- Home

- »

- Petrochemicals

- »

-

Succinic Acid Market Size & Share Report, 2022-2030GVR Report cover

![Succinic Acid Market Size, Share & Trends Report]()

Succinic Acid Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Petro-based, Bio-based), By End Use (Food & Beverages, Pharmaceuticals, Industrial), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: 978-1-68038-571-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Succinic Acid Market Summary

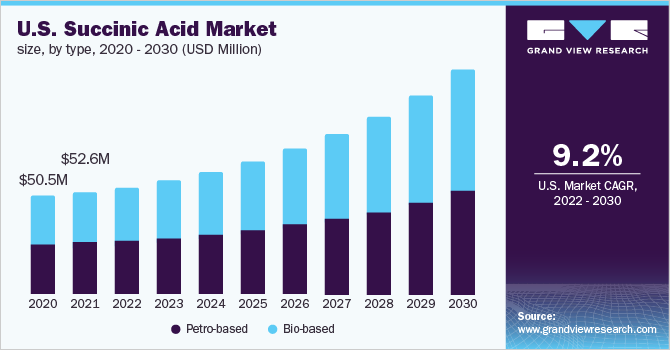

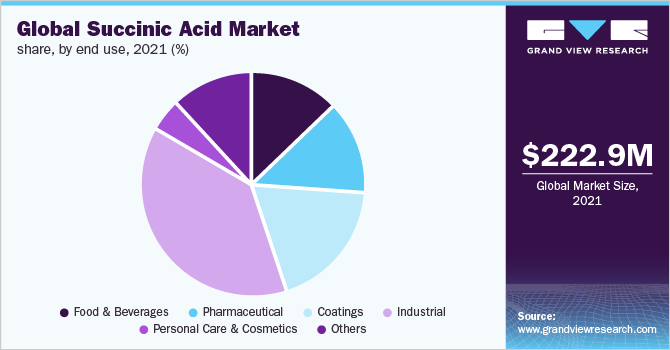

The global succinic acid market size was estimated at USD 222.9 million in 2021 and is projected to reach USD 512.8 million by 2030, growing at a CAGR of 9.7% from 2022 to 2030. The growth is attributed to the increasing usage of Succinic Acid (SA) in the pharmaceutical industry and the construction and infrastructure development activities. It is produced from petroleum and bio-based sources.

Key Market Trends & Insights

- Europe dominated the market in 2021 and accounted for the largest revenue share of more than 35.5% 2021.

- By type, the petro-based segment dominated the global market with a revenue share of more than 50.0% in 2021.

- By end use, the industrial segment dominated the succinic acid market with the largest revenue share of more than 39.0% in 2021.

Market Size & Forecast

- 2021 Market Size: USD 222.9 Million

- 2030 Projected Market Size: USD 512.8 Million

- CAGR (2022-2030): 9.7%

- Europe: Largest market in 2021

Increasing preference for succinic acid over butane-based maleic anhydride in the production of chemicals, such as succinic anhydride, plastics, diethylmaleate, polymers, fumaric, and glyoxylic acid, which are conventionally manufactured from butane, is anticipated to positively influence the market growth.

Petro-based SA is alpha, omega-dicarboxylic acid from the oxidation of methyl groups of butane to the corresponding carboxyl group. The bio-based variant is produced by the process of fermentation of sugars. The enormous amount of CO2 emission is a major concern for the regulatory authorities in many developed countries. This has resulted in the shift of consumer focus toward organic and bio-derived products. Bio-succinic acid is eco-friendly, which is expected to work in favor of the growth of this market in the forthcoming years.

The global market is highly competitive owing to the presence of various multinational corporations trying to gain a competitive advantage with a strong product portfolio, diversification, distribution network, and business strategies, such as partnerships, joint ventures, and capacity expansions. For instance, in 2017, GC Innovation America opened another succinic acid production plant in Leuna, Germany, and expanded its production capacity to 5000 metric tons.

The COVID-19 pandemic affected every major sector. Most governments of the world had to impose lockdowns and movement restrictions to curb the spread of the virus. This adversely affected the economy of all the major countries. All industries and manufacturing units sustained shutdowns, disrupting the supply chain. Key countries, including France, Italy, Spain, India, and the U.K., witnessed an unfavorable effect on product demand. However, the gradual reopening of various sectors will lead to a stable rise in demand for succinic acid in the global market.

Type Insights

The petro-based type dominated the global market with a revenue share of more than 50.0% in 2021. This is attributed to the use of petro-based succinic acid as an alternative to adipic acid in polyurethane production. The petro-based variant is produced from the oxidation of methyl groups of butane to the corresponding carboxy group. It finds a wide range of applications including in the production of plasticizers and flavor enhancers in a variety of packaged food items. The increasing demand from industrial, personal care, and food & beverage industries is expected to fuel the segment growth.

The bio-based segment is the second-largest revenue contributor. Increasing health consciousness among consumers and the rising focus of the governments on environmental concerns have created a large barrier to the market growth of petro-based products. Increasing preference for succinic acid over butane-based maleic anhydride in the production of chemicals such as fumaric acid, succinic anhydride, plastics, diethylmaleate, polymers, and glyoxylic acid, which are conventionally manufactured from butane, is also anticipated to positively influence the demand for a bio-based product.

End-use Insights

The industrial -use segment dominated the succinic acid market with the largest revenue share of more than 39.0% in 2021. This significant share of the segment can be attributed to the increasing use of the products, such as 1,4-butanediol (BDO), polyurethane, and tetrahydrofuran, in various industries where succinic acid is the primary raw material. BDO is used for manufacturing tetrahydrofuran, which is not only used as a solvent in the chemical industry but also as a significant raw material for the production of spandex. Spandex has exceptional elasticity and strength. High demand for this material is in turn expected to contribute to the growth of this segment.

The coatings segment held the second-largest revenue share in 2021, attributed to the rising demand from the construction and automotive industries. Succinic acid is widely used as a raw material in coatings as it provides hardness, a quick cure ratio, and shine to the surface. Improving infrastructure due to increased government spending in countries like the U.S., India, and China is expected to further fuel the demand. Rising construction activities and rapid urbanization are also expected to drive the demand. The shifting of the automotive manufacturing industry from Europe to parts of Asia Pacific is likely to develop the automotive industry in this region and propel the demand for coatings.

Regional Insights

Europe dominated the market in 2021 and accounted for the largest revenue share of more than 35.5% 2021. This growth is attributed to the rising healthcare and agricultural sectors in the region. Europe is expected to witness a stagnant product demand due to the growing preference for bio-based products among consumers as a drop-in replacement.

In Europe, succinic acid is extensively used in the personal care & cosmetics industry. Europe is home to many cosmetic brands, such as Unilever and P&G, which is a key contributing factor to the growth of this regional market. The strong presence of aircraft manufacturers in various parts of Germany and the U.K. has led to the growth of the aerospace sector.

North America accounted for the second-largest revenue share of the global market in 2021. This can be attributed to the presence of various opportunities to build and expand new production facilities in the region. The production of succinic acid from the microbial conversion of renewable feedstock has piqued interest in North America as a means to achieve sustainable development in this era of petroleum scarcity.

Key Companies & Market Share Insights

The presence of many multinational players has resulted in high competition in the market. These companies are keen on expanding their operations in untapped markets to generate higher revenues. They are following various business strategies to establish a widespread dealer network, a strong customer database, and a variety of products to gain an advantage over other players. Companies, with the help of technological advancements, are also trying to adapt to innovative production techniques to gain maximum profit with minimal input and investment. For instance, in 2019, BASF SE launched a novel technique based on crude glycerol and whey permeate for effective succinic acid synthesis. Some prominent players in the global succinic acid market include:

-

BASF SE

-

GC Innovation America

-

Parchem

-

Dow Chemicals

-

Ernesto Ventos S.A.

-

The Chemical Company

-

Kawasaki Kasei Chemicals Ltd.

-

Mitsubishi Chemical Corporation

Succinic Acid Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 234.8 million

Revenue forecast in 2030

USD 512.8 million

Growth Rate

CAGR of 9.7 % from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD thousand/million, volume in tons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Italy; France; Spain; China; India; Japan; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF SE; GC Innovation America; Parchem; Dow Chemicals; Ernesto Ventos S.A.; The Chemical Company; Kawasaki Kasei Chemicals Ltd.; Mitsubishi Chemical Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global succinic acid market report based on type, end-use, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Petro-based

-

Bio-based

-

-

End-use Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

Food & Beverages

-

Pharmaceutical

-

Coatings

-

Industrial

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Thousand, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global succinic acid market size was estimated at USD 222.9 million in 2021 and is expected to reach USD 234.8 million in 2022.

b. The global succinic acid market is expected to grow at a compound annual growth rate of 9.7% from 2022 to 2030 to reach USD 512.8 million by 2030.

b. The Asia Pacific dominated the succinic acid market with a share of over 30% in 2021. This is attributable to the relaxed regulatory environment in countries including India and China.

b. Some key players operating in the succinic acid market include Anqing Hexing Chemical Co. Ltd., Reverdia, Gadiv Petrochemical Industries Ltd., Kawasaki Kasei Chemicals, GC Innovation America, Showa Denko K.K., Succinity GmbH, and Nippon Shokubai Co., Ltd.

b. Key factors that are driving the succinic acid market growth include rising demand for 1,4-butanediol and growing demand for PBS in the packaging industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.