North America Covid-19 Detection Poc Kits Market Size & Outlook

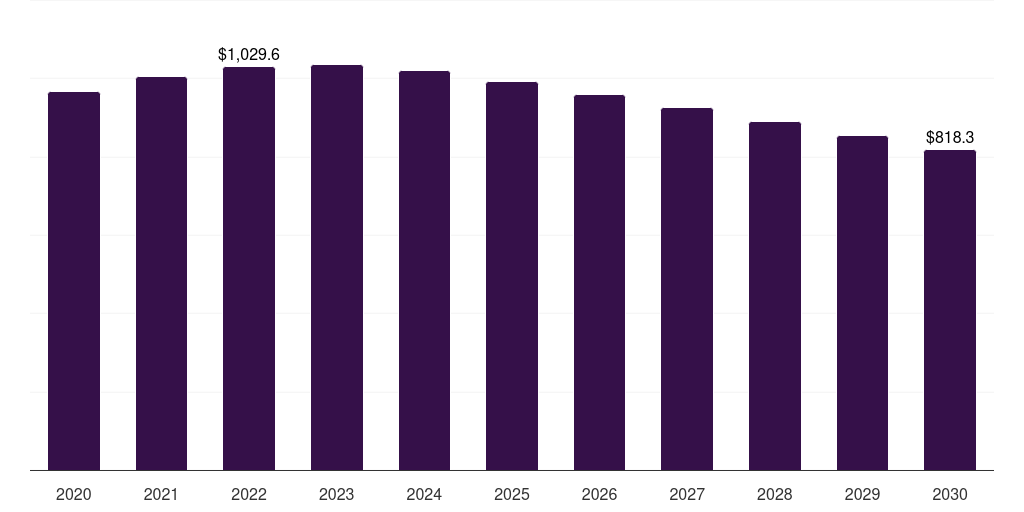

North America covid-19 detection poc kits market, 2020-2030 (US$M)

Related Markets

North America covid-19 detection poc kits market highlights

- The North America covid-19 detection poc kits market generated a revenue of USD 1,029.6 million in 2022.

- The market is expected to grow at a CAGR of -2.8% from 2023 to 2030.

- In terms of segment, nasopharyngeal (np) swab was the largest revenue generating type in 2022.

- Oropharyngeal (OP) swab is the most lucrative type segment registering the fastest growth during the forecast period.

- Country-wise, Canada is expected to register the highest CAGR from 2023 to 2030.

North America data book summary

| Market revenue in 2022 | USD 1,029.6 million |

| Market revenue in 2030 | USD 818.3 million |

| Growth rate | -2.8% (CAGR from 2022 to 2030) |

| Largest segment | Nasopharyngeal (np) swab |

| Fastest growing segment | Oropharyngeal (OP) swab |

| Historical data covered | 2020 - 2021 |

| Base year for estimation | 2022 |

| Forecast period covered | 2023 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Nasopharyngeal (NP) swab, Oropharyngeal (OP) swab, Nasal Swabs, Saliva |

| Key market players worldwide | Abbott Laboratories, Mylab Discovery Solutions, Converge Technology Solutions Corp, Thermo Fisher Scientific Inc, Roche, Danaher Corp, Birks Group Inc Class A, Cue Health Inc, Quest Diagnostics Inc, SD Biosensor |

Other key industry trends

- In terms of revenue, North America region accounted for 29.3% of the global covid-19 detection poc kits market in 2022.

- Globally, North America is projected to lead the regional market in terms of revenue in 2030.

- North America is the fastest growing regional market and is projected to reach USD 818.3 million by 2030.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

COVID-19 Detection PoC Kits Market Scope

COVID-19 Detection PoC Kits Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

North America covid-19 detection poc kits market outlook

The databook is designed to serve as a comprehensive guide to navigating this sector. The databook focuses on market statistics denoted in the form of revenue and y-o-y growth and CAGR across the globe and regions. A detailed competitive and opportunity analyses related to covid-19 detection poc kits market will help companies and investors design strategic landscapes.

Nasopharyngeal (np) swab was the largest segment with a revenue share of 57.55% in 2022. Horizon Databook has segmented the North America covid-19 detection poc kits market based on nasopharyngeal (np) swab, oropharyngeal (op) swab, nasal swabs, saliva covering the revenue growth of each sub-segment from 2020 to 2030.

The spike in incidence of COVID-19 and local presence of major players involved in research & manufacture of diagnostic tests, utilizing various technologies, are expected to contribute to the North American market's growth.

As reported by World meter, as of June 2021, the number of COVID-19 cases in North America reached 40,032,365, indicating the increased demand for COVID-19 diagnostic kits in the region. Due to the pandemic, governing bodies such as Health Canada and the U.S.

FDA allowed Emergency Use Authorizations (EUAs) for COVID-19 test kits, including PoC tests, to increase testing. For instance, in September 2021, the U.S. FDA authorized over 400 COVID-19 tests and collection kits, including 235 molecular, 88 antibody, and 34 antigen tests.

Reasons to subscribe to North America covid-19 detection poc kits market databook:

-

Access to comprehensive data: Horizon Databook provides over 1 million market statistics and 20,000+ reports, offering extensive coverage across various industries and regions.

-

Informed decision making: Subscribers gain insights into market trends, customer preferences, and competitor strategies, empowering informed business decisions.

-

Cost-Effective solution: It's recognized as the world's most cost-effective market research database, offering high ROI through its vast repository of data and reports.

-

Customizable reports: Tailored reports and analytics allow companies to drill down into specific markets, demographics, or product segments, adapting to unique business needs.

-

Strategic advantage: By staying updated with the latest market intelligence, companies can stay ahead of competitors, anticipate industry shifts, and capitalize on emerging opportunities.

Target buyers of North America covid-19 detection poc kits market databook

-

Our clientele includes a mix of covid-19 detection poc kits market companies, investment firms, advisory firms & academic institutions.

-

30% of our revenue is generated working with investment firms and helping them identify viable opportunity areas.

-

Approximately 65% of our revenue is generated working with competitive intelligence & market intelligence teams of market participants (manufacturers, service providers, etc.).

-

The rest of the revenue is generated working with academic and research not-for-profit institutes. We do our bit of pro-bono by working with these institutions at subsidized rates.

Horizon Databook provides a detailed overview of continent-level data and insights on the North America covid-19 detection poc kits market , including forecasts for subscribers. This continent databook contains high-level insights into North America covid-19 detection poc kits market from 2020 to 2030, including revenue numbers, major trends, and company profiles.

Partial client list

North America covid-19 detection poc kits market size, by country, 2020-2030 (US$M)

North America COVID-19 Detection PoC Kits Market Outlook Share, 2022 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more