Japan Nuclear Decommissioning Services Market Size & Outlook

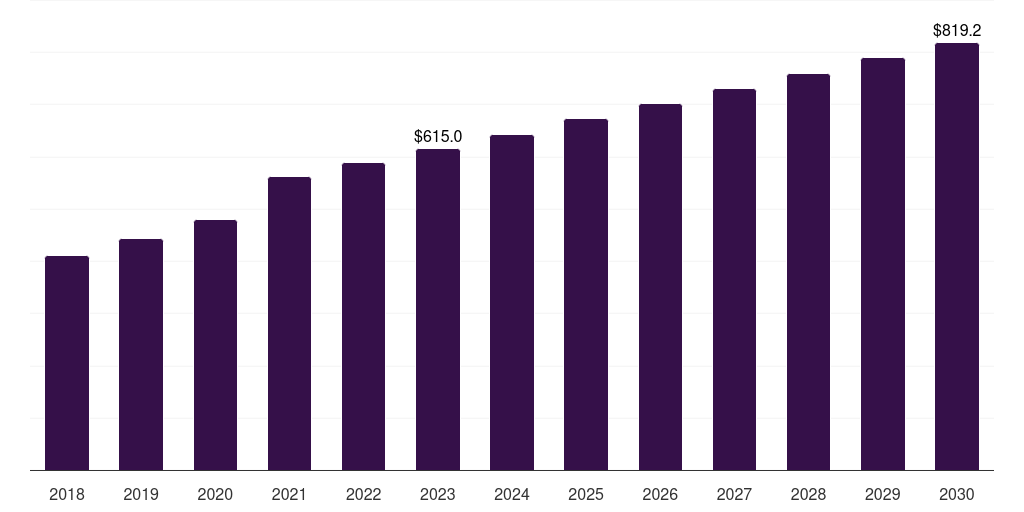

Japan nuclear decommissioning services market, 2018-2030 (US$M)

Related Markets

Japan nuclear decommissioning services market highlights

- The Japan nuclear decommissioning services market generated a revenue of USD 615.0 million in 2023 and is expected to reach USD 819.2 million by 2030.

- The Japan market is expected to grow at a CAGR of 4.2% from 2024 to 2030.

- In terms of segment, pwr was the largest revenue generating reactor type in 2023.

- PWR is the most lucrative reactor type segment registering the fastest growth during the forecast period.

Nuclear decommissioning services market data book summary

| Market revenue in 2023 | USD 615.0 million |

| Market revenue in 2030 | USD 819.2 million |

| Growth rate | 4.2% (CAGR from 2023 to 2030) |

| Largest segment | Pwr |

| Fastest growing segment | PWR |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | PWR, BWR, PHWR, GCR |

| Key market players worldwide | Orion Group Holdings Inc, Babcock International Group PLC, Westinghouse Air Brake Technologies Corp, AECOM, Studsvik AB ADR, Bechtle AG |

Other key industry trends

- In terms of revenue, Japan accounted for 7.5% of the global nuclear decommissioning services market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, Japan nuclear decommissioning services market is projected to lead the regional market in terms of revenue in 2030.

- Japan is the fastest growing regional market in Asia Pacific and is projected to reach USD 819.2 million by 2030.

Pwr was the largest segment with a revenue share of 40.33% in 2023. Horizon Databook has segmented the Japan nuclear decommissioning services market based on pwr, bwr, phwr, gcr covering the revenue growth of each sub-segment from 2018 to 2030.

The Japanese nuclear decommissioning services market is poised to witness substantial growth, driven by the unique energy landscape shaped by the Fukushima Daiichi disaster. In 2011, nuclear power accounted for approximately 30% of Japan's electricity generation, which was projected to rise to 40% by 2017.

However, the destructive events at Fukushima started a shift in policy, with current plans aiming for nuclear power to contribute at least 20% to the energy mix by 2030 despite a significantly reduced fleet. According to the World Nuclear Association, Japan has 33 operable nuclear reactors, of which only 27 are slated for decommissioning by the end of 2024.

This substantial reduction in active reactors underscores the urgent need for comprehensive decommissioning services to safely dismantle facilities, manage radioactive materials, and restore sites.

Key Regions: U.S. , UK , Germany , France , South Korea

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Nuclear Decommissioning Services Market Scope

Nuclear Decommissioning Services Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Japan nuclear decommissioning services market size, by reactor type, 2018-2030 (US$M)

Japan Nuclear Decommissioning Services Market Outlook Share, 2023 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more