India Antifungal Drugs Market Size & Outlook, 2023-2030

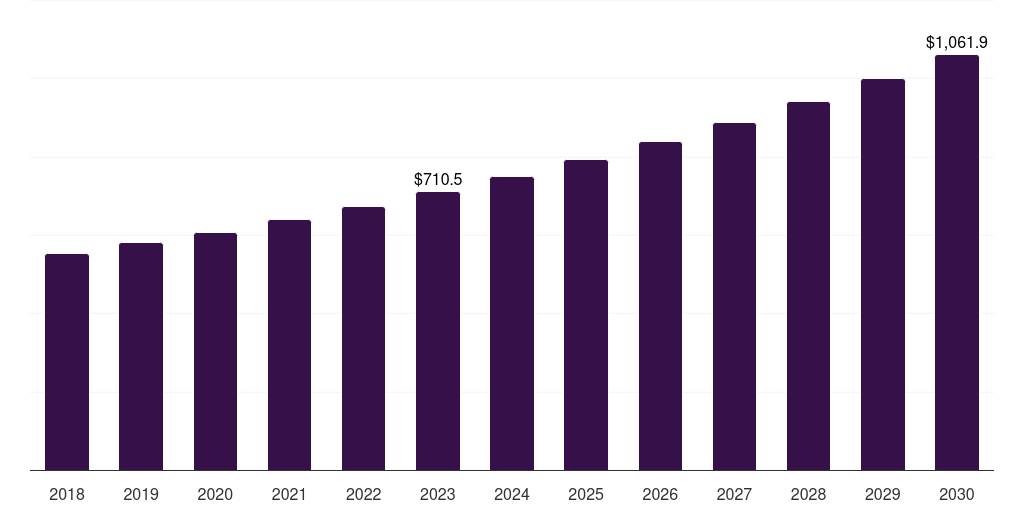

India antifungal drugs market, 2018-2030 (US$M)

Related Markets

India antifungal drugs market highlights

- The India antifungal drugs market generated a revenue of USD 710.5 million in 2023 and is expected to reach USD 1,061.9 million by 2030.

- The India market is expected to grow at a CAGR of 5.9% from 2024 to 2030.

- In terms of segment, azoles was the largest revenue generating drug class in 2023.

- Echinocandins is the most lucrative drug class segment registering the fastest growth during the forecast period.

Antifungal drugs market data book summary

| Market revenue in 2023 | USD 710.5 million |

| Market revenue in 2030 | USD 1,061.9 million |

| Growth rate | 5.9% (CAGR from 2023 to 2030) |

| Largest segment | Azoles |

| Fastest growing segment | Echinocandins |

| Historical data | 2018 - 2022 |

| Base year | 2023 |

| Forecast period | 2024 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Azoles, Echinocandins, Polyenes, Allylamines |

| Key market players worldwide | Novartis AG ADR, Pfizer Inc, Bayer AG, Sanofi SA, Merck KGaA, Merck & Co Inc, GlaxoSmithKline, Abbott Laboratories, Enzon Pharmaceuticals Inc, Astellas Pharma Inc, Glenmark Pharmaceuticals |

Other key industry trends

- In terms of revenue, India accounted for 4.5% of the global antifungal drugs market in 2023.

- Country-wise, U.S. is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, Japan antifungal drugs market is projected to lead the regional market in terms of revenue in 2030.

- China is the fastest growing regional market in Asia Pacific and is projected to reach USD 1,381.0 million by 2030.

Azoles was the largest segment with a revenue share of 47.83% in 2023. Horizon Databook has segmented the India antifungal drugs market based on azoles, echinocandins, polyenes, allylamines covering the revenue growth of each sub-segment from 2018 to 2030.

Players are addressing requirements in the Indian market through product launches. For instance, in May 2022, Bayer launched Canesten, an antifungal treatment solution, in India. Major global players have a robust distribution network in India, through which, companies can address the country’s unmet needs, thereby strengthening their market presence.

For instance, in May 2021, Gilead Sciences announced the supply of 1 million vials to India to manage the increasing number of black fungus cases. Moreover, players are entering into partnerships for product commercialization.

For instance, in May 2021, TLC and Strides Pharma entered into a collaboration for the launch of liposomal amphotericin B in the Indian market. Competitors are entering the segment with new variations in the products, which have increased bioavailability.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Antifungal Drugs Market Scope

Antifungal Drugs Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

India antifungal drugs market size, by drug class, 2018-2030 (US$M)

India Antifungal Drugs Market Outlook Share, 2023 & 2030 (US$M)

Related regional statistics

No records

No related regions found.

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more