the rollout of 5G edge computing. These trends are expected to continue, positioning the U.S. as a leader in the global 5G edge computing industry.

Europe 5G Edge Computing Market Trends

The Europe 5G edge computing industry is witnessing a fast-paced growth with the growing investments in 5G infrastructure and rising IoT devices across sectors. The digital transformation drive of the region and smart technologies are driving the adoption of edge computing as enterprises look to accelerate data processing capabilities and lower latency. Industry verticals like manufacturing, healthcare, transportation, and energy are adopting edge computing solutions in order to facilitate real-time analytics, enhance operational efficiency, and support better decision-making. Government and private sectors in Europe are also concentrating on developing a 5G ecosystem that supports sophisticated applications such as autonomous vehicles and smart cities, further fueling demand for 5G edge computing in the region.

The U.K. 5G edge computing market is experiencing strong growth, fueled by the nation's efforts to be a 5G technology and digital innovation leader. The need for low-latency applications and real-time data processing is growing in industries like healthcare, telecommunications, finance, and transportation. The U.K. is also looking at smart cities and smart infrastructure, where 5G edge computing is instrumental in enabling critical applications such as autonomous transport and city management. Government programs and collaborations among telecom operators, technology firms, and the public sector are driving the adoption of edge computing solutions to address data sovereignty issues, guaranteeing compliance with data privacy laws and driving the next wave of digital transformation.

The 5G edge computing market in Germany is growing strongly, driven by its dominance of industrial automation and advanced manufacturing. The convergence of 5G networks with edge computing is supporting German manufacturers to streamline their manufacturing processes, cut latency, and enhance operational effectiveness. The automotive sector is driving growth, as firms implement edge computing within autonomous vehicles and connected car solutions. In addition, Germany's investment in smart city and smart grid initiatives is increasing the demand for 5G edge computing solutions to support real-time data processing and efficient management of resources. The emphasis on sustainability and energy efficiency in the country further encourages the implementation of 5G-enabled edge technologies in industries such as energy and transportation.

Asia Pacific 5G Edge Computing Market Trends

The Asia Pacific accounted for a sizable market share in 2024. The market is likely to witness growth at a CAGR of 53.9% during the forecast period. This fast growth is fueled by the region's massive 5G infrastructure advancements as well as the expansion of the connected device ecosystem. China, India, and Japan are leading the way in integrating edge computing with cloud computing to advance the architecture of 5G edge computing and provide commercial services. The region's rapidly growing IoT market has resulted in a huge increase in data generation, which has generated a high demand for strong computational infrastructures that can handle enormous amounts of data in real-time. With more Asia Pacific industries adopting digital transformation, the 5G edge computing industry is set to witness considerable growth as more demand for low-latency, high-speed, and scalable computing solutions arises.

The Asia Pacific market for 5G edge computing is growing at a rapid pace, driven by strong 5G network and IoT device adoption in the region across industries. With leaders such as China, India, and Japan, demand is building for real-time data processing, low-latency applications, and enhanced network capabilities. The country is placing a significant bet on smart cities, autonomous technology, and industry automation, in which 5G edge computing provides quicker and more efficient handling of data and facilitates the digital transformation of main industries like healthcare, manufacturing, and energy.

China's 5G edge computing market is the largest in the region, fueled by heavy investments in 5G infrastructure and smart technologies. As the world leader in 5G deployment, China is increasingly incorporating edge computing in its smart cities, automotive sector, and industrial use cases. The nation is employing 5G edge computing to enable real-time data analysis, IoT networks, and autonomous systems. These developments are likely to increase efficiency in manufacturing, transportation, and energy industries, further driving China's digital economy.

The 5G edge computing market in India will grow strongly, led by the government's initiative for digitalization and the deployment of 5G networks in the country. Edge computing demand is highest in sectors such as telecommunications, healthcare, and agriculture, where real-time processing of data is essential for IoT applications and smart systems. As India becomes more and more inclined to utilize 5G technology in smart cities, manufacturing automation, and agricultural innovation, edge computing in 5G will have a central role to enhance operational efficiency and connectivity.

Middle East & Africa 5G Edge Computing Market Trends

Middle East & Africa (MEA) 5G edge computing industry is expanding with the region's investment in 5G networks and smart technology. Telecommunications, healthcare, and energy are the key sectors adopting edge computing to improve real-time data processing and lower latency. Smart cities and industrial automation initiatives are leading the demand for 5G edge computing, driving the region's digitalization and enhancing the operational efficiency of different industries.

The UAE 5G edge computing market is expected to grow during the forecast period. The UAE is leading the Middle East in the adoption of 5G edge computing, investing heavily in digital infrastructure and smart cities. The nation is using edge computing to improve IoT applications, real-time analytics, and connectivity in healthcare, transportation, and energy, driving its goals to become a world leader in digital innovation and smart city creation.

Edge computing market in Saudi Arabia is expected to grow during the forecast period. Saudi Arabia is quickly adopting 5G edge computing as a key part of its Vision 2030 efforts to diversify its economy. Saudi Arabia is adopting edge computing in industries such as energy, manufacturing, and petrochemicals to better optimize operations and enhance efficiency. Focusing on smart cities and industrial automation, 5G edge computing plays a crucial role in enabling real-time data processing and enhancing Saudi Arabia's drive towards digital transformation.

Key 5G Edge Computing Company Insights

Some of the key players in the 5G edge computing market include ADLINK Technology Inc.; Advantech Co., Ltd.; and Amazon Web Services, Inc.

-

ADLINK Technology Inc. is offers 5G edge computing solution with its high-performance edge computing solutions for real-time data processing, IoT integration, and AI at the edge. The company specializes in offering hardware and software solutions that empower industries like telecommunications, manufacturing, and healthcare to harness 5G networks for sophisticated edge computing applications.

-

Amazon Web Services, Inc. (AWS) is a leading player in 5G edge computing with the provision of end-to-end cloud solutions through AWS Wavelength. The solution extends AWS services to telecommunication networks, allowing for ultra-low latency and high-bandwidth applications across gaming, autonomous vehicles, and smart cities. AWS's robust presence in cloud computing puts it at the top of the market.

-

Hewlett Packard Enterprise Development LP provides edge computing solutions engineered to maximize 5G network edge data processing. Their HPE Edgeline lineup is directed toward industries requiring strong, scalable edge solutions for operational efficiency and real-time analytics, playing a substantial role in the market share in industries such as telecommunications and manufacturing.

Huawei Technologies Co., Ltd.; Juniper Networks, Inc.; and EdgeConneX, Inc. are some of the emerging participants in the market.

-

Huawei Technologies Co., Ltd. is also a key player in the 5G edge computing solutions. Huawei is aiming to combine edge computing with 5G infrastructure, offering telecom operators solutions to support ultra-low latency applications and network reliability. Its wide-ranging portfolio supports applications for smart cities, manufacturing, and autonomous driving, cementing its position in this market.

-

Juniper Networks, Inc. is growing its presence in the 5G edge computing market by providing networking solutions that include edge computing functionality. Juniper Networks' AI-based solutions aim to maximize network performance, minimize latency, and support high-bandwidth applications, making Juniper Networks a serious player in the edge computing market.

-

EdgeConneX, Inc. is expanding quickly in the 5G edge computing space with edge data centers that lower latency and improve network performance. Their data centers are strategically placed to serve 5G networks, enabling business and telecom operators to process data near the source, enhancing performance in IoT, healthcare, and entertainment industries.

Key 5G Edge Computing Companies:

The following are the leading companies in the 5G edge computing market. These companies collectively hold the largest market share and dictate industry trends.

- ADLINK Technology Inc.

- Advantech Co., Ltd.

- Amazon Web Services, Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Saguna Network Ltd.

- EdgeConneX, Inc.

- Johnson Controls International

- Vapor IO

Recent Developments

-

In 2024, Amazon Web Services (AWS) introduced AWS Wavelength in partnership with telecommunications operators, extending its 5G edge computing ability. The cloud platform enables enterprises to execute applications with ultra-low latency at 5G networks' edges, enabling real-time data processing across industries such as autonomous vehicles, gaming, and industrial automation.

-

In 2024, Hewlett Packard Enterprise (HPE) launched an enhanced release of its HPE Edgeline edge computing platform. This enhanced release offers greater scalability and performance, allowing companies to deploy AI-driven applications and real-time analytics in smart cities, healthcare, manufacturing, and other industries, enhancing operational efficiency and minimizing latency.

-

In 2024, Huawei Technologies launched its 5G edge computing solution that fuses AI and IoT capabilities for sectors such as smart factories and logistics. The solution is designed to improve the traffic of the network as well as speed up data processing rates, greatly enhancing operational efficiency and making it possible to roll out real-time applications within these sectors.

-

In April 2024, EdgeConneX opened a new 5G edge data center in Europe to address increasing demand for low-latency applications. The new facility will enable IoT, smart cities, and industrial automation through the provision of scalable, localized data processing, which minimizes the need for far-off cloud infrastructure and enhances network performance for clients in sectors including telecommunications and entertainment.

5G Edge Computing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 7.32 billion |

|

Revenue forecast in 2030 |

USD 51.57 billion |

|

Growth rate |

CAGR of 47.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Solution, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

ADLINK Technology Inc.; Amazon Web Services, Inc.; Advantech Co., Ltd.; EdgeConneX, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; Juniper Networks Inc.; Saguna Network Ltd; Vapor IO; Johnson Controls International |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 5G Edge Computing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 5G edge computing market report based on solution, end use, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

Smart Cities, Smart Homes, and Smart Buildings

-

Datacenters

-

Energy & Utilities

-

Automotive

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Frequently Asked Questions About This Report

b. The global 5G edge computing market size was estimated at USD 4.74 billion in 2024 and is expected to reach USD 7.32 billion in 2025.

b. The global 5G edge computing market is expected to grow at a compound annual growth rate of 47.8% from 2025 to 2030 to reach USD 51.57 billion by 2030.

b. North America accounted for a revenue share of over 39% in 2024 in the global 5G edge computing market, as the region becomes one of the early adopters of the 5G network, and the number of IoT devices is expected to increase significantly.

b. Some of the key players in the global 5G edge computing market include ADLINK Technology Inc., Advantech Co., Ltd., Amazon Web Services, Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Juniper Networks, Inc., Saguna Network Ltd., EdgeConneX, Inc., Johnson Controls International, Vapor IO.

b. Key factors driving the 5G edge computing market include increased adoption across industries, rise in the adoption of artificial intelligence and machine learning technologies, and their incorporation in edge hardware and software solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."