U.S. Meal Kit Delivery Services Market Size & Outlook

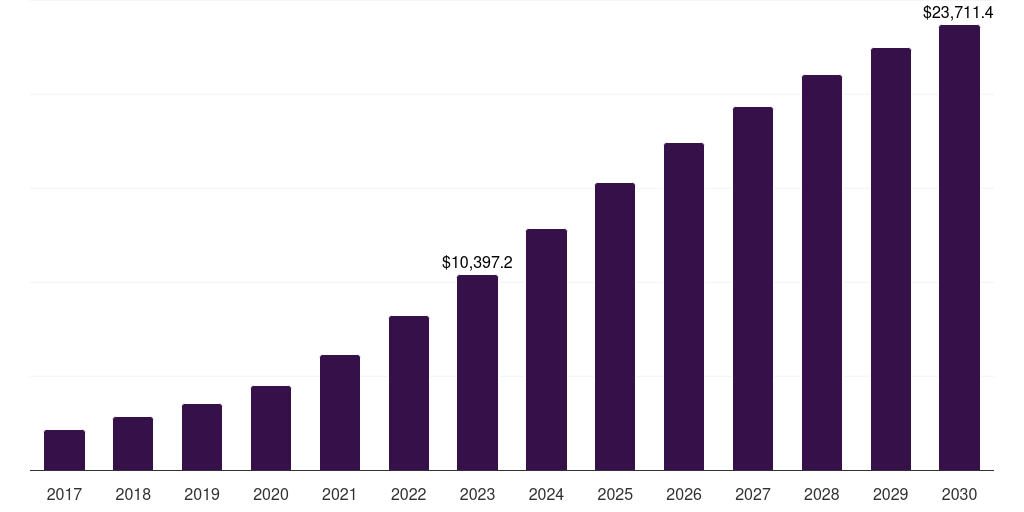

U.S. meal kit delivery services market, 2017-2030 (US$M)

Related Markets

U.S. meal kit delivery services market highlights

- The U.S. meal kit delivery services market generated a revenue of USD 10,397.2 million in 2023 and is expected to reach USD 23,711.4 million by 2030.

- The U.S. market is expected to grow at a CAGR of 12.5% from 2024 to 2030.

- In terms of segment, cook & eat was the largest revenue generating offering in 2023.

- Heat & Eat is the most lucrative offering segment registering the fastest growth during the forecast period.

Meal kit delivery services market data book summary

| Market revenue in 2023 | USD 10,397.2 million |

| Market revenue in 2030 | USD 23,711.4 million |

| Growth rate | 12.5% (CAGR from 2023 to 2030) |

| Largest segment | Cook & eat |

| Fastest growing segment | Heat & Eat |

| Historical data | 2017 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Heat & Eat, Cook & Eat |

| Key market players worldwide | Nestle SA, HelloFresh SE Bearer Shares, Blue Apron, SunBasket, Home Chef, Gobble, Marley Spoon, The Purple Carrot, Fresh n' Lean, Hungryroot |

Other key industry trends

- In terms of revenue, U.S. accounted for 39.5% of the global meal kit delivery services market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. meal kit delivery services market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 3,256.1 million by 2030.

Cook & eat was the largest segment with a revenue share of 61.6% in 2023. Horizon Databook has segmented the U.S. meal kit delivery services market based on heat & eat, cook & eat covering the revenue growth of each sub-segment from 2017 to 2030.

The hectic work schedules and busy lifestyles of consumers across the country leave them with less time for cooking at home. This is driving the preference and demand for ready-to-eat meal kits instead of takeout and other unhealthy food options.

In December 2018, a survey by Peapod highlighted that 77% of Americans preferred eating a homemade meal to going out for dinner. Owing to the COVID-19 lockdown orders issued in the country, customers are increasingly opting for meal kits from companies such as Freshly, HelloFresh, and Sun Basket, which have been gaining significant popularity during this period.

According to data provided by HelloFresh, its customer base for meal kit deliveries witnessed a growth of 90% in the first quarter of 2020 as compared to the first quarter of 2019. Similarly, Freshly delivered 4.2 million meals in March 2020, a significant increase from 3.5 million meals in February 2020.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Meal Kit Delivery Services Market Scope

Meal Kit Delivery Services Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. meal kit delivery services market size, by offering, 2017-2030 (US$M)

U.S. Meal Kit Delivery Services Market Outlook Share, 2023 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more