UK Structural Wood Screws Market Size & Outlook, 2025-2033

Related Markets

UK structural wood screws market highlights

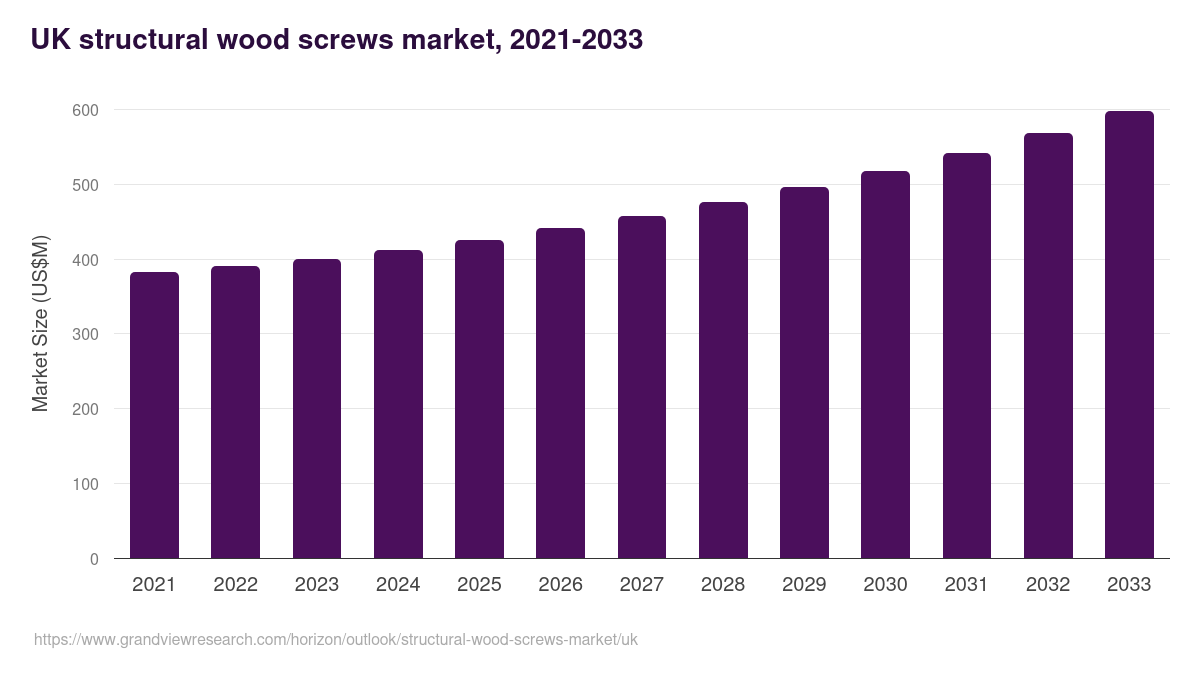

- The UK structural wood screws market generated a revenue of USD 412.3 million in 2024 and is expected to reach USD 598.2 million by 2033.

- The UK market is expected to grow at a CAGR of 4.3% from 2025 to 2033.

- In terms of segment, stainless steel was the largest revenue generating type in 2024.

- Carbon Steel is the most lucrative type segment registering the fastest growth during the forecast period.

Structural wood screws market data book summary

| Market revenue in 2024 | USD 412.3 million |

| Market revenue in 2033 | USD 598.2 million |

| Growth rate | 4.3% (CAGR from 2025 to 2033) |

| Largest segment | Stainless steel |

| Fastest growing segment | Carbon Steel |

| Historical data | 2021 - 2023 |

| Base year | 2024 |

| Forecast period | 2025 - 2033 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Carbon Steel, Stainless Steel |

| Key market players worldwide | SFS Group AG, Simpson Manufacturing Co Inc, Eurotech Ltd, Illinois Tool Works Inc, Kyocera Corp, SPAX International, Grip-Rite, Simpson Strong-Tie Company, Rothoblaas, GRK Fasteners, MiTek, Hillman, TR Fastenings, Forch, Dresselhaus, Friulsider, Kreg Tool Company, FastCAP, Wurth |

Other key industry trends

- In terms of revenue, UK accounted for 9.0% of the global structural wood screws market in 2024.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2033.

- In Europe, UK structural wood screws market is projected to lead the regional market in terms of revenue in 2033.

- France is the fastest growing regional market in Europe and is projected to reach USD 423.2 million by 2033.

Stainless steel was the largest segment with a revenue share of 83.09% in 2024. Horizon Databook has segmented the UK structural wood screws market based on carbon steel, stainless steel covering the revenue growth of each sub-segment from 2021 to 2033.

The growth of structural wood screws market in the UK is expected to be driven by the increase in construction and restoration activities related to housing units, offices, educational institutes, hotels & restaurants, resorts, transport buildings, online retail warehousing, etc. in the country.

However, weakened commercial and industrial activities in the UK, coupled with uncertainty related to its industrial sector due to Brexit, may lead to a moderate demand for structural wood screws over the forecast period. According to Trading Economics, the construction industry contributed approximately 7% to the GDP of the UK in 2022.

The construction output in the UK was more than USD 11.69 trillion in 2022. Of this, new construction accounted for a share of approximately 60%, while maintenance and refurbishment held a share of approximately 40% of the overall construction output. Additionally, rising investments in public and private construction activities in the country are expected to fuel the growth of the construction industry in the UK.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Structural Wood Screws Market Scope

Structural Wood Screws Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| MiTek | View profile | 5001-10000 | Chesterfield, Missouri, United States, North America | http://www.mitek-us.com/ |

| Wurth | View profile | 501-1000 | Kent, Kent, United Kingdom, Europe | https://eshop.wurth.co.uk/ |

| FastCAP | View profile | 11-50 | Boston, Massachusetts, United States, North America | https://www.fastcapultracapacitors.com |

| Kreg Tool Company | View profile | 101-250 | Huxley, Iowa, United States, North America | http://kregtool.com |

| Friulsider | View profile | 101-250 | San Giovanni Al Natisone, Friuli-Venezia Giulia, Italy, Europe | https://www.friulsider.com |

| Dresselhaus | View profile | 501-1000 | Herford, Nordrhein-Westfalen, Germany, Europe | https://www.dresselhaus.de/ |

| Forch | View profile | 1001-5000 | Neuenstadt, Baden-Wurttemberg, Germany, Europe | https://www.foerch.de/ |

| TR Fastenings | View profile | 1001-5000 | Uckfield, East Sussex, United Kingdom, Europe | https://trfastenings.com |

| Hillman | View profile | 1001-5000 | Cincinnati, Ohio, United States, North America | http://www.hillmangroup.com |

| GRK Fasteners | View profile | 11-50 | Thunder Bay, Ontario, Canada, North America | https://grkfasteners.com |

| Rothoblaas | View profile | 251-500 | Cortaccia, Trentino-Alto Adige, Italy, Europe | https://www.rothoblaas.com/ |

| Grip-Rite | View profile | 501-1000 | Irving, Texas, United States, North America | https://grip-rite.com |

| SPAX International | View profile | 51-100 | Ennepetal, Nordrhein-Westfalen, Germany, Europe | http://www.spax.com/en/ |

| Simpson Strong-Tie Company | View profile | 1001-5000 | Pleasanton, California, United States, North America | https://www.strongtie.com |

| Eurotech Ltd | View profile | 7 | 10306 Eaton Place, Suite 220, Fairfax, VA, United States, 22030 | http://www.eurotechltd.com |

| Kyocera Corp | View profile | 81209 | 6, Takeda Tobadono-cho, Fushimi-ku, Kyoto, Japan, 612-8501 | http://www.kyocera.co.jp |

| SFS Group AG | View profile | 13198 | Rosenbergsaustrasse 8, Heerbrugg, Switzerland, 9435 | https://www.sfs.com |

| Simpson Manufacturing Co Inc | View profile | 5497 | 5956 W. Las Positas Boulevard, Pleasanton, CA, United States, 94588 | https://www.simpsonmfg.com |

| Illinois Tool Works Inc | View profile | 45000 | 155 Harlem Avenue, Glenview, IL, United States, 60025 | https://www.itw.com |

UK structural wood screws market size, by type, 2021-2033 (US$M)

UK Structural Wood Screws Market Outlook Share, 2024 & 2033 (US$M)

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more