- Home

- »

- Next Generation Technologies

- »

-

STEM Education In K-12 Market Size, Industry Report, 2030GVR Report cover

![STEM Education In K-12 Market Size, Share & Trends Report]()

STEM Education In K-12 Market Size, Share & Trends Analysis Report By Type (Self-paced, Instructor-led), By Application (Elementary School (K-5), Middle School (6-8), High School (9-12)), By Region And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-994-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

STEM Education In K-12 Market Trends

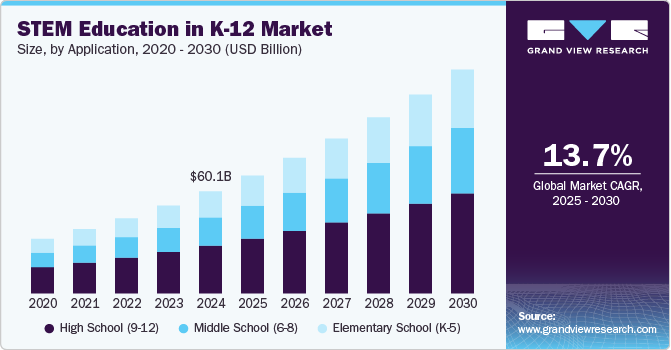

The global STEM education in K-12 market size was estimated at USD 60.14 billion in 2024 and is expected to grow at a CAGR of 13.7% from 2025 to 2030. An unprecedented spike in high-tech occupations and the need for innovations and critical thinking have expedited the trend for science, technology, engineering, and mathematics (STEM) education. Advanced technologies, such as artificial intelligence (AI) and quantum computing, could reinforce the STEM education system to propel innovation-based competitiveness. STEM, the foundation for technological advancements and discovery, could bolster creativity and ingenuity. STEM learning during the K 12 years is expected to expedite experimentation, build resilience, boost science literacy, foster teamwork, and drive tech use, helping produce the next generation of innovators.

STEM education in K-12 industry focuses on programs to help learners gain skills and knowledge to excel in the job market. It inspires and motivates students to generate new ideas and promotes problem-solving and project-based learning. Education leaders are expected to expose children at preschool and kindergarten to subjects once perceived as higher level, including science, programming, math, engineering, and languages. Integrating STEM concepts through a K-12 education could have an invaluable influence on the talent pool, requiring advanced knowledge and skills to stay competitive in the digitally disruptive world. STEM education in K-12 industry is poised to hold prominence in helping students explore machine learning, AI, and IoT. STEM pedagogy at the K-12 level will remain instrumental in creating a solid foundation for academic growth, fostering positive attitudes, and preparing children for jobs.

The emergence of advanced educational technologies (EdTech) is making STEM education more engaging and accessible for students. These technologies include online learning platforms, simulations, virtual reality experiences, and robotics. EdTech can personalize learning experiences and cater to various learning styles, making STEM education more inclusive. Various governments in developing countries recognize the importance of STEM education and are increasing their investment in STEM programs. This funding is used to develop new curriculum materials, train teachers, and provide professional development opportunities.

Type Insights

The self-paced segment led the STEM education in K-12 industry in 2024, accounting for over 68% share of the global revenue. The high share can be attributed to individualized learning, which has received impetus as it allows students to learn at their pace, controlling how and when they know. Prominently, built-in assessment and engagement tools have witnessed tremendous traction among K-12 students as the former provides real-time assessments. At the same time, the latter keeps learners interested through videos, photos, and interactive lessons.

The instructor-led segment is predicted to foresee significant growth in the forecast years. Instructor-led learning defines the instruction provided by one or more instructors in the form of lectures, presentations, demonstrations, and conversations. Although one-on-one instruction is less common and generally more expensive, the instructor typically addresses groups. During the instructor-led training, a large group is addressed at once, and various tactics are used, including games, exercises, and role-playing, to enhance the digital learning experience.

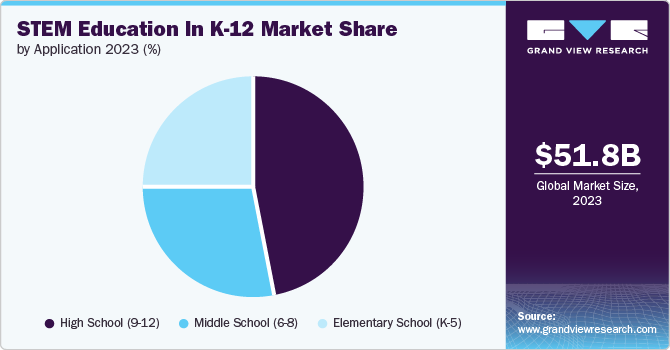

Application Insights

The high school (9-12) courses segment accounted for the largest revenue share in 2024 in the STEM education in K-12 industry due to the expanding penetration of online education. Educators and other stakeholders are investing in STEM education for high school students. High school allows students to delve deeper into specific STEM fields, such as engineering, computer science, or biotechnology. Project-based learning allows them to apply their knowledge to real-world problems, fostering critical thinking, collaboration, and innovation skills. For instance, in May 2024, the Indian Institute of Technology Delhi launched its STEM mentorship program for high school girls in Classes 9 and 11. The initiative includes expert lectures, lab demonstrations, hands-on problem-solving, and a Maker Space workshop for DIY projects, aiming to immerse participants in STEM fields.

The middle school (6-8) segment is expected to showcase significant growth over the forecast period. Middle school provides an opportunity to identify students with a talent for STEM and provide them with early intervention and enrichment programs. This can help close achievement gaps and ensure all students thrive in STEM fields. Middle school students are naturally curious and eager to explore new things. Engaging in STEM programs incorporating hands-on activities, experiments, and project-based learning can enhance their interest in science, technology, engineering, and mathematics. For instance, in November 2024, Virginia Commonwealth University received USD 1.7 million for a four-year research project, "Hybrid2: Creating Equitable Spaces for Science Discourse in Blended Learning Environments. Funded by the National Center for Education Research, the project aims to enhance science learning for marginalized middle school students by integrating scientific discourse with everyday experiences and leveraging technology for inclusivity.

Regional Insights

North America STEM education in K-12 market dominated with a revenue share of over 44% in 2024 in STEM education in K-12 industry. North American economies are heavily reliant on innovation and technological advancement. This creates a strong demand for professionals with strong STEM skills across various industries. North America is a hub for educational technology (EdTech) innovation. These technologies are transforming STEM education by making it more engaging, interactive, and accessible for students.

U.S. STEM Education In K-12 Market Trends

The U.S. STEM education in K-12 market is expected to grow substantially over the forecast period. The U.S. has the presence of leading universities and research institutions, fostering innovation and research in STEM education. Moreover, the growing EdTech industry provides a variety of tools and resources to enhance STEM learning experiences.

Europe STEM Education In K-12 Market Trends

The STEM education in the K-12 market in Europe is gaining traction. The European Union (EU) plays a crucial role in supporting STEM education through various initiatives and funding programs. These programs promote collaboration between member states, encourage curriculum development, and support teacher training in STEM subjects.

Asia Pacific STEM Education In K-12 Market Trends

The STEM education in K-12 market in Asia Pacific is positioned for significant growth. Rapid economic growth across the region necessitates a workforce equipped with strong STEM skills. STEM education programs prepare students for future careers in these high-demand fields.

Key STEM Education In K-12 Company Insights

Some key players in the STEM education in K-12 market, such as Chegg Inc.; Qkids Teacher; Varsity Tutors; and Vedantu are actively working to expand their customer base and gain a competitive advantage. To achieve this, they are pursuing various strategic initiatives, including partnerships, mergers and acquisitions, collaborations, and the development of new products. This proactive approach allows them to enhance their market presence and innovate in response to evolving needs.

-

McGraw-Hill Education specializes in learning science, offering customized learning experiences that aid students, parents, educators, and professionals. The company provides its offerings across 125 countries globally. In the U.S., the company’s products are used by over 5,000 higher education institutions and 13,000 K-12 school districts across all 50 states. The company’s product offerings are broadly classified into four types, namely PreK-12, Higher Ed, Professional, and International. The company provides various applications in its PreK-12 category, such as McGraw Hill AR, ALEKS Adventure, ALEKS Online Learning, and Everyday Mathematics Game Kits.

-

Activate Learning is a U.S.-based educational company dedicated to transforming K-12 STEM education through innovative curriculum and hands-on learning solutions. The company provides comprehensive teaching resources, including inquiry-based STEM programs, digital tools, and professional development for educators. Its flagship programs, such as "IQWST" (Investigating and Questioning our World through Science and Technology), are designed to align with Next Generation Science Standards (NGSS).

Key STEM Education In K-12 Companies:

The following are the leading companies in the STEM education in K-12 market. These companies collectively hold the largest market share and dictate industry trends.

- Activate Learning

- Amplify Education, Inc.

- Bedford, Freeman & Worth Publishing Group, LLC

- Carolina Biological Supply Company

- Cengage Learning

- Discovery Education

- EduCo International

- Houghton Mifflin Harcourt

- Kendall Hunt Publishing Company

- Lab-Aids

- McGraw Hill

- OpenSciEd

- PASCO Scientific

- Savvas Learning

- School Specialty, LLC

Recent Developments

-

In October 2024, Siemens Stiftung partnered with Siemens to introduce its digital Open Education Resource (OER) platform, Experimento, to Indian schools under Project Jigyaasa, a curiosity-based STEM learning initiative. The program, implemented by the Pratham Foundation, provides multimedia educational resources, including video activities, lesson plans, quizzes, and student worksheets, to enhance STEM education and accessibility for school students.

-

In October 2024, Shell International B.V. launched new EdTech initiatives to strengthen STEM education for the next generation in India. Using AI, data analytics, and advanced digital tools, the programs offer personalized learning interventions. Developed with partners such as Pratham InfoTech Foundation, Educational Initiatives, and Khan Academy, they build on the success of Shell International B.V.'s NXplorers program, which has already impacted over 3 lakh Indian students.

-

In March 2024, Bayer India, a pharmaceutical and biotechnology company, partnered with BharatCares, a non-profit social impact organization, to launch the Better School Program for Adpodra Group Government Primary School in Himatnagar, Gujarat, India. Designed to improve educational infrastructure and offer hands-on learning experiences for students in Himatnagar, the 'Better School Program' targets giving economically challenged students a major educational boost. It will assist over 850 students from 1st to 8th grade, spread across four schools.

STEM Education In K-12 Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 69.53 billion

Revenue forecast in 2030

USD 131.98 billion

Growth rate

CAGR of 13.7% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Activate Learning; Amplify Education, Inc.; Bedford, Freeman & Worth Publishing Group, LLC; Carolina Biological Supply Company; Cengage Learning; Discovery Education; EduCo International; Houghton Mifflin Harcourt; Kendall Hunt Publishing Company; Lab-Aids; McGraw Hill; OpenSciEd; PASCO Scientific; Savvas Learning; School Specialty, LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global STEM Education In K-12 Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global STEM education in K-12 market report based on type, application, and region.

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Self-paced

-

Instructor-led

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Elementary School (K-5)

-

Middle School (6-8)

-

High School (9-12)

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global STEM education in K-12 market size was estimated at USD 60.14 billion in 2024 and is expected to reach USD 69.53 billion in 2025.

b. The global STEM education in K-12 market is expected to grow at a compound annual growth rate of 13.7% from 2025 to 2030 to reach USD 131.98 billion by 2030

b. North America dominated the STEM education in K-12 market with a share of 44.0% in 2024. This is attributable to the plenty of investments from venture capitalists and private-equity investors in STEM education in the U.S.

b. Some key players operating in the STEM education in K-12 market include BYJU'S,, edX LLC., Hurix, STEM Learning Ltd., StemLabs, Stride, Inc., Edutech, MEL Science, Stemi Education, STEMROBOTM Technologies Pvt Ltd

b. Key factors that are driving the STEM education in K-12 market growth include increasing demand for STEM education as a result of the growing employment opportunities in the STEM sectors and technology advancements have increased the popularity of market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."