India Anti-fog Additives Market Size & Outlook, 2021-2030

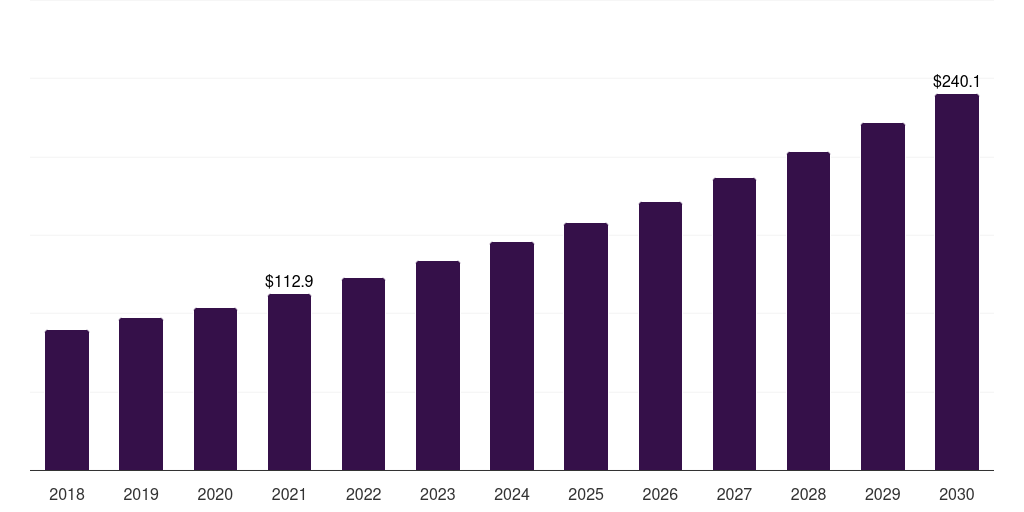

India anti-fog additives market, 2018-2030 (US$M)

Related Markets

India anti-fog additives market highlights

- The India anti-fog additives market generated a revenue of USD 112.9 million in 2021 and is expected to reach USD 240.1 million by 2030.

- The India market is expected to grow at a CAGR of 8.7% from 2022 to 2030.

- In terms of segment, glycerol esters was the largest revenue generating product in 2021.

- Polyglycerol Esters is the most lucrative product segment registering the fastest growth during the forecast period.

Anti-fog additives market data book summary

| Market revenue in 2021 | USD 112.9 million |

| Market revenue in 2030 | USD 240.1 million |

| Growth rate | 8.7% (CAGR from 2021 to 2030) |

| Largest segment | Glycerol esters |

| Fastest growing segment | Polyglycerol Esters |

| Historical data | 2018 - 2020 |

| Base year | 2021 |

| Forecast period | 2022 - 2030 |

| Quantitative units | Revenue in USD million |

| Market segmentation | Glycerol Esters, Ethoxylated Sorbitan Esters, Polyglycerol Esters, Sorbitan Esters, Polyoxyethylene Esters |

| Key market players worldwide | Clariant AG, Akzo Nobel NV, Ashland Inc, Croda International PLC, Evonik Industries AG, Avient Corp, DuPont de Nemours Inc, Palsgaard, Lifeline Biotechnologies Inc |

Other key industry trends

- In terms of revenue, India accounted for 6.3% of the global anti-fog additives market in 2021.

- Country-wise, China is expected to lead the global market in terms of revenue in 2030.

- In Asia Pacific, China anti-fog additives market is projected to lead the regional market in terms of revenue in 2030.

- India is the fastest growing regional market in Asia Pacific and is projected to reach USD 240.1 million by 2030.

Glycerol esters was the largest segment with a revenue share of 30.29% in 2021. Horizon Databook has segmented the India anti-fog additives market based on glycerol esters, ethoxylated sorbitan esters, polyglycerol esters, sorbitan esters, polyoxyethylene esters covering the revenue growth of each sub-segment from 2018 to 2030.

In September 2014, the government of India announced establishment of 42 mega food parks intended for enhancing the production output of food processing industry. This government move is projected to upscale the requirements of anti-fog additives in packaging of processed foods.

Rising demand for bread, cookies, cakes and other baked goods on a domestic level as a result of expansion of new retail outlets is expected to promote the use of anti-fog additives in packaging industry over the next eight years.

Rising processed foods industry in India in light of growing demand for Indian brands such as Bikanervala Foods, MTR ready to eat foodstuff and ‘ITC’s Kitchens of India’ in retail outlets is anticipated to have a positive impact on the market.

No credit card required*

Horizon in a snapshot

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more

Anti-Fog Additives Market Scope

Anti-Fog Additives Market Companies

| Name | Profile | # Employees | HQ | Website |

|---|

India anti-fog additives market size, by product, 2018-2030 (US$M)

India Anti-Fog Additives Market Outlook Share, 2021 & 2030 (US$M)

Related industry reports

Related regional statistics

Sign up - it's easy, and free!

Sign up and get instant basic access to databook, upgrade

when ready, or enjoy our

free plan indefinitely.

Included in Horizon account

- 30K+ Global Market Reports

- 120K+ Country Reports

- 1.2M+ Market Statistics

- 200K+ Company Profiles

- Industry insights and more