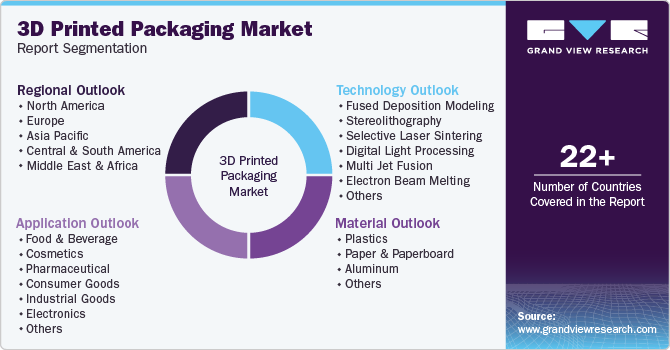

3D Printed Packaging Market Size, Share & Trends Analysis Report By Material (Plastics, Paper & Paperboard, Aluminum), By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-466-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

3D Printed Packaging Market Size & Trends

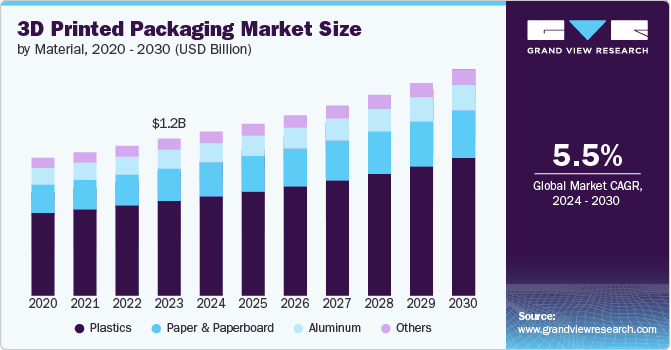

The global 3D printed packaging market size was estimated at USD 1.25 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. The market is experiencing growth due to several driving factors, including the need for customization, sustainability initiatives, and advancements in additive manufacturing technologies. One of the primary drivers is the increasing demand for personalized packaging solutions. Brands are looking for ways to stand out in a competitive market, and 3D printing offers them the flexibility to design and produce customized packaging that enhances the consumer experience. For instance, luxury brands often use 3D printing to create intricate, bespoke packaging designs that are tailored to individual customers, creating a sense of exclusivity and personalization.

Sustainability is another critical factor driving the 3D-printed packaging market. As businesses aim to reduce their carbon footprint, 3D printing provides an efficient method to reduce waste in packaging production. Traditional manufacturing methods often involve material wastage, but 3D printing uses only the necessary amount of material, which aligns with global sustainability goals. Moreover, advancements in biodegradable and recyclable 3D printing materials are further pushing the adoption of this technology in packaging.

Technological advancements in additive manufacturing are also playing a significant role in the growth of 3D-printed packaging. The development of faster and more precise 3D printers allows for mass customization and shorter production cycles. This is particularly beneficial in industries like food and beverage, where packaging needs to be produced quickly and in large quantities. For example, Coca-Cola has used 3D printing technology to create limited-edition bottles, showcasing how the technology can support large-scale production while maintaining design flexibility.

Additionally, the ability to produce lightweight and durable packaging is driving the adoption of 3D printing in industries such as e-commerce and logistics. Lightweight packaging reduces shipping costs and carbon emissions, while durable materials ensure product protection during transportation. This combination of cost savings, sustainability, and product security is encouraging companies to explore 3D-printed packaging solutions, particularly in markets with high demand for efficient and sustainable logistics solutions.

Material Insights

Based on material, the global 3D printed packaging market has been segmented into plastics, paper & paperboard, aluminum, and others. Plastics dominated the overall market with a revenue share of over 60.0% in 2023. Plastics are widely used in 3D printed packaging due to their versatility, durability, and lightweight properties. Materials such as Polylactic Acid (PLA), PET, and Acrylonitrile Butadiene Styrene (ABS) are common in this category. They offer flexibility in design, making them ideal for customized and intricate packaging solutions. Plastics are often favored for creating prototypes and small production runs of packaging, especially in industries like cosmetics, electronics, and consumer goods.

Furthermore, paper and paperboard are emerging materials in 3D printed packaging, particularly for sustainable and eco-friendly applications. These materials offer a renewable and biodegradable alternative to plastics, appealing to environmentally conscious brands. While 3D printing with paper and paperboard is still in its early stages, it has potential for creating custom, lightweight packaging solutions.

Aluminum is known for its strength, durability, and recyclability, making it a premium option in 3D printed packaging. It is primarily used in high-end packaging for sectors like electronics and luxury goods, where robustness and aesthetic appeal are crucial. Aluminum's use in 3D printing offers opportunities for innovative design and functional features in packaging, including the ability to create lightweight yet strong packages.

Technology Insights

Based on product, the global 3D printed packaging market has been segmented into fused deposition modeling (FDM), stereolithography (SLA), selective laser sintering (SLS), digital light processing (DLP), multi jet fusion (MJF), electron beam melting (EBM), direct metal laser sintering (DMLS), binder jetting, laminated object manufacturing (LOM). Stereolithography (SLA) dominated the overall market with a revenue market share of over 18.0% in 2023. SLA is widely used in creating detailed packaging prototypes, especially in industries where aesthetics and design intricacies are important. SLA excels at producing high-quality molds and casting patterns for packaging applications.

Fused deposition modeling (FDM) is the most common and accessible form of 3D printing, utilizing thermoplastic materials such as PLA, ABS, and PETG. FDM is known for its simplicity, cost-effectiveness, and wide material availability, making it popular for packaging prototypes and custom packaging solutions. The key driving factors for FDM in 3D printed packaging include the availability of low-cost materials, ease of use, and wide adaptability across industries.

Multi Jet Fusion (MJF) is an advanced 3D printing technology that uses a combination of fusing agents and infrared light to produce functional parts with excellent detail and strength. MJF is used in creating strong, functional packaging components or customized packaging elements, particularly in high-performance sectors.t

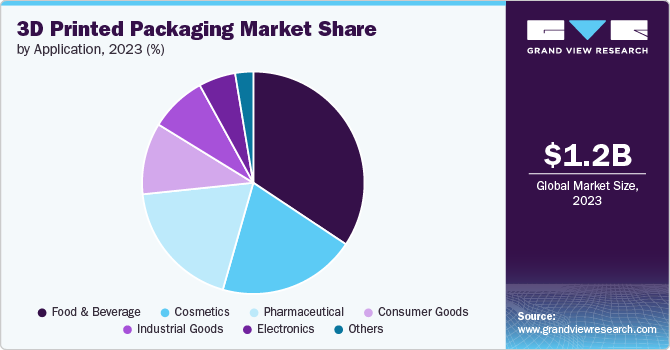

Application Insights

Based on application, the market is segmented into food & beverages, cosmetics, pharmaceuticals, consumer goods, industrial goods, electronics, and others. The food & beverages application segment dominated the market and accounted for largest revenue share of over 34.0% in 2023. The food & beverages industry is increasingly leveraging 3D printed packaging for creating customized, sustainable, and innovative designs. 3D printing allows manufacturers to create packaging solutions that enhance product preservation, maintain freshness, and improve aesthetic appeal. It also enables brands to develop lightweight, durable packaging with intricate designs tailored to specific product needs.

3D printed packaging in the cosmetics industry focuses on creating bespoke and visually appealing designs that reflect brand identity and luxury. This technology enables brands to develop limited-edition or customized packaging, adding a premium touch to products like perfumes, skincare, and makeup.

Moreover, in the pharmaceutical sector, 3D printing is used to develop tamper-proof, sterile, and functional packaging solutions for drugs and medical devices. This technology enables the creation of intricate and personalized designs, such as dosage forms or packaging that incorporate anti-counterfeiting features.

Regional Insights

North America dominated the market and accounted for the largest revenue share of over 33.0% in 2023. North America is driving the 3D printed packaging market due to several key factors, including technological advancements, strong industrial infrastructure, and the demand for sustainable, customized packaging solutions. The region's well-established 3D printing ecosystem is supported by leading companies, such as Stratasys and 3D Systems, which have pioneered innovations in additive manufacturing technologies. These advancements enable businesses to create highly customized packaging with greater precision, reducing lead times and minimizing waste.

U.S. 3D Printed Packaging Market Trends

Growth of the 3D printed packaging market in the U.S. is primarily driven by the increasing focus on sustainability in U.S. packaging industry. As environmental concerns grow, U.S.-based companies are using 3D printing to create more sustainable packaging solutions by minimizing waste, utilizing recyclable materials, and adopting energy-efficient production processes. 3D printing allows for precision manufacturing, reducing excess material usage and enabling the production of packaging that fits products more efficiently, thus lowering transportation costs and emissions. For instance, companies such as HP and Carbon have been developing biodegradable and compostable 3D-printed packaging materials to meet eco-conscious consumer demands.

Europe 3D Printed Packaging Market Trends

The Europe packaging market’s growth is driven by a strong focus on consumer experience and customization. 3D printing offers the ability to create highly personalized and tailored packaging designs, which is appealing to European consumers who increasingly demand unique and individualized products. Brands such as Coca-Cola have leveraged 3D printing to create limited-edition packaging in European markets, allowing them to engage consumers with interactive and innovative designs. This trend of personalization, combined with the flexibility that 3D printing offers, is particularly well-suited to the European market, where brand differentiation is a key factor in consumer purchasing decisions.

Asia Pacific 3D Printed Packaging Market Trends

The growing e-commerce sector in Asia Pacific is another critical factor driving the adoption of 3D printed packaging. With the rise of online shopping and quick delivery expectations, companies are seeking packaging solutions that are lightweight, customizable, and sustainable. 3D printing allows for on-demand production, which helps brands meet these requirements more effectively. For example, companies in China are using 3D printed packaging for personalized and sustainable e-commerce parcels, significantly reducing the need for traditional packaging materials and allowing faster prototyping for new packaging designs.

Key 3D Printed Packaging Company Insights

The competitive environment of the 3D printed packaging market is characterized by the presence of both established packaging companies and innovative startups leveraging additive manufacturing technologies to create customized, sustainable, and lightweight packaging solutions. Key players are focusing on research and development to improve material compatibility, design flexibility, and production efficiency, catering to industries such as food & beverage, cosmetics, and e-commerce. Strategic partnerships, mergers, and acquisitions are common as companies aim to strengthen their technological capabilities and expand their global market reach. Additionally, sustainability trends and the increasing demand for personalized packaging drive competition, with companies seeking to differentiate through eco-friendly materials and cost-effective solutions.

-

In April 2024, GP3DPrint introduced a novel approach to sustainable packaging through a collaboration between Baralan, Stratasys, and ICA. This initiative focuses on 3D printing technology to create personalized and eco-friendly cosmetic packaging. The service utilizes a specially developed water-based paint by ICA that integrates with Baralan's bio range, ensuring compliance with cosmetic packaging standards while promoting sustainability.

-

In March 2024, Unilever adopted 3D printing technology to enhance its plastic bottle production process, utilizing resin 3D printing from Formlabs to create molds. This innovative approach significantly reduces the time and cost associated with traditional mold-making, allowing Unilever to produce a mold in just two days compared to the usual six to eight weeks, and enabling faster prototyping with up to five designs in the same timeframe.

Key 3D Printed Packaging Companies:

The following are the leading companies in the 3D printed packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Stratasys Ltd.

- 3D Systems Corporation

- Materialise NV

- EOS GmbH

- Arcam AB

- SLM Solutions Group AG

- Nexa3D

- Protolabs Inc.

- GE Additive

- Carbon, Inc.

- Desktop Metal, Inc.

- Formlabs, Inc.

- Xometry, Inc.

- CELLINK AB

- Markforged, Inc.

3D Printed Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.31 billion |

|

Revenue forecast in 2030 |

USD 1.80 billion |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, volume in kilotons, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Material, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Stratasys Ltd.; 3D Systems Corporation; Materialise NV; EOS GmbH; Arcam AB; SLM Solutions Group AG; Nexa3D; Protolabs Inc.; GE Additive; Carbon, Inc.; Desktop Metal, Inc.; Formlabs, Inc.; Xometry, Inc.; CELLINK AB; Markforged, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 3D Printed Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D printed packaging market report on the basis of material, technology, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Plastics

-

Paper & Paperboard

-

Aluminum

-

Others

-

-

Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fused Deposition Modeling (FDM)

-

Stereolithography (SLA)

-

Selective Laser Sintering (SLS)

-

Digital Light Processing (DLP)

-

Multi Jet Fusion (MJF)

-

Electron Beam Melting (EBM)

-

Direct Metal Laser Sintering (DMLS)

-

Binder Jetting

-

Laminated Object Manufacturing (LOM)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Cosmetics

-

Pharmaceutical

-

Consumer Goods

-

Industrial Goods

-

Electronics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D-printed packaging market was estimated at USD 1.25 billion in 2023 and is expected to reach USD 1.31 billion in 2024.

b. The global 3D-printed packaging market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030, reaching around USD 1.80 billion by 2030.

b. Plastics dominated the overall market, with a revenue market share of over 60.0% in 2023. Due to their versatility, durability, and lightweight properties, plastics are widely used in 3D-printed packaging. Materials such as Polylactic Acid (PLA), PET, and Acrylonitrile Butadiene Styrene (ABS) are common in this category.

b. .Some of the key players operating in the 3d printed packaging market are Stratasys Ltd.; 3D Systems Corporation; Materialise NV; EOS GmbH; Arcam AB; SLM Solutions Group AG; Nexa3D; Protolabs Inc.; GE Additive; Carbon, Inc.; Desktop Metal, Inc.; Formlabs, Inc.; Xometry, Inc.; CELLINK AB; and Markforged, Inc.

b. The 3D-printed packaging market is experiencing growth due to several driving factors, including the need for customization, sustainability initiatives, and advancements in additive manufacturing technologies. One of the primary drivers is the increasing demand for personalized packaging solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."