3D Rendering Market Size, Share & Trends Analysis Report By Component (Software, Services), By Operating System (Windows, MacOS), By Organization Size, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-411-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

3D Rendering Market Size & Trends

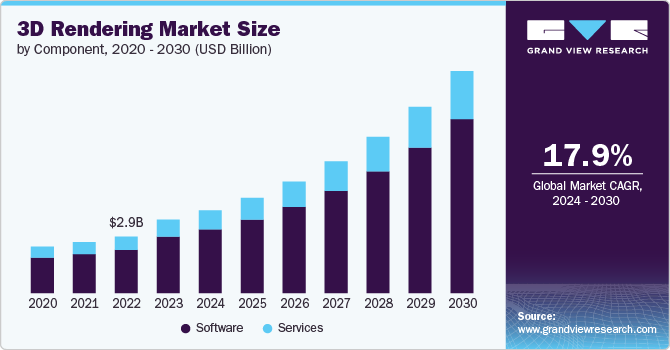

The global 3D rendering market size was estimated at USD 3.74 billion in 2023 and is expected to grow at a CAGR of 17.9% from 2024 to 2030. The market is primarily driven by technological advancements, increasing demand across various industries, and the growing need for high-quality visual content. Technological innovations, such as enhanced graphics processing units (GPUs), real-time rendering capabilities, and sophisticated rendering software, significantly contribute to market expansion.

The rise of sectors such as entertainment, architecture, automotive, and virtual reality further fuels the demand for realistic and immersive 3D visualizations. In addition, the proliferation of digital media and the increasing focus on consumer engagement through high-fidelity graphics in gaming, film, and advertising are pivotal factors propelling the market forward.

The growing need for high-quality visual content is a significant driver of the market for 3D rendering, as various industries increasingly seek to enhance consumer engagement and improve communication through realistic and compelling imagery. In the entertainment, advertising, and real estate sectors, the demand for detailed and immersive visuals pushes the boundaries of rendering technology. High-resolution and photorealistic graphics are essential for creating captivating experiences in video games, virtual simulations, or promotional materials. This heightened demand for visually sophisticated content necessitates advanced rendering solutions capable of delivering intricate and lifelike representations, thereby propelling the expansion of the market. Consequently, the quest for superior visual quality is driving continuous innovation and investment in rendering technologies.

The proliferation of digital media and the heightened emphasis on consumer engagement through high-fidelity graphics substantially drive the market growth. As digital platforms become ubiquitous, industries such as gaming, film, and advertising increasingly leverage advanced 3D rendering technologies to capture audience attention and deliver immersive experiences. In gaming, the demand for realistic and interactive environments pushes the boundaries of rendering capabilities, necessitating more sophisticated graphical solutions. Similarly, the quest for visually stunning and believable effects in film drives advancements in rendering techniques. In advertising, high-quality 3D visuals create compelling and memorable brand experiences. This convergence of digital media proliferation and the need for enhanced consumer engagement underscores the growing importance of 3D rendering technologies, fueling market expansion and innovation.

Component Insights

Software held the largest market share of around 76% in 2023. The adoption of 3D rendering software is predominantly driven by advancements in technological capabilities, such as improved GPUs and more powerful computing resources. The increasing demand for sophisticated and realistic visualizations across various industries, including architecture, automotive design, and product development, is propelling the adoption of these software solutions. Enhanced features such as real-time rendering, high-resolution output, and integration with other digital tools contribute to the appeal of 3D rendering software. In addition, the growing availability of user-friendly interfaces and scalable solutions caters to small-scale and large-scale projects, further accelerating the software's adoption.

The services segment is expected to grow at a significant CAGR from 2024 to 2030. The need for specialized expertise and the complexity of high-quality visual content production largely influence the adoption of 3D rendering services. Organizations across sectors such as entertainment, real estate, and advertising often require advanced rendering capabilities that necessitate professional skills and resources beyond their in-house capabilities. Outsourcing to specialized rendering services provides access to cutting-edge technology, expert knowledge, and scalable solutions tailored to specific project requirements. Furthermore, the demand for rapid turnaround times and cost-effective solutions encourages companies to leverage external rendering services to achieve high-quality results without the overhead of maintaining dedicated rendering infrastructure.

Operating System Insights

The Windows operating system segment accounted for the largest market share in 2023. The adoption of 3D rendering software on the Windows operating system is primarily driven by Windows' dominant market share in the personal and professional computing environments. The extensive compatibility of Windows with a wide range of 3D rendering end uses, coupled with robust support for high-performance hardware configurations, makes it an attractive platform for rendering tasks. The availability of specialized software optimized for Windows, alongside its extensive ecosystem of development tools and support resources, further enhances its appeal. The flexibility and customizability of Windows-based systems allow users to tailor their hardware and software setups to meet the demanding requirements of advanced 3D rendering processes.

The macOS segment is expected to register the fastest CAGR of around 19% from 2024 to 2030. The adoption of 3D rendering software on macOS is driven by the platform's reputation for delivering high-quality graphics and a seamless user experience. macOS offers a stable and optimized environment for 3D rendering end use, with solid performance and support for professional-grade software. Integrating macOS with Apple's advanced hardware, such as the M1 and M2 chips, provides significant performance benefits for rendering tasks. Furthermore, macOS' aesthetic appeal, user-friendly interface, and compatibility with specific high-end creative and design end use attract users in industries like graphic design, animation, and visual effects. This alignment with the needs of creative professionals fosters the adoption of 3D rendering software on macOS.

Organization Size Insights

The large enterprises segment accounted for the largest market share of around 68% in 2023. Large enterprises are increasingly adopting 3D rendering software due to the need for sophisticated visual solutions that support complex projects and enhance strategic decision-making. The scale and scope of large enterprises often involve intricate design, simulation, and visualization requirements that necessitate advanced rendering capabilities. 3D rendering software provides these enterprises with the tools to create high-quality, detailed visualizations essential for product development, architectural planning, and marketing. In addition, large enterprises benefit from the ability to integrate rendering software with other enterprise systems, enabling streamlined workflows and enhanced collaboration across departments. The substantial investment in technology infrastructure and the pursuit of competitive advantage further drive the adoption of advanced 3D rendering solutions among large enterprises.

The SMEs segment is expected to register the fastest CAGR from 2024 to 2030. Small and medium-sized enterprises (SMEs) are adopting 3D rendering software to improve their competitiveness and operational efficiency within their respective markets. For SMEs, adopting 3D rendering software offers a cost-effective means to produce high-quality visual content, which is crucial for marketing, product presentations, and client engagement. Advances in software affordability and cloud-based solutions have made these technologies more accessible to smaller businesses. In addition, user-friendly interfaces and scalable options allow SMEs to leverage 3D rendering capabilities without requiring extensive technical expertise or significant capital investment. Enhancing visual communication and streamlining design processes supports SMEs in achieving their business objectives and expanding their market presence.

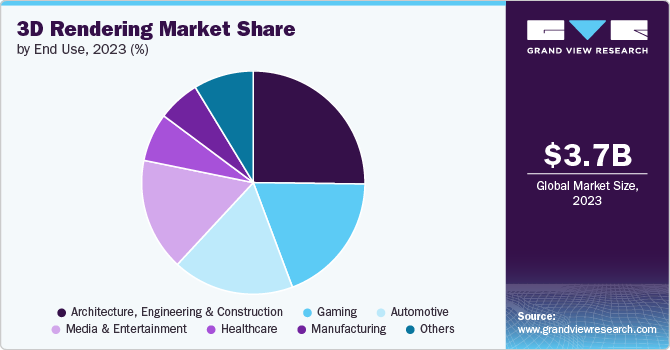

End Use Insights

Based on end use, the Architecture, Engineering, and Construction (AEC) segment accounted for the largest market share of around 25% in 2023. In the AEC industry, the adoption of 3D rendering software is driven by the need for detailed and accurate visual representations of complex projects. 3D rendering facilitates the creation of realistic visualizations and virtual walkthroughs, allowing stakeholders to understand design concepts better and make informed decisions. This technology enhances communication between architects, engineers, clients, and contractors, enabling more effective collaboration and project planning. In addition, 3D rendering software supports visualizing structural changes, material choices, and spatial relationships, which are essential for refining designs and ensuring compliance with regulatory standards. The ability to present high-quality renderings also aids in securing client approvals and attracting potential investors, further driving the adoption of these tools within the AEC sector.

The gaming segment is expected to grow significantly over the forecast period. In the gaming industry, the adoption of 3D rendering software is propelled by the demand for immersive and visually stunning gaming experiences. Advanced 3D rendering technology allows game developers to create highly detailed and realistic environments, characters, and visual effects that enhance gameplay and engage players. Continually pursuing higher graphical fidelity and real-time rendering capabilities drives innovation and adoption of cutting-edge rendering software. In addition, the gaming industry's competitive nature necessitates using advanced tools to differentiate games and deliver unique experiences. The integration of 3D rendering software with game engines and development platforms further supports its adoption, enabling developers to streamline their workflows and achieve high-quality visual outcomes efficiently.

Regional Insights

The 3D rendering market in North America dominated with a global revenue share of around 39% in 2023. In the North America region, the market is experiencing robust growth driven by technological advancements and increasing demand across various sectors. Key trends include the rapid adoption of real-time rendering technologies, particularly influential in gaming and virtual reality end use. In addition, integrating artificial intelligence (AI) and machine learning with 3D rendering tools enhances the efficiency and capabilities of rendering processes. The growing focus on high-quality visual content for marketing and product design, coupled with significant investments in infrastructure by major tech companies, is further accelerating market growth in this region.

U.S. 3D Rendering Market Trends

The 3D rendering market in the U.S. is expected to grow at a significant CAGR from 2024 to 2030. A strong emphasis on innovation and technological advancement characterizes the U.S. market Trends include the widespread use of cloud-based rendering solutions, which offer scalable and cost-effective options for high-performance rendering. The entertainment industry, including film and gaming, drives significant demand for advanced rendering technologies, as do architectural firms seeking detailed visualizations for complex projects. In addition, there is a notable trend toward adopting immersive technologies such as augmented reality (AR) and virtual reality (VR), which rely heavily on sophisticated 3D rendering capabilities.

Asia Pacific 3D Rendering Market Trends

The 3D rendering market in Asia Pacific is expected to grow at the fastest CAGR of around 18% from 2024 to 2030. In the Asia Pacific region, the market is expanding rapidly due to significant investments in infrastructure and technology. Trends include the growing adoption of 3D rendering in sectors such as real estate and construction, driven by urbanization and development projects in emerging economies. The entertainment and gaming industries in countries such as China, Japan, and South Korea are major contributors to market growth, with increasing demand for high-quality visual effects and immersive experiences. In addition, the rise of digital media and e-commerce in the region fuels the need for advanced rendering technologies to enhance product visualizations and online experiences. The proliferation of mobile and cloud technologies further supports the accessibility and adoption of 3D rendering solutions across diverse industries in Asia Pacific.

Europe 3D Rendering Market Trends

The 3D rendering market in Europe is expected to grow at a significant CAGR from 2024 to 2030. In the Europe region, the market is growing with a focus on sustainability and efficiency. Trends include increasing 3D rendering in architectural visualization to support green building practices and energy-efficient designs. European countries are also seeing a rise in the adoption of rendering software in the automotive and aerospace industries, driven by the need for precise and detailed simulations. The region's emphasis on regulatory compliance and high-quality standards influences the demand for advanced rendering solutions. Furthermore, European companies are exploring collaborative and cloud-based rendering platforms to streamline workflows and foster innovation.

Key 3D Rendering Company Insights

Key players operating in the market for 3D rendering include Adobe, Autodesk Inc., Chaos Software EOOD Dassault Systèmes, and among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2024, Autodesk Inc. announced the acquisition of Wonder Dynamics, the developer behind Wonder Studio. Wonder Studio is a cloud-based 3D animation and visual effects solution that integrates AI with established tools. It is notably compatible with other leading 3D software, including Autodesk Maya, facilitating the lighting, animation, and composition of 3D characters within live-action scenes.

-

In July 2024, Seven2, a prominent European private equity firm, announced the majority recapitalization of Lumion, a 3D visualization software provider for the Architecture, Engineering, and Construction (AEC) industry, including interior designers, architects, and landscape architects. This transaction marks Lumion's first significant majority investment and highlights a strategic partnership to drive the company's growth and innovation.

Key 3D Rendering Companies:

The following are the leading companies in the 3D rendering market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Autodesk Inc.

- Chaos Software EOOD

- Dassault Systèmes

- Epic Games, Inc.

- Lumion

- Maxon Computer GMBH

- NVIDIA Corp.

- SideFX

- Unity Technologies

3D Rendering Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.21 billion |

|

Revenue forecast in 2030 |

USD 11.30 billion |

|

Growth Rate |

CAGR of 17.9% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018- 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, operating system, organization size, end use, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

Adobe, Autodesk Inc., Chaos Software EOOD Dassault Systèmes, Epic Games, Inc., Lumion, Maxon Computer GMBH, NVIDIA Corp., SideFX, Unity Technologies |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 3D Rendering Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global 3D rendering market report based on component, operating system, organization size, end use, and region:

-

3D Rendering Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

3D Rendering Operating System Outlook (Revenue, USD Billion, 2018 - 2030)

-

Windows

-

MacOS

-

Linux

-

-

3D Rendering Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

3D Rendering End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Architecture, Engineering & Construction

-

Automotive

-

Healthcare

-

Gaming

-

Manufacturing

-

Media & entertainment

-

Others

-

-

3D Rendering Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D rendering market size was estimated at USD 3.74 billion in 2023 and is expected to reach USD 4.21 billion in 2024

b. The global 3D rendering market is expected to grow at a compound annual growth rate of 17.9% from 2024 to 2030 to reach USD 11.30 billion by 2030

b. North America dominated the 3D rendering market with a market share of 39.4% in 2023. The 3D rendering market in North America is experiencing robust growth driven by technological advancements and increasing demand across various sectors. Key trends include the rapid adoption of real-time rendering technologies, particularly influential in gaming and virtual reality end use. Additionally, integrating artificial intelligence (AI) and machine learning with 3D rendering tools enhances the efficiency and capabilities of rendering processes.

b. Some key players operating in the 3D rendering market include Adobe, Autodesk Inc., Chaos Software EOOD Dassault Systèmes, Epic Games, Inc., Lumion, Maxon Computer GMBH, NVIDIA Corp., SideFX, and Unity Technologies.

b. Several key factors are driving the growth of the 3D rendering market. The 3D rendering market is primarily driven by technological advancements, increasing demand across various industries, and the growing need for high-quality visual content. Technological innovations, such as enhanced graphics processing units (GPUs), real-time rendering capabilities, and sophisticated rendering software, significantly contribute to market expansion. The rise of sectors such as entertainment, architecture, automotive, and virtual reality further fuels the demand for realistic and immersive 3D visualizations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."