3D Display Market Size, Share & Trends Analysis Report By Product (Volumetric Display, Stereoscopic Display), By Technology Type, By Access Method, By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-003-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

3D Display Market Size & Trends

The global 3D display market size was estimated at USD 144.54 billion in 2024 and is anticipated to grow at a CAGR of 19.3% from 2025 to 2030, mainly due to the increasing adoption of 3D technologies in entertainment and gaming sectors. With the growing popularity of virtual reality (VR), augmented reality (AR), and gaming, there has been a significant push for 3D displays to provide more immersive experiences. Consumers are increasingly seeking higher-quality visual experiences, which are facilitated by 3D displays that deliver more lifelike and engaging content.

In addition to entertainment, the healthcare industry is also contributing to the market's growth. The use of 3D displays for medical imaging, surgical planning, and training simulations is gaining traction. These displays enable more accurate and detailed visualization of medical data, aiding in better decision-making for healthcare professionals. This trend is expected to continue as the healthcare sector increasingly invests in advanced technologies. For instance, in March 2025, VividQ, a U.K.-based display technology provider, introduced a groundbreaking 3D holographic gaming experience by making the iconic Call of Duty franchise playable in holographic form. The company ported Call of Duty: Modern Warfare II to its hologram-compatible format, showcasing impressive advancements in image quality, frame rate (FPS), and the cutting-edge holographic hardware display platform. This innovation marks a significant milestone in the gaming industry, allowing players to experience games in lifelike 3D holograms.

Moreover, traditional flat displays are increasingly being replaced by 3D signage, which draws more attention and captivates customers in ways that static or 2D images cannot. 3D displays offer depth, movement, and dynamic visuals that stand out, making them highly effective in grabbing the attention of passersby. They have become a powerful tool in retail windows and in-store displays to showcase products in an innovative and visually stunning way. For example, a 3D display can make a shoe appear as if it is floating in mid-air or allow a piece of clothing to be shown from multiple angles, giving customers a more interactive and realistic view of the product.

Product Insights

The stereoscopic display segment dominated the market and accounted for the revenue share of nearly 60.0% in 2024, due to the increasing demand for immersive experiences, particularly in entertainment and gaming. The appeal of stereoscopic displays lies in their ability to create a more lifelike and three-dimensional visual experience, which is particularly important in applications such as virtual reality (VR), augmented reality (AR), and 3D gaming.

The holographic display segment is expected to grow at a significant CAGR of 22.6% over the forecast period. Recent advancements in holographic display technologies, particularly those incorporating micro-electromechanical systems (MEMS) and liquid crystal displays (LCDs), have significantly enhanced their capabilities and applications. These developments have led to more affordable and compact systems, broadening the integration of holographic displays across various sectors.

Technology Type Insights

The LED segment accounted for the largest revenue share of over 71.0% in 2024 due to the global emphasis on energy efficiency and sustainability. LEDs are known for their low power consumption and long lifespan compared to traditional incandescent and fluorescent lighting options. As governments and organizations worldwide implement stricter energy efficiency regulations and focus on reducing carbon footprints, the demand for LEDs has surged.

The OLED segment is expected to grow at a significant CAGR over the forecast period. OLED technology is increasingly being adopted in consumer electronics, particularly in high-end televisions, smartphones, and wearables. Major television brands like LG and Samsung have incorporated OLED panels into their premium TV lines, capitalizing on the demand for superior viewing experiences.

Access Method Insights

The screen-based display segment accounted for the largest revenue share of over 63.0% in 2024. The demand for larger, higher-resolution screens is a key factor fueling the growth of the screen-based display segment. With the rise of 4K and 8K televisions, as well as the increasing use of large-format screens for digital signage and public displays, consumers and businesses are investing in larger, high-definition screens to enhance visual experiences

The micro display segment is expected to grow at a significant CAGR over the forecast period. As demand for wearable and portable devices grows, there is a need for smaller and lighter displays. Micro displays, with their compact size, are ideal for use in applications like AR glasses and head-mounted displays (HMDs) in VR. These displays must be integrated into lightweight and user-friendly systems, and the access methods for micro displays have to be tailored to allow for easy manipulation of 3D content.

Application Insights

The TV segment accounted for a largest revenue share of over 70.0% in 2024. The success of 3D movies in cinemas, combined with the increasing availability of 3D content in streaming platforms and gaming, is fueling demand for 3D TVs. Streaming services, Blu-ray formats, and gaming consoles are expanding their support for stereoscopic 3D content, encouraging consumers to invest in compatible display technologies.

The HMD segment is expected to grow at a significant CAGR over the forecast period, driven by increasing adoption across industries such as gaming, healthcare, education, and industrial applications. With advancements in augmented reality (AR), virtual reality (VR), and mixed reality (MR), the demand for high-quality, immersive 3D visuals has surged. Consumers and businesses alike are seeking more realistic and engaging experiences, fueling the development of cutting-edge HMDs equipped with high-resolution 3D displays.

End-use Insights

The consumer electronics segment accounted for a largest revenue share of over 56.0% in 2024. Rising disposable incomes and consumer willingness to invest in premium entertainment systems are boosting the demand for 3D-enabled smartphones, tablets, and smart TVs. As content creators and streaming platforms develop more 3D-compatible media, the ecosystem supporting 3D display technology continues to expand, reinforcing its presence in the consumer electronics market.

The automotive segment is expected to grow at a significant CAGR over the forecast period, driven by increasing demand for advanced visualization technologies in vehicle infotainment, driver assistance systems, and head-up displays (HUDs). As the automotive industry shifts towards connected and autonomous vehicles, the need for enhanced in-car experiences and real-time 3D visualization has become a priority. Automakers are integrating 3D displays into dashboards, digital instrument clusters, and HUDs to provide drivers with more intuitive, immersive, and safer ways to interact with their vehicles.

Regional Insights

The 3D display market in North America held a significant share of over 27.0% in 2024, driven by the region’s strong presence of leading technology firms investing in advanced display solutions. The rising adoption of 3D displays in gaming, entertainment, and defense applications, coupled with increasing demand for AR/VR technologies in industrial and training sectors, is fueling market expansion. Additionally, government support for research in next-generation display technologies is encouraging innovation and commercialization.

U.S. 3D Display Market Trends

The 3D display market in the U.S. is expected to grow significantly at a CAGR of 17.6% from 2025 to 2030 propelled by the booming gaming and entertainment industries, with Hollywood studios and streaming platforms actively investing in 3D content. The strong presence of medical device manufacturers utilizing 3D imaging for diagnostics and surgery further accelerates demand.

Europe 3D Display Market Trends

The 3D display industry in Europe is anticipated to register a considerable growth from 2025 to 2030, driven by advancements in automotive applications, where automakers are integrating 3D dashboards and HUDs to enhance driving experiences. The region’s push toward digital transformation in education and healthcare, with the adoption of 3D visualization tools for remote learning and medical imaging, is further boosting demand.

The U.K. 3D display market is expected to grow rapidly in the coming years due to the increasing adoption in the retail sector, where brands are using holographic displays to enhance customer engagement. The country’s strong R&D ecosystem, supported by universities and innovation hubs, is accelerating the development of next-gen 3D display solutions.

3D display market in Germany held a substantial market share in 2024, fueled by the strong presence of automotive and industrial technology firms leveraging 3D visualization for prototyping and design. The country’s focus on Industry 4.0 is driving demand for advanced 3D displays in manufacturing and engineering applications. Additionally, the adoption of 3D surgical navigation systems in the healthcare sector is playing a crucial role in market growth.

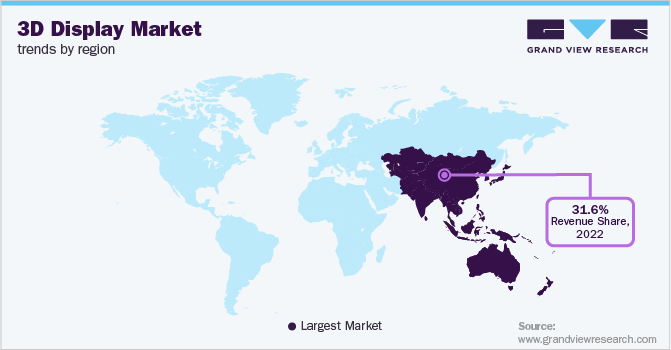

Asia Pacific 3D Display Market Trends

Asia Pacific is growing significantly at a CAGR of 23.4% from 2025 to 2030, due to increasing consumer demand for high-tech electronics, including 3D smartphones, TVs, and gaming devices. The expansion of smart cities and digital signage applications in commercial and public spaces is also driving adoption. Moreover, government initiatives promoting technological advancements in education and healthcare are supporting the integration of 3D display technologies.

The Japan 3D display market is expected to grow rapidly in the coming years, driven by the country’s dominance in consumer electronics manufacturing, with local brands actively developing 3D-enabled devices for mass-market adoption. The integration of 3D displays in e-commerce and virtual shopping experiences is another key driver, as retailers leverage holographic and AR-based displays to enhance online and in-store interactions. The growing investment in metaverse-related technologies is further fueling demand

3D display market in China held a substantial market share in 2024. Japan's 3D display market benefits from the country's strong focus on innovation in display technologies, particularly in gaming, automotive, and healthcare applications. The presence of leading electronics manufacturers continuously developing high-resolution 3D screens is accelerating market growth. Moreover, Japan’s growing robotics industry is integrating 3D visualization for enhanced human-machine interaction, boosting demand across industrial and service sectors.

Key 3D Display Company Insights

Key players operating in the 3D display industry are SAMSUNG, LG DISPLAY CO., LTD., Sony Corporation, and Panasonic Corporation. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, SAMSUNG introduced the Odyssey 3D, a gaming monitor that delivers a glasses-free 3D experience. Utilizing light field display (LFD) technology, the monitor transforms 2D content into immersive 3D visuals through a lenticular lens integrated into the front panel. To enhance depth perception and user experience, the Odyssey 3D features Eye Tracking, which monitors eye movements via a built-in stereo camera, and View Mapping, which adjusts images in real-time. This innovation offers lifelike visuals without the need for additional accessories.

-

In May 2024, LG DISPLAY CO., LTD introduced a range of next-generation OLED and advanced display technologies, including the OLEDoS for smartwatches. This 1.3-inch display features an impressive 4K resolution, ensuring sharp and detailed visuals even on a compact screen. Additionally, it incorporates glasses-free 3D technology, known as light field technology, which creates holographic-like effects for an enhanced viewing experience.

Key 3D Display Companies:

The following are the leading companies in the 3D display market. These companies collectively hold the largest market share and dictate industry trends.

- AUO Corporation

- BOE Technology Group Co., Ltd.

- Himax Technologies, Inc.

- Innolux Corporation

- Konica Minolta, Inc.

- Leia Inc.

- LG Electronics

- Light Field Lab, Inc.,

- Mitsubishi Electric Corporation

- Panasonic Holdings Corporation

- SAMSUNG

- SHARP CORPORATION

- Sony Corporation

- TCL

- TOSHIBA CORPORATION

3D Display Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 171.19 billion |

|

Revenue forecast in 2030 |

USD 413.13 billion |

|

Growth rate |

CAGR of 19.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report services |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology type, access method, application, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa |

|

Key companies profiled |

AUO Corporation; BOE Technology Group Co., Ltd.; Himax Technologies, Inc.; Innolux Corporation; Konica Minolta, Inc.; Leia Inc.; LG DISPLAY CO.; Light Field Lab, Inc.; Mitsubishi Electric Corporation; Panasonic Holdings Corporation; SAMSUNG; SHARP CORPORATION; Sony Corporation; TCL; TOSHIBA CORPORATION |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global 3D Display Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D display market report based on product, technology type, access method, application, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Volumetric Display

-

Stereoscopic Display

-

Holographic Display

-

-

Technology Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

DLP

-

PDP

-

OLED

-

LED

-

-

Access Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Micro Display

-

Screen-based Display

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

TV

-

Smartphones

-

Monitor

-

Mobile Computing Devices

-

Projectors

-

Head Mounted Display (HMD)

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Medical

-

Aerospace & Defense

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global 3D display market size was estimated at USD 144.54 billion in 2024 and is expected to reach USD 171.19 billion by 2025.

b. The global 3D display market is expected to grow at a compound annual growth rate of 19.3% from 2025 to 2030 to reach USD 413.13 billion by 2030.

b. The stereoscopic display segment dominated the market and accounted for the revenue share of nearly 60.0% in 2024 due the increasing demand for immersive experiences, particularly in entertainment and gaming.

b. Some key players operating in the 3D display market include AUO Corporation, BOE Technology Group Co., Ltd., Himax Technologies, Inc., Innolux Corporation, Konica Minolta, Inc., Leia Inc., LG DISPLAY CO., Light Field Lab, Inc., Mitsubishi Electric Corporation, Panasonic Holdings Corporation, SAMSUNG, SHARP CORPORATION, Sony Corporation, TCL, TOSHIBA CORPORATION

b. Key factors driving the 3D display market growth include the increasing adoption of 3D technologies in the entertainment and gaming sectors. With the growing popularity of virtual reality (VR), augmented reality (AR), and gaming, there has been a significant push for 3D displays to provide more immersive experiences.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."