- Home

- »

- Next Generation Technologies

- »

-

3D Camera Market Size And Share, Industry Report, 2033GVR Report cover

![3D Camera Market Size, Share & Trends Report]()

3D Camera Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Stereo Vision, Time Of Flight, Structured Light), By Application (3D Imaging, 3D Scanning & Modeling, Robotics & Automation), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-263-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Camera Market Summary

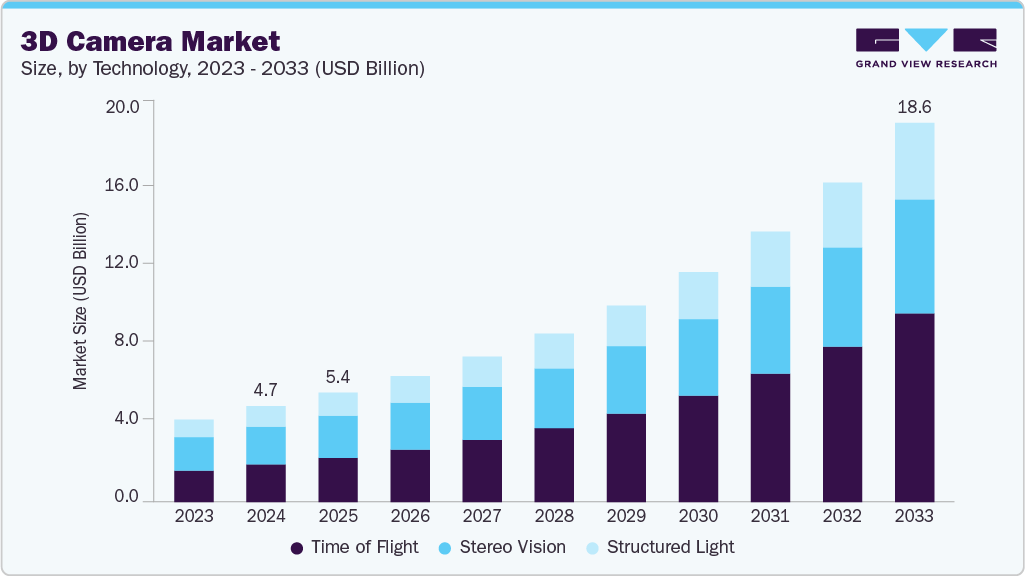

The global 3D camera market size was estimated at USD 4,689.9 million in 2024 and is projected to reach USD 18,557.8 million by 2033, growing at a CAGR of 16.8% from 2025 to 2033. The market growth is primarily driven by the increasing integration of 3D cameras in consumer electronics, particularly smartphones.

Key Market Trends & Insights

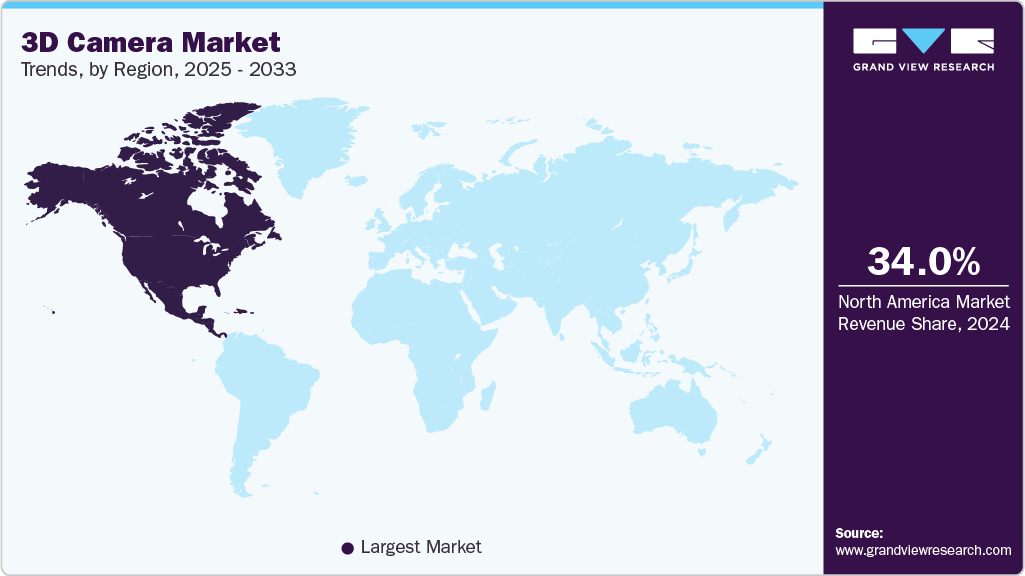

- The 3D camera market in North America accounted for the largest revenue share of 34% in 2024.

- The U.S. 3D camera market is anticipated to grow at a CAGR of 14% from 2025 to 2033, owing to government initiatives in the country.

- Based on technology, the stereo vision segment had the largest revenue share, over 39%, in 2024.

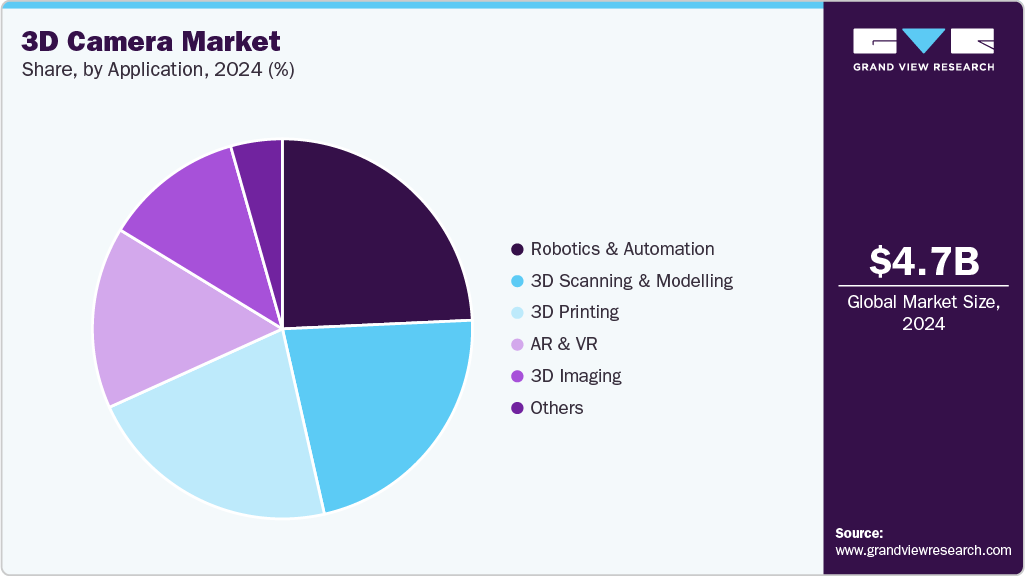

- Based on application, the 3D imaging segment held the highest revenue share of over 24% in 2024.

- Based on end use, the consumer electronics segment had the highest market share, over 27%, in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,689.9 Million

- 2033 Projected Market Size: USD 18,557.8 Million

- CAGR (2025-2033): 16.8%

- North America: Largest market in 2024

Additionally, manufacturers are adopting advanced 3D imaging technologies to enable facial recognition, enhance photography, and support immersive AR and VR experiences, especially in entertainment and gaming. The demand for 3D cameras surges across various sectors, including home security, military applications, and industrial settings, further accelerating its global uptake. The film and television industries also increasingly leverage these cameras to produce compelling 3D content. This broad-based adoption and continuous enhancement in functionality are poised to significantly fuel the market’s growth in the coming years.Additionally, the growing popularity of 3D content has become a major driver for the expansion of the 3D camera industry. Technological advances have captured consumer interest in immersive experiences, offering enhanced depth and realism. This trend is visible across entertainment, gaming, education, and virtual reality, where 3D content is rapidly gaining traction. Companies are investing heavily in 3D technologies to meet evolving consumer expectations and stay competitive, which in turn is driving further demand in the 3D camera space.

Additionally, the entertainment industry has significantly contributed to the growth of the 3D camera industry. Many movies and television shows are now produced in 3D, driving up the demand for specialized 3D cameras from studios and production companies. For example, movies such as Gravity, Avatar: The Way of Water, Avatar, and Jurassic World, among others, have achieved huge commercial success largely due to their innovative use of 3D technology. Similarly, television shows like The Mandalorian and Game of Thrones have utilized 3D technology to create stunning visual effects and immersive worlds.

Furthermore, implementing 3D cameras in the automotive sector for autonomous driving, advanced driver assistance systems (ADAS), and in-cabin monitoring to ensure a safe and risk-free driving experience significantly boosts the 3D camera industry's growth. Technological advancements in 3D imaging and AI integration are also boosting the adoption of 3D cameras. The inclination toward smart and connected vehicles further accelerates market growth.

Technology Insights

The stereo vision segment dominated the market with a market share of over 39% in 2024, driven primarily by its extensive use in industrial and manufacturing settings for quality control and inspection tasks and applications in surveillance and security systems. This technology mimics human binocular vision by using two or more lenses to capture depth information accurately, making it invaluable for robotics, autonomous vehicles, and augmented reality (AR). Additionally, the availability of cost-effective and compact stereo vision camera solutions has further fueled their demand across various industries.

The time-of-flight segment is expected to grow at the fastest CAGR of over 19% from 2025 to 2033, driven by the growing application of 3D cameras in autonomous vehicles and smart devices for accurate distance mapping and object detection to improve the user interface and enhance safety. Moreover, recent advancements have brought forth the development of more compact and energy-efficient ToF sensors, enhancing their integration into portable devices, thereby driving the segment growth.

Application Insights

The 3D imaging segment dominated the market in 2024, driven by the increasing demand for immersive and interactive experiences in entertainment and gaming. Moreover, the integration of 3D imaging in smartphones and consumer electronics is making the technology more accessible to a broader audience, and the segment’s application across security, surveillance, and industrial automation is expanding the use cases for 3D imaging, thereby driving the segment's growth.

The augmented reality (AR) & virtual reality (VR) segment is estimated to register the fastest growth rate from 2025 to 2033. The growth is attributed to the aggressive integration of 3D imaging in smartphones and other consumer electronics, which is making AR and VR technologies more accessible to a broader audience. The innovations in 3D camera technology, such as the development of cameras that can capture 3D data in a single exposure, are making integrating AR and VR systems more efficient and cost-effective, thereby augmenting the segment growth.

End Use Insights

The consumer electronics segment accounted for the largest market share in 2024. The segment growth is attributed to the growing demand for high-quality imaging and interactive experiences. The rising popularity of social media platforms that utilize 3D imaging for content creation further drives the integration of 3D cameras in consumer electronics. In addition, recent technological advancements have made 3D cameras more compact and energy-efficient, increasing their adoption in portable devices.

The healthcare and life sciences segment is anticipated to expand at the fastest CAGR from 2025 to 2033. This growth can be attributed to the growing adoption of 3D cameras to enhance diagnostic capabilities and surgical precision. In diagnostics, 3D cameras facilitate accurate and detailed internal imaging, which helps in the early detection and assessment of diseases by providing a clearer view of the body's internal structures. Such developments will contribute to the segmental growth in the coming years.

Regional Insights

The North America 3D camera market accounted for the largest revenue share, over 34%, in 2024. This market was fueled by integrating advanced 3D cameras into consumer electronics such as smartphones and gaming consoles, with major companies driving innovation. Entertainment, healthcare, automotive, and industrial applications support the demand. The rise of augmented reality (AR) and virtual reality (VR) technologies also boosts market expansion. Strategic partnerships between camera manufacturers and software developers enhance product capabilities and market reach.

U.S. 3D Camera Market Trends

The U.S. 3D camera market dominated with a share of over 82% in 2024, propelled by the entertainment industry, healthcare advancements, and automotive applications. The growing innovations in imaging technology and AI integration for enhanced depth perception and object recognition are accelerating market growth. The U.S. market benefits from substantial R&D investments and the adoption of 3D cameras in consumer devices and industrial automation.

Europe 3D Camera Market Trends

The Europe 3D camera market accounted for over 24% in 2024, owing to the increasing adoption of 3D printing technologies in manufacturing and industrial sectors. The region focuses on technological innovation and automation, with applications expanding in automotive, healthcare, and entertainment. Integrating AI and machine vision enhances the market, which is supported by strong industrial infrastructure and regulatory frameworks promoting advanced manufacturing.

The Germany 3D camera market is expected to grow significantly in the coming years, driven by the automotive and manufacturing industries. The country's emphasis on Industry 4.0 and automation increases demand for 3D vision systems for quality control, robotics, and smart factory applications. Technological innovation and government support for digital transformation contribute to steady market expansion.

The UK 3D camera market is rapidly expanding, driven primarily by the entertainment and media sectors. The demand for 3D content and immersive experiences in gaming and film production fuels growth. The UK also benefits from technological advancements and increased adoption of AR/VR applications, promoting 3D camera integration in various consumer and professional devices.

Asia Pacific 3D Camera Market Trends

The Asia Pacific 3D camera market is expected to grow at a significant CAGR of over 18% from 2025 to 2033, driven by rapid growth in consumer electronics, especially smartphones, and expanding applications in gaming, healthcare, automotive, and industrial sectors. The region benefits from advancements in imaging technology, rising demand for 3D content, and increasing use of VR and AR. Strong manufacturing capabilities and growing industrialization in developing countries further accelerate market growth.

The China 3D camera market is expanding rapidly, supported by heavy investment in entertainment, VR, and 3D movie production. The country’s focus on technological innovation in robotics, automotive, and AI-powered imaging solutions drives demand. Growth is also fueled by the large consumer electronics market and government initiatives promoting digital technologies.

The Japan 3D camera market is rapidly expanding, owing to its strong emphasis on technological innovation, particularly in robotics and automotive industries where 3D vision is critical. The demand for high-precision 3D cameras in manufacturing and healthcare supports steady expansion. Japan also benefits from advancements in sensor technologies and the integration of AI in imaging systems.

Key 3D Camera Company Insights

Some of the key players operating in the market are Canon, Inc., NIKON CORPORATION, Sony Corporation, and Eastman Kodak Company.

-

Canon, Inc. is a multinational corporation that manufactures imaging and optical products, including cameras, photocopiers, camcorders, computer printers, and medical equipment. The company has categorized its business into four units, namely the Printing Business Unit, the Medical Business Unit, the Imaging Business Unit, and the Industrial Business Unit. The company has undergone a strategic transformation over the past decade, shifting its portfolio beyond traditional cameras and office equipment to focus on growth areas like semiconductor lithography and network cameras.

-

Sony Corporation is a major multinational conglomerate known for its consumer and professional electronics, including advanced imaging sensors and 3D cameras. It holds a significant share of the 3D camera market, leveraging its expertise in digital imaging and sensor technology to supply high-resolution depth-sensing cameras for various applications. Sony’s innovation-driven approach and broad product portfolio make it a mature and influential player in the 3D camera industry.

Matterport, Inc. and Giraffe360 Limited are some of the emerging market participants in the 3D camera market.

-

Matterport, Inc., is an innovative company specializing in 3D spatial data capture technology. It provides 3D cameras and software solutions primarily for real estate, architecture, and construction sectors. The company recently enhanced the durability and functionality of its Pro3 camera, strengthening its position as an emerging player in the 3D camera market. Matterport focuses on enabling immersive virtual tours and accurate 3D modeling, driving adoption of 3D imaging in commercial and consumer markets.

-

Giraffe360 Limited is an emerging technology company that offers high-definition virtual tours and precise floor plans, mainly to the real estate industry. By combining 3D imaging with advanced software, Giraffe360 aims to revolutionize property marketing and visualization. Though smaller and more niche compared to mature players, it is gaining recognition for its innovative contributions to the expanding 3D camera and virtual tour market.

Key 3D Camera Companies:

The following are the leading companies in the 3D camera market. These companies collectively hold the largest market share and dictate industry trends.

- Canon Inc.

- Cognex Corporation

- Eastman Kodak Company

- FARO Technologies, Inc.

- FUJIFILM Holdings Corporation

- Giraffe360 Limited

- Intel Corporation

- Leica Geosystems AG (Hexagon AB)

- Luxonis Holding Corporation

- Matterport, Inc.

- NIKON CORPORATION

- Olympus Corporation of the Americas (Olympus Corporation)

- Orbbec 3D Technology International, Inc.

- Panasonic Holdings Corporation

- Ricoh Company, Ltd.

- Samsung Electronics Co., Ltd.

- SICK AG

- Sony Corporation

- Stereolabs Inc.

- XRPro LLC (Structure)

- Teledyne Technologies Incorporated

- Basler AG

- Zivid AS

Recent Developments

-

In January 2025, Sony Corporation announced the launch of XYN, an integrated software and hardware solution designed to support the creation of spatial content by accurately capturing real-world objects, human motion, and backgrounds to recreate them in virtual environments for 3D computer graphics (CG) production.

-

In April 2024, Cognex Corporation introduced the In-Sight L38 3D Vision System, which integrates AI with both 2D and 3D vision technologies to address various inspection and measurement needs. The system generates unique projection images that merge 3D data into a straightforward 2D format for easier labeling and training, while also highlighting features that conventional 2D imaging cannot detect.

-

In March 2024, Matterport, Inc. introduced upgrades to the case and packaging of its Pro3 camera, aiming to improve the sustainability and functionality of its 3D cameras. The new carrying case design envisaged simplifying camera transportation, minimizing packaging for more efficient shipping by channel partners, and reducing both costs and environmental impact of distributing the Pro3 cameras.

3D Camera Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,363.8 million

Revenue forecast in 2033

USD 18,557.8 million

Growth rate

CAGR of 16.8% from 2025 to 2033

Base year of estimation

2024

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East; Africa

Country scope

U.S.; Canada; Germany; Mexico; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Canon Inc.; Cognex Corporation; Eastman Kodak Company; FARO Technologies, Inc.; FUJIFILM Holdings Corporation; Giraffe360 Limited; Intel Corporation; Leica Geosystems AG (Hexagon AB); Luxonis Holding Corporation; Matterport, Inc.; NIKON CORPORATION; Olympus Corporation of the Americas (Olympus Corporation); Orbbec 3D Technology International, Inc.; Panasonic Holdings Corporation; Ricoh Company, Ltd.; Samsung Electronics Co., Ltd.; SICK AG; Sony Corporation; Stereolabs Inc.; XRPro LLC (Structure); Teledyne Technologies Incorporated; Basler AG; Zivid AS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global 3D Camera Market Report Segmentation

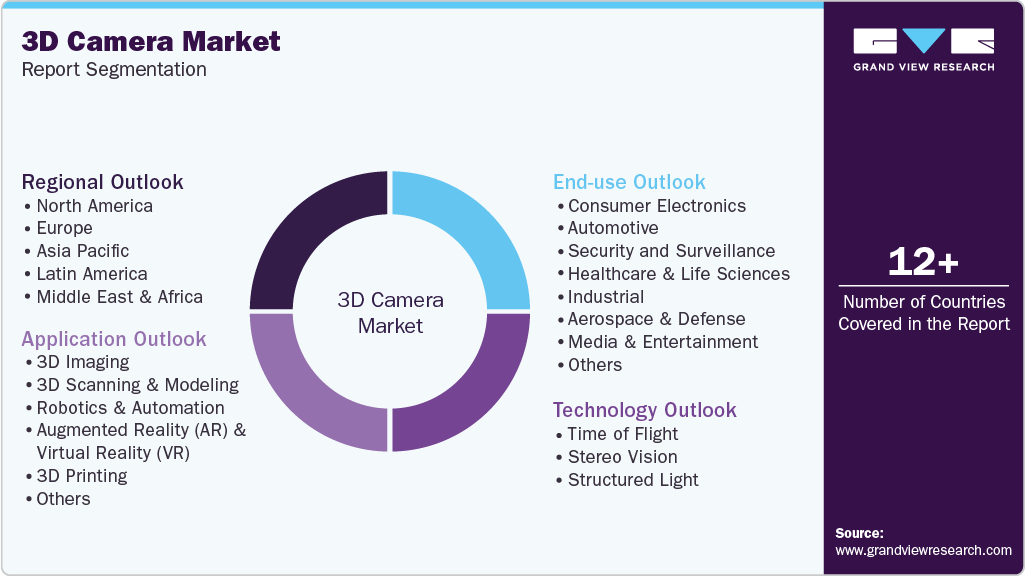

This report forecasts and estimates revenue growth at the global, regional, and country levels along with analyzing the latest market trends and opportunities in each one of the sub-segments from 2021 to 2033. For this study, Grand View Research has further segmented the global 3D camera market report based on technology, application, end use, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Time of Flight

-

Stereo Vision

-

Structured Light

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

3D Imaging

-

3D Scanning & Modeling

-

Robotics & Automation

-

Augmented Reality (AR) & Virtual Reality (VR)

-

3D Printing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Automotive

-

Security and Surveillance

-

Healthcare & Life Sciences

-

Industrial

-

Aerospace & Defense

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global 3D camera size was estimated at USD 4.69 billion in 2024 and is expected to reach USD 5.36 billion in 2025.

b. The global 3D camera is expected to grow at a compounded growth rate of 16.8% from 2025 to 2033 to reach USD 18.56 billion by 2033.

b. Key factors that are driving the market growth include are increasing demand for 3D content in entertainment and media is a major driving force. With the rising popularity of 3D movies, virtual reality (VR) experiences, and augmented reality (AR) applications, there is a growing need for high-quality 3D cameras that can capture and create immersive content.

b. Stereo vision dominated the market with a share of over 39% in 2024. Stereo vision cameras are often used in industrial and manufacturing settings for quality control and inspection tasks, as well as in surveillance and security systems.

b. Some key players operating in white 3D camera market are Sony Corporation, Canon Inc., Samsung Electronics Co., Ltd., LG Electronics, NIKON CORPORATION, Panasonic Corporation, GoPro, Inc., FUJIFILM Corporation, Eastman Kodak Company, Orbbec 3D Technology International, Inc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.