Middle East & Africa Impact Investing Market Size & Outlook

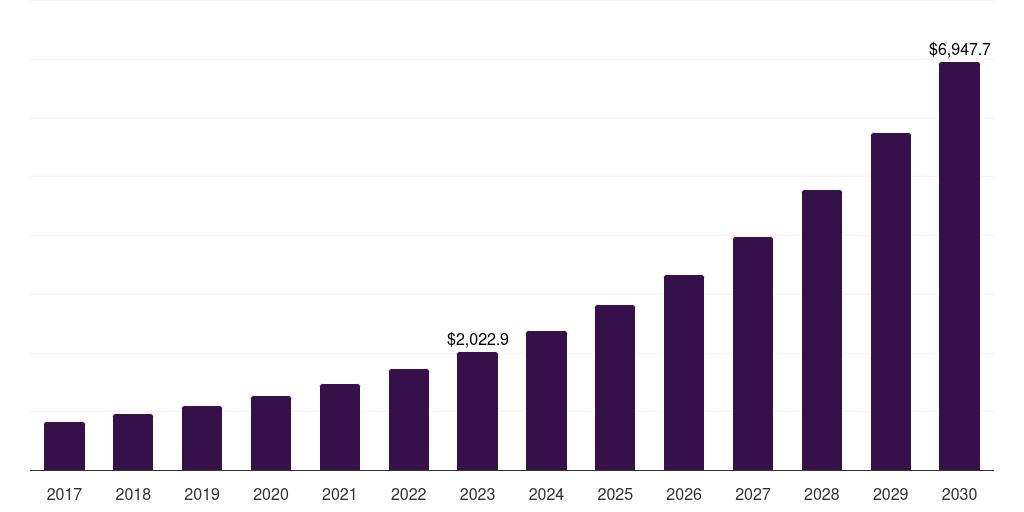

Middle East & Africa impact investing market, 2017-2030 (US$M)

Related Markets

MEA impact investing market highlights

- The MEA impact investing market generated a revenue of USD 2,022.9 million in 2023.

- The market is expected to grow at a CAGR of 19.3% from 2024 to 2030.

- In terms of segment, equity was the largest revenue generating asset class in 2023.

- Fixed Income is the most lucrative asset class segment registering the fastest growth during the forecast period.

- Country-wise, South Africa is expected to register the highest CAGR from 2024 to 2030.

MEA data book summary

| Market revenue in 2023 | USD 2,022.9 million |

| Market revenue in 2030 | USD 6,947.7 million |

| Growth rate | 19.3% (CAGR from 2023 to 2030) |

| Largest segment | Equity |

| Fastest growing segment | Fixed Income |

| Historical data covered | 2017 - 2022 |

| Base year for estimation | 2023 |

| Forecast period covered | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Equity, Fixed Income, Multi-asset, Alternatives |

| Key market players worldwide | BlackRock Inc, The Goldman Sachs Group Inc, Bain Capital Specialty Finance Inc, Morgan Stanley, Prudential Financial Inc, Manulife Financial Corp, Schroders PLC, Vital Capital, LeapFrog Investments, Community Investment Management |

Other key industry trends

- In terms of revenue, MEA region accounted for 2.7% of the global impact investing market in 2023.

- Globally, North America is projected to lead the regional market in terms of revenue in 2030.

- Asia Pacific is the fastest growing regional market and is projected to reach USD 67,778.5 million by 2030.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Impact Investing Market Scope

Impact Investing Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Middle East & Africa impact investing market outlook

The databook is designed to serve as a comprehensive guide to navigating this sector. The databook focuses on market statistics denoted in the form of revenue and y-o-y growth and CAGR across the globe and regions. A detailed competitive and opportunity analyses related to impact investing market will help companies and investors design strategic landscapes.

Equity was the largest segment with a revenue share of 47.81% in 2023. Horizon Databook has segmented the Middle East & Africa impact investing market based on equity, fixed income, multi-asset, alternatives covering the revenue growth of each sub-segment from 2017 to 2030.

- Middle East & Africa Impact Investing Asset Class Outlook (Revenue, USD Million, 2017-2030)

- Equity

- Fixed Income

- Multi-asset

- Alternatives

- Middle East & Africa Impact Investing Offerings Outlook (Revenue, USD Million, 2017-2030)

- Equity

- Bond Funds

- ETFs/Index Funds

- Alternatives/Hedge Funds

- Middle East & Africa Impact Investing Investment Style Outlook (Revenue, USD Million, 2017-2030)

- Active

- Passive

- Middle East & Africa Impact Investing Investor Type Outlook (Revenue, USD Million, 2017-2030)

- Institutional Investors

- Retail Investors

Reasons to subscribe to Middle East & Africa impact investing market databook:

-

Access to comprehensive data: Horizon Databook provides over 1 million market statistics and 20,000+ reports, offering extensive coverage across various industries and regions.

-

Informed decision making: Subscribers gain insights into market trends, customer preferences, and competitor strategies, empowering informed business decisions.

-

Cost-Effective solution: It's recognized as the world's most cost-effective market research database, offering high ROI through its vast repository of data and reports.

-

Customizable reports: Tailored reports and analytics allow companies to drill down into specific markets, demographics, or product segments, adapting to unique business needs.

-

Strategic advantage: By staying updated with the latest market intelligence, companies can stay ahead of competitors, anticipate industry shifts, and capitalize on emerging opportunities.

Target buyers of Middle East & Africa impact investing market databook

-

Our clientele includes a mix of impact investing market companies, investment firms, advisory firms & academic institutions.

-

30% of our revenue is generated working with investment firms and helping them identify viable opportunity areas.

-

Approximately 65% of our revenue is generated working with competitive intelligence & market intelligence teams of market participants (manufacturers, service providers, etc.).

-

The rest of the revenue is generated working with academic and research not-for-profit institutes. We do our bit of pro-bono by working with these institutions at subsidized rates.

Horizon Databook provides a detailed overview of continent-level data and insights on the Middle East & Africa impact investing market , including forecasts for subscribers. This continent databook contains high-level insights into Middle East & Africa impact investing market from 2017 to 2030, including revenue numbers, major trends, and company profiles.

Partial client list

MEA impact investing market size, by country, 2017-2030 (US$M)

Middle East & Africa Impact Investing Market Outlook Share, 2023 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more