- Home

- »

- Medical Devices

- »

-

Aesthetic Medicine Market Size, Share, Industry Report, 2033GVR Report cover

![Aesthetic Medicine Market Size, Share & Trends Report]()

Aesthetic Medicine Market (2025 - 2033) Size, Share & Trends Analysis Report By Procedure Type (Invasive, Non-invasive Procedures), By End Use (Hospitals, Clinics & Aesthetic Centers), By Region, And Segment Forecasts

- Report ID: 978-1-68038-733-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aesthetic Medicine Market Summary

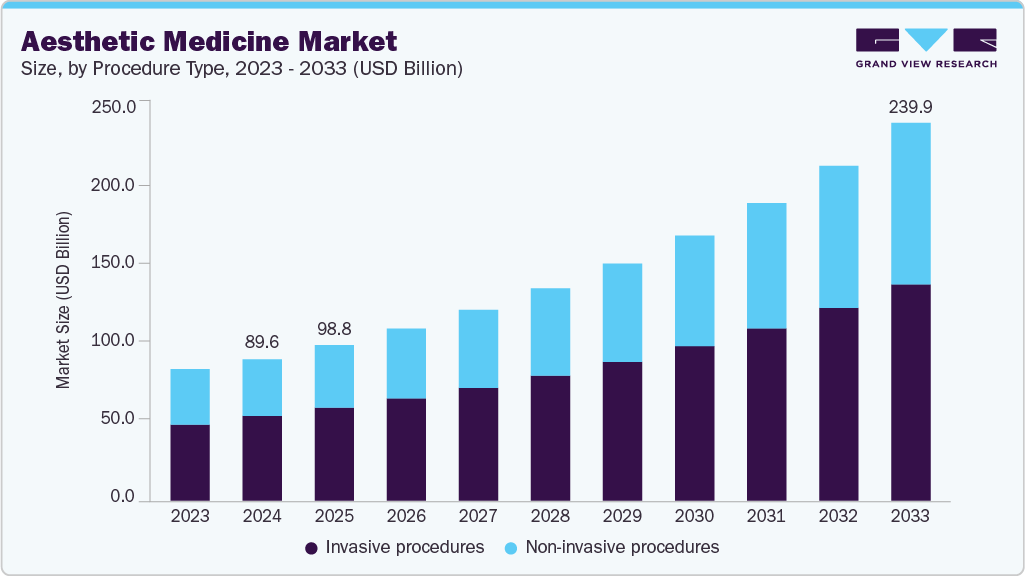

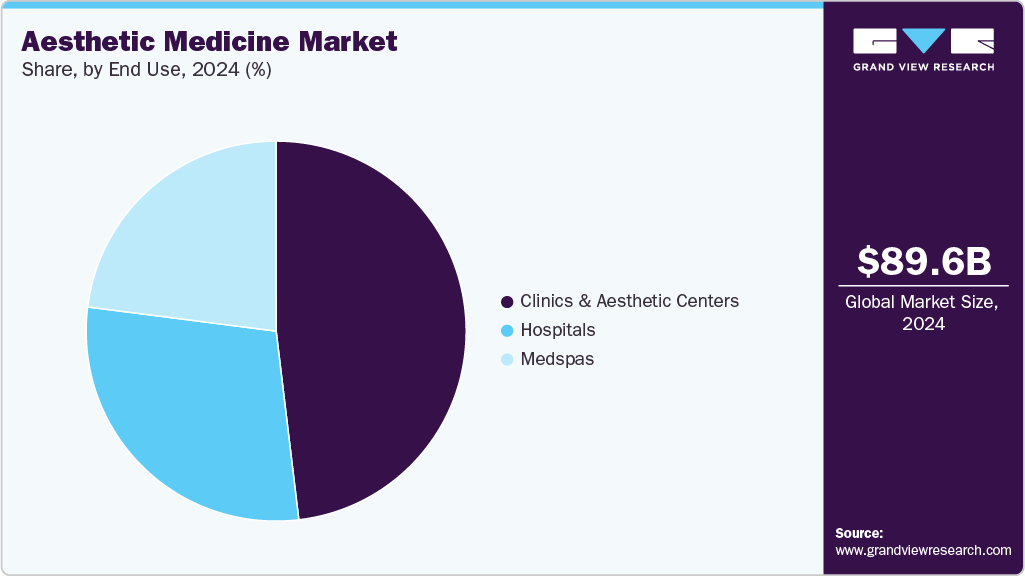

The global aesthetic medicine market size was estimated at USD 89.64 billion in 2024 and is projected to reach USD 239.98 billion by 2033, growing at a CAGR of 11.73% from 2025 to 2033. This growth can be attributed to the increasing adoption of minimally invasive and noninvasive procedures, coupled with the growth in the population prone to experiencing signs of aging.

Key Market Trends & Insights

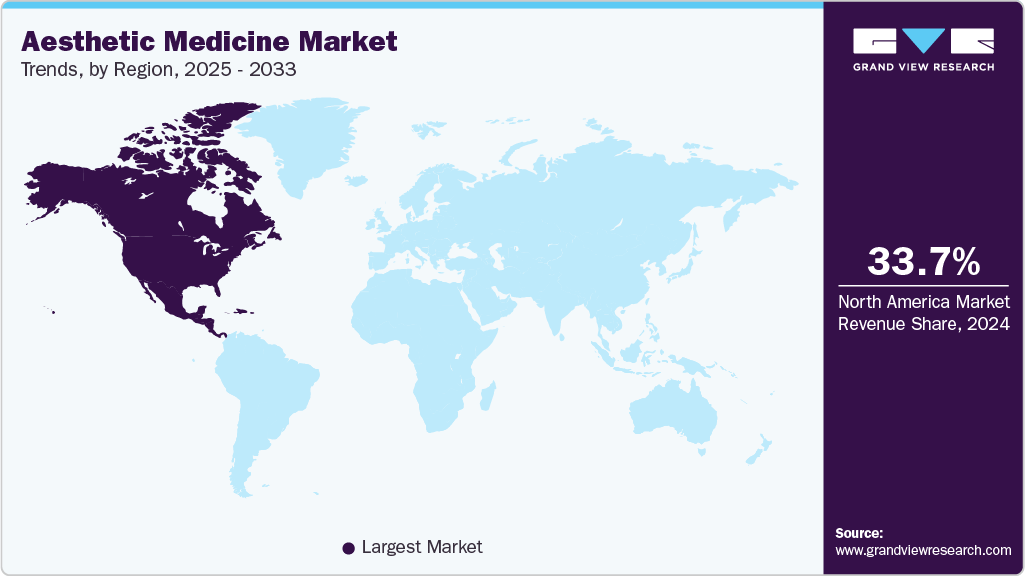

- The North America aesthetic medicine market held the largest global revenue share of 33.74% in 2024.

- The Canada aesthetic medicine industry is anticipated to register the fastest CAGR from 2025 to 2033.

- By procedure type, the invasive procedures segment held the largest revenue share in 2024.

- By end use, the clinics & aesthetic centers segment led the aesthetic medicine market with a significant share of 48.09% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 89.64 Billion

- 2033 Projected Market Size: USD 239.98 Billion

- CAGR (2025-2033): 11.73%

- North America: Largest market in 2024

As per the ISAPS report, a total of 17.42 million surgical procedures and 20.54 million non-surgical procedures were performed in 2024. Moreover, technological advancements, such as minimally invasive techniques, laser treatments, and injectables such as Botox and dermal fillers, have made cosmetic procedures safer and more accessible, encouraging more individuals to consider them. In addition, the increase in healthcare tourism and the availability of well-trained specialists in emerging markets also support the expansion of this market.The increasing geriatric population across the globe is expected to drive the aesthetic medicine market. Major economies are undergoing a demographic shift due to a rapidly aging population, and the demand for cosmetic solutions is growing to combat the visible signs of aging and maintain a youthful appearance. This has led to a significant surge in demand for aesthetic medicines that effectively reduce wrinkles, fine lines, and other age-related concerns.

This demographic shift is expected to promote the development of innovative procedures, including aesthetic medicines, which cater to the needs of the rapidly aging population. This trend creates a favorable environment for the market to thrive and effectively meet the growing demand.

The tables below illustrate the geriatric population:

North America geriatric population (aged 65 years & above), by country, 2024

Country

Male

Female

U.S.

28,389,475.0

33,541,120.0

Canada

3,637,395.0

4,231,439.0

Mexico

4,819,265.0

5,974,894.0

Latin America geriatric population (aged 65 years & above), by country, 2024

Country

Male

Female

Brazil

10,294,931.0

13,129,178.0

Argentina

2,400,795.0

3,272,838.0

Moreover, social media plays a vital role in influencing the purchasing decisions of millennials. However, peer recommendations have a significant impact. According to a case study published in 2022, titled "The Impact of Snapchat Use on Self-Image and Inclination Toward Cosmetic Procedures in Saudi Arabia," 80% of the population expressed interest in undergoing cosmetic procedures, influenced by social media. In addition, very few influencers control the majority of social media referral branding. Hence, ongoing client interaction is essential when a business advertises its goods on social media.

Case Study: Patient Motivations for Cosmetic Procedures

Overview:

One of the main reasons behind the growing acceptance of aesthetic treatments is the change in why people choose them. Cosmetic procedures, which were once seen mostly as something people did for looks alone, are now recognized as ways to improve wellbeing and quality of life. A study published in JAMA Dermatology examined the reasons patients seek cosmetic treatments and gave clear insights into how perceptions have changed.

Key Findings and Functional Benefits:

The study showed that patients see cosmetic procedures as offering personal benefits beyond appearance. Key results include:

-

Improved Self-Confidence: 69.5% of patients said they had treatments to feel more confident in daily life.

-

Better Quality of Life: 67.2% reported overall improvements in wellbeing as a reason for seeking treatment.

-

Less Focus on Looks Alone: Fewer patients said their main reason was appearance, showing that these treatments are linked more to self-care.

-

Wide Acceptance Across Groups: The motivations were similar across men and women and different age groups, showing that aesthetic medicine is widely accepted.

Clinical and Market Implications:

These results highlight that the demand for cosmetic procedures goes beyond appearance, as many patients seek them to improve confidence, relationships, and social or work life. As more people consider these treatments part of their self-care, the acceptance of aesthetic medicine has continued to grow.

Conclusion:

The JAMA Dermatology case study shows that the growth of aesthetic medicine is strongly linked to people’s needs for self-confidence and quality-of-life improvement. This perspective supports the market’s expansion, as treatments are increasingly seen as cosmetic enhancements and meaningful contributors to personal wellness. These findings further confirm the rising awareness and acceptance of aesthetic treatments globally.

Furthermore, a shift from invasive to minimally invasive procedures is being observed, which is expected to fuel market growth over the forecast period. According to the American Society of Aesthetic Plastic Surgeons (ASPS), in 2024, around 28.2 million cosmetic minimally invasive procedures were performed in the U.S. Moreover, more people are opting for permanent procedures, such as fat grafting, fillers, and lip advancement. According to the same source, botulinum toxin & hyaluronic acid fillers, skin resurfacing, and laser skin treatments are some of the common and in-demand noninvasive aesthetic procedures in the U.S.

In addition, the most popular procedures are fillers, as the risk associated with these treatments is very low. Fillers, such as hyaluronic acid, which are FDA-approved, are easily accepted by the body, causing minimal adverse effects & allergic reactions. The growing popularity of nonsurgical skincare treatment options is one of the primary factors responsible for an increase in the number of patients seeking plastic surgery services.

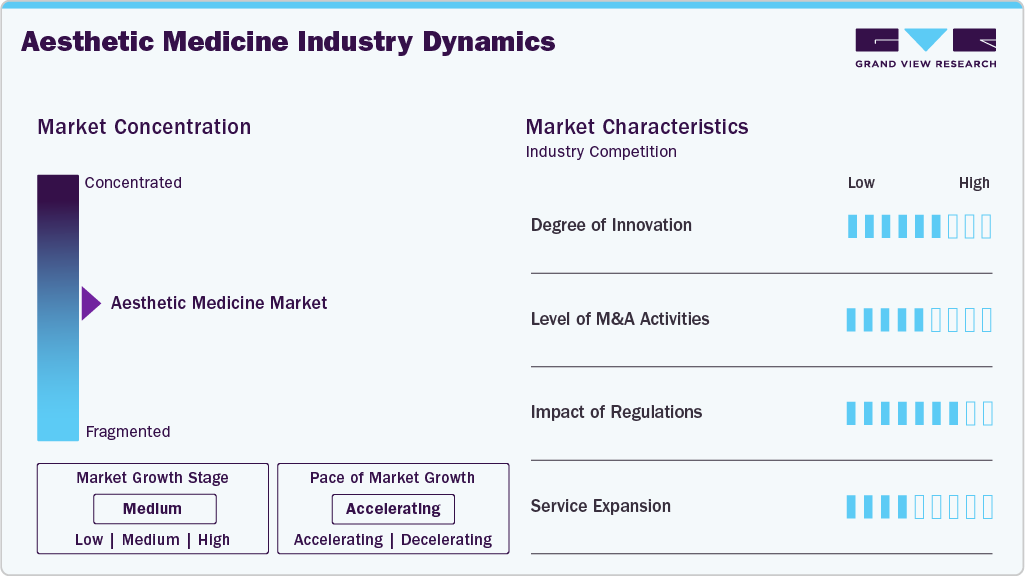

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, characteristics, and participants. The industry is fragmented, with many service providers entering the market. There is a high degree of innovation, moderate level of merger & acquisition activities, high impact of regulations, and market expansion of the aesthetic medicine industry.

The industry shows a high degree of innovation, driven by rapid advancements in technology and changing consumer preferences. New techniques such as non-invasive body contouring, laser-based therapies, and regenerative medicine solutions are making treatments safer, faster, and more effective. As per the ISAPS survey, in 2024, approximately 361,210 botulinum toxin procedures were performed in Germany. Furthermore, companies are investing heavily in R&D to develop devices and products that offer minimal downtime, greater precision, and more natural-looking results. Digital tools, including AI-based diagnostic platforms and virtual consultations, are also shaping patient experiences.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. For instance, in July 2025, Waldencast acquired Novaestiq Corp. along with the U.S. rights to Saypha, a series of hyaluronic acid injectable gels, incorporating these products into the portfolio of Obagi Medical. This acquisition represents a strategic effort to expand Obagi Medical’s focus beyond just skincare.

Regulations have a significant impact on the aesthetic medicine market as they set standards for safety, quality, and ethical practices. Strict approval processes for new devices, injectables, and procedures ensure patient safety but can slow down the introduction of innovative products. Different countries have varying rules, making it necessary for companies to adapt their strategies to each market. At the same time, strong regulatory frameworks help build trust among patients, as they feel more confident about the safety and effectiveness of treatments.

Key players adopt several other strategies, such as service line expansion, to maintain or strengthen their market presence. In August 2025, Thérapie Clinic announced its continued expansion with the launch of its first location in Wales. Known for offering advanced treatments such as laser hair removal, skin rejuvenation, injectables, and body contouring, the brand has been rapidly growing across the UK and Ireland. The move into Wales marks a significant milestone in its growth strategy, bringing world-class aesthetic services closer to Welsh clients seeking safe, effective, and affordable treatment. With a focus on accessibility and customer experience, the new clinic reinforces Thérapie Clinic’s position as a major player in the aesthetics industry while addressing the rising demand for non-surgical cosmetic procedures in the region.

Procedure Type Insights

The invasive segment led the aesthetic medicine industry with a significant share of 59.96% in 2024. Invasive aesthetic procedures have become significantly popular since 2019, with the pandemic seemingly having little impact on the demand for these treatments. According to the ISAPS report, 17.4 million surgical procedures were performed by plastic surgeons in 2024. In addition, eyelid surgery has become the most prevalent surgical procedure, surpassing liposuction. This is followed by liposuction, breast augmentation, scar revision, and rhinoplasty. The leading non-surgical treatments include botulinum toxin, hyaluronic acid (filler), hair removal, non-surgical skin tightening, and chemical peels.According to the American Society of Plastic Surgeons report 2024, breast procedures (implant placement for both primary and/or revisions), increased by 1% from 2024 (306,196) compared to 2023 (304,181).

The non-invasive segment is expected to grow to a significant CAGR during the forecast period. Noninvasive refers to medical procedures or treatments that do not require inserting instruments into the body or removing tissue. These procedures are performed externally without breaking the skin or penetrating the body's surface.According to the ISAPS article published in 2024, 20.54 million nonsurgical procedures were performed globally. The U.S. is positioned as the country with the highest number of plastic surgeons at 7,752, with 4.16 million procedures performed.One of the most popular noninvasive procedures is Botulinum Toxin, commonly known as Botox. It is used to treat various cosmetic and medical conditions, including wrinkles, facial lines, and muscle spasms.

End Use Insights

The clinics & aesthetic centers segment led the aesthetic medicine market with a significant share of 48.09% in 2024. Clinics and aesthetic centers are essential facilities, particularly in reducing & removing scars. These specialized facilities provide comprehensive care beyond the acute phase managed by hospitals. While hospitals handle emergency care for injuries or conditions prone to scarring, patients often transition to clinics and aesthetic centers for ongoing scar management. Moreover, increasing demand for scar treatment and aesthetics-focused clinics & centers have adopted technological advancements. Equipped with state-of-the-art technology, they offer diverse cutting-edge scar treatment techniques, enhancing patient care and outcomes.This commitment to innovation aligns with the broader trend of prioritizing aesthetics and elevating physical appearance, driving the aesthetics medicine market.

The medspas segment is expected to grow at a significant CAGR during the forecast period. Medspas in aesthetic clinics are facilities where cosmetic treatments are provided under the supervision of a licensed physician. Medspas are generally a combination of aesthetic medical centers and day spas that offer rejuvenation and corrective esthetic treatments & products. The treatments that are provided in med spas include noninvasive body contouring (CoolSculpting, hot sculpting, butt/breast, etc.), facial injections (dermal fillers, botulinum, boosters), laser hair removal, skin rejuvenation (chemical peel, laser skin resurfacing, photorejuvenation, hydradermabrasion), IPL hair removal, laser tattoo removal, and laser scar removal. Furthermore, increasing adoption of advanced technology is driving segmental growth. In April 2025, Nextech, a well-known healthcare technology company, announced the launch of a new med spa platform designed specifically for medical spas to help them with medical compliance (ensuring they follow regulations and safety standards) and to make operations smoother.

Regional Insights

North America dominated the aesthetic medicine market with the largest revenue share of 33.74% in 2024, due to an increase in the aging population, which is creating a strong demand for treatments that address age-related concerns. As individuals grow older, they experience visible changes such as wrinkles, fine lines, sagging skin, and volume loss, which often affect confidence and quality of life. This has led to a rising preference for non-invasive and minimally invasive aesthetic procedures, including Botox, dermal fillers, and skin rejuvenation therapies.

U.S. Aesthetic Medicine Market Trends

The U.S. aesthetic medicine industry is expected to grow over the forecast period, as the increasing societal emphasis on appearance fuels the demand for aesthetic procedures, contributing to market growth. This shift in cultural norms, combined with the growing awareness of the diverse cosmetic solutions accessible, has played a pivotal role in facilitating growth.

Asia Pacific Aesthetic Medicine Market Trends

The Asia Pacific aesthetic medicine industry is expected to witness significant growth during the forecast period. China, India, and Japan are developing economies and key revenue contributors to the growth. The market is expected to grow at a rapid pace with swiftly evolving economies. This can be attributed to the growing medical tourism industry, as it significantly drives the growth of the market in the Asia Pacific. The region’s reputation for cost-effective yet high-quality medical care, combined with advanced surgical innovations in India and Thailand and cutting-edge pharmaceutical developments in Japan and South Korea, has positioned it as a global hub for cosmetic and aesthetic procedures.

The China aesthetic medicine market held a significant revenue share in 2024. China’s contemporary culture greatly values the physical appearance of women and puts a strong emphasis on ideal beauty standards. Therefore, the country is a hub for aesthetic procedures. A major factor expected to drive this market is increasing workplace competition. The cosmetic procedures market in China is expected to witness lucrative growth during the forecast period. This can be attributed to the increasing number of local & global market players, rising beauty standards, and growing disposable income.

Europe Aesthetic Medicine Market Trends

The Europe aesthetic medicine industry is experiencing strong growth, driven by several key factors. A significant driver is the increasing demand for non-invasive and minimally invasive procedures, such as Botox injections, dermal fillers, and laser therapies. These treatments offer reduced recovery times, lower risks, and more affordable options compared to traditional surgical procedures, making them appeal to a broader demographic.

The Germany aesthetic medicine market held a significant revenue share in 2024 and is experiencing significant growth, driven by the country's increasing demand for non-invasive and minimally invasive procedures, such as Botox, dermal fillers, and laser treatments. These treatments are gaining popularity due to their affordability compared to surgical options and their ability to deliver natural-looking results with minimal downtime. For instance, as per the International Society of Aesthetic Plastic Surgery (IASPS), a total of 1.30 million cosmetic surgeries were performed in 2024.

Latin America Aesthetic Medicine Market Trends

The aesthetic medicine industry in Latin America has experienced significant growth, driven by various factors such as the rise of the middle class. This increase in disposable income has led to a greater willingness to undergo aesthetic treatments. There has also been an increase in awareness and acceptance of such treatments, partly due to the pervasive influence of Western beauty standards. The rapid increase in the use of noninvasive cosmetic treatments such as Botox and dermal fillers has become highly popular among individuals looking for effective, quick methods to enhance their appearance without the need for surgery, and is anticipated to drive market growth.

The Argentina aesthetic medicine market held a significant revenue share in 2024. The market in Argentina is growing, benefiting from a confluence of socioeconomic factors and growing consumer demand for beauty enhancements. One prominent trend in the market in Argentina is the increasing preference for noninvasive cosmetic procedures, such as Botox injections and dermal fillers, which have gained significant popularity among consumers seeking effective yet minimally invasive ways to refresh their appearance.

Middle East And Africa Aesthetic Medicine Market Trends

The aesthetic medicine industry in Middle East and Africa has witnessed notable growth, driven by a mix of cultural changes, economic growth, and enhanced access to state-of-the-art medical technologies. The growing acceptance of noninvasive cosmetic treatments, such as Botox, dermal fillers, and laser therapies, has gained significant traction among consumers desiring to improve their appearance without resorting to surgery, and this is one of the factors responsible for the regional market growth.

The UAE aesthetic medicine market held a significant market share in 2024. The healthcare industry in the country is witnessing rapid growth, driven by various factors including the expansion of hospital networks, provision of specialized services, and a heightened demand for both reconstructive and elective surgical & nonsurgical procedures. This growth trajectory is indicative of the UAE's commitment to advancing its healthcare sector, ensuring residents have access to world-class medical facilities and services.

Key Aesthetic Medicine Company Insights

The market is fragmented, with the presence of many aesthetic medicine providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Aesthetic Medicine Companies:

The following are the leading companies in the aesthetic medicine market. These companies collectively hold the largest market share and dictate industry trends.

- The Cosmetic Clinic (SILK Laser Australia Limited)

- Therapie Clinic /Valterous Limited.

- Skinotive Clinic

- Shea Aesthetic Clinic

- Sisu Clinic

- THE BANGKOK COSMETIC CLINIC

- Cutis Medical Laser Clinics

- Grand Plastic Surgery

- MUSE CITY CLINIC

- The Esthetic Clinics

Recent Developments

-

In January 2025, Shea Aesthetic Clinic announced the launch of its brand-new website, designed to offer visitors a more seamless, engaging, and informative experience. The updated platform reflects the clinic’s commitment to innovation, patient care, and accessibility by providing easy navigation, detailed information on treatments and services, and insights into the latest aesthetic advancements. Visitors can now explore a modern, user-friendly interface that highlights the clinic’s expertise, philosophy, and patient-centric approach. The launch marks a significant step in strengthening Shea Aesthetic Clinic’s digital presence, ensuring clients can conveniently connect, learn, and book services online.

-

In January 2025, Sisu Clinic secured a USD 15 million venture debt facility to support its global expansion plans. The funding has been provided by Structural Capital, a Menlo Park-based investment firm known for backing well-known consumer health and wellness companies such as Noom, Manscaped, and Beauty Counter. With this financial boost, Sisu Clinic aims to scale its network of clinics and strengthen its position in the international aesthetics market.

-

In December 2024, The Esthetic Clinic established itself as a premier destination for cosmetic surgery in India, attracting both domestic and international patients seeking high-quality aesthetic treatments. Renowned for combining advanced medical technology with expert surgical precision, the clinic offers a wide range of procedures, including plastic surgery, dental aesthetics, skin rejuvenation, and minimally invasive enhancements.

Aesthetic Medicine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 98.78 billion

Revenue forecast in 2033

USD 239.98 billion

Growth Rate

CAGR of 11.73% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Procedure type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

The Cosmetic Clinic (SILK Laser Australia Limited); Therapie Clinic /Valterous Limited; Skinotive Clinic; Shea Aesthetic Clinic; Sisu Clinic; THE BANGKOK COSMETIC CLINIC; Cutis Medical Laser Clinics; Grand Plastic Surgery; MUSE CITY CLINIC; The Esthetic Clinics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aesthetic Medicine Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global aesthetic medicine market report based on procedure type, end use, and region:

-

Procedure Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Invasive Procedures

-

Breast augmentation

-

Liposuction

-

Nose reshaping

-

Eyelid Surgery

-

Tummy tuck

-

Others

-

-

Non-invasive Procedures

-

Botox injections

-

Soft tissue fillers

-

Chemical peel

-

Laser hair removal

-

Microdermabrasion

-

Others

-

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Hospitals

-

Clinics & Aesthetic Centers

-

Medspas

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.