China Ultrasound Devices Market Size & Outlook, 2023-2030

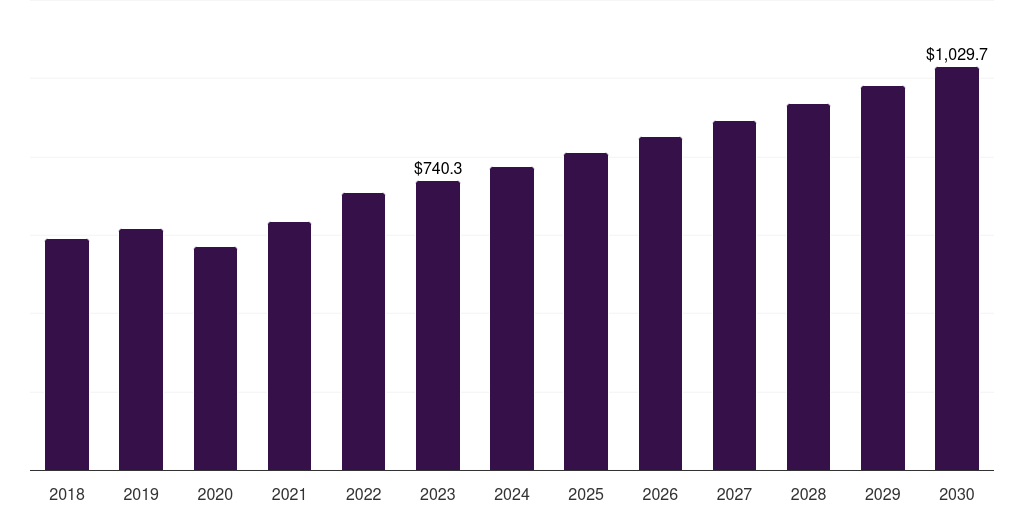

China ultrasound devices market, 2018-2030 (US$M)

Related Markets

China ultrasound devices market highlights

- The China ultrasound devices market generated a revenue of USD 740.1 million in 2023 and is expected to reach USD 1,029.8 million by 2030.

- The China market is expected to grow at a CAGR of 4.8% from 2024 to 2030.

- In terms of segment, diagnostic ultrasound devices was the largest revenue generating product in 2023.

- Therapeutic Ultrasound Devices is the most lucrative product segment registering the fastest growth during the forecast period.

Ultrasound devices market data book summary

| Market revenue in 2023 | USD 740.1 million |

| Market revenue in 2030 | USD 1,029.8 million |

| Growth rate | 4.8% (CAGR from 2023 to 2030) |

| Largest segment | Diagnostic ultrasound devices |

| Fastest growing segment | Therapeutic Ultrasound Devices |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Diagnostic Ultrasound Devices, Therapeutic Ultrasound Devices |

| Key market players worldwide | Koninklijke Philips NV, GE HealthCare Technologies Inc Common Stock, Siemens Healthineers AG ADR, Canon Inc, Mindray Medical International, Samsung BioLogics, FUJIFILM Holdings Corp, Konica Minolta Inc, Esaote |

Other key industry trends

- In terms of revenue, China accounted for 7.6% of the global ultrasound devices market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, China ultrasound devices market is projected to lead the regional market in terms of revenue in 2030.

- Japan is the fastest growing regional market in Asia Pacific and is projected to reach USD 759.1 million by 2030.

Diagnostic ultrasound devices was the largest segment with a revenue share of 84.42% in 2023. Horizon Databook has segmented the China ultrasound devices market based on diagnostic ultrasound devices, therapeutic ultrasound devices covering the revenue growth of each sub-segment from 2018 to 2030.

Changes in demographics & disease patterns and the growth of private healthcare sector are among the key factors expected to drive the ultrasound market in China. The number of private hospitals is increasing every year, including those delivering specialized care, such as maternity and orthopedic treatment centers.

This can be attributed to the allowance of foreign investments in the country’s healthcare sector. The growing number of hospitals is likely to drive the demand for ultrasound devices in the region, as ultrasound services are an integral and essential part of modern healthcare facilities.

Furthermore, the importance of integrating ultrasound devices in POC diagnostics has been a key takeaway in the country’s fight against COVID-19. This has raised a large number of tenders for ultrasound devices in China and local ultrasound device manufacturers, such as Mindray, are trying to leverage this opportunity.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Ultrasound Devices Market Scope

Ultrasound Devices Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

China ultrasound devices market size, by product, 2018-2030 (US$M)

China Ultrasound Devices Market Outlook Share, 2023 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more