3D Printed Drones Market Size, Share & Trends Analysis Report By Type (Fixed-wing, Multi-rotor, Single-rotor, Hybrid), By Component, By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-440-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

3D Printed Drones Market Size & Trends

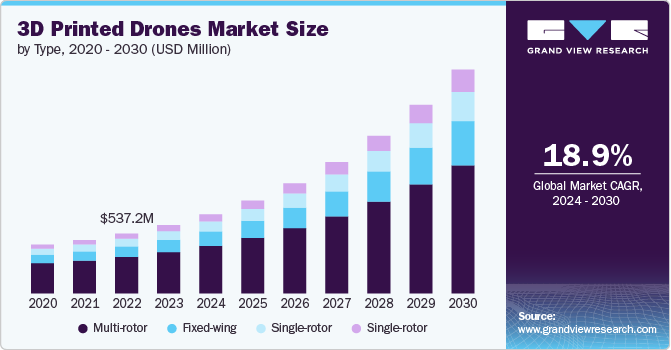

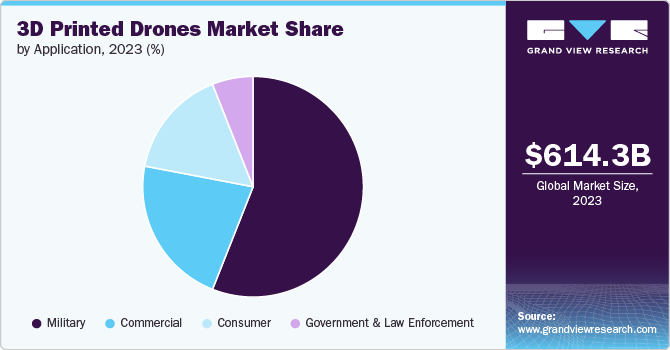

The global 3D printed drones market size was estimated at USD 614.3 million in 2023 and is projected to grow at a CAGR of 18.9% from 2024 to 2030. The growing advancements in additive manufacturing technologies are driving the market growth. The rapid prototyping and production of drones are increasingly being utilized across various sectors, such as agriculture, logistics, surveillance, and environmental monitoring, which is expected to fuel the market growth in coming years.

Technological innovations in additive manufacturing is a significant factor contributing to market growth. The ability to fabricate complex lightweight structures at lower costs enhances production efficiency and reduces inventory expenses. This flexibility is particularly beneficial in military applications, where rapid design iterations are essential to meet evolving operational needs. Furthermore, the integration of advanced materials in 3D printing expands the potential for creating high-performance drone components, thereby creating lucrative opportunities for the market expansion.

In addition, many countries are investing in research and development initiatives aimed at advancing drone technology through additive manufacturing processes. These investments foster innovation as well as encourage collaboration between public institutions and private companies, leading to enhanced capabilities in drone design and production. This trend is driven by the need for rapid production and the ability to quickly adapt designs to meet evolving market needs.

Furthermore, the versatility of 3D-printed drones is leading to increased demand across multiple applications, including surveillance, agriculture, delivery services, and recreational use. As industries recognize the benefits of drones for operational efficiency and data collection, the market for 3D-printed drones is expected to expand significantly. This trend is supported by ongoing technological advancements that enhance drone capabilities, making them more attractive for various commercial and professional uses.

Moreover, ongoing advancements in 3D printing materials and technologies are expanding the possibilities for 3D-printed drones. Innovations in materials like polymers, composites, and metals allow for the production of drone components that are stronger, lighter, and more durable. These developments help enhance the performance of 3D-printed drones as well as encourage their adoption in more demanding environments, including military and industrial applications.

Type Insights

The multi-rotor segment accounted for the largest market share in 2023, owing to its widespread use across various industries, including military, commercial, and recreational applications. Multi-rotor drones are favored for their versatility, ease of control, and ability to hover and maneuver in tight spaces, making them ideal for tasks such as aerial photography, surveillance, and inspections. The adaptability of multi-rotor designs to 3D printing has further enhanced their popularity, allowing for rapid prototyping and customization, which solidified their leading position in the market.

The hybrid segment is expected to witness the fastest CAGR from 2024 to 2030, driven by the growing demand for drones that combine the vertical takeoff and landing (VTOL) capabilities of multi-rotors with the long-range efficiency of fixed-wing drones. Hybrid drones offer the best of both worlds, making them highly attractive for applications that require extended flight times and the ability to operate in various environments. The advancement of 3D printing technology enables the production of lightweight and complex hybrid designs, fueling innovation and contributing to the rapid growth of this segment.

Component Insights

The airframe segment accounted for the largest market share of over 36% in 2023, owing to its critical role in the overall structure and functionality of drones. 3D printing technology enables the production of lightweight, durable, and complex airframe designs that enhance the drone's performance and efficiency. The ability to rapidly prototype and customize airframes to meet specific requirements has made 3D printing a preferred method for manufacturers, particularly in the military and commercial sectors, where performance and reliability are paramount. This widespread application and the importance of the airframe in drone design contributed to the segment's dominance in the market.

The wings segment is expected to witness a significant CAGR of over 19% from 2024 to 2030, driven by the increasing demand for advanced aerodynamic designs that enhance flight efficiency and range. 3D printing allows for creating highly optimized wing structures that are both lightweight and strong, enabling drones to achieve better lift and maneuverability. As industries such as logistics, agriculture, and surveillance expand their use of drones for long-range and high-endurance missions, the need for sophisticated wing designs is growing, thereby enhancing the segment growth.

Technology Insights

The fused deposition modeling (FDM) segment in the market accounted for the largest share in 2023. This growth can be attributed to its widespread accessibility, cost-effectiveness, and suitability for producing durable, lightweight drone components. FDM is a popular 3D printing method that extrudes thermoplastic materials to build objects layer by layer, making it ideal for creating complex drone parts with precision. Its ability to utilize a variety of materials, including high-strength and heat-resistant polymers, has made FDM the go-to technology for manufacturers seeking to produce functional and reliable drones, thereby driving the segmental growth.

The stereolithography (SLA) segment is anticipated to record the fastest growth from 2024 to 2030, driven by its superior precision and ability to produce highly detailed and smooth-finished drone components. SLA uses a laser to cure liquid resin into solid parts, allowing for the creation of intricate and lightweight designs that are increasingly in demand for specialized drone applications, such as medical delivery and high-resolution imaging. As the market evolves towards more complex and customized solutions, the exceptional quality and material versatility offered by SLA technology are expected to drive its rapid adoption and growth.

Application Insights

The military segment accounted for the largest market share in 2023, owing to its significant investments in advanced technology to enhance combat and surveillance capabilities. Militaries worldwide are increasingly adopting 3D printing technology to develop customized drones that meet specific mission requirements, reduce production time, and lower costs. The ability to rapidly prototype and produce lightweight, high-performance drones has given the military an edge in modern warfare, thereby driving the segmental growth.

The government & law enforcement segment is expected to witness fastest CAGR from 2024 to 2030, driven by the growing demand for 3D printed drones in public safety, surveillance, and disaster management. These drones offer cost-effective, customizable solutions for various applications, such as monitoring large crowds, border security, and search and rescue operations. The ability to quickly produce drones tailored to specific operational needs is driving the rapid adoption of 3D printing technology in this segment, resulting in its accelerated growth.

Regional Insights

The North America region accounted for the highest revenue share of over 36% in 2023, driven by the increasing adoption of advanced technologies in the region, particularly in the defense and aerospace sectors. The trend is shifting towards the development of lightweight, high-performance drones with complex designs, which can be achieved through 3D printing. The region is also home to several major drone manufacturers, which are investing in 3D printing technology to improve their production processes. Furthermore, the growing demand for recreational drones and the increasing popularity of drone racing are also driving the demand for 3D printed drones in the region.

U.S. 3D Printed Drones Market Trends

The 3D printed drones market in U.S. is projected to grow at a CAGR of over 15% from 2024 to 2030. The U.S. government’s significant investment in defense technology fuels demand for 3D printed drones, which are used for surveillance, reconnaissance, and combat missions. The ability to rapidly prototype and produce mission-specific drones using 3D printing technology is crucial for maintaining a competitive edge.

Europe 3D Printed Drones Market Trends

The 3D printed drones market in Europe is anticipated to grow at a CAGR of over 17% from 2024 to 2030. This growth is driven by the growing focus on innovation and research and development in the region. The trend is shifting towards the development of drones with advanced capabilities, such as autonomous flight and surveillance capabilities, which can be achieved through 3D printing. Additionally, the growing demand for drones in industries such as agriculture, construction, and environmental monitoring is also driving the demand for 3D Printed Drones in the region.

Asia-Pacific 3D Printed Drones Market Trends

The 3D printed drones market in the Asia Pacific region is expected to grow at a significant CAGR of 22% from 2024 to 2030. The development of affordable and high-performance drones that can be used in various applications, including surveillance, mapping, and cargo delivery is driving the market growth in the region.Furthermore, the growing demand for recreational drones and the increasing popularity of drone racing are also driving the demand for 3D printed drones in the region.

Key 3D Printed Drones Company Insights

Some of the key players operating in the market include The Boeing Company and AeroVironment, Inc. among others.

-

The Boeing Company is an aerospace and defense company that has made significant strides in the 3D printed drone market. The company focus heavily on integrating 3D printing into its manufacturing processes which allows for the production of high-performance, lightweight drones with enhanced capabilities.

-

AeroVironment, Inc. specializes in small, Unmanned Aircraft Systems (UAS) and has been at the forefront of incorporating 3D printing technology into its drone manufacturing. The company's portfolio includes a range of tactical and surveillance drones that benefit from 3D printing's ability to produce lightweight, durable, and customizable parts. The company’s focus on innovation and its ability to rapidly prototype and iterate designs using 3D printing technology enables it to meet the evolving needs of defense and commercial sectors.

Lockheed Martin Corporation, and Firestorm Labs, Inc. are some of the emerging market participants in the market.

-

Lockheed Martin Corporation is an aerospace, defense, and security company that has increasingly adopted 3D printing technology in its drone manufacturing processes. The company utilizes 3D printing to create advanced drone components and prototypes, enhancing its capabilities in developing high-performance, customized drones for military and commercial applications.

-

Firestorm Labs, Inc. is known for its focus on integrating cutting-edge 3D printing technology with drone design and manufacturing. The company specializes in creating customized, high-performance drones using advanced 3D printing techniques that enable rapid prototyping and production of intricate components.

Key 3D Printed Drones Companies:

The following are the leading companies in the 3D printed drones market. These companies collectively hold the largest market share and dictate industry trends.

- The Boeing Company

- AeroVironment, Inc.

- BAE Systems plc

- Draganfly Innovations, Inc.

- Thales Group

- Parrot Drones SAS

- General Atomics

- Skydio, Inc.

- Airbus SE

- Flyability SA

- Dronamics Global Limited

- Kratos Defense & Security Solutions, Inc.

- Lockheed Martin Corporation

- Firestorm Labs, Inc.

- Northrop Grumman Systems Corporation

Recent Developments

-

In April 2024, the U.S. Navy announced USD 84 million contract with Insitu, Inc., A Boeing Company for the production of unmanned aerial vehicles (UAVs) and sensor payloads aimed at enhancing persistent surveillance capabilities for the Navy, U.S. Marine Corps, and allied forces.

-

In March 2024, Firestorm Labs, Inc. secured USD 12.5 million in seed funding led by Lockheed Martin Ventures, along with support from other defense investors. This investment aims to address the evolving needs of modern warfare, emphasizing the importance of rapid technology delivery and interoperability for military operations.

-

In February 2024, General Atomics successfully demonstrated a new air-launched effects platform, the Advanced Air-Launched Effects vehicle (A2LE), made using additive manufacturing from the internal weapons bay of an MQ-20 Avenger unmanned system.

3D Printed Drones Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 711.9 million |

|

Revenue forecast in 2030 |

USD 2,013.5 million |

|

Growth rate |

CAGR of 18.9% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report Component |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

type, component, technology, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE. |

|

Key companies profiled |

The Boeing Company; AeroVironment Inc.; Parrot Drones SAS; General Atomics; Skydio Inc.; Airbus SE; Flyability SA; Dronamics Global Limited; Lockheed Martin Corporation; Firestorm; Northrop Grumman Systems Corporation; BAE Systems plc; Draganfly Innovations Inc.; Thales Group; Kratos Defense & Security Solutions Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 3D Printed Drones Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D printed drones market report based on component, technology, type, application, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Airframe

-

Wings

-

Landing Gears

-

Propellers

-

Mounts & Holders

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Fused Deposition Modeling (FDM)

-

Stereolithography (SLA)

-

Selective Laser Sintering (SLS)

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed-wing

-

Multi-rotor

-

Single-rotor

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Military

-

Commercial

-

Government & Law Enforcement

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The key factors driving the 3D printed drones market include the growing demand for customizable and lightweight drone components, as well as advancements in additive manufacturing technologies that enhance production efficiency and reduce costs. Additionally, the increasing adoption of drones in various industries, such as agriculture, defense, and logistics, further fuels market growth.

b. The global 3D printed drones market size was estimated at USD 614.3 billion in 2023 and is expected to reach USD 711.9 billion in 2024.

b. The global 3D printed drones market is expected to grow at a compound annual growth rate of 18.9% from 2024 to 2030 to reach USD 2,013.5 billion by 2030.

b. North America accounted for a market revenue share of 36% in 2023,driven by the increasing adoption of advanced technologies in the region, particularly in the defense and aerospace sectors. The trend is shifting towards the development of lightweight, high-performance drones with complex designs, which can be achieved through 3D printing.

b. Some key players operating in the 3D printed drones market include The Boeing Company, AeroVironment, Inc., Parrot Drones SAS, General Atomics, Skydio, Inc., Airbus SE, Flyability SA, Dronamics Global Limited, Lockheed Martin Corporation, Firestorm, Northrop Grumman Systems Corporation, BAE Systems plc, Draganfly Innovations, Inc., Thales Group, Kratos Defense & Security Solutions, Inc.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."