- Home

- »

- Next Generation Technologies

- »

-

3D Food Printing Market Size, Share & Growth Report, 2030GVR Report cover

![3D Food Printing Market Size, Share & Trends Report]()

3D Food Printing Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Technology (Extrusion-based Printing, Binder Printing), By Ingredient (Confectionery, Dough), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-309-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Food Printing Market Summary

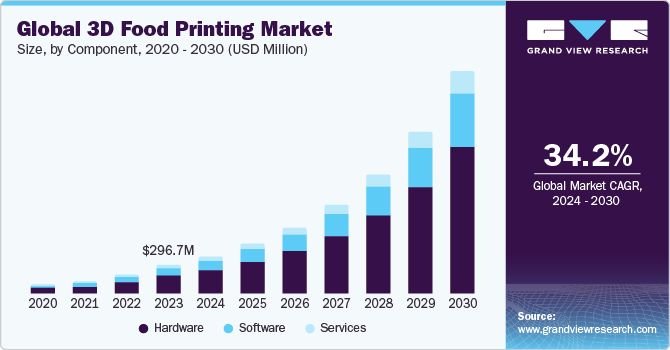

The global 3D food printing market size was estimated at USD 296.7 million in 2023 and is projected to reach USD 2,263.6 million by 2030, growing at a CAGR of 34.2% from 2024 to 2030. The market is an innovative and rapidly growing sector within the broader food technology industry.

Key Market Trends & Insights

- North America asserted its dominance in 2023, capturing the largest revenue share at 33.3%.

- The U.S. market held the largest share, 71.4%, in North America in 2023 and is also anticipated to grow at a significant CAGR from 2024 to 2030.

- Based on component, the hardware segment dominated the target market and accounted for the largest revenue share of 63.2% in 2023.

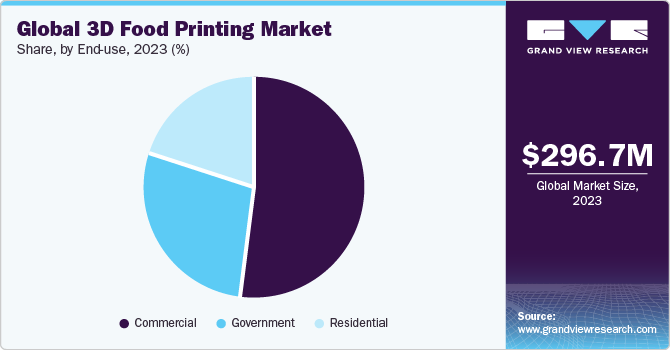

- Based on end use, the commercial segment dominated the target market, accounting for a revenue share of 51.8% in 2023.

- Based on technology, the extrusion-based printing segment dominated the target market, accounting for a revenue share of 62.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 296.7 Million

- 2030 Projected Market Size: USD 2,263.6 Million

- CAGR (2024-2030): 34.2%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In a world where dietary preferences and restrictions are becoming more varied, from gluten-free and vegan diets to low-carb and keto, this printing technology offers a solution that can tailor food items to individual nutritional needs and tastes. This ability to customize food on a personal level not only enhances consumer satisfaction but also allows for precise control over ingredients, which is particularly beneficial for people with specific dietary requirements or allergies. The market is witnessing significant growth due to the increasing demand for personalized nutrition, the rise of sustainable and functional foods, and technological advancements in edibles manufacturing.

Another significant factor fueling the growth of this market is its potential to address global edible waste and sustainability challenges. By enabling on-demand and localized production, 3D food printing can minimize transportation costs, reduce product waste, and ultimately contribute to a more sustainable food ecosystem. Additionally, the technology has captured the interest of the edible service industry, where it can streamline complex plating processes, ensure consistency in presentation, and facilitate the creation of visually appealing and intricate dishes, enhancing the overall dining experience.

Technological advancements in 3D printing are also propelling the target market growth. Innovations in extrusion-based, selective laser sintering, and inkjet printing technologies are expanding the range of ingredients that can be used, from chocolate and dough to proteins and fruits. These advancements not only enhance the versatility of 3D food printing but also improve the quality and consistency of printed edible items. As a result, the applications of 3D food printing are broadening, from gourmet culinary creations and intricate confectionery.

Additionally, the development of multi-material 3D food printers that can incorporate a variety of ingredients, textures, and flavors into a single printed product, resulting in more complex and innovative edible creations, is also acting as a catalyst for market growth. Furthermore, the market is witnessing increased collaboration between edible manufacturers, technology companies, and research institutions, accelerating the development of new materials, techniques, and applications for 3D food printing.

Market Concentration & Characteristics

The 3D food printing market is characterized by its consolidated nature, where a limited number of key players dominate the market landscape. This market structure is shaped by several distinctive features and trends. One prominent characteristic is the high barrier to entry, which is largely due to the significant investment required in research and development. The technology underlying 3D food printing is complex, involving sophisticated software, hardware, and materials science. Companies in this market must continuously innovate to improve printing speed, accuracy, and the range of printable ingredients. This level of technological sophistication necessitates substantial capital and expertise, limiting the entry of new competitors.

The market is also defined by strategic partnerships and collaborations. Established companies often engage in alliances with academic institutions, edible industry giants, and technology firms to leverage shared knowledge and resources. Despite the consolidated nature of the market, there is a growing interest from various industry sectors, including food manufacturers, food service providers, and technology companies, to explore the potential of the target market. This has led to strategic partnerships, collaborations, and acquisitions aimed at expanding product offerings, enhancing technological capabilities, and gaining access to new market segments.

The market places a strong emphasis on innovation and continuous technological advancements. Companies are actively investing in research and development to improve the precision, speed, and versatility of 3D food printers and develop new materials and techniques for printing a wider range of products.

Another key aspect of the market is its focus on intellectual property. Leading companies invest heavily in securing patents and developing proprietary technologies, creating competitive advantages that are difficult for new entrants to overcome. This emphasis on intellectual property maintains the market's consolidated nature, as it protects the technological innovations and business models of established players.

Regulatory frameworks and food safety considerations play a crucial role in shaping the market dynamics. As the technology evolves and finds applications in various sectors, including consumer packaged goods and food service, regulatory bodies are closely monitoring the development and adoption of 3D food printing to ensure compliance with food safety standards and labeling requirements.

Component Insights

The hardware segment dominated the target market and accounted for the largest revenue share of 63.2% in 2023. The hardware segment holds the largest market share in the target market due to several critical factors that underscore its centrality in this technology-driven industry. First and foremost, the hardware components of 3D food printers, including the printer itself, nozzles, and extruders, are fundamental to the functionality and efficiency of the printing process. These components are integral to achieving precision in layering and constructing complex edible structures, which is essential for the market’s applications ranging from high-end culinary arts.

Investment in advanced hardware is substantial, driven by the need for innovation to enhance printing speed, accuracy, and reliability. Manufacturers allocate significant resources to developing and refining these components to meet the diverse requirements of various food products. This continuous investment in hardware development ensures that 3D food printers can handle a wide range of ingredients and produce consistent, high-quality results, thereby making hardware the most capital-intensive.

The software segment is expected to register a significant CAGR from 2024 to 2030. The software is further bifurcated into design software, slicing software, and others. The growth of the software segment can be attributed to its crucial role in enhancing printer functionality, customization, and user experience. Additionally, advanced software enhances the precision and efficiency of the printing process by optimizing print paths and ingredient usage, which is crucial for minimizing waste and improving sustainability. Furthermore, software innovations facilitate the integration of 3D food printers with other digital technologies, such as IoT and AI, enabling real-time monitoring and adjustments for better quality control.

End-use Insights

The commercial segment dominated the target market, accounting for a revenue share of 51.8% in 2023. The commercial segment's dominance in the target market can be attributed to the significant opportunities it presents for product innovation, cost optimization, and operational efficiency. Commercial entities, such as restaurants, bakeries, and catering services, have been early adopters of this technology, leveraging it to create unique and visually appealing edible products that differentiate them from competitors.

3D printing allows for intricate designs and customization, enabling commercial establishments to cater to evolving consumer preferences and demand for personalized experiences. Additionally, technology offers the potential for streamlining production processes, reducing labor costs, and minimizing food waste, contributing to improved profitability and sustainability in commercial operations. Moreover, the commercial segment has been receptive to investing in advanced technologies that provide a competitive edge, driving the adoption of 3D food printing to enhance product offerings and operational efficiencies.

The government segment is expected to grow at a considerable CAGR from 2024 to 2030. The government segment's growth in the market is driven by its potential to address food security, sustainability, and nutritional challenges. Governments recognize the technology's ability to produce food locally, reducing transportation costs and emissions and aligning with sustainable food system initiatives. Additionally, customized, and personalized 3D printed meals can help combat malnutrition in government institutions like schools and hospitals.

The technology's on-demand edible production capability makes it valuable for disaster relief and emergencies with disrupted supply chains. Moreover, government-funded research institutions and space agencies are exploring 3D food printing's applications in space exploration missions to provide fresh, nutritious meals for astronauts during extended space travel. For example, NASA is exploring its options for 3D food printing for long-duration space missions.

Technology Insights

The extrusion-based printing segment dominated the target market, accounting for a revenue share of 62.4% in 2023, and is expected to maintain its dominance over the forecast period. Extrusion-based printing technology is known for its relatively low cost compared to other 3D edible printing processes. This technology works by depositing edible materials layer by layer through a nozzle, which can accommodate different textures and consistencies, from purees and doughs to pastes and gels. Its adaptability to various edible substrates makes it suitable for creating complex shapes and structures, essential for both high-end culinary applications and mass-produced edible products.

The cost-effectiveness of extrusion-based printers compared to other 3D printing technologies also contributes to their widespread adoption. The extrusion-based printers are generally simpler in design and less expensive to produce and maintain, making them accessible to a broader range of users, from large edible manufacturers to small businesses and research institutions. Furthermore, extrusion-based technology is well-established and continuously being refined, leading to improvements in print speed, accuracy, and the quality of printed edible items.

This technology is expected to maintain its dominance due to ongoing advancements and its alignment with industry needs. As the demand for customized and functional edible grows, extrusion-based printing offers a scalable and efficient solution. Innovations in nozzle design, multi-material printing, and the integration of sensors for real-time monitoring are enhancing its capabilities, ensuring it remains the preferred choice in the evolving market.

Ingredients Insights

The confectionery segment dominated the target market, accounting for a revenue share of 43.2% in 2023. The confectionery segment's dominance in the 3D food printing ingredient market can be attributed to several factors. Firstly, confectionery ingredients like chocolate, candy, and icings possess unique properties that make them well-suited for 3D printing. Their ability to solidify and maintain shape after extrusion allows for the creation of intricate and visually appealing designs. Secondly, the confectionery industry has been at the forefront of adopting 3D printing technology, recognizing its potential for customization, novelty, and artistic expression in confectionery products.

The technology enables precise control over shapes, textures, and flavors, catering to personalized preferences and unique treat creation. Moreover, confectionery ingredients' relatively low melting points and thermoplastic behavior facilitate the 3D printing process, making them compatible with most commercially available 3D food printers.

The meat segment is expected to grow at the fastest CAGR over the forecast period from 2024-2030. This can be attributed to the rising demand for personalized and customized meat products that cater to diverse dietary needs and preferences, which 3D printing technology can address through precise control over ingredients, textures, and shapes. Additionally, the technology's potential to enhance sustainability and reduce waste in meat production aligns with the industry's efforts towards more eco-friendly practices. The emergence of alternative protein sources like plant-based and cultured meats, which often require precise structuring and texturizing achievable through 3D printing, is also driving adoption in this segment. Furthermore, continued advancements in 3D printing materials and techniques specifically tailored for meat products will likely enable more realistic and appealing 3D-printed meat alternatives, further accelerating growth in this segment driven by consumer demand for personalization, sustainability concerns, and the rise of innovative protein sources.

Regional Insights

North America asserted its dominance in 2023, capturing the largest revenue share at 33.3%. This dominance can be attributed to robust technological infrastructure and a highly developed research and development ecosystem, facilitating innovation and advancement in 3D printing technology. Additionally, North America is home to a significant number of leading 3D printing companies and research institutions, driving the adoption and commercialization of 3D food printing solutions. Furthermore, supportive regulatory frameworks and a culture of entrepreneurship encourage investment and experimentation in emerging technologies, further consolidating North America's position as a global leader in the market.

The U.S. 3D Food Printing Market Trends

The U.S. marketheld the largest share, 71.4%, in North America in 2023 and is also anticipated to grow at a significant CAGR from 2024 to 2030. The U.S. leads in the North America market due to its advanced technological infrastructure, strong investment in research and development, and thriving target industry. The country's established ecosystem of innovative companies and research institutions drives continuous advancements in 3D printing technology. Additionally, a supportive regulatory environment and a large consumer base receptive to personalized and sustainable food solutions contribute to the market's growth. The U.S. also benefits from a culture of entrepreneurship and a history of pioneering innovation, further solidifying its position as the dominant player in the North America market.

Asia Pacific 3D Food Printing Market Trends

Asia Pacific is expected to record the fastest CAGR of 35.0% in the market over the forecast period. Asia-Pacific is poised to be the fastest-growing region in the market due to several factors. Firstly, rapid urbanization and increasing disposable incomes in countries like China, India, and Japan are driving demand for innovative food solutions, including personalized and functional foods enabled by 3D printing technology. Moreover, a growing awareness of sustainability and environmental concerns in the region is fueling interest in alternative edible production methods, such as 3D printing, which can minimize waste and resource consumption. Additionally, Asia-Pacific's burgeoning tech-savvy population and strong manufacturing capabilities provide fertile ground for the development and adoption of 3D food printing technology.

The 3D food printing market in China is experiencing significant growth, attributed to several key factors. Firstly, increasing consumer demand for personalized nutrition and innovative food solutions is fueling interest in 3D edible printing technology. This trend aligns with a broader shift towards health-consciousness and customized dietary preferences. Secondly, government support for technological innovation, including investments in research and development and infrastructure, is creating an enabling environment for the industry's growth. China's large and diverse edible market presents significant opportunities for the adoption of 3D food printing, as consumers seek novel meal experiences and products. Additionally, the presence of a robust manufacturing ecosystem, including skilled labor and established supply chains, provides a solid foundation for industry development. Local companies can produce 3D printers, materials, and software, reducing dependence on imports and driving domestic innovation.

Europe 3D Food Printing Market Trends

The adoption of 3D food printing in Europe is on the rise, driven by several key factors. Europe is anticipated to experience substantial growth in the market owing to its advanced technological infrastructure, strong research and development sector, and supportive regulatory environment. With a culture of innovation and sustainability, European countries are increasingly investing in emerging food technologies like 3D printing to address evolving consumer preferences and environmental concerns. Additionally, the region's diverse culinary landscape and emphasis on premium edible products present ample opportunities for the adoption of customized and artisanal 3D printed foods.

The UK 3D food printing market can be attributed to its strong technological infrastructure, growing interest in food innovation, and emphasis on sustainability. With a discerning consumer base and a thriving food industry, there is an increasing demand for customizable and environmentally friendly food solutions.

Key 3D Food Printing Company Insights

Some of the key companies operating in the market include BeeHex, 3D Systems Inc., among others.

-

BeeHex, a NASA spin-off company, originated from a project to develop a 3D Food Printer system for astronauts on long-duration space missions. Founded in 2016, BeeHex identified new applications of 3D Food Printing for the bakery industry and commercialized the core technology. With a vision to lead the edible automation industry, BeeHex aims to automate food production, personalization, and packaging, making food accessible and affordable globally. The company specializes in innovative solutions for the edible processing industry, utilizing 3D Food Printing, Robotics, artificial intelligence (AI), and machine vision.

-

3D Systems, Inc. is a comprehensive 3D printing and digital manufacturing solutions provider based in the U.S. The company offers a range of products and services, including 3D printers for both plastics and metals, software solutions for design and production optimization, on-demand manufacturing services, and digital design tools. With a global presence, 3D Systems operates through multiple offices and facilities across North America, Latin America, Europe, the Middle East & Africa, and Asia Pacific regions. The company's offerings cater to various industries, including automotive, aerospace, healthcare, consumer goods, and more.

Natural Machines, and Changxing Shiyin Technology Co., Ltd. are some of the emerging market companies in the target market.

-

Natural Machines specializes in 3D food printing, offering personalized solutions tailored to the pharmaceutical, personal care, and food industries, with a primary focus on wellness. Leveraging cutting-edge technology, they empower clients to create custom food formulations optimized for individual needs. With a track record of over 50 accolades and recognitions, including their recognition as a top emerging health and wellness startup, they have demonstrated dedication to innovation and excellence in 3D food printing. Their strategic focus revolves around delivering customized food solutions for dysphagia patients, ensuring texture, viscosity, and appearance meet specific requirements. While their online presence highlights imaginative food prints, they also engage with larger market clients directly or through partners, offering tailored 3D food printing solutions.

-

Changxing Shiyin Technology Co., Ltd. is a leading innovator in the 3D food printing industry. It is known for integrating advanced 3D printing technology into kitchen environments with its flagship product, the Foodbot 3D Food Printer. This printer can create intricate 3D models using a variety of ingredients, such as chocolate and sugar glaze, offering a revolutionary approach to food preparation, with a strong foundation in the Laboratory of Zhejiang University and a team of expert researchers. The company focuses on 3D food printing, ensuring continuous innovation and long-term industry leadership. The Foodbot printer is acclaimed for its high-quality performance, user-friendly operation, and versatility. At the same time, the company's dedicated support team provides reliable assistance to ensure optimal printer performance and customer satisfaction.

Key 3D Food Printing Companies:

The following are the leading companies in the 3D food printing market. These companies collectively hold the largest market share and dictate industry trends.

- BeeHex

- byFlow B.V.

- Natural Machines

- TNO

- Systems And Materials Research Corporation (SMRC)

- Choc Edge

- 3D Systems, Inc.

- Procusini

- Revo Foods

- Mucusini

- FELIXprinters

- Savoureat Ltd

- 3D Food Srl

- Redefine Meat Ltd.

- Changxing Shiyin Technology Co., Ltd.

- Cocuus

Recent Developments

-

In January 2024, Cocuus announced its plans to produce 1,000 tonnes of 3D-printed plant-based bacon in 2024 at its newly opened facility in Northern Spain, pioneering industrial-scale production for retail distribution. The company has introduced its plant-based bacon in 400 Carrefour supermarkets and plans to expand production to include vegan tuna and shrimp.

-

In September 2023, SavorEat Ltd. and Sodexo launched the first 3D-printing robot for plant-based burgers at the University of Denver two years after announcing their partnership in 2021. This collaboration aims to expand Sodexo’s plant-based offerings and reduce its carbon footprint, aligning with its commitment to make 42% of its college and university plant-based by 2025.

-

In February 2022, FELIXprinters launched a new line of 3D food printers designed to revolutionize food preparation and presentation. These printers can create intricate designs with various edible materials, including chocolate and avocado, improving kitchen efficiency and addressing issues like food waste and swallowing difficulties. With options for single or dual print heads, these printers offer versatile and creative solutions for both commercial and industrial kitchens.

3D Food Printing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 388.4 million

Revenue forecast in 2030

USD 2,263.6 million

Growth rate

CAGR of 34.2% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, ingredient, end-use, region

Regional scope

North America, Europe, Asia Pacific, South America, Middle East & Africa (MEA)

Country scope

U.S.; Canada; UK; Germany; France; Spain; China; Japan; India; South Korea; Australia; Brazil

Key companies profiled

BeeHex; byFlow B.V.; Natural Machines; TNO; Choc Edge; 3D Systems, Inc.; Procusini; Revo Foods; Mucusini; FELIXprinters; Savoureat Ltd.; 3D Food Srl; Redefine Meat Ltd.; Changxing Shiyin Technology Co.; Ltd.; Cocuus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Food Printing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global 3D food printing market report based on component, technology, ingredient, end-use, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Design Software

-

Slicing Software

-

Others

-

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Extrusion-based Printing

-

Binder Printing

-

Selective Laser Sintering

-

Inkjet Printing

-

-

Ingredient Outlook (Revenue, USD Million, 2017 - 2030)

-

Confectionary

-

Dough

-

Dairy product

-

Fruits and Vegetables

-

Meat

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Government

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global 3D food printing market size was estimated at USD 296.7 million in 2023 and is expected to reach USD 388.4 million in 2024.

b. The global 3D food printing market is expected to grow at a compound annual growth rate of 34.2% from 2024 to 2030 to reach USD 2.26 billion by 2030.

b. North America dominated the 3D food printing market with a share of over 33.3% in 2023. This is attributable to the technology-savvy population, and early adoption of technology in the region.

b. Some key players operating in the 3D food printing market include BeeHex, byFlow B.V., Natural Machines, TNO, Choc Edge, 3D Systems, Inc., Procusini, Revo Foods, Mucusini, FELIXprinters, Savoureat Ltd., 3D Food Srl, Redefine Meat Ltd., Changxing Shiyin Technology Co., Ltd., and Cocuus.

b. Key factors driving market growth include personalization of food based on dietary needs and preferences, and potential application in space exploration and disaster relief.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.