Latin America Enhanced Oil Recovery Market Size & Outlook

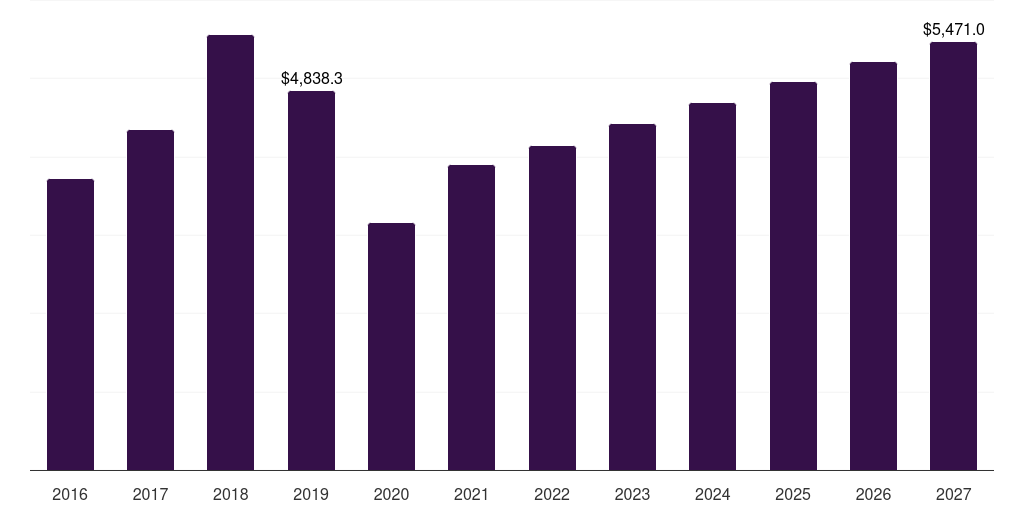

Latin America enhanced oil recovery market, 2016-2027 (US$M)

Related Markets

Latin America enhanced oil recovery market highlights

- The Latin America enhanced oil recovery market generated a revenue of USD 4,838.3 million in 2019.

- The market is expected to grow at a CAGR of 1.5% from 2020 to 2027.

- In terms of segment, thermal was the largest revenue generating technology in 2019.

- CO2 Injection is the most lucrative technology segment registering the fastest growth during the forecast period.

- Country-wise, Brazil is expected to register the highest CAGR from 2020 to 2027.

Latin America data book summary

| Market revenue in 2019 | USD 4,838.3 million |

| Market revenue in 2027 | USD 5,471.0 million |

| Growth rate | 1.5% (CAGR from 2019 to 2027) |

| Largest segment | Thermal |

| Fastest growing segment | CO2 Injection |

| Historical data covered | 2016 - 2018 |

| Base year for estimation | 2019 |

| Forecast period covered | 2020 - 2027 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Thermal, CO2 Injection, Chemical |

| Key market players worldwide | BP PLC, Cenovus Energy, Chevron Corp, Equinor ASA, ExxonMobil, LUKOIL, Petroleo Brasileiro SA Petrobras ADR, TotalEnergies SE |

Other key industry trends

- In terms of revenue, Latin America region accounted for 10.4% of the global enhanced oil recovery market in 2019.

- Globally, North America is projected to lead the regional market in terms of revenue in 2027.

- Asia Pacific is the fastest growing regional market and is projected to reach USD 15,624.4 million by 2027.

Thermal was the largest segment with a revenue share of 56.26% in 2019. Horizon Databook has segmented the Latin America enhanced oil recovery market based on thermal, co2 injection, chemical covering the revenue growth of each sub-segment from 2016 to 2027.

The demand for EOR technologies & services is anticipated to increase over the next eight years on account of rising deep-water exploration and production activities in the Gulf region. In 2015, major companies such as YPF, Total, Shell, PETRONAS, and Chevron announced investment plans for E&P activities.

Natural gas imports in the region are expected to increase progressively over the forecast period owing to the declining production and expansion of LNG import capacity. The net percentage of LNG imports is anticipated to increase from 39% to 47% over the forecast period.

Favorable government initiatives, such as concessions to Petrobras, have facilitated new investments and the renewal of leases of Marlin and Voador fields. The strategies are expected to offer ample growth opportunities for established players as well as new entrants over the forecast period.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Enhanced Oil Recovery Market Scope

Enhanced Oil Recovery Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

Latin America enhanced oil recovery market size, by country, 2016-2027 (US$M)

Latin America Enhanced Oil Recovery Market Outlook Share, 2019 & 2027 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more