China Cancer Diagnostics Market Size & Outlook, 2025-2030

Related Markets

China cancer diagnostics market highlights

- The China cancer diagnostics market generated a revenue of USD 10,036.0 million in 2024 and is expected to reach USD 14,339.3 million by 2030.

- The China market is expected to grow at a CAGR of 6.3% from 2025 to 2030.

- In terms of segment, public insurance was the largest revenue generating coverage in 2024.

- Public insurance is the most lucrative coverage segment registering the fastest growth during the forecast period.

Cancer diagnostics market data book summary

| Market revenue in 2024 | USD 10,036.0 million |

| Market revenue in 2030 | USD 14,339.3 million |

| Growth rate | 6.3% (CAGR from 2025 to 2030) |

| Largest segment | Public insurance |

| Fastest growing segment | Public insurance |

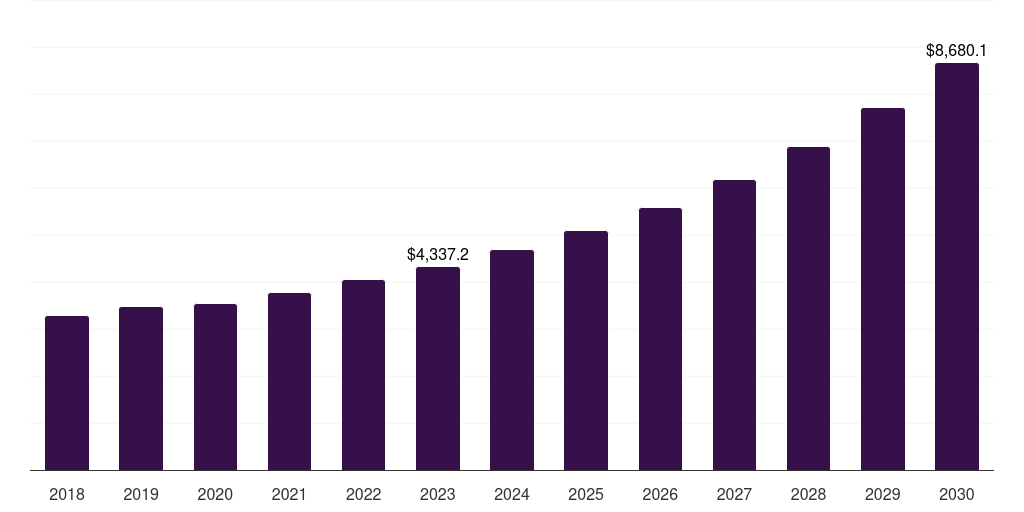

| Historical data | 2018 - 2023 |

| Base year | 2024 |

| Forecast period | 2025 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Public insurance, Private |

| Key market players worldwide | Abbott Laboratories, Roche Holding AG, GE HealthCare Technologies Inc Common Stock, Qiagen NV, Becton Dickinson & Co, Koninklijke Philips NV, Siemens Healthineers AG ADR, Hologic Inc, Thermo Fisher Scientific Inc, Illumina Inc |

Other key industry trends

- In terms of revenue, China accounted for 9.2% of the global cancer diagnostics market in 2024.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, China cancer diagnostics market is projected to lead the regional market in terms of revenue in 2030.

- Japan is the fastest growing regional market in Asia Pacific and is projected to reach USD 3,303.2 million by 2030.

Public insurance was the largest segment with a revenue share of 63.58% in 2024. Horizon Databook has segmented the China cancer diagnostics market based on public insurance, private covering the revenue growth of each sub-segment from 2018 to 2030.

China’s government has undertaken various initiatives, such as free cervical cancer screening campaigns for women of all ages and collaborations with nonprofit organizations to improve the accessibility of tests. Various companies have entered into collaborations and partnership agreements to provide MCED tests in the country.

For example, in July 2022, Guardant Health collaborated with Adicon Holdings Limited, a Hangzhou-based clinical lab company, to offer its liquid biopsy test, which can detect 96% of early-stage cancer with a single blood draw.

Many biotechnology companies have initiated trials in China, as clinical trial regulations are lenient. Companies expect higher approvals for MCED tests in China than in European or LATAM countries, where trials required for approval & reimbursement are expensive. However, the remoteness of certain regions of the country may hamper test reach, and expensive testing is expected to impede market growth in China.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Cancer Diagnostics Market Scope

Cancer Diagnostics Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|---|---|---|---|

| Hologic Inc | View profile | 6990 | 250 Campus Drive, Marlborough, MA, United States, 01752 | http://www.hologic.com |

| Qiagen NV | View profile | 5900 | Hulsterweg 82, Venlo, LI, Netherlands, 5912 PL | https://www.qiagen.com |

| Illumina Inc | View profile | 9300 | 5200 Illumina Way, San Diego, CA, United States, 92122 | https://www.illumina.com |

| Roche Holding AG | View profile | 103605 | Grenzacherstrasse 124, Basel, Switzerland, 4070 | https://www.roche.com |

| Thermo Fisher Scientific Inc | View profile | 122000 | 168 Third Avenue, Waltham, MA, United States, 02451 | https://www.thermofisher.com |

| Siemens Healthineers AG ADR | View profile | 71400 | Siemensstr. 3, Forchheim, BY, Germany, 91301 | https://www.siemens-healthineers.com |

| Koninklijke Philips NV | View profile | 73712 | Philips Center, Amstelplein 2, Amsterdam, Netherlands, 1096 BC | https://www.philips.com |

| Becton Dickinson & Co | View profile | 73000 | 1 Becton Drive, Franklin Lakes, NJ, United States, 07417-1880 | https://www.bd.com |

| Abbott Laboratories | View profile | 114000 | 100 Abbott Park Road, Abbott Park, IL, United States, 60064-6400 | https://www.abbottinvestor.com |

| GE HealthCare Technologies Inc Common Stock | View profile | 51000 | 500 West Monroe Street, Chicago, IL, United States, 60661 | https://www.gehealthcare.com |

China cancer diagnostics market size, by coverage, 2018-2030 (US$M)

China Cancer Diagnostics Market Outlook Share, 2024 & 2030 (US$M)

Related industry reports

Related statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more