- Home

- »

- Advanced Interior Materials

- »

-

3D Printing Metal Market Size & Share, Industry Report 2030GVR Report cover

![3D Printing Metal Market Size, Share & Trends Report]()

3D Printing Metal Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Titanium, Nickel), By Form (Filament, Powder), By End Use (Aerospace & Defense, Medical & Dental), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-848-0

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Printing Metal Market Summary

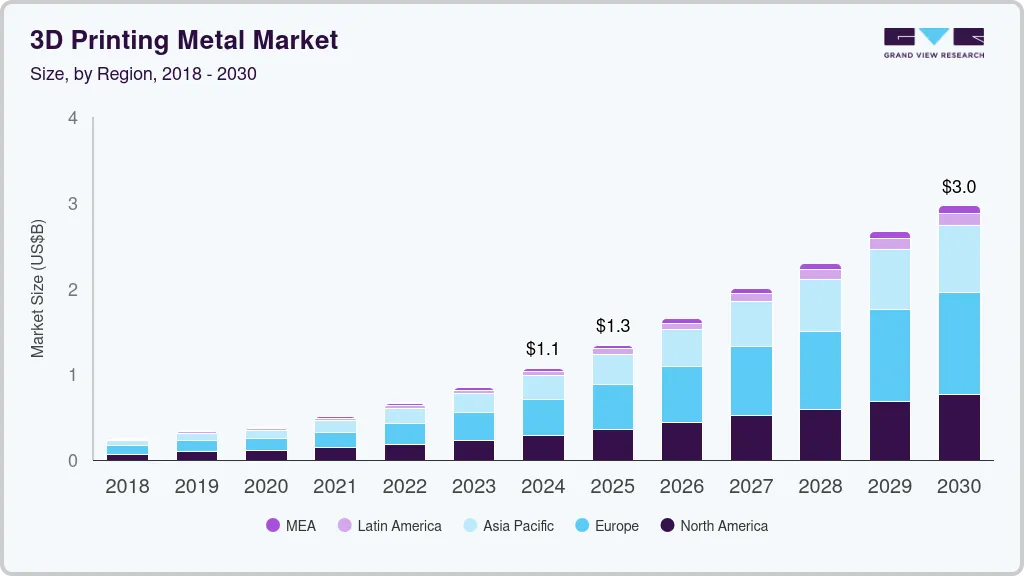

The global 3D printing metal market size was estimated at USD 1,072.9 million in 2024 and is projected to reach USD 2,965.5 million by 2030, growing at a CAGR of 17.3% from 2025 to 2030. The growth is mainly due to continuous innovations in 3D printing technologies and the rising integration of digital manufacturing processes.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2023.

- Country-wise, Spain is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, titanium accounted for a revenue of USD 370.3 million in 2023.

- Titanium is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 1,072.9 Million

- 2030 Projected Market Size: USD 2,965.5 Million

- CAGR (2025-2030): 17.3%

- Europe: Largest market in 2023

Advancements such as improved print speeds, higher resolution, and the development of new metal alloys enhance the quality and functionality of printed parts. In addition, the seamless integration of 3D printing with digital manufacturing tools allows for more efficient design, prototyping, and production processes, reducing costs and lead times. These innovations make metal 3D printing more accessible and practical, fueling widespread adoption across various industries and expanding market size.

Moreover, the shift toward sustainability and the development of high-quality metal alloys are anticipated to accelerate the market expansion. As industries strive for more efficient, eco-friendly production processes, 3D printing offers reduced material waste, energy savings, and the ability to recycle metal powders. The development of advanced, high-performance alloys enhances the capabilities of metal 3D printing, enabling the production of stronger, more durable components. This combination of sustainability and innovation in material science is poised to expand the market across industries.

Product Insights

Based on products, the titanium segment captured the largest share of 44.5% in 2024, fueled by its unique combination of strength, lightweight properties, and high corrosion resistance. These attributes make it ideal for various industries where durability and precision are critical. Titanium’s ability to withstand extreme temperatures and its biocompatibility further enhance its appeal in high-performance applications, especially in creating custom implants and components. As demand for advanced manufacturing solutions grows, titanium's versatile qualities continue to drive its dominance in the 3D printing sector.

The stainless steel segment is expected to emerge as the fastest-growing segment and is projected to grow at a CAGR of 15.8% over the forecast period, driven by its excellent mechanical properties, corrosion resistance, and versatility in various industries. Its widespread application in aerospace, automotive, healthcare, and manufacturing sectors drives demand for stainless steel-based 3D printed parts. As the technology evolves, stainless steel offers cost-effective, high-performance solutions for producing complex geometries, reducing material waste, and accelerating production times.

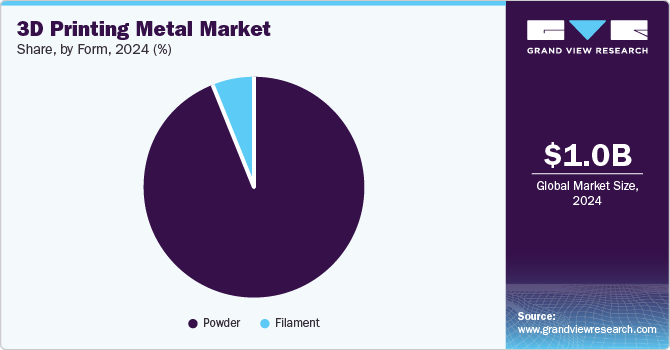

Form Insights

The powder segment held the largest share of 94% in 2024, owing to its superior compatibility with various additive manufacturing techniques, such as Selective Laser Sintering (SLS) and Direct Metal Laser Sintering (DMLS). Metal powders offer high precision, excellent material properties, and the ability to create intricate, lightweight structures. In addition, the availability of a wide range of metal powders, including titanium, aluminum, and stainless steel, enables diverse industrial applications, driving growth. The cost-effectiveness and flexibility of metal powders further enhance their prominence in this rapidly evolving market.

The filament segment is expected to grow at the fastest CAGR of 19.1% over the forecast period, driven by its ease of use, cost-effectiveness, and rapid production capabilities. Filaments are increasingly favored for compatibility with a wide range of 3D printers, offering a simpler alternative to powder-based methods. As technology advances, more metal filaments with improved properties, such as stainless steel, copper, and titanium, are becoming available. This growing material diversity, along with increased accessibility and affordability, is driving substantial demand across industries.

Application Insights

The aerospace and defense segment held the largest share of 43.3% in 2024, propelled by the need for lightweight, durable, high-performance components. 3D printing allows for the creation of complex, customized parts with reduced material waste, making it ideal for applications including aircraft engines, structural elements, and defense systems. The ability to rapidly prototype and produce low-volume, high-quality parts at reduced costs further drives adoption in this sector. Moreover, advancements in metal 3D printing technologies continue to enhance performance, fueling further market expansion in aerospace and defense.

The medical and dental segment is anticipated to expand at a CAGR of 18.4% from 2025 to 2030 due to the surging demand for personalized and complex medical implants, prosthetics, and dental devices. 3D printing enables the production of highly customized solutions that perfectly fit individual patient needs, improving treatment outcomes. Moreover, advancements in biocompatible metal alloys and the rising adoption of additive manufacturing technologies in healthcare are propelling growth. The ability to streamline production and reduce lead times further enhances the appeal of 3D printing in the medical and dental industries.

Regional Insights

Based on region, Europe secured the largest revenue share of 38.5% in 2024, fueled by its strong industrial base, advanced technological infrastructure, and sizable investments in research and development. The robust aerospace, automotive, and healthcare industries in the region have driven demand for metal 3D printing, with countries including Germany, the UK, and France leading in innovation and manufacturing. Europe’s focus on sustainable production and rapid prototyping, coupled with a rising emphasis on digital manufacturing, has further bolstered the adoption of 3D printing technologies, solidifying its dominant position in the market.

North America is set to emerge as the fastest growing region and expand at a CAGR of 15.8% from 2025 to 2030, driven by the adoption of 3D printing for end-use production and growth in healthcare applications. Aerospace and automotive industries are increasingly using 3D printing for manufacturing functional parts, enabling greater customization and design flexibility. Besides, the healthcare sector benefits from metal 3D printing for custom implants, prosthetics, and surgical tools, offering personalized solutions that improve patient outcomes. These trends expand the range of applications and contribute to the surging demand for advanced metal 3D printing technologies across the region.

U.S. 3D Printing Metal Market Trends

The U.S. held a considerable position in the 3D printing metal industry in 2024, spurred by the increased focus on sustainability and the integration of automation and AI. 3D printing reduces material waste compared to traditional manufacturing, contributing to more sustainable production processes. Moreover, automation and AI enhance precision, optimize designs, and improve production efficiency, lowering costs and boosting productivity. These advancements enable industries to produce high-quality, complex parts more efficiently, making 3D printing an attractive option for large-scale, eco-friendly manufacturing, fueling market expansion.

Canada is projected to achieve a significant CAGR over the forecast period, owing to the reduction in material waste through 3D printing. This technology enables precise material usage, minimizing waste and promoting sustainability, which appeals to environmentally conscious manufacturers. In addition, ongoing regulatory and standardization developments are boosting confidence in the industry. As Canada strengthens its framework for 3D-printed metal parts, particularly in aerospace, healthcare, and automotive sectors, it ensures safety, quality, and consistency. These advancements encourage more companies to adopt metal 3D printing, further expanding the market's size and potential.

Europe 3D Printing Metal Market Trends

Furthermore, substantial investments in research and development, early adoption of advanced manufacturing technologies, and a strong industrial ecosystem are accelerating the growth of the 3D printing metal market across Europe. Leading aerospace, automotive, and healthcare industries have embraced 3D metal printing for its ability to produce complex, high-performance components. Countries including Germany, the UK, and France are at the forefront, with a high concentration of innovation-driven companies and a skilled workforce. In addition, supportive government policies and a collaborative environment between businesses and research institutions have further accelerated growth in the region.

The UK is expected to establish a commendable foothold by 2030, fueled by its focus on advanced manufacturing, aerospace, and defense industries. The country’s strong R&D capabilities and governmental support for innovation play a key role in fostering the adoption of 3D printing technologies. The demand for customized, lightweight, high-performance metal parts in the aerospace and automotive sectors is boosting the market. As the UK embraces digital manufacturing and sustainable production practices, its position in the 3D printing metal market is set to expand rapidly in the coming years.

Germany is anticipated to accumulate notable gains by 2030, propelled by emerging supply chain resilience and advancements in R&D for metal alloys. As industries seek to mitigate supply chain disruptions, 3D printing enables on-demand, localized production of critical parts, reducing reliance on global suppliers and enhancing operational flexibility. In addition, continuous research and innovation in new metal alloys are expanding material capabilities, allowing for stronger, more durable, and higher-performing printed components. These factors are accelerating the adoption of metal 3D printing in various industrial sectors, thereby driving market growth.

Asia Pacific 3D Printing Metal Market Trends

Asia Pacific is projected to grow at a significant CAGR over the forecast period, spurred by the emergence of local 3D printing service providers and advancements in manufacturing innovation and customization. Local service providers are making metal 3D printing more accessible to various industries, reducing costs and lead times. Besides, the increasing demand for highly customized and complex parts, especially in aerospace, automotive, and healthcare, is fueling innovation in 3D printing technologies. These factors expand the market as industries embrace cost-effective, tailored solutions for end-use production.

Sustainability and waste reduction, coupled with the escalating use of 3D printing for prototyping and low-volume production, are expected to catalyze China's 3D printing metal market. 3D printing reduces material waste compared to traditional manufacturing methods, aligning with China's environmental goals and fostering sustainable production practices. The demand for rapid prototyping and cost-effective low-volume production in the aerospace, automotive, and healthcare industries is also surging. This trend enables manufacturers to produce complex parts efficiently and at a lower cost, contributing to the growing adoption of metal 3D printing technologies in China.

India is poised to emerge as the fastest growing region over the forecast period due to its rapidly expanding industrial base and increasing adoption of advanced manufacturing technologies. The country’s strong focus on aerospace, automotive, and healthcare sectors and a growing startup ecosystem drive demand for 3D printed metal components. In addition, government initiatives promoting innovation and digital manufacturing are encouraging investment in 3D printing technologies. As India’s manufacturing capabilities and technological infrastructure continue to improve, the metal 3D printing market is expected to experience notable growth.

Key 3D Printing Metal Company Insights

Some of the key companies in the 3D printing metal market include ATI, CNPC Powders, Colibrium Additive (GE Aerospace), CRS Holdings, LLC, GKN Powder Metallurgy, Höganäs AB, INDO-MIM, Kennametal Inc, Materialise NV, OC Oerlikon Management AG, Outokumpu, POLEMA, Powder Alloy Corporation, Rio Tinto Metal Powder, Sandvik, and others.

-

Powder Alloy Corporation specializes in producing high-quality metal powders for 3D printing and additive manufacturing. It offers a range of alloys used in industries such as aerospace, automotive, and medical.

-

Sandvik provides advanced metal powders and additive manufacturing solutions, focusing on delivering high-performance materials and innovative technologies to enhance the efficiency and precision of 3D printing processes.

Key 3D Printing Metal Companies:

The following are the leading companies in the 3D printing metal market. These companies collectively hold the largest market share and dictate industry trends.

- ATI

- CNPC Powders

- Colibrium Additive (GE Aerospace)

- CRS Holdings, LLC.

- GKN Powder Metallurgy

- Höganäs AB

- INDO-MIM

- Materialise NV

- Materialise NV

- OC Oerlikon Management AG

- Outokumpu

- POLEMA

- Powder Alloy Corporation

- Rio Tinto Metal Powder

- Sandvik

Recent Developments

-

In November 2024, 3D Monotech launched the Markforged FX10 in India, the world’s first 3D printer capable of working with metal and advanced composites.

-

In January 2024, Eplus3D introduced a large-format Laser Beam Powder Bed Fusion (PBF-LB) 3D printer, EP-M2050, equipped with up to 64 lasers. The printer has 36 lasers as a standard feature, offering enhanced efficiency and precision for metal 3D printing.

3D Printing Metal Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.3 billion

Revenue forecast in 2030

USD 2.9 billion

Growth rate

CAGR of 17.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in Tons, USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Singapore, South Korea, Brazil

Key companies profiled

ATI, CNPC Powders, Colibrium Additive (GE Aerospace), CRS Holdings, LLC, GKN Powder Metallurgy, Höganäs AB, INDO-MIM, Kennametal Inc, Materialise NV, OC Oerlikon Management AG, Outokumpu, POLEMA, Powder Alloy Corporation, Rio Tinto Metal Powder, and Sandvik

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

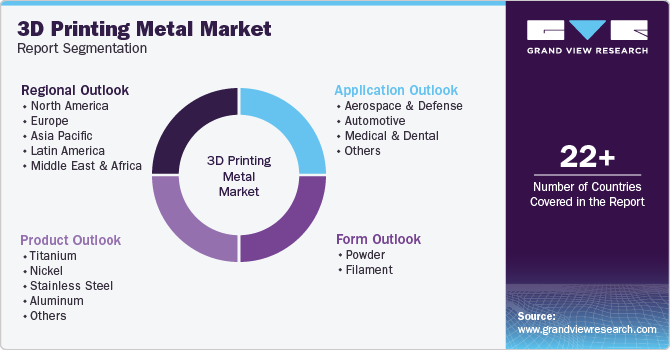

Global 3D Printing Metal Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global 3D printing metal market report on the basis of product, form, application, and region:

-

Product Outlook (Revenue, Tons, USD Million, 2018 - 2030)

-

Titanium

-

Nickel

-

Stainless Steel

-

Aluminum

-

Others

-

-

Form Outlook (Revenue,Tons, USD Million, 2018 - 2030)

-

Powder

-

Filament

-

-

Application Outlook (Revenue,Tons, USD Million, 2018 - 2030)

-

Aerospace & Defense

-

Automotive

-

Medical & Dental

-

Others

-

-

Regional Outlook (Revenue, Tons, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

South Korea

-

-

Latin America

-

Brazil

-

Middle East & Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.