U.S. Craft Spirits Market Size & Outlook, 2023-2030

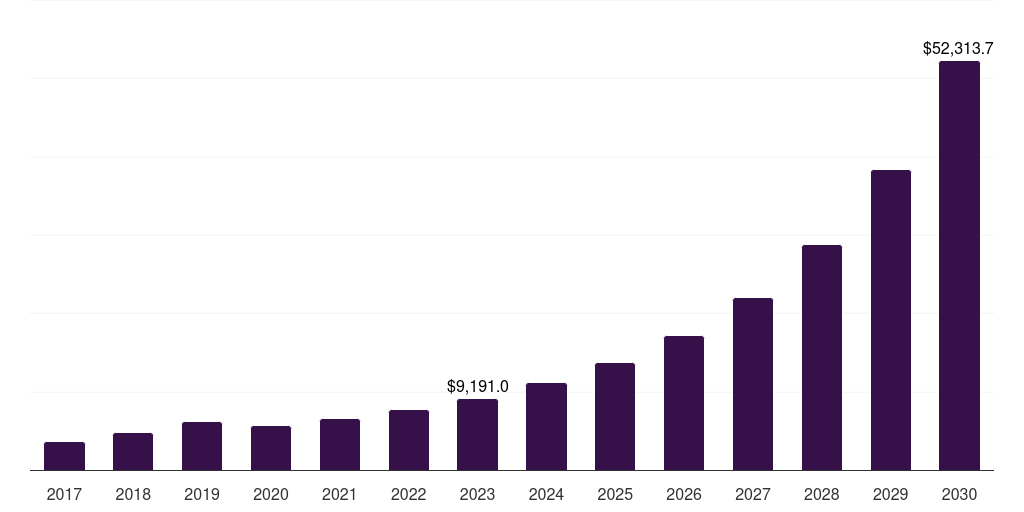

U.S. craft spirits market, 2017-2030 (US$M)

Related Markets

U.S. craft spirits market highlights

- The U.S. craft spirits market generated a revenue of USD 9,191.1 million in 2023 and is expected to reach USD 52,313.9 million by 2030.

- The U.S. market is expected to grow at a CAGR of 28.2% from 2024 to 2030.

- In terms of segment, whiskey was the largest revenue generating product in 2023.

- Gin is the most lucrative product segment registering the fastest growth during the forecast period.

Craft spirits market data book summary

| Market revenue in 2023 | USD 9,191.1 million |

| Market revenue in 2030 | USD 52,313.9 million |

| Growth rate | 28.2% (CAGR from 2023 to 2030) |

| Largest segment | Whiskey |

| Fastest growing segment | Gin |

| Historical data | 2017 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Whiskey, Vodka, Gin, Rum, Brandy, Liquer |

| Key market players worldwide | Diageo PLC, Pernod Ricard SA, Constellation Brands Inc Class A, Suntory Beverage & Food Ltd, Bacardi, Heaven Hill Distilleries, Campari Group, Sazerac Company, Highwood Distillers, Rogue Ales |

Other key industry trends

- In terms of revenue, U.S. accounted for 43.4% of the global craft spirits market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In North America, U.S. craft spirits market is projected to lead the regional market in terms of revenue in 2030.

- Canada is the fastest growing regional market in North America and is projected to reach USD 14,616.0 million by 2030.

Whiskey was the largest segment with a revenue share of 44.92% in 2023. Horizon Databook has segmented the U.S. craft spirits market based on whiskey, vodka, gin, rum, brandy, liquer covering the revenue growth of each sub-segment from 2017 to 2030.

According to the ACSA, despite the detrimental impact of COVID-19 on the global economy, the U.S. craft spirits industry as a whole continued to thrive in 2020. As of August 2021, there were 2,290 active artisan distillers in the U.S., up 1.1% from the previous year.

Moreover, as the Craft Beverage Modernization and Tax Reform Act was passed in 2017 and later extended, Federal Excise Tax was reduced on distilled spirits. As a result, the amount of money invested by the U.S. spirit industry in the craft spirits business rose to USD 759 million in 2020 from USD 698 million in 2019.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Craft Spirits Market Scope

Craft Spirits Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

U.S. craft spirits market size, by product, 2017-2030 (US$M)

U.S. Craft Spirits Market Outlook Share, 2023 & 2030 (US$M)

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more