- Home

- »

- Electronic Devices

- »

-

360-Degree Camera Market Size And Share Report 2030GVR Report cover

![360-degree Camera Market Size, Share & Trends Report]()

360-degree Camera Market (2024 - 2030) Size, Share & Trends Analysis Report By Connectivity, By Resolution, By Product, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-359-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

360-degree Camera Market Summary

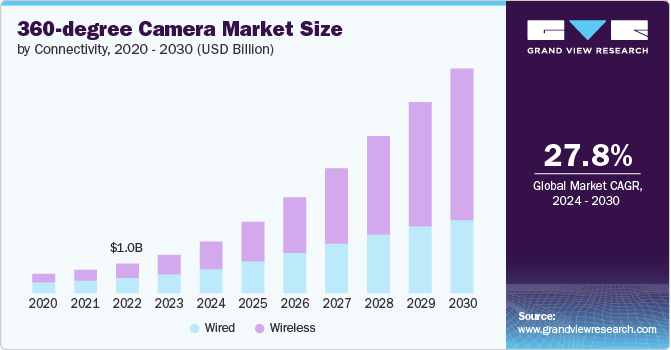

The global 360-degree camera market size was estimated at USD 1,381.4 million in 2023 and is projected to reach USD 8,133.6 million by 2030, growing at a CAGR of 27.8% from 2024 to 2030. The increasing incidences of security breaches and threats in various public, commercial, and residential spaces are fueling the demand of 360-degree cameras.

Key Market Trends & Insights

- North America dominated the 360-degree camera market with the largest revenue share of 36.14% in 2023.

- The 360-degree camera market in U.S. is projected to grow at the fastest CAGR of 25% from 2024 to 2030.

- Based on connectivity, the wireless segment led the market with the largest revenue share of 51.02% in 2023.

- Based on resolution, the ultrahigh-definition segment led the market with the largest revenue share of 64.85% in 2023.

- By product, the single product segment led the market with the largest revenue share of 51.23% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1,381.4 Million

- 2030 Projected Market Size: USD 8,133.6 Million

- CAGR (2024-2030): 27.8%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

These cameras are being integrated with advanced technologies to enhance surveillance capabilities, improving efficiency and functionality in monitoring wide-open areas such as warehouses, parking lots, and retail locations, which is expected to further fuel the market expansion. The automotive industry is experiencing a surge in the adoption of 360-degree cameras, driven by the growing consumer demand for improved driving experiences. These cameras provide comprehensive views around vehicles, significantly reducing blind spots and aiding in parking and maneuvering. The integration of 360-degree cameras with advanced driver assistance systems (ADAS) and autonomous driving technologies is further boosting the market demand of 360-degree cameras. In addition, rising consumer expectations for high-tech, convenient, and safer driving experiences are propelling market growth.

The integration of 360-degree cameras with drone technology has revolutionized various industries such as agriculture, construction, environmental monitoring, and more by providing unique aerial perspectives and enhancing data collection capabilities. By combining 360-degree cameras with drones, industries can capture comprehensive visual data from all angles, enabling detailed analysis and decision-making. This trend has gained significant traction due to the numerous benefits it offers in these sectors.

The demand for 360-degree cameras with high-resolution imaging capabilities is increasing owing to the need for clear and detailed visuals across various applications. Improved image quality enhances the overall viewing experience and enables better analysis of captured footage. 360-degree cameras are being widely adopted in the tourism and hospitality industry to provide virtual tours and immersive experiences for potential customers. Hotels, resorts, and travel agencies are leveraging these cameras to showcase their offerings in a captivating way.

The rising prevalence of virtual and augmented reality technologies in video games, social networking platforms, and interactive entertainment is driving the demand for 360-degree cameras. These cameras play a crucial role in capturing immersive content that enhances user experiences in VR/AR environments, enabling more realistic and engaging gaming experiences, fostering stronger social connections through interactive content, and revolutionizing the entertainment industry by creating captivating, immersive experiences, which is further expected to drive the adoption of 360-degree cameras.

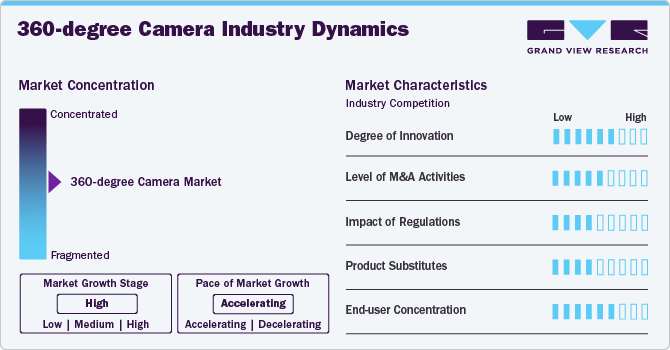

Market Concentration & Characteristics

The market is characterized by a high degree of innovation, driven by continuous advancements in technology and the expanding applications of these cameras. Manufacturers are constantly improving image quality, with the availability of models capable of capturing ultra-high definition (UHD) content up to 16K resolution, catering to the needs of professional content creators.These innovations are driving increased adoption across various industries, including entertainment, surveillance, and virtual reality.

The level of mergers & acquisition activities in the market is expected to be moderate. Companies operating in this sector are engaging in M&A activities to expand their product offerings, acquire new technologies, and strengthen their competitive positions. There is an increasing number of start-ups and smaller players entering the market with new products and solutions. This has led to a moderate level of merger and acquisition (M&A) activities as larger players seek to acquire innovative technologies and expand their market presence.

The impact of regulations on the market is expected to be low to moderate. While there are no specific regulations directly targeting this market, companies must comply with general standards and data protection regulations. For instance, manufacturers must ensure that their devices meet safety standards established by organizations like the FCC (Federal Communications Commission) in the U.S. or the CE (Conformité Européene) mark in Europe.

The competition from product substitutes in the market is expected to be low to moderate. Product substitutes for 360-degree cameras include traditional cameras, smartphones with high-quality cameras, and drones with panoramic or spherical imaging capabilities. These alternatives may offer competitive features at lower prices or integrated solutions for consumers who do not require a dedicated 360-degree camera. However, the unique value proposition offered by 360-degree cameras - capturing immersive experiences for VR/AR applications - differentiates them from conventional alternatives solutions.

Connectivity Insights

Based on connectivity, the wireless segment led the market with the largest revenue share of 51.02% in 2023. This growth can be attributed to the growing demand for convenience, flexibility, and mobility across consumer, and commercial applications. Wireless connectivity eliminates the need for physical connections, enabling cameras to be placed in hard-to-reach or moving locations. The ability to instantly share and stream 360-degree content over wireless networks is a key advantage, particularly for live events, social media, and remote collaboration. Wireless 360-degree cameras are also more suitable for applications where running cables is impractical or costly.

The wired segment is expected to grow at the fastest CAGR from 2024 to 2030. Wired 360-degree cameras provide a reliable, low-latency connection for high-resolution video transmission, making them suitable for professional applications such as broadcast, cinema, and security where uninterrupted, high-quality footage is critical. The ability to power the camera directly through the cable is another advantage of wired connectivity, eliminating the need for batteries and enabling continuous operation, which is driving the adoption of wired connectivity 360-degree cameras.

Resolution Insights

Based on resolution, the ultrahigh-definition segment led the market with the largest revenue share of 64.85% in 2023. This growth can be attributed to the increasing adoption of 360-degree Camera technologies by critical infrastructure facilities, government agencies, and military organizations to protect against unauthorized drone activities. In addition, advancements in detection and mitigation technologies, including radar systems, RF sensors, jamming devices, and drone capture mechanisms, are expected to drive the segmental growth.

The high-definition segment is anticipated to witness at a significant CAGR from 2024 to 2030, owing to the growing popularity of virtual reality, augmented reality, and other immersive media experiences. This has increased demand for 360-degree content in UHD resolutions like 4K, 4.7K, and 8K. Furthermore, the improvements in image sensors, processors, and compression technologies have enabled the development of more affordable and practical high-definition 360-degree cameras, thereby driving segmental growth.

Product Insights

The single product segment led the market with the largest revenue share of 51.23% in 2023. Personal 360-degree cameras are becoming more affordable and accessible to mainstream consumers, which is driving the adoption of personal 360-degree cameras, especially in the consumer and travel/tourism verticals. In addition, these cameras offer better image quality with higher resolutions, better low-light performance, and advanced stabilization. This makes the content more engaging and immersive, which is further driving the segmental growth.

The professional segment is anticipated to grow at the fastest CAGR from 2024 to 2030. There is a growing demand for high-quality 360-degree content, especially in UHD resolutions, for professional applications such as virtual events, remote collaboration, and immersive entertainment. In addition, professional 360-degree cameras are increasingly being deployed in enterprise and commercial settings such as virtual events, remote training, security, and monitoring, which is further boosting the market growth.

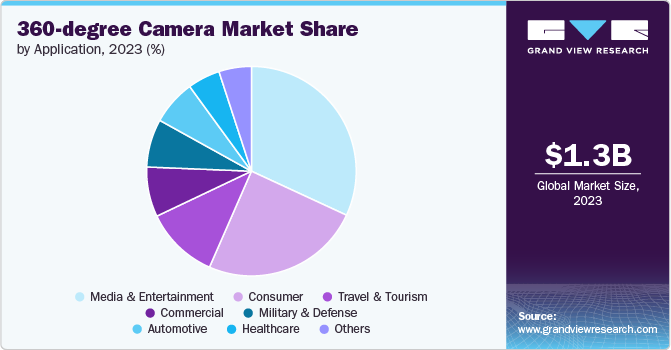

Application Insights

Based on application, the media & entertainment segment led the market with the largest revenue share of 31.82% in 2023. The growing popularity of platforms such as Facebook, YouTube, and Instagram has driven demand for 360-degree cameras among consumers to create and share immersive, panoramic videos. Additionally, the integration of 360-degree cameras with smartphones and other mobile devices has made the technology more accessible and user-friendly for consumers, which has revolutionized the landscape of the media & entertainment industry. This allows consumers to easily capture, edit, and share 360-degree content directly from their smartphones, thereby driving segmental growth.

The automotive segment is anticipated to grow at the fastest CAGR from 2024 to 2030. 360-degree cameras have become a crucial technology in modern vehicles, offering enhanced safety and convenience features. These cameras provide drivers with a complete view of their surroundings, helping them navigate tight spaces, park more easily, and avoid collisions. Continuous advancements in camera technology, such as higher resolution sensors, improved image processing algorithms, and integration with other vehicle systems, such as parking assist and collision avoidance systems, are making 360-degree cameras more effective and reliable, which is further driving segmental growth.

Regional Insights

North America dominated the 360-degree camera market with the largest revenue share of 36.14% in 2023. The high willingness of North American consumers to embrace new and innovative technologies is a major driver for the market growth. The growing popularity of VR/AR and the demand for immersive content creation are fueling this trend. In addition, the rise in security incidents and the need for comprehensive monitoring have led to greater adoption of 360-degree cameras in commercial, public, and residential settings across North America.

U.S. 360-degree Camera Market Trends

The 360-degree camera market in U.S. is projected to grow at the fastest CAGR of 25% from 2024 to 2030. The market is seeing the introduction of more affordable and user-friendly 360-degree cameras targeted at the consumer segment, particularly among travelers, vloggers, and content creators, which is expected to further fuel the market expansion in U.S.

Europe 360-degree Camera Market Trends

The 360-degree camera market in Europe is anticipated to grow at the fastest CAGR of 26% from 2024 to 2030. This growth is driven by the growing popularity of virtual reality (VR) and augmented reality (AR) applications in gaming, entertainment, and various industries is a major driver for the market growth in Europe.

The UK 360-degree camera market is anticipated to grow at a substantial CAGR from 2024 to 2030. The rise of social media platforms and the need for engaging and visually appealing content have led to increased adoption of 360-degree cameras among content creators, vloggers, and media professionals in the UK.

The 360-degree camera market in Germany is expected to grow at a significant CAGR from 2024 to 2030. The integration of 360-degree cameras with drone Product and their use in various applications, such as construction, agriculture, and infrastructure monitoring, are emerging trends in Germany.

The France 360-degree camera market is projected to grow at a substantial CAGR from 2024 to 2030. The need for comprehensive monitoring and surveillance in commercial, public, and residential settings is driving the adoption of 360-degree cameras in France.

Asia Pacific 360-degree Camera Market Trends

The 360-degree camera market in the Asia-Pacific region is expected to grow at the fastest CAGR of 30% from 2024 to 2030. Social media platforms such as Facebook and YouTube support 360-degree videos, enabling users to create and share immersive content easily. This trend has fueled the demand for 360-degree cameras among content creators, influencers, and social media enthusiasts in the region.

The China 360-degree camera market is projected to grow at a significant CAGR from 2024 to 2030.The e-commerce boom in China has created opportunities for businesses to showcase their products through interactive 360-degree images and videos. E-commerce platforms are leveraging this Product to enhance the shopping experience for consumers, thereby driving the demand for 360-degree cameras.

The 360-degree camera market in Japan is expected to grow at a substantial CAGR from 2024 to 2030. The increasing adoption of consumer drones globally has led to a surge in the demand for 360-degree Camera systems to mitigate potential threats posed by unauthorized drone activities.

The India 360-degree camera market is expected to grow at the fastest CAGR from 2024 to 2030. The tourism sector in India is increasingly using 360-degree videos to promote destinations and attract travelers. Tour operators, hotels, and travel agencies are investing in immersive content creation to offer virtual tours and experiences, leading to an increased adoption of 360-degree cameras in the country.

Middle East and Africa 360-degree Camera Market Trends

The 360-degree camera market in Middle East and Africa is expected to grow at the fastest CAGR of over 31% from 2024 to 2030. The demand for immersive content creation is a significant driver in the MEA region. As consumers and businesses seek to create engaging and interactive content for various applications such as virtual tours, gaming, and sports broadcasting, the need for 360-degree cameras is growing.

The Saudi Arabia 360-degree camera market is anticipated to grow at a significant CAGR from 2024 to 2030. The market is driven by the increasing adoption of advanced imaging technologies across various industries and the rising demand for immersive content creation.

Key 360-degree Camera Company Insights

Some of the key players operating in the market include GoPro, Insta360, Samsung Electronics, among others.

-

GoPro specializes in the design and manufacture of action cameras and related accessories. The company has been at the forefront of the action camera industry for years, and it has leveraged its expertise to expand into the 360-degree camera segment.The company's 360-degree camera models, such as the GoPro Fusion and GoPro MAX, are known for their high-quality image and video capture, durability, and ease of use

-

Insta360 designs and produces a range of high-performance 360-degree cameras, including the popular Insta360 One X, Insta360 One R, and Insta360 X3 models. The company's cameras are known for their advanced features like 4.7K video resolution, FlowState stabilization, and AI-powered editing tools that make 360-degree content creation accessible.In addition to cameras, Insta360 also offers a suite of accessories like selfie sticks, tripods, and mobile apps to enhance the 360-degree video experience

360fly, YI Camera Technology, are some of the emerging market participants in the global market.

-

360fly is a specialized 360-degree camera manufacturer based in the U.S. The company is known for its innovative and user-friendly 360-degree camera models that cater to both professional and consumer markets. The company creates unique, 360 degree digital products that inspire users to capture, share and experience life’s greatest moments in 360 degrees

-

YI Camera Technology offers affordable and feature-rich 360-degree cameras that target a wider consumer base by leveraging its expertise in imaging technologies. The company leverages its expertise in imaging technologies to develop innovative 360-degree camera products that cater to a wide Resolution of consumers. YI Camera Technology’s 360-degree camera models are equipped with advanced features such as high-resolution image capture, seamless stitching, and easy-to-use mobile apps for content sharing

Key 360-degree Camera Companies:

The following are the leading companies in the 360-degree camera market. These companies collectively hold the largest market share and dictate industry trends.

- 360fly

- Digital Domain Productions

- GoPro

- Insta360 (Arashi Vision Inc.)

- Kodak

- LG Electronics

- Nikon Corporation

- PANONO (Professional 360GmbH)

- Ricoh

- Samsung Electronics

- Xiaomi

- YI Camera Technology

Recent Developments

-

In April 2024, Insta360 launched the new X4 360-degree action camera, which features several key upgrades over the previous modeI such as 8K video recording capability, AI-powered gesture control, larger touchscreen display, and longer battery life. Overall, this announcement highlights Insta360's commitment to iterating and improving their 360-degree camera lineup to meet the evolving needs of the market

-

In January 2023, Insta360 attached two of their X2 360-degree action cameras to a satellite and launched it 500km into space. This is the first time a 360-degree camera has ever reached space. The satellite is programmed to orbit the Earth for 2 years, capturing incredible 360-degree views of the stars, Milky Way, and our planet

-

In January 2022, Ricoh announced the launch of the RICOH THETA X, the latest advanced model in their RICOH THETA series of 360-degree cameras. The product represents an evolution of Ricoh's 360-degree camera lineup, adding a high-resolution sensor, touchscreen interface, and expanded power/storage options. These enhancements are aimed at improving the camera's performance and usability, particularly in business and professional settings where the THETA series is widely adopted

360-degree Camera Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,862.71 million

Revenue forecast in 2030

USD 8,133.6 million

Growth rate

CAGR of 27.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report deployment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Connectivity,resolution, product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

360fly; Digital Domain Productions; GoPro; Insta360 (Arashi Vision Inc.); Kodak; LG Electronics; Nikon Corporation; PANONO (Professional 360GmbH); Ricoh; Samsung Electronics; Xiaomi; YI Camera Technology

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 360-Degree Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 360-degree camera market report based on connectivity, resolution, product, application, and region:

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Wired

-

Wireless

-

-

Resolution Outlook (Revenue, USD Million, 2018 - 2030)

-

High-Definition

-

Ultra-High-Definition

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Single

-

Professional

-

Infotainment

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer

-

Travel & Tourism

-

Commercial

-

Media & Entertainment

-

Automotive

-

Military & Defense

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Australia

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global 360-degree camera market size was estimated at USD 1,381.4 million in 2023 and is expected to reach USD 1,862.7 million in 2024.

b. The global 360-degree camera market is expected to grow at a compound annual growth rate of 27.8% from 2024 to 2030 to reach USD 8,133.6 million by 2030.

b. North America dominated the 360-degree camera market with a share of around 36% in 2023. The rise in security incidents and the need for comprehensive monitoring have led to greater adoption of 360-degree cameras in commercial, public, and residential settings across North America.

b. Some key players operating in the 360-degree camera market include 360fly, Digital Domain Productions, GoPro, Insta360 (Arashi Vision Inc.), Kodak, LG Electronics, Nikon Corporation, PANONO (Professional 360GmbH), Ricoh, Samsung Electronics, Xiaomi, YI Camera Technology.

b. Key factors that are driving the 360-degree camera market growth include the increasing incidences of security breaches and threats in various public, commercial, and residential spaces and integration of 360-degree cameras with drone technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.