UK Nuclear Decommissioning Services Market Size & Outlook

Related Markets

UK nuclear decommissioning services market highlights

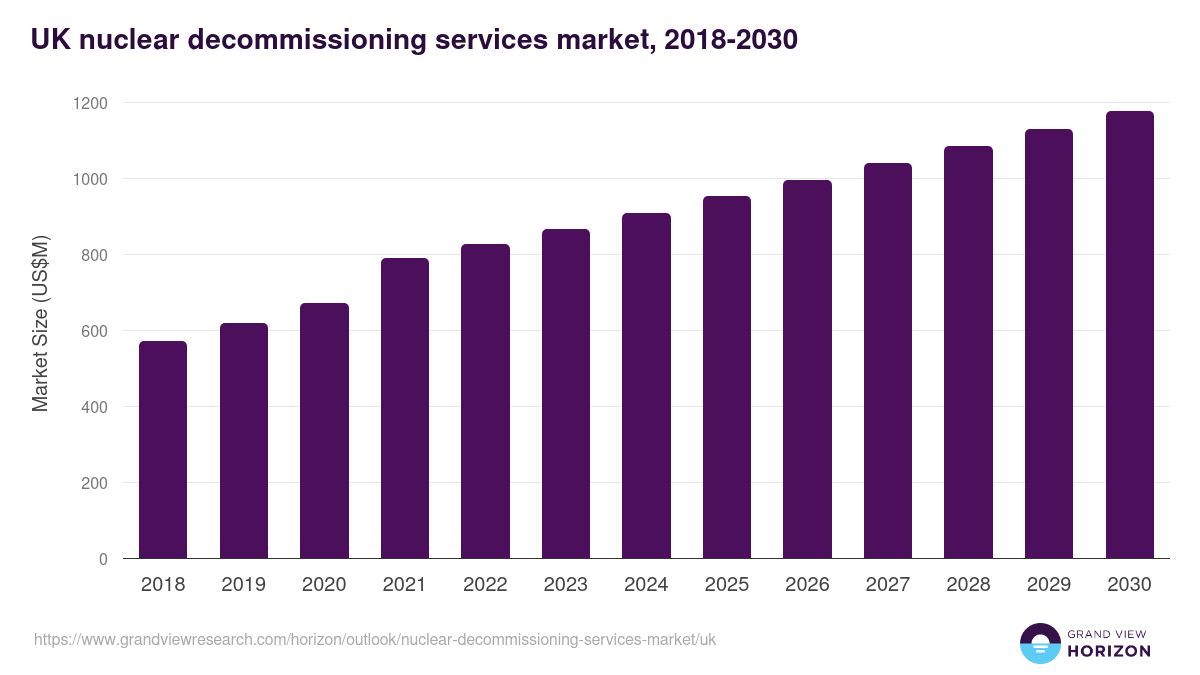

- The UK nuclear decommissioning services market generated a revenue of USD 867.9 million in 2023 and is expected to reach USD 1,177.5 million by 2030.

- The UK market is expected to grow at a CAGR of 4.5% from 2024 to 2030.

- In terms of segment, gcr was the largest revenue generating reactor type in 2023.

- GCR is the most lucrative reactor type segment registering the fastest growth during the forecast period.

Nuclear decommissioning services market data book summary

| Market revenue in 2023 | USD 867.9 million |

| Market revenue in 2030 | USD 1,177.5 million |

| Growth rate | 4.5% (CAGR from 2023 to 2030) |

| Largest segment | Gcr |

| Fastest growing segment | GCR |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | PWR, BWR, PHWR, GCR |

| Key market players worldwide | Orion Group Holdings Inc, Babcock International Group PLC, Westinghouse Air Brake Technologies Corp, AECOM, Studsvik AB ADR, Bechtle AG |

Other key industry trends

- In terms of revenue, UK accounted for 10.6% of the global nuclear decommissioning services market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Europe, Germany nuclear decommissioning services market is projected to lead the regional market in terms of revenue in 2030.

- UK is the fastest growing regional market in Europe and is projected to reach USD 1,177.5 million by 2030.

Gcr was the largest segment with a revenue share of 44.01% in 2023. Horizon Databook has segmented the UK nuclear decommissioning services market based on pwr, bwr, phwr, gcr covering the revenue growth of each sub-segment from 2018 to 2030.

As per the World Nuclear Association, most of the current fleet of reactors in the UK will retire by 2028. Construction of the first of a new generation of plants has begun. Moreover, the nation has not constructed any nuclear reactors since the Fukushima accident and is determined to switch to renewable energy.

The Nuclear Decommissioning Authority regulates the nuclear industry in the UK. The authority under the Energy Act 2008 requires plant operators to submit a Funded Decommissioning Program (FDP) before commencing construction of nuclear plants.

The presence of such authorities and government inclination toward nuclear power plant decommissioning is likely to positively influence market growth. Besides, key market players, such as Babcock International Group PLC and Magnox Ltd, have fostered market growth over the forecast period with extensive research and development in the country.

Key Regions: U.S. , Japan , Germany , France , South Korea

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Nuclear Decommissioning Services Market Scope

Nuclear Decommissioning Services Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Bechtle AG | View profile | 15159 | Bechtle Platz 1, Neckarsulm, BW, Germany, 74172 | https://www.bechtle.com |

| Studsvik AB ADR | View profile | 530 | Studsvik, Nykoping, Sweden, 611 82 | https://www.studsvik.com |

| Orion Group Holdings Inc | View profile | 1796 | 12000 Aerospace Avenue, Suite 300, Houston, TX, United States, 77034 | https://www.oriongroupholdingsinc.com |

| Westinghouse Air Brake Technologies Corp | View profile | 1100 | 30 Isabella Street, Pittsburgh, PA, United States, 15212 | https://www.wabteccorp.com |

| Babcock International Group PLC | View profile | 26735 | 33 Wigmore Street, London, United Kingdom, W1U 1QX | https://www.babcockinternational.com |

| AECOM | View profile | 52000 | 13355 Noel Road, Suite 400, Dallas, TX, United States, 75240 | https://www.aecom.com |

UK nuclear decommissioning services market size, by reactor type, 2018-2030 (US$M)

UK Nuclear Decommissioning Services Market Outlook Share, 2023 & 2030 (US$M)

Related industry reports

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more