South Africa Weight Loss Supplements Market Size & Outlook

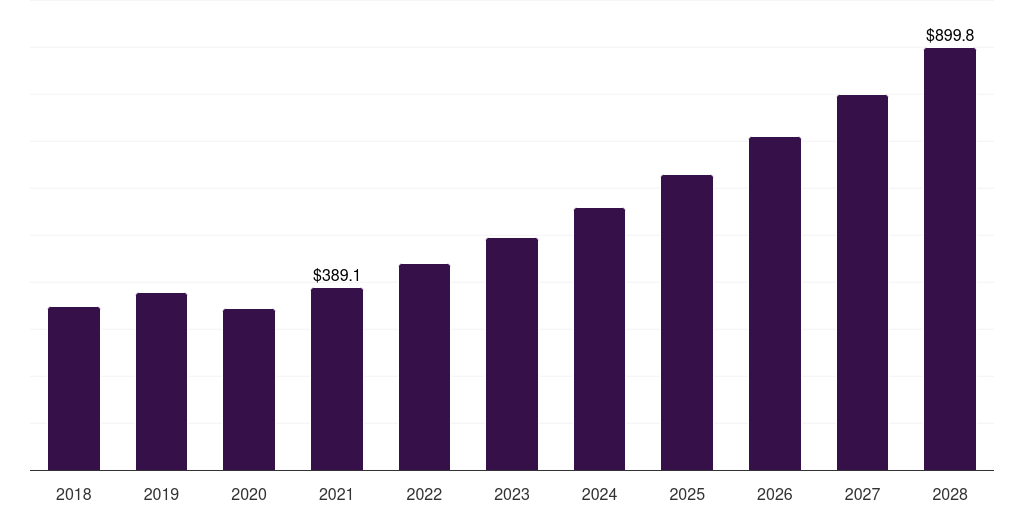

South Africa weight loss supplements market, 2018-2030 (US$M)

Related Markets

South Africa weight loss supplements market highlights

- The South Africa weight loss supplements market generated a revenue of USD 305.6 million in 2024 and is expected to reach USD 610.5 million by 2030.

- The South Africa market is expected to grow at a CAGR of 12.2% from 2025 to 2030.

- In terms of segment, powder was the largest revenue generating type in 2024.

- Pills is the most lucrative type segment registering the fastest growth during the forecast period.

Weight loss supplements market data book summary

| Market revenue in 2024 | USD 305.6 million |

| Market revenue in 2030 | USD 610.5 million |

| Growth rate | 12.2% (CAGR from 2024 to 2030) |

| Largest segment | Powder |

| Fastest growing segment | Pills |

| Historical data | 2018 - 2023 |

| Base year | 2024 |

| Forecast period | 2025 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Liquid, Powder, Softgels, Pills |

| Key market players worldwide | Glanbia PLC, Abbott Laboratories, Nestle SA, The Kraft Heinz Co, PepsiCo Inc, Ajinomoto Co Inc, GSK PLC ADR, Herbalife Ltd, WK Kellogg Co, Amway Malaysia Holdings |

Other key industry trends

- In terms of revenue, South Africa accounted for 0.9% of the global weight loss supplements market in 2024.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Middle East & Africa, UAE weight loss supplements market is projected to lead the regional market in terms of revenue in 2030.

- UAE is the fastest growing regional market in Middle East & Africa and is projected to reach USD 661.9 million by 2030.

Powder was the largest segment with a revenue share of 37.7% in 2024. Horizon Databook has segmented the South Africa weight loss supplements market based on liquid, powder, softgels, pills covering the revenue growth of each sub-segment from 2018 to 2030.

South Africa has one of the highest obesity rates in sub-Saharan Africa, particularly among urban populations, driving demand for weight management solutions. As disposable incomes rise, more consumers are willing to invest in products that support their health and appearance.

There is a growing preference for natural and herbal-based supplements, influenced by traditional African remedies, with ingredients like Garcinia Cambogia, green tea extract, and Moringa gaining popularity.

South African consumers are also drawn to products that align with the global wellness trend, including gluten-free and vegan options. The growth of e-commerce platforms has expanded access to a wide variety of supplements, making it easier for consumers in both urban and rural areas to purchase weight loss products.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Weight Loss Supplements Market Scope

Weight Loss Supplements Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

South Africa weight loss supplements market size, by type, 2018-2030 (US$M)

South Africa Weight Loss Supplements Market Outlook Share, 2024 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more