- Home

- »

- Organic Chemicals

- »

-

2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market 2030GVR Report cover

![2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market Size, Share & Trend Report]()

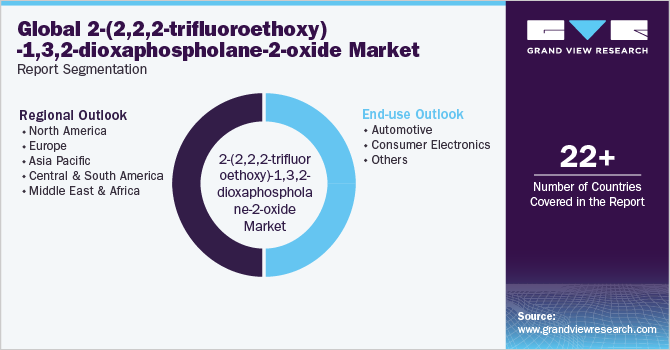

2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market Size, Share & Trend Analysis Report By End Use (Automotive, Consumer Electronics) By Region (North America, Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-126-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

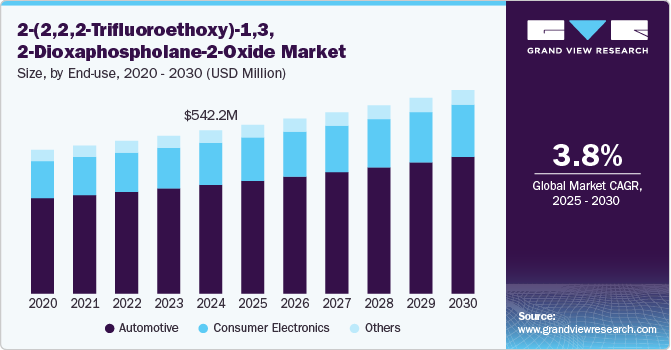

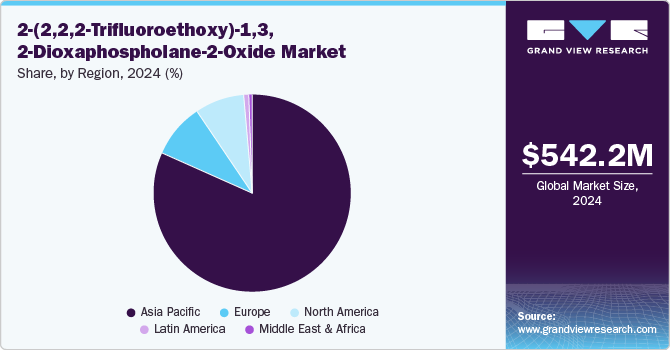

The global 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide market size was estimated at USD 542.16 million in 2024 and is projected to grow at a CAGR of 3.8% from 2025 to 2030. The rising demand for lithium-ion batteries in the automotive and electronics industries is a key market driver. The compound 2-(2,2,2-trifluoromethoxy)-1,3,2-dioxaphospholane 2-oxide is primarily used as a flame-retardant electrolyte in lithium-ion batteries, which power electric vehicles and various electronic devices. As electric vehicles (EVs) and portable electronic devices continue to develop rapidly, a strong global demand exists for high-performance energy storage solutions. Lithium-ion batteries are increasingly favored in portable consumer electronics due to their high operating voltages and energy densities, leveraging organic electrolytes to store energy efficiently.

The growth of the industry in the U.S. is primarily driven by the rising adoption of electric vehicles and the government's strict regulations to control greenhouse gas (GHG) emissions. Furthermore, as electric car sales continue to surge, the demand for lithium-ion batteries in the automotive industry in the U.S. is expected to increase significantly throughout the forecast period.

Electronic chemicals are high-purity materials and substances that are utilized during various stages of the electronics manufacturing process, including cleaning, manufacturing, doping, polishing, etching, and servicing of integrated circuits (ICs), semiconductors, and printed circuit boards (PCBs).

Key factors driving the electronics chemicals market include the rapid evolution of consumer electronics, increasing demand for advanced semiconductor devices, and the growing adoption of technologies like 5G, Internet of Things (IoT), and Artificial Intelligence (AI). As electronic components become smaller and more complex, the demand for high-purity chemicals (including electronic electrolytes), precision cleaning agents, photoresists, etchants, and other specialized substances continues to rise. Moreover, the Asia Pacific region holds a significant share of the overall electronics chemicals market due to the presence of major electronics manufacturers in countries such as China, Japan, South Korea, and Taiwan.

Drivers, Opportunities & Restraints

2-(2,2,2-trifluoroethoxy)-1,3,2-dioxaphospholane 2-oxide is majorly used as a flame-retardant electrolyte in lithium-ion batteries, which are further used in electric vehicles and other electronic devices. With the rapid development of electric vehicles and wearable and portable electronic devices, high-performance energy storage devices are witnessing ever-increasing global demand. Due to their high operating voltages and energy densities, lithium-ion batteries are increasingly used in portable consumer electronics as they utilize organic electrolytes to store energy. The demand for electric vehicles is increasing in emerging economies as these vehicles are the key to decarbonizing the road transportation sector, which accounts for over 15% of the global energy-related emissions as per the International Energy Association (IEA). In recent years, the global electric vehicles industry has witnessed a surge in the sales of these vehicles owing to the easy availability of their wide range of models and their improved performance. There has been increasing popularity of passenger electric cars globally and according to the International Energy Association (IEA), approximately 18% of cars sold globally in 2023 are expected to be electric.

2-(2,2,2-trifluoroethoxy)-1,3,2-dioxaphospholane 2-oxide market is a niche market due to difficulty in procuring raw materials required for producing 2-(2,2,2-trifluoroethoxy)-1,3,2-dioxaphospholane 2-oxide. The major raw materials used for manufacturing it is 2-Chloro-1,3,2-dioxaphospholane-2-oxide and 2,2,2-trifluoroethanol. There are very few players present in the market that supply these raw materials, thereby creating a high raw material supply risk for its manufacturers.

Moreover, the high cost of 2-(2,2,2-trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide may be a restraint for some potential buyers as it is costlier than other electrolytes used in the manufacturing of electric vehicle batteries. This is due to the specialized nature of this compound, which acts as a flame-retardant chemical electrolyte, as well as its limited supply in the market.

As lithium-ion batteries are also used for energy storage applications, such as in grid-scale energy storage systems and residential energy storage systems, the surge in demand for renewable energy sources is expected to fuel the consumption of these systems. This acts as an opportunity for lithium-ion battery manufacturers, thereby increasing the demand for 2-(2,2,2-trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide in the market.

End Use Insights

The automotive segment accounted for the largest revenue share of 66.7%, in 2024 and is expected to continue to dominate the industry over the forecast period. The global automotive industry is a major consumer of lithium-ion batteries, primarily for use in electric vehicles (EVs). As the demand for electric vehicles increases, so does the need for lithium-ion batteries installed in these automobiles, leading to a corresponding rise in battery sales.

The solvent is utilized in manufacturing lithium-ion batteries, commonly found in consumer electronics such as smartphones, laptops, and tablets. It plays a crucial role in developing high-performance batteries by enhancing their stability and performance. Additionally, the product has other applications in industries such as aerospace, marine, and healthcare devices.

Specifically, 2-(2,2,2-trifluoromethoxy)-1,3,2-dioxaphospholane-2-oxide significantly improves the stability and performance of lithium-ion batteries, making them an essential component for a variety of industries. In the aerospace sector, lithium-ion batteries power various equipment, including spacecraft, satellites, and drones.

Regional Insights

The growth of the 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market in North America is driven by the increasing adoption of electric vehicles wherein they are used, along with the presence of stringent regulations implemented by the governments of different countries of the region to control greenhouse gas (GHG) emissions. As 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide for lithium-ion batteries is extensively used in lithium-ion batteries driving the market in the region. Additionally, with the surging sales of electric vehicles, the demand for lithium-ion batteries in the automotive industry of North America is expected to increase significantly during the forecast period.

The U.S. 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide market held over 92.5% revenue share of the overall North America 2-(22-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide market. The increasing adoption of electric vehicles and electronic devices are anticipated to propel the growth of lithium-ion battery market in the region during the forecast period.

Europe America 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market

The 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide in Europe is expected to experience significant growth in the coming years owing to the increasing adoption of electric vehicles in the region. This trend is anticipated to provide a substantial boost to the growth of the lithium-ion battery industry in Europe. There has been a surge in the proliferation of different vehicle types worldwide with varying degrees of electrification and hybridization, including hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), and electric vehicles (EVs).

Asia Pacific 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market

The demand for 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide in Asia Pacific is significantly impacted by its applications in lithium-ion batteries. China and India are expected to emerge as key countries for lithium-ion battery manufacturers in the near future owing to surging government support for renewable energy and electric vehicles and increasing middle-class population. These factors are fueling the demand for consumer electronics in these countries.

Latin America 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market

The Latin America 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market is growing. As 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxideused as an electrolyte additive in lithium-ion batteries. Lithium-ion batteries are widely used in electronic devices and electric vehicles and their demand has been on the rise in the Latin American region.

Middle East & Africa 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market

2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide has various applications in the electronics industry, including as a solvent and a flame retardant. Its use in lithium-ion batteries has been of particular interest in recent years. It is also widely used in the production of batteries for electronic devices and electric vehicles in the Middle East and Africa region.

Key 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Company Insights

Some key players operating in the market include BASF SE, Ashland, and Evonik Industries AG.

-

Innopharmchem.com is a science and technology-oriented company that operates in R&D, API manufacturing, fine chemicals, pharmaceutical intermediates, and agrochemicals. The company provides its products and services to more than 60 countries. It has 3 manufacturing facilities in China.

-

Tokyo Chemical Industry Co., Ltd. is a global manufacturer of chemicals for research and development and provides organic laboratory chemicals as well as pharmaceutical, cosmetic, and functional materials. The company offers 30,000 products as well as customized synthesis. TCI has facilities in North America, Europe, China, and India.

Key 2-(2,2,2-trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide Companies:

The following are the leading companies in the 2-(2,2,2-trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market. These companies collectively hold the largest market share and dictate industry trends.

- Innopharmchem.com (NINGBO INNO PHARMCHEM CO., LTD.)

- Tokyo Chemical Industry Co., Ltd.

- Hangzhou MolCore BioPharmatech Co., Ltd.

- Dalian Ease New Material Co., Ltd.

- Shanghai Minstar Chemical Co., Ltd.

2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 561.12 million

Revenue forecast in 2030

USD 676.59 million

Growth rate

CAGR of 3.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative Units

Volume in kilograms, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Russia; China; India; Japan; South Korea; Australia; Vietnam; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Innopharmchem.com (NINGBO INNO PHARMCHEM CO., LTD.); Tokyo Chemical, Industry Co., Ltd.; Hangzhou MolCore; BioPharmatech Co., Ltd.; Dalian Ease New Material Co., Ltd.; Shanghai Minstar Chemical Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 2-(2,2,2-Trifluoroethoxy)-1,3,2-Dioxaphospholane-2-Oxide market report based on end use, and region:

-

End Use Outlook (Volume, kilograms; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Other End uses

-

-

Regional Outlook (Volume, kilograms; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

Poland

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market size was estimated at USD 542.2 million in 2024 and is expected to reach USD 561.1 million in 2025.

b. The global 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 676.6 million by 2030

b. Asia Pacific dominated the 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market with a share of 81.8% in 2024. This is attributable to the demand for the market in Asia Pacific is significantly impacted by its applications in lithium-ion batteries.

b. Some key players operating in the 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market include Innopharmchem.com (NINGBO INNO PHARMCHEM CO., LTD.), Tokyo Chemical Industry Co., Ltd., Hangzhou MolCore BioPharmatech Co., Ltd., Dalian Ease New Material Co., Ltd., Shanghai Minstar Chemical Co., Ltd.

b. Key factors that are driving the 2-(2,2,2-Trifluoroethoxy)-1,3,2-dioxaphospholane-2-oxide market growth include the rising global demand for lithium-ion batteries in automotive & electronic devices

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."