- Home

- »

- Organic Chemicals

- »

-

1,4 Butanediol Market Size, Share & Growth Report, 2030GVR Report cover

![1,4 Butanediol Market Size, Share & Trends Report]()

1,4 Butanediol Market Size, Share & Trends Analysis Report By Application (THF, GBL, PBT, Polyurethane), By Region (North America, Asia Pacific, Europe, CSA, MEA), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-084-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global 1,4 butanediol market size was estimated at USD 6.51 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 9.5% from 2023 to 2030. The growth is attributed to its applications of tetrahydrofuran (THF), polybutylene terephthalate (PBT), and polyurethane (PU) in various industrial processes along with the growing demand for spandex in textiles. This colorless liquid is derived from butane and is one of the most stable isomers of butanediol. The most common manufacturing method for the production of 1,4 butanediol (BDO) is the Reppe process, which involves the reaction of acetylene with formaldehyde and is widely practiced by major industry players, such as BASF and DuPont. The 1,4 BDO product suppliers have also integrated backward to begin production of the raw materials themselves.

This strategy significantly lowers logistics costs and procurement hassles for these companies in the long run. Consumers are increasingly becoming more aware of product benefits and technologies, therefore, suppliers maintain quality supplies throughout the production process. The increased global focus on green chemistry has encouraged major market participants, such as BioAmber, Genomatica, and Myriant, to develop alternative, bio-based processing technologies, which is likely to drive the market growth during the forecast period. The market is also expected to benefit from increasing investments in sustainable technologies that are likely to boost existing processes and improve overall efficiency.

Davy process technology is also known as the Maleic anhydride-based process. It has rapidly gained popularity during the past few years, owing to reduced complexity, equipment requirement, and capital cost. Maleic anhydride is converted into ester, which undergoes fixed-bed hydrogenolysis to make a mixture of 1,4 BDO, THF, and GBL. BASF has integrated the Davy process with Huntsman Mars V/VI, in Kuantan, Malaysia, to reduce production costs and penetrate the highly profitable Asia Pacific market. Several recent technologies such as hydrogenation of succinic acid, fermentation of sugars, and esterification have also transformed the 1,4 BDO industry.

Biological ways to produce 1,4 BDO are also providing ample opportunities to new participants in the chemicals market. In addition, government agencies, such as the U.S. EPA, are integrating fundamentals of green chemistry toward the production of chemicals, and also promoting utilization of the renewable feedstock, which is further propelling the market growth. The outbreak of COVID-19 impacted the market severely due to the disruption in the supply chain of chemical products during the pandemic, which resulted in a price hike for raw materials. The prevailing COVID-19 situation led to a global lockdown; therefore, chemical manufacturers had to shut their operations for a long period in 2020. This factor adversely affected the market growth globally.

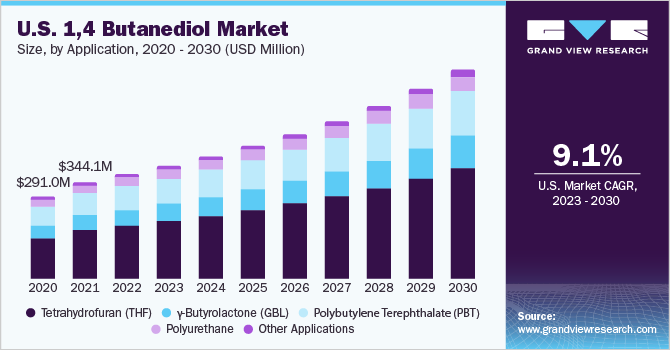

Application Insights

The THF segment dominated the market with the highest revenue share of 54.0% in 2022. Its high share is attributed to the increased product use for producing poly-tetramethylene glycol (PTMEG), which is a polymer extensively utilized for manufacturing urethane elastomers and fibers. PTMEG demand has witnessed pace owing to superior properties, such as exceptional flexibility and elasticity. PBT application was the second-largest revenue contributor, with a share of 21.6% globally in 2022. This is attributed to the increasing plastics consumption in automotive applications owing to the strong rise in demand for lightweight vehicles.

This is anticipated to drive demand for PBT during the forecast period. Other key growth drivers for PBT consumption include replacement of the conventional metals in the automotive and electronics industries, the introduction of new-generation PBT grades, and the development of bio-based PBT. PU demand is anticipated to be driven by the growing insistence for lightweight and durable products in industries, such as automotive, construction, and electronics, in regions like Asia Pacific.

Extensive research & development activities in the global plastics industry considering the changing need arising from various end-use industries has prompted the development of novel plastic products, which outperform conventional plastics in terms of their physical and chemical properties. Expansion of the application scope through innovation and extensive research & development are the key strategies being adopted by the industry participants to capture market share and penetrate untapped regional-level markets. Owing to the accelerating demand from the automotive and packaging industry, the market exhibits ample potential and it is also shifting focus toward polyurethane products.

Regional Insights

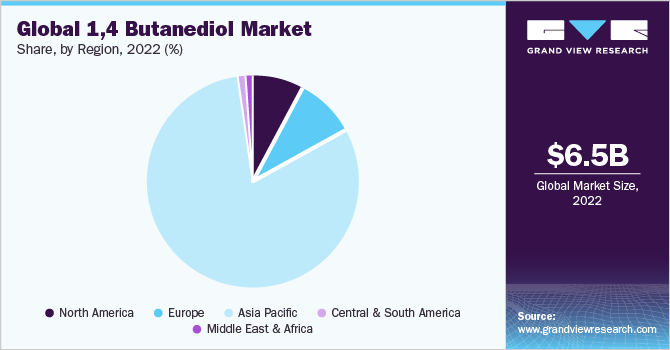

Asia Pacific dominated the market with the highest revenue share of 81.1% in 2022. This is attributed to the availability of skilled labor along with the easy availability of land. A shift in the production landscape in developing countries, particularly in China and India, is expected to drive market growth during the forecast period. The region is a hub for several expanding industries, such as construction, automotive, electronics, and others that offer vast potential for 1,4 BDO manufacturers. China’s construction market is likely to outperform other South-East Asian countries only because of government initiatives and funding to retain its development.

These factors are driving PU construction in the rapidly expanding construction and infrastructure sector of China. Furthermore, the rising demand for green materials in the automotive industry, to foster carbon emission savings, is anticipated to create a strong demand for the bio-based production of 1,4 BDO during the forecast period. North America was the second-largest contributor with a revenue share of 20.1% globally in 2022.

The major factor driving 1,4 BDO demand in the region is the wide application scope and extensive usage across several key end-use industries, such as automotive & transportation, construction, footwear, furniture, consumer goods, packaging, and electronics. Europe is one of the premium chemical manufacturing hubs owing to its advanced infrastructure and technology, research and development initiatives & facilities, and highly skilled workforce. The region is anticipated to witness strong demand on account of the rising product usage from end-use industries, such as automotive, textiles, transportation, and building & construction.

Key Companies & Market Share Insights

The companies are focused on establishing a widespread dealer network, strong customer database, and variety of products to gain an advantage over other players. This aim of companies is achieved by taking various strategic decisions and their implementation on a global level. Companies with the help of technological advancements try to adapt a variety of production techniques to gain the maximum profit possible with minimal input and investment. Some of the prominent players in the global 1,4 butanediol market include:

-

BASF SE

-

Ashland

-

DCC

-

Mitsubishi Chemical Group Corporation

-

Evonik Industries AG

-

LyondellBasell Industries Holdings B.V.

-

Sipchem Company

-

SINOPEC (China Petrochemical Corporation)

-

Genomatica, Inc.

1,4 Butanediol Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 7.07 billion

Revenue forecast in 2030

USD 13.41 billion

Growth rate

CAGR of 9.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Netherlands; Russia; China; India; Japan; South Korea; Australia; Vietnam; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; Ashland; DCC; Mitsubishi Chemical Group Corporation; Evonik Industries AG; Lyondell Basell Industries Holdings B.V.; Sipchem Company; SINOPEC (China Petrochemical Corp.), Genomatica, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 1,4 Butanediol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 1,4 butanediol market report on the basis of application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Tetrahydrofuran (THF)

-

γ-Butyrolactone (GBL)

-

Polybutylene Terephthalate (PBT)

-

Polyurethane

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Vietnam

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific dominated the 1,4 butanediol market with a share of 81.1% in 2022. This is attributable to rapidly expanding industries, a wide consumer pool with growing income levels, and the presence of low-cost labor & resources.

b. Some key players operating in the 1,4 butanediol market include BASF SE, Ashland, DCC, Mitsubishi Chemical Group Corporation, Evonik Industries AG, LyondellBasell Industries Holdings B.V., Sipchem Company, SINOPEC (China Petrochemical Corporation), Genomatica, Inc.

b. Key factors that are driving the 1,4 butanediol market growth include growing applications of tetrahydrofuran (THF), polybutylene terephthalate (PBT), and polyurethane (PU) in various industrial processes along with the growing demand for spandex in textiles.

b. The global 1,4 butanediol market size was estimated at USD 6.5 billion in 2022 and is expected to reach USD 7.0 billion in 2023.

b. The global 1,4 butanediol market is expected to grow at a compound annual growth rate of 9.5% from 2023 to 2030 to reach USD 13.4 billion by 2030.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."