Less Than Or Equal To 5 mm² Pressure Sensor Market Size, Share & Trends Analysis Report By Product, By Type, By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-456-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

≤ 5 mm² Pressure Sensor Market Trends

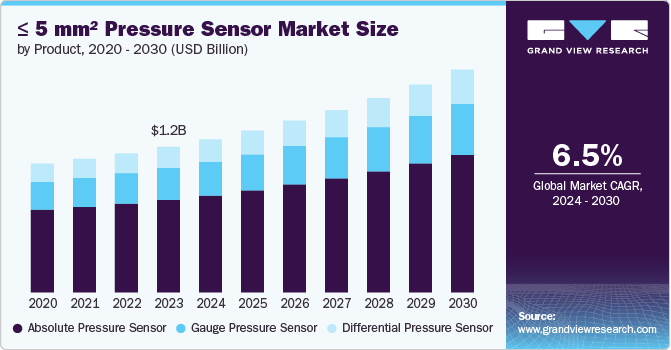

The global ≤ 5 mm² pressure sensor market size was estimated at USD 1.17 billion in 2023 and is expected to grow at a CAGR of 6.5% from 2024 to 2030. Mobile devices such as smartphones and tablets are increasing worldwide across all age groups. The adoption of smartphones has increased significantly in emerging economies, such as Brazil, Mexico, and India, coinciding with the continued rollout of high-speed mobile data networks. India is experiencing a high smartphone penetration rate due to the increasing adoption of budget smartphones among the middle-class and lower-middle-class income groups. According to Ericsson Mobility Report, worldwide mobile subscriptions reached 8,460 million in 2023. Smartphone subscriptions stood at 6,620 million in 2022, growing to 6,970 million in 2023.

Pressure sensors are essential for improving the overall functionality of smartphones and tablets. These sensors are used in various applications, such as barometric pressure measurement, which enables altitude determination. This capability is particularly useful in navigation apps, where altitude data can provide more accurate location tracking in activities such as hiking, climbing, or even urban navigation, where elevation changes may impact route planning. In addition, barometric pressure sensors can be used for weather forecasting, giving users insights into potential weather changes based on atmospheric pressure variations.

The growing demand for thinner and lighter smartphones and tablets presents the need for internal components with smaller form factors that do not compromise performance. This demand for miniaturization is particularly important for pressure sensors, which must fit into increasingly limited spaces while maintaining accuracy and reliability. Pressure sensors ≤ 5 mm² are ideally suited for this purpose, as they can be integrated into the tight confines of modern mobile devices. Their small size also allows for more flexible placement within the device, enabling manufacturers to optimize internal layouts and accommodate critical components such as batteries and cameras.

In addition, the constant rise in the number of minimally invasive medical procedures globally is a key factor driving the market. Pressure sensors ≤ 5 mm² are crucial components in microcatheters and implantable medical devices, enabling the precise monitoring of physiological parameters within the body. Microcatheters are tiny, flexible tubes used in minimally invasive medical procedures to navigate the body's vascular system or other small, intricate pathways. Integrating pressure sensors within these microcatheters allows for real-time internal pressure monitoring, vital for diagnostic and therapeutic purposes.

Moreover, pressure sensors within microcatheters can also assist in guiding the catheter through the body. By detecting pressure changes as the catheter moves through different anatomical regions, these sensors can help navigate tight or complex areas, such as the coronary arteries. It ensures that the catheter reaches the target site safely and efficiently, minimizing the risk of complications.

Product Insights

The absolute pressure sensors segment dominated the market and accounted for a 63.56% share of global revenue in 2023. Absolute pressure sensors are widely used in the automotive, industrial, healthcare, and aerospace sectors. An increase in demand for compact, power-efficient, and advanced absolute pressure sensors from various industries is expected to drive the segment's growth. Micro-Electro-Mechanical Systems (MEMS) technological advancements have enabled the development of these miniature sensors. The demand for smaller, integrated sensors will continue to drive the segment's growth over the forecast period.

The differential pressure sensor segment is projected to grow significantly from 2024 to 2030. Differential pressure sensors are generally used in industrial environments where the flow of gases and liquids is determined by calculating the pressure difference. The growing need for highly accurate and compact sensing solutions in industries such as Heating, Ventilation, and Air Conditioning (HVAC), automotive, and industrial automation is anticipated to fuel the segment's growth.

Type Insights

The wired segment dominated the market in 2023. Incumbents of the automotive industry can be considered the major consumers of wired pressure sensors. The strict rules and regulations related to the security and safety of a vehicle are expected to drive the demand for wired pressure sensors from the automotive industry. These sensors offer precise monitoring in tight spaces where large sensors are impractical. Wired configuration ensures consistent power supply and data transmission, making them ideal for critical applications where reliability is paramount.

The wireless segment is projected to grow significantly from 2024 to 2030. The segments’ growth can be attributed to the installation of wireless pressure sensors in connected devices, such as wearables and medical devices. The demand for ≤ 5 mm² wireless pressure sensors is experiencing rapid growth, driven by the increasing demand for compact and flexible sensing solutions from industries such as healthcare, automotive, aerospace, and industrial automation. These miniature sensors offer the advantage of wireless communication, eliminating the need for physical connections and enabling easier integration into complex systems, especially in hard-to-reach or rotating components.

Technology Insights

The piezoresistive segment dominated the market in 2023. This segment is experiencing robust growth, driven by the increasing need for highly sensitive, compact pressure measurement solutions across industries, such as automotive, medical devices, consumer electronics, and aerospace. These sensors, which rely on the piezoresistive effect to convert pressure into an electrical signal, are valued for their precision, stability, and ability to operate in small form factors, making them ideal for applications in tight spaces or wearables.

The capacitive segment is projected to grow significantly from 2024 to 2030, owing to the increasing adoption of ≤ 5 mm² capacitive pressure sensors in wearables and portable devices. Advancements in MEMS technology are enabling the creation of increasingly smaller and more affordable capacitive sensors. This trend is driving their adoption in consumer electronics and IoT applications.

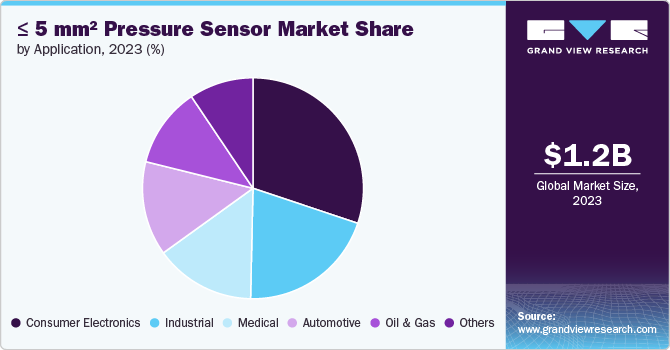

Application Insights

The consumer electronics segment dominated the market in 2023. There is an increasing demand for pressure sensors for wearables, smartphones, and smart home appliances, where space constraints and performance requirements are critical. Advancements in MEMS technology have helped significantly reduce the size of the sensors integrated into various consumer electronics.

The medical segment is projected to grow significantly from 2024 to 2030. Pressure sensors are used in ventilators, infusion pumps, blood pressure measurement devices, and oxygen concentrators, among other medical devices. Integrating sensors in patient monitoring and respiratory devices is a prominent trend in the medical field. An increase in the development of technologically advanced intelligent devices for enhancing healthcare is expected to drive the adoption of pressure sensors in the medical industry.

Regional Insights

The North American ≤ 5 mm² pressure sensor market held a significant share of the market in 2023. The growth of the regional market can be attributed to several key factors, including the continued technological innovations and the subsequent advances in automation; the pursuit of Industry 4.0 initiatives and the subsequent integration of smart technologies; the presence of leading technology companies; and the availability of a robust infrastructure for research and development, all of which are driving the demand for compact, high-precision pressure sensors.

U.S. ≤ 5 mm² Pressure Sensor Market Trends

The U.S. ≤ 5 mm² pressure sensor market is expected to grow at a significant CAGR from 2024 to 2030. The U.S. has a robust industrial base. As a result, the adoption of advanced industrial automation solutions is gaining significant traction across the U.S. The continued advances in the Internet of Things (IoT) and smart manufacturing are also driving the adoption of high-accuracy sensors, enabling more precise and real-time monitoring of various systems.

Europe ≤ 5 mm² Pressure Sensor Market Trends

The Europe ≤ 5 mm² pressure sensor market is expected to witness notable growth from 2024 to 2030. The increasing demand for smaller, more compact electronic devices, such as wearables, IoT devices, and medical equipment, is encouraging the development of ultra-small pressure sensors. The increasing production of Electric Vehicles (EVs) and the growing preference for autonomous driving systems across Europe also drive the need for precise pressure sensors for various automotive applications.

Asia Pacific ≤ 5 mm² Pressure Sensor Market Trends

The Asia Pacific ≤ 5 mm² pressure sensors market held the largest share of 37.08% of the global market. Rapid industrialization and technological advancements across the Asia Pacific drive the demand for ≤ 5 mm² pressure sensors. The preference for compact, precise pressure sensors among the incumbents of the automotive, healthcare, and consumer electronics industries based in China, Japan, and India, among other Asia Pacific nations, is growing significantly.

Key ≤ 5 mm² Pressure Sensor Company Insights

Key players operating in the market are focusing on numerous strategic initiatives, including new product development, agreements, and partnerships & collaborations to gain a competitive advantage over their competitors.

Key ≤ 5 mm² Pressure Sensor Companies:

The following are the leading companies in the ≤ 5 mm² pressure sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- STMicroelectronics

- TDK Corporation

- NXP Semiconductors

- ALPS ALPINE CO., LTD

- Althen Sensors and Controls

- Phoenix Sensors

- Goertek.

- ROHM Co., Ltd

Recent Developments

- In April 2022, Robert Bosch GmbH’s subsidiary Bosch Sensortec GmbH launched BMP581. This barometric pressure sensor combines low power consumption with exceptional accuracy, which is perfect for altitude tracking in hearables, wearables, and IoT devices. Its advanced capabilities make it ideal for fall detection, fitness tracking, navigation, and indoor localization applications.

≤ 5 mm² Pressure Sensor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.23 billion |

|

Revenue forecast in 2030 |

USD 1.79 billion |

|

Growth rate |

CAGR of 6.5% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

Robert Bosch GmbH; STMicroelectronics; TDK Corporation; NXP Semiconductors; ALPS ALPINE CO., LTD; Althen Sensors and Controls; Phoenix Sensors; Goertek; ROHM Co., Ltd. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global ≤ 5 mm² Pressure Sensor Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ≤ 5 mm² pressure sensor market report based on product, type, technology, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Absolute Pressure Sensor

-

Differential Pressure Sensor

-

Gauge Pressure Sensor

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Piezoresistive

-

Capacitive

-

Resonant Solid State

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Oil & Gas

-

Consumer Electronics

-

Medical

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ≤ 5 mm² pressure sensor market size was estimated at USD 1.17 billion in 2023 and is expected to reach USD 1.23 billion in 2024.

b. The global ≤ 5 mm² pressure sensor market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 1.79 billion by 2030.

b. Asia Pacific dominated the ≤ 5 mm² pressure sensor market with a share of 37.08% in 2023. Rapid industrialization and technological advancements across the Asia Pacific drive the demand for ≤ 5 mm² pressure sensors.

b. Some key players operating in the ≤ 5 mm² pressure sensor market include Robert Bosch GmbH, STMicroelectronics, TDK Corporation, NXP Semiconductors, ALPS ALPINE CO., LTD, Althen Sensors and Controls, Phoenix Sensors, Goertek, and ROHM Co., Ltd.

b. Key factors that are driving the market growth include the rising adoption of smartphones and tablets and rise in the number of minimally invasive medical procedures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."