- Home

- »

- Plastics, Polymers & Resins

- »

-

3D Printing Plastics Market Size, Share, Growth Report, 2030GVR Report cover

![3D Printing Plastics Market Size, Share & Trends Report]()

3D Printing Plastics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Photopolymers, ABS & ASA, Polyamide/Nylon), By Form (Filament, Ink, Powder), By End-use (Automotive, Medical, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-576-2

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printing Plastics Market Summary

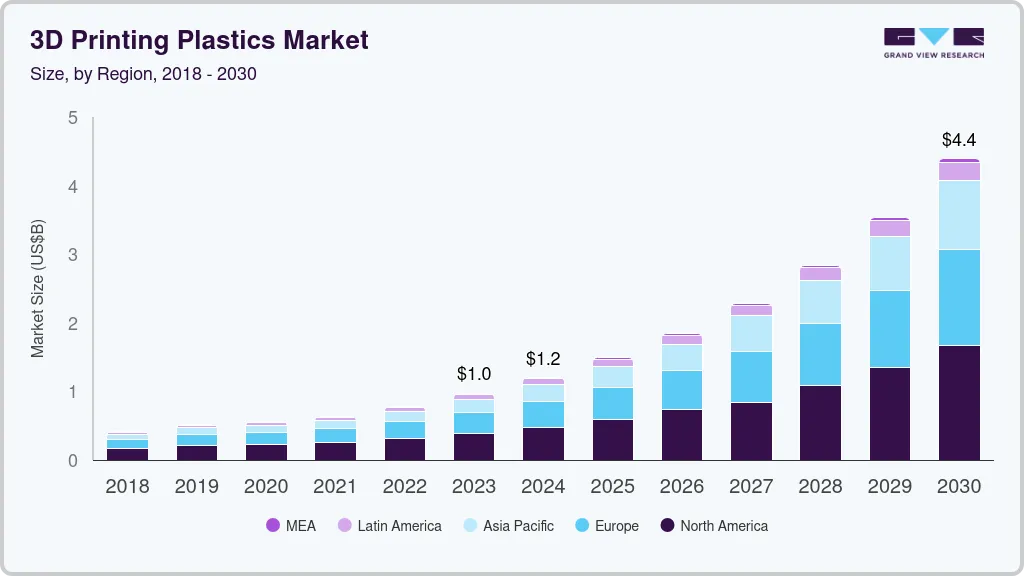

The global 3d printing plastics market size was estimated at USD 1.20 billion in 2024 and is projected to reach USD 4.39 billion by 2030, growing at a CAGR of 24.2% from 2025 to 2030. The growing demand for customized and personalized products drives innovation in the 3D printing industry, leading to an increased need for 3D printing plastics.

Key Market Trends & Insights

- The 3D printing plastics market in Asia Pacific accounted for the largest revenue share of 33.7% in 2024.

- Based on type, the photopolymers segment led the market with a revenue share of 58.4% in 2024.

- Based on form, the filament segment dominated the market with the largest revenue share of 71.4% in 2024.

- The aerospace & defense segment is poised to grow at a significant rate from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 1.20 Billion

- 2030 Projected Market Size: USD 4.39 Billion

- CAGR (2025-2030): 24.1%

- Asia Pacific: Largest market in 2024

The market is witnessing a strong shift toward sustainable and eco-friendly materials. As industries move toward more responsible manufacturing, bioplastics and recycled materials are becoming increasingly popular in 3D printing applications. This trend is driven by environmental regulations and a growing consumer preference for sustainable products. Companies are investing in research and development to create innovative, biodegradable plastics that offer the same performance as traditional materials but with a reduced environmental impact. This shift not only addresses sustainability goals but also opens new opportunities in industries like healthcare and consumer goods.

Drivers, Opportunities & Restraints

The growing adoption of 3D printing in healthcare is a major driver for the market. Medical applications such as custom prosthetics, implants, and surgical models are increasingly utilizing 3D printing due to its precision and ability to create patient-specific solutions. Plastics used in these applications, like polylactic acid (PLA) and polyether ether ketone (PEEK), offer the flexibility and durability required for medical devices. The rise in demand for personalized healthcare, coupled with advancements in biocompatible and high-performance plastics, is propelling the growth of the market.

One significant opportunity in the 3D printing plastics market lies in the automotive industry. As manufacturers look to reduce vehicle weight to improve fuel efficiency and meet stricter emissions standards, 3D printing provides an effective solution for producing lightweight plastic components. With the growing shift toward electric vehicles (EVs), which require lightweight materials for extended battery life, the demand for high-performance 3D printing plastics is expected to rise. Companies that can develop innovative, lightweight materials specifically for automotive applications are well-positioned to capitalize on this emerging opportunity.

Despite its potential, the high cost of 3D printing materials remains a significant restraint for the market. Plastics used in 3D printing, especially those with specialized properties like high heat resistance or biocompatibility, can be expensive compared to traditional manufacturing materials. Additionally, the cost of 3D printing equipment and the slower production speeds compared to mass production techniques make it less viable for large-scale manufacturing. This limits the market’s expansion, particularly in cost-sensitive industries such as consumer goods and packaging, where price competitiveness is a key factor.

Type Insights

Based on type, the photopolymers segment led the market with a revenue share of 58.4% in 2024, owing to the increasing demand for high-precision manufacturing in industries like dental, jewelry, and electronics. Photopolymer resins, which harden when exposed to light, offer exceptional accuracy and fine detailing, making them ideal for producing complex and intricate designs. In the dental industry, for instance, photopolymer 3D printing is used to create highly customized crowns, bridges, and dental implants with exacting precision. Similarly, in electronics, the technology is applied to produce micro-scale components that are difficult to achieve through traditional methods. The growing preference for customized and miniaturized products, coupled with advancements in photopolymer formulations that enhance strength and durability, is fueling the growth of this market.

The polyamide/nylon segment is expected to grow at a rapid rate over the forecast period. Nylon is known for its excellent mechanical properties, including high tensile strength, flexibility, and durability, which makes it ideal for functional prototypes and end-use parts across industries such as automotive, aerospace, and consumer goods. In the automotive and aerospace sectors, manufacturers are increasingly turning to Nylon 3D printing to produce lightweight components that reduce overall vehicle weight without compromising performance. This shift is further supported by the material’s heat and chemical resistance, which is crucial for demanding environments.

Form Insights

Based on form, the filament segment dominated the market with the largest revenue share of 71.4% in 2024, driven by the increasing accessibility of desktop 3D printers. As more individuals, small businesses, and educational institutions adopt affordable 3D printing technology, the demand for versatile and user-friendly filaments like PLA (polylactic acid), ABS (acrylonitrile butadiene styrene), and nylon has surged. These materials are popular due to their ease of use, wide availability, and suitability for a variety of applications ranging from prototyping to hobbyist projects. Additionally, the rise of e-commerce platforms that offer a broad selection of filaments has made it easier for users to experiment and innovate.

The powder segment is anticipated to augment at a substantial rate over the forecast period. The expanding use of powder-based 3D printing technologies like selective laser sintering (SLS) and multi-jet fusion (MJF) is a key driver for the segment. These technologies are gaining popularity in industries such as aerospace, automotive, and healthcare due to their ability to produce complex, high-strength parts with excellent surface finishes and fine details. Plastic powders, particularly Nylon (Polyamide), are favored for their high performance in these processes, offering durability, flexibility, and resistance to impact and chemicals. The ability of powder-based 3D printing to minimize material waste and create lightweight yet robust components has also attracted manufacturers looking to reduce costs and environmental impact.

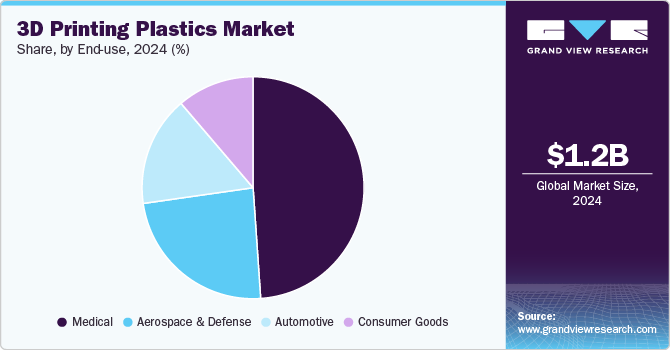

End-use Insights

Based on end use, the medical segment dominated the market with the largest revenue share of 48.91% in 2023. The increasing demand for personalized medical devices and implants is a key driver for the use of 3D printing plastics in the medical industry. 3D printing allows the production of highly customized, patient-specific solutions such as prosthetics, dental implants, and surgical models, significantly improving patient outcomes. Biocompatible plastics like PLA, PEEK (polyether ether ketone), and medical-grade Nylon are widely used due to their safety, strength, and flexibility, making them ideal for use within the human body or in surgical procedures. This customization capability reduces surgery times and enhances precision in complex procedures.

The aerospace & defense segment is poised to grow at a significant rate from 2025 to 2030. Aerospace manufacturers are increasingly turning to 3D printing to produce complex, weight-reducing plastic parts that enhance fuel efficiency and reduce emissions without sacrificing strength or durability. High-performance plastics such as PEEK (polyether ether ketone), ULTEM (polyetherimide), and Nylon are widely used for their heat resistance, chemical resistance, and ability to withstand extreme conditions, making them ideal for critical aerospace components like air ducts, brackets, and interior cabin parts. In the defense sector, 3D printing plastics enable rapid prototyping and the on-demand production of custom parts in remote or mission-critical environments.

Regional Insights

North America 3D printing plastics market is growing as the rising trend toward on-demand manufacturing and rapid prototyping is a key driver for the regional market. Companies in industries like aerospace, automotive, and healthcare are increasingly adopting 3D printing to reduce lead times, minimize material waste, and produce high-performance plastic parts with intricate designs. This is supported by the region’s strong ecosystem of 3D printing service providers and material manufacturers who offer a wide range of specialized plastics such as Nylon, ABS, and PEEK. North America's focus on technological innovation, combined with government support for advanced manufacturing, is further boosting the demand for 3D printing plastics in various industrial applications.

U.S. 3D Printing Plastics Market Trends

The 3D printing plastics market in the U.S. is being driven by the strong adoption of 3D printing in the healthcare and aerospace industries, where precision and customization are critical. Medical applications, including the production of patient-specific implants, prosthetics, and surgical tools, are rapidly growing, with biocompatible and durable plastics like PLA and PEEK playing a central role. In aerospace, 3D printing is being used to create lightweight, heat-resistant components that reduce fuel consumption and enhance performance. The U.S. government’s focus on maintaining technological leadership and the presence of leading 3D printing companies in the country further amplify the market's expansion.

Asia Pacific 3D Printing Plastics Market Trends

The 3D printing plastics market in Asia Pacific accounted for the largest revenue share of 33.7% in 2024, driven by rapid industrialization and the increasing adoption of advanced manufacturing technologies in countries like China, India, and Japan. Governments across the region are heavily investing in 3D printing technology as part of broader initiatives to modernize manufacturing and strengthen local industries. This growth is further supported by the rising demand for 3D printed products in sectors such as electronics, automotive, and healthcare, where high-performance plastic materials are used to create lightweight, complex components. Additionally, the expansion of small and medium enterprises (SMEs) utilizing 3D printing technology for customized production is accelerating market growth across the region.

China 3D printing plastics market is being driven by the country's rapid advancements in manufacturing technologies and its ambition to become a global leader in 3D printing. The Chinese government is actively promoting 3D printing as part of its "Made in China 2025" initiative, which aims to upgrade the country's manufacturing capabilities. This has led to a surge in demand for 3D printing plastics in sectors such as electronics, consumer goods, and construction, where manufacturers are using 3D printing to create high-quality, complex products more efficiently. The availability of low-cost raw materials and strong local supply chains further support the widespread adoption of 3D printing plastics in China.

Europe 3D Printing Plastics Market Trends

The 3D printing plastics market in Europe is growing due to the growing emphasis on sustainability and the circular economy. European manufacturers are increasingly adopting eco-friendly materials such as biodegradable and recycled plastics in their 3D printing processes to meet stringent environmental regulations. Sectors like automotive and aerospace are also leveraging 3D printing to produce lightweight components that help reduce emissions and enhance fuel efficiency. Additionally, Europe’s strong focus on research and development in advanced materials, combined with the region’s robust industrial base, is fostering innovation in 3D printing plastics, further driving market growth.

Key 3D Printing Plastics Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include 3D Systems Corporation, Arkema Inc., Envisiontec Inc., Stratasys Ltd., SABIC, Materialse nv., HP INC., Eos GmbH Electro Optical Systems, PolyOne Corporation, and Royal DSM N.V. The 3D printing plastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key 3D Printing Plastics Companies:

The following are the leading companies in the 3D printing plastics market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Systems Corporation

- Arkema Inc.

- Envisiontec Inc.

- Stratasys Ltd.

- SABIC

- Materialse nv

- HP INC.

- Eos GmbH Electro Optical Systems

- PolyOne Corporation

- Royal DSM N.V.

Recent Developments

-

In October 2023, Evonik launched a groundbreaking carbon-fibre reinforced PEEK filament, claiming it to be the "world's first" for 3D printed medical implants. This new material, available in two grades (VESTAKEEP iC4620 3DF and iC4612 3DF), contains 20% and 12% carbon fibre, respectively, allowing manufacturers to choose based on the strength and flexibility needed for implants like bone plates.

-

In September 2023, Polymaker launched a new line of high-speed 3D printing filaments called PolySonic at the TCT Asia event in Shanghai. This range includes PolySonic PLA and PolySonic PRO, designed to enhance printing speed without sacrificing quality or strength. PolySonic materials maintain strong mechanical properties even at high speeds, with only a 6% reduction in strength compared to traditional printing speeds, while standard PLA shows a 24% drop.

3D Printing Plastics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.48 billion

Revenue forecast in 2030

USD 4.39 billion

Growth rate

CAGR of 24.2% from 2025 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Type, form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

3D Systems Corporation; Arkema Inc.; Envisiontec Inc.; Stratasys Ltd.; SABIC; Materialse nv.; HP INC.; Eos GmbH Electro Optical Systems; PolyOne Corporation; Royal DSM N.V

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Printing Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D printing plastics market report on the basis of type, form, end-use, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Photopolymers

-

ABS & ASA

-

Polyamide/Nylon

-

Polylactic Acid

-

Others

-

-

Form Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Filament

-

Ink

-

Powder

-

-

End-use Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Medical

-

Prosthetics & implants

-

Surgical Instruments

-

Others

-

-

Aerospace & Defense

-

Consumer Goods

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global 3D printing plastics market size was estimated at USD 1.20 billion in 2024 and is expected to reach USD 1.48 billion in 2025.

b. The global 3D printing plastics market is expected to grow at a compound annual growth rate of 24.2% from 2024 to 2030 to reach USD 4.39 billion by 2030.

b. Asia Pacific dominated the global 3D printing plastics market and accounted for largest revenue share of 33.7% in 2024, driven by the rapid industrialization and increasing adoption of advanced manufacturing technologies in countries like China, India, and Japan.

b. Some key players operating in the 3D printing plastics market include 3D Systems Corporation, Arkema Inc., Envisiontec Inc., Stratasys Ltd., SABIC, Materialse nv., HP INC., Eos GmbH Electro Optical Systems, PolyOne Corporation, and Royal DSM N.V. The 3D

b. The growing demand for customized and personalized products drives innovation in the 3D printing industry, leading to an increased need for 3D printing plastics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.