U.S. Medical Rubber Stopper Market Size & Outlook

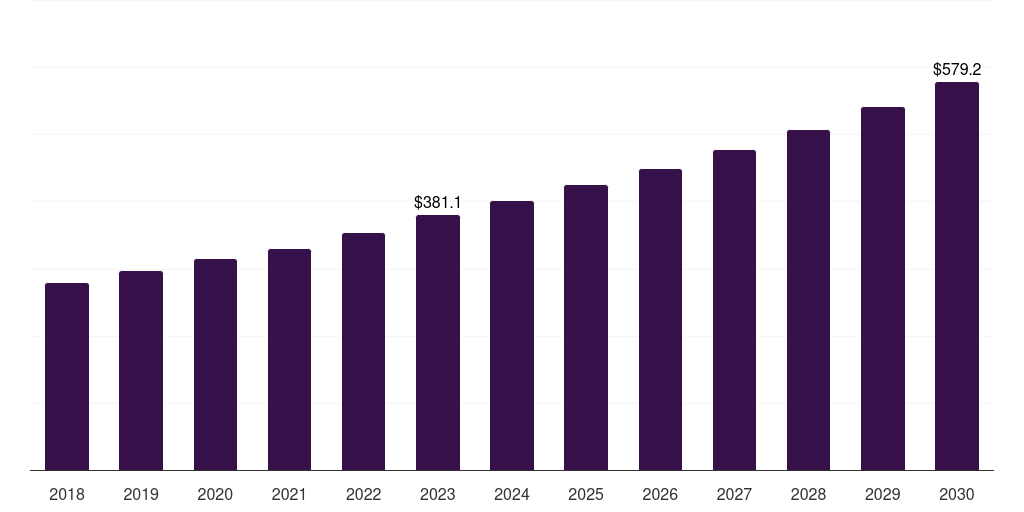

U.S. medical rubber stopper market, 2018-2030 (US$M)

Related Markets

U.S. medical rubber stopper market highlights

- The U.S. medical rubber stopper market generated a revenue of USD 381.1 million in 2023 and is expected to reach USD 579.2 million by 2030.

- The U.S. market is expected to grow at a CAGR of 6.2% from 2024 to 2030.

- In terms of segment, teflon coated was the largest revenue generating surface treatment in 2023.

- Teflon Coated is the most lucrative surface treatment segment registering the fastest growth during the forecast period.

Medical rubber stopper market data book summary

| Market revenue in 2023 | USD 381.1 million |

| Market revenue in 2030 | USD 579.2 million |

| Growth rate | 6.2% (CAGR from 2023 to 2030) |

| Largest segment | Teflon coated |

| Fastest growing segment | Teflon Coated |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Siliconized, Teflon Coated, Uncoated Stoppers |

| Key market players worldwide | AptarGroup Inc, West Pharmaceutical Services Inc, Samsung Electronics Co Ltd, Daetwyler Holding AG, Bharat Rubber Works, Jiangyin Hongmeng Rubber and Plastic Products Co., Universal Medicap, Lonstroff, Bormioli Pharma, Sagar Rubber Products |

Other key industry trends

- In terms of revenue, U.S. accounted for 21.5% of the global medical rubber stopper market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. medical rubber stopper market is projected to lead the regional market in terms of revenue in 2030.

- U.S. is the fastest growing regional market in North America and is projected to reach USD 579.2 million by 2030.

Teflon coated was the largest segment with a revenue share of 63.26% in 2023. Horizon Databook has segmented the U.S. medical rubber stopper market based on siliconized, teflon coated, uncoated stoppers covering the revenue growth of each sub-segment from 2018 to 2030.

The U.S. holds a significant position in the global production and sales of pharmaceuticals, as well as carries out research activities to launch new pharmaceuticals in the market. This is supported by the data provided by the EFPIA. According to this data, the U.S. held a share of 64.4% of the global sales of new medicines launched from 2017 to 2022.

As major pharmaceutical companies are headquartered in the U.S., the spread of the COVID-19 in 2020 in the U.S. offered growth opportunities for vaccine manufacturers based in the country. In April 2021, Pfizer began exporting COVID-19 vaccines produced at its Michigan plant to Mexico.

This resulted in an increased demand for stoppers in the U.S. Although the COVID-19 threat has reduced significantly, the development of new vaccines has opened new growth opportunities for U.S.-based vaccine manufacturers and the stoppers consumption in the country.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Medical Rubber Stopper Market Scope

Medical Rubber Stopper Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. medical rubber stopper market size, by surface treatment, 2018-2030 (US$M)

U.S. Medical Rubber Stopper Market Outlook Share, 2023 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more