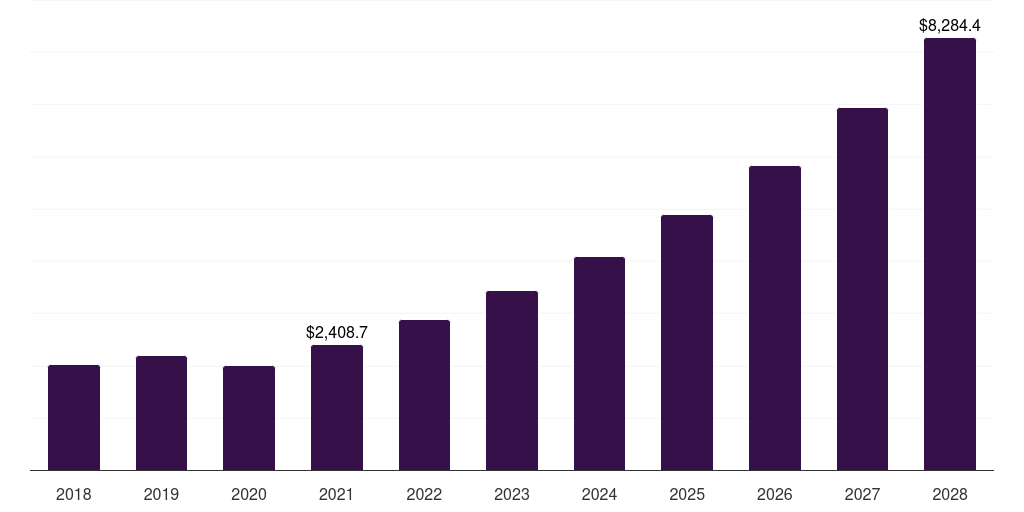

India Weight Loss Supplements Market Size & Outlook

Related Markets

India weight loss supplements market highlights

- The India weight loss supplements market generated a revenue of USD 1,367.2 million in 2024 and is expected to reach USD 3,830.2 million by 2030.

- The India market is expected to grow at a CAGR of 18.7% from 2025 to 2030.

- In terms of segment, powder was the largest revenue generating type in 2024.

- Pills is the most lucrative type segment registering the fastest growth during the forecast period.

Weight loss supplements market data book summary

| Market revenue in 2024 | USD 1,367.2 million |

| Market revenue in 2030 | USD 3,830.2 million |

| Growth rate | 18.7% (CAGR from 2024 to 2030) |

| Largest segment | Powder |

| Fastest growing segment | Pills |

| Historical data | 2018 - 2023 |

| Base year | 2024 |

| Forecast period | 2025 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Liquid, Powder, Softgels, Pills |

| Key market players worldwide | Glanbia PLC, Abbott Laboratories, Nestle SA, The Kraft Heinz Co, PepsiCo Inc, Ajinomoto Co Inc, GSK PLC ADR, Herbalife Ltd, WK Kellogg Co, Amway Malaysia Holdings |

Other key industry trends

- In terms of revenue, India accounted for 4.1% of the global weight loss supplements market in 2024.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, Japan weight loss supplements market is projected to lead the regional market in terms of revenue in 2030.

- India is the fastest growing regional market in Asia Pacific and is projected to reach USD 3,830.2 million by 2030.

Powder was the largest segment with a revenue share of 37.67% in 2024. Horizon Databook has segmented the India weight loss supplements market based on liquid, powder, softgels, pills covering the revenue growth of each sub-segment from 2018 to 2030.

The weight loss supplements market in India is experiencing significant growth, driven by increasing health awareness and changing lifestyle patterns. With rising obesity levels, especially in urban areas, more Indians are seeking ways to manage their weight effectively.

Additionally, the influence of Western culture, including fitness and wellness trends, has led to a surge in demand for health supplements. Social media platforms and fitness influencers are playing a key role in promoting weight loss products, creating a strong consumer interest.

Traditional Ayurvedic and herbal remedies are also gaining popularity, with consumers preferring natural, plant-based solutions for weight management. The increasing penetration of e-commerce platforms has made weight loss supplements more accessible, especially in smaller cities and rural areas.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Weight Loss Supplements Market Scope

Weight Loss Supplements Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Amway Malaysia Holdings | View profile | - | Petaling Jaya, Selangor, Malaysia, Asia | http://www.amway.my |

| Ajinomoto Co Inc | View profile | 43318 | 15-1, Kyobashi 1-chome, Chuo-ku, Tokyo, Japan, 104-8315 | http://www.ajinomoto.co.jp |

| The Kraft Heinz Co | View profile | 36000 | One PPG Place, Pittsburgh, PA, United States, 15222 | https://www.kraftheinzcompany.com |

| WK Kellogg Co | View profile | 3150 | One Kellogg Square, Battle Creek, MI, United States, 49016-3599 | https://www.wkkellogg.com |

| Herbalife Ltd | View profile | 9200 | Ugland House, South Church Street, P.O. Box 309GT, Grand Cayman, Cayman Islands, KY1-1104 | https://www.herbalife.com |

| PepsiCo Inc | View profile | 318000 | 700 Anderson Hill Road, Purchase, NY, United States, 10577 | https://www.pepsico.com |

| Glanbia PLC | View profile | 5534 | Ring Road, Glanbia House, Kilkenny, Ireland, R95 E866 | https://www.glanbia.com |

| GSK PLC ADR | View profile | 70200 | 980 Great West Road, Brentford, Middlesex, United Kingdom, TW8 9GS | https://www.gsk.com |

| Nestle SA | View profile | 270000 | Avenue Nestle 55, Vevey, Switzerland, CH-1800 | https://www.nestle.com |

| Abbott Laboratories | View profile | 114000 | 100 Abbott Park Road, Abbott Park, IL, United States, 60064-6400 | https://www.abbottinvestor.com |

India Type - Weight Loss Supplements Market size, 2024 - 2030 (US$M)

India Weight Loss Supplements Market Outlook Share, 2024 & 2030 (US$M)

Related industry reports

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more